GTSEnergyMarkets 2025 Review: Everything You Need to Know

Executive Summary

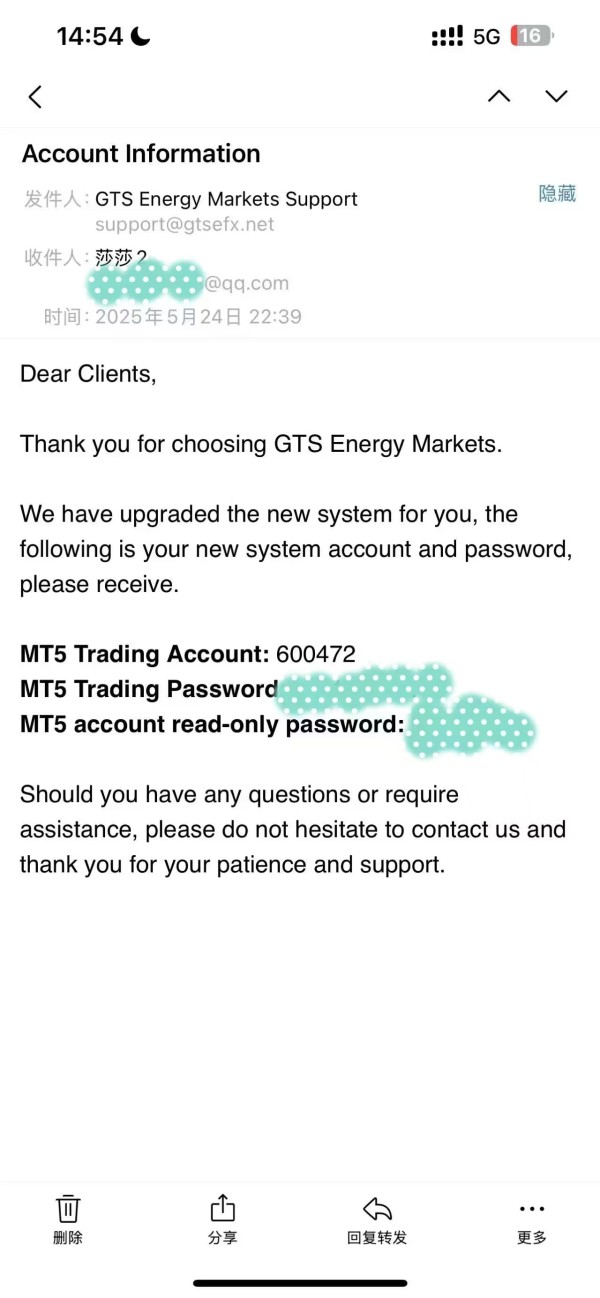

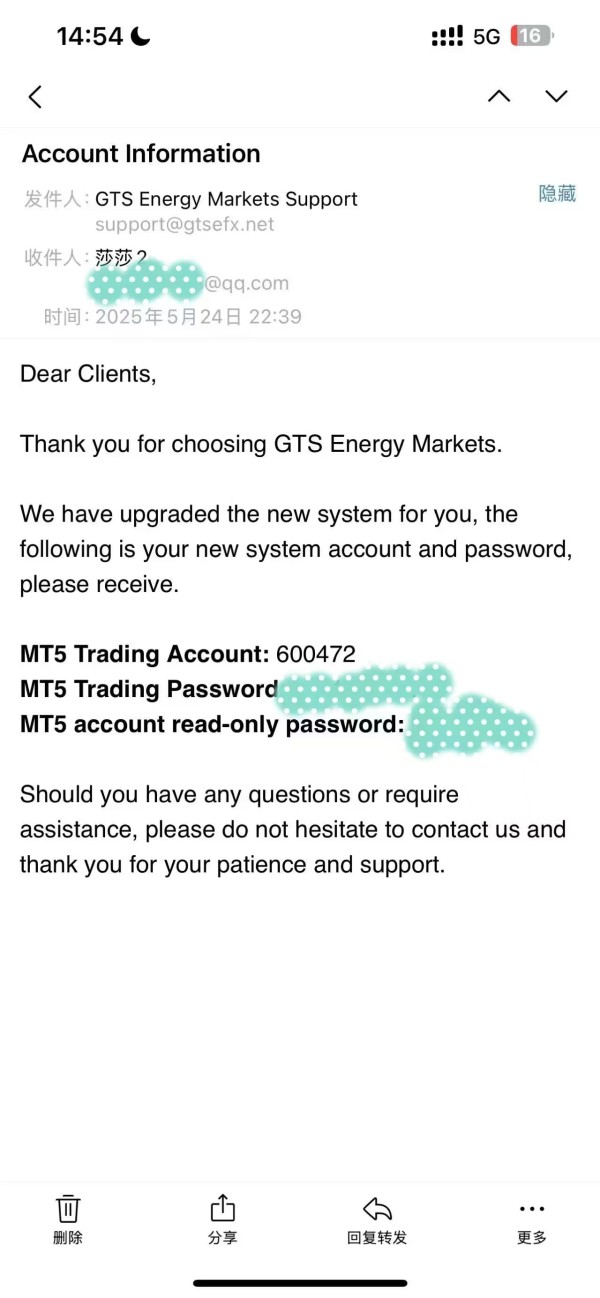

This comprehensive gtsenergymarkets review shows a concerning picture of a forex broker that works without proper regulatory oversight. GTSEnergyMarkets was established on May 22, 2000, and is registered in Cyprus. The company positions itself as a provider of forex and CFD trading services across multiple asset classes including foreign exchange, precious metals, energy, and indices. Our analysis shows that this broker has not gotten approval or supervision from any recognized financial regulatory authority. This raises significant red flags for potential investors.

The broker offers a variety of trading instruments, which could be considered its primary strength. However, this positive aspect is overshadowed by substantial regulatory problems and concerning user feedback patterns. According to available data, GTSEnergyMarkets has received only 2 positive reviews and 1 neutral review, while accumulating 33 exposure reviews. This ratio strongly suggests problematic user experiences and potential safety concerns.

This broker appears to target experienced investors who are comfortable with high-risk trading environments. We strongly advise caution given the lack of regulatory protection. The absence of oversight from established financial authorities means traders have limited recourse in case of disputes or issues with fund security.

Important Notice

Regional Entity Differences: GTSEnergyMarkets has not received approval from any recognized financial regulatory institutions. This means its legality and safety standards may vary significantly across different jurisdictions. Potential clients should be aware that the lack of proper regulatory oversight creates substantial risks regardless of their location.

Review Methodology: This evaluation is based on publicly available information and user feedback compiled from various sources. Due to limited transparency from the broker itself, some aspects of this review may not be comprehensive. Readers should conduct additional due diligence before making any investment decisions.

Rating Framework

Broker Overview

GTSEnergyMarkets was established on May 22, 2000. This makes it a relatively long-standing entity in the forex trading space. The company is registered in Cyprus and operates as a forex and Contracts for Difference (CFD) broker. Despite its longevity, the broker has failed to secure regulatory approval from any major financial authorities. This is particularly concerning given the nearly 25 years it has been in operation. The lack of regulatory status suggests either an unwillingness to meet international standards or an inability to satisfy the requirements of established financial regulators.

The broker's primary business model centers around providing forex and CFD trading services to retail and potentially institutional clients. GTSEnergyMarkets offers access to various financial markets, including foreign exchange pairs, precious metals such as gold and silver, energy commodities, and major stock indices through CFD instruments. While this diversity in trading options could appeal to traders seeking portfolio diversification, the absence of regulatory oversight significantly undermines the broker's credibility. It also raises questions about client fund security and fair trading practices.

According to our gtsenergymarkets review findings, the company's operational transparency remains limited. There is minimal publicly available information about its management structure, financial backing, or operational procedures. This lack of transparency, combined with the regulatory deficiencies, creates a challenging environment for potential clients to assess the broker's reliability and long-term viability.

Regulatory Status: GTSEnergyMarkets operates without approval or supervision from any recognized financial regulatory authority. This absence of regulatory oversight means the broker is not subject to the stringent capital requirements, client fund segregation rules, or operational standards that regulated brokers must maintain.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available source materials. This itself is concerning as reputable brokers typically provide clear information about funding options and procedures.

Minimum Deposit Requirements: The minimum deposit requirements for opening an account with GTSEnergyMarkets are not specified in the available documentation. This makes it difficult for potential clients to understand the financial commitment required to begin trading.

Promotions and Bonuses: No information about promotional offers or bonus programs is available in the source materials. This may indicate either a lack of such programs or insufficient transparency in marketing practices.

Available Trading Assets: GTSEnergyMarkets provides access to multiple asset classes including forex currency pairs, precious metals (gold, silver, and other metals), energy commodities (oil, natural gas), and major stock indices through CFD trading. This variety represents one of the few positive aspects identified in this gtsenergymarkets review.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the source materials. This lack of pricing transparency makes it impossible for traders to accurately assess the true cost of trading with this broker or compare it effectively with regulated alternatives.

Leverage Ratios: Specific leverage ratios offered by GTSEnergyMarkets are not mentioned in available documentation.

Platform Options: The trading platforms available through GTSEnergyMarkets are not specifically detailed in the source materials.

Geographic Restrictions: Information about geographic restrictions or availability by region is not provided in the available documentation.

Customer Support Languages: Details about customer support language options are not available in the source materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: N/A)

The lack of available information regarding GTSEnergyMarkets' account conditions represents a significant transparency issue. Potential clients should carefully consider this gap. Reputable forex brokers typically provide detailed information about their account types, minimum deposit requirements, and specific features available to different client categories. The absence of such information makes it impossible to evaluate whether the broker offers competitive account conditions or meets the diverse needs of different trader profiles.

Without clear information about account opening procedures, verification requirements, or account maintenance fees, potential clients cannot make informed decisions. They cannot determine whether GTSEnergyMarkets aligns with their trading needs and financial circumstances. This information gap is particularly concerning when combined with the broker's lack of regulatory oversight. It suggests a pattern of limited transparency that extends beyond just regulatory matters.

The unavailability of account condition details also makes it difficult to assess how GTSEnergyMarkets compares to regulated alternatives. Professional traders and institutions typically require detailed account specifications to ensure compliance with their own risk management and operational requirements. This broker appears unable to provide such specifications.

In this gtsenergymarkets review, the absence of account condition information must be considered a significant negative factor. Potential clients should weigh this heavily in their decision-making process.

GTSEnergyMarkets demonstrates some strength in its range of available trading instruments. The broker offers access to forex pairs, precious metals, energy commodities, and stock indices through CFD trading. This variety provides traders with opportunities for portfolio diversification and exposure to different market sectors. Such options can be valuable for implementing comprehensive trading strategies. The inclusion of energy commodities aligns with the broker's name and suggests some specialization in this sector.

However, the positive aspects of the broker's instrument variety are significantly undermined by the lack of detailed information about research and analysis resources. There is also no information about educational materials or advanced trading tools. Modern forex trading requires access to sophisticated analytical tools, real-time market data, economic calendars, and educational resources to support informed decision-making. The absence of information about such resources suggests either that they are not available or that the broker lacks the transparency to properly communicate its offerings.

Furthermore, without information about automated trading support, API access, or advanced order types, it's unclear whether GTSEnergyMarkets can meet the needs of sophisticated traders. Many traders rely on algorithmic trading strategies or complex order management systems. The limited information available makes it difficult to assess whether the broker's tools and resources can compete with those offered by regulated alternatives that typically provide comprehensive trading ecosystems.

Customer Service and Support Analysis (Score: N/A)

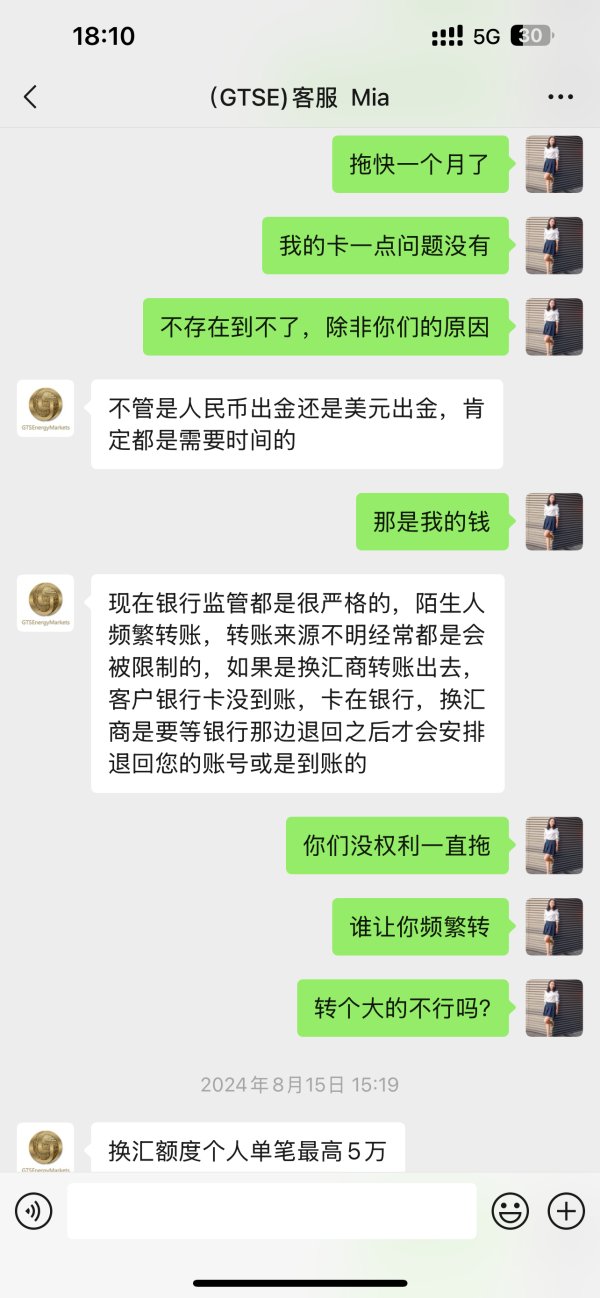

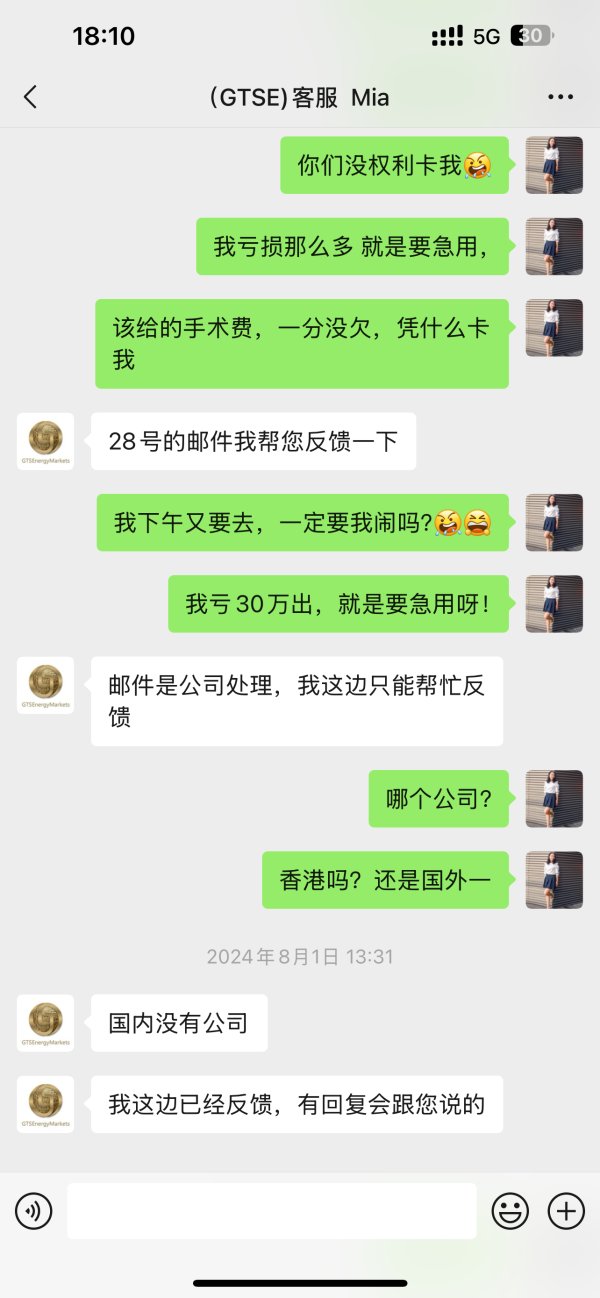

The complete absence of information regarding GTSEnergyMarkets' customer service and support infrastructure represents a critical gap in this evaluation. Customer service quality is fundamental to the forex trading experience. Traders often need immediate assistance with technical issues, account problems, or trading-related questions, particularly during volatile market conditions when quick resolution can impact trading outcomes significantly.

Reputable forex brokers typically provide multiple communication channels including phone support, live chat, email support, and sometimes even dedicated account managers for larger clients. They also usually offer extended customer service hours to accommodate global trading schedules and provide multilingual support to serve international client bases effectively. The lack of available information about these basic service elements raises serious questions about GTSEnergyMarkets' commitment to client support.

Additionally, without information about response times, service quality metrics, or problem resolution procedures, potential clients have no way to assess whether the broker can provide adequate support when issues arise. This is particularly concerning for traders who may need urgent assistance with fund withdrawals, technical platform problems, or dispute resolution.

The absence of customer service information, combined with the broker's lack of regulatory oversight, creates a scenario where clients may have limited options for assistance or recourse if problems occur. Issues with trading accounts or fund security could leave clients with nowhere to turn.

Trading Experience Analysis (Score: N/A)

The evaluation of GTSEnergyMarkets' trading experience is severely hampered by the lack of available information about platform performance, execution quality, and overall trading environment. Trading experience encompasses critical factors such as platform stability, order execution speed, slippage rates, and the reliability of price feeds. All of these directly impact a trader's ability to implement strategies effectively and achieve desired outcomes.

Without specific data about platform uptime, execution latency, or mobile trading capabilities, potential clients cannot assess whether GTSEnergyMarkets can provide the technical infrastructure necessary for serious forex trading. Modern traders expect platforms that can handle high-frequency trading, provide real-time market data, and maintain stability during periods of high market volatility when trading opportunities are most abundant.

The absence of information about order execution methods, whether the broker operates as a market maker or uses straight-through processing, and details about potential conflicts of interest makes it impossible to evaluate the fairness and transparency of the trading environment. These factors are crucial for traders who need to understand how their orders will be handled and whether they can expect fair execution of their trades.

In this gtsenergymarkets review, the lack of trading experience information must be considered alongside the regulatory concerns as another significant factor. This undermines the broker's credibility and makes it difficult to recommend to serious traders.

Trust and Safety Analysis (Score: 2/10)

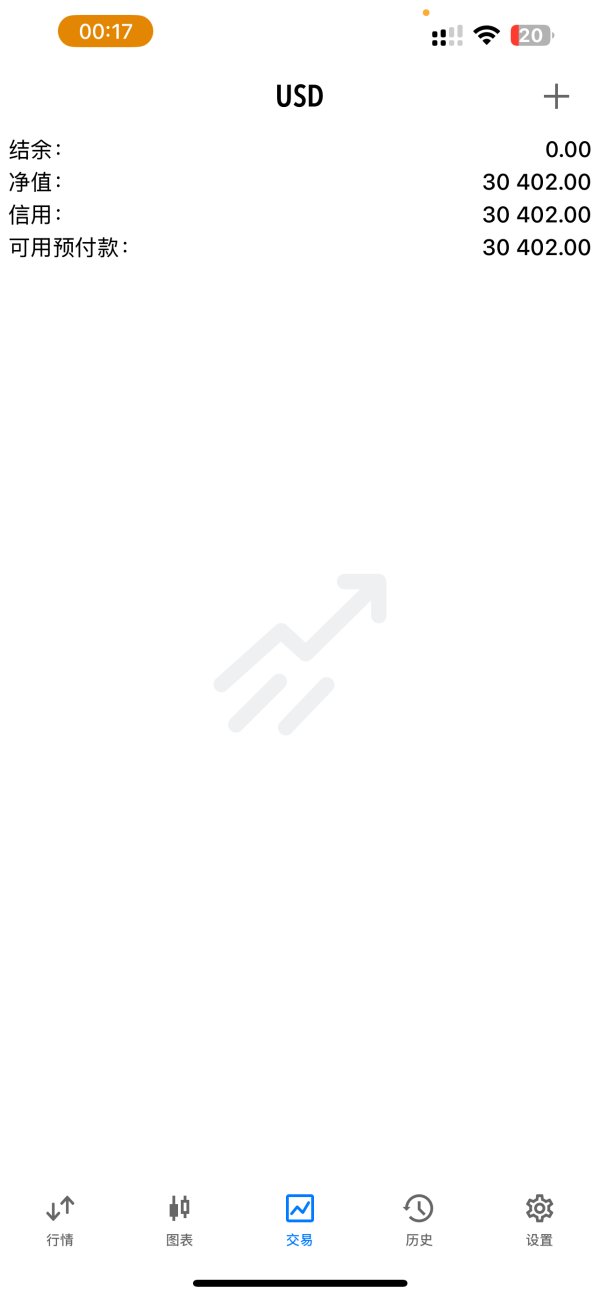

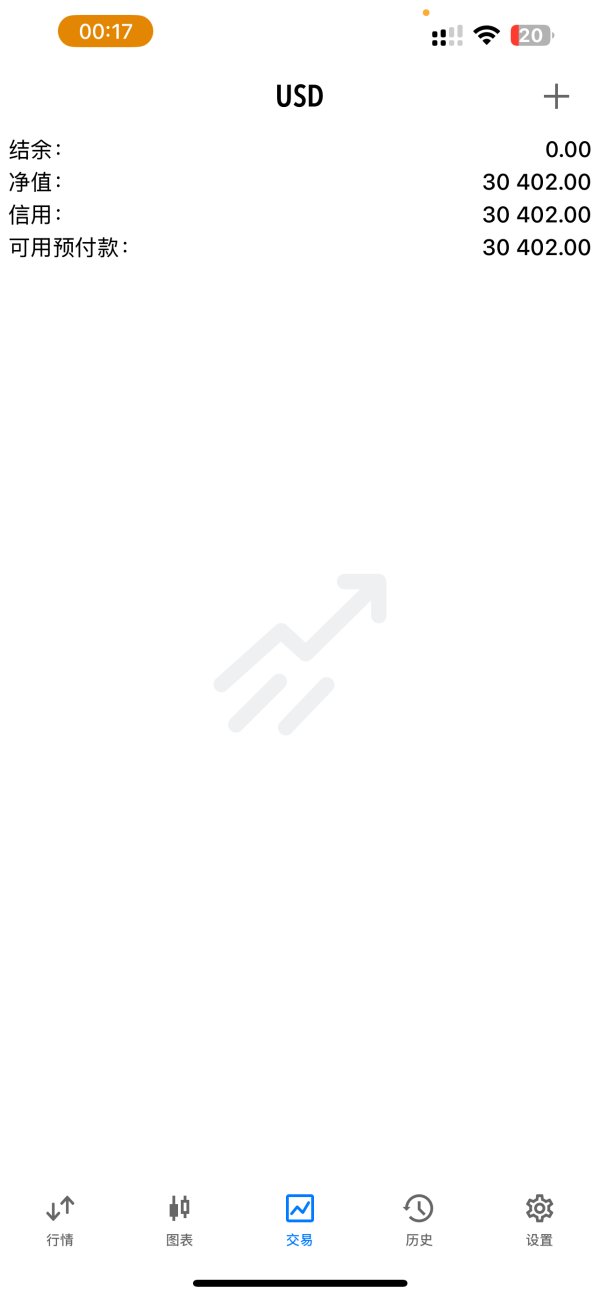

The trust and safety evaluation of GTSEnergyMarkets reveals the most concerning aspects of this broker's operations. The complete absence of regulatory approval from any recognized financial authority represents a fundamental safety risk that cannot be overlooked. Regulatory oversight provides essential protections including segregated client funds, compensation schemes, regular audits, and standardized complaint resolution procedures. These protections are simply not available with unregulated brokers.

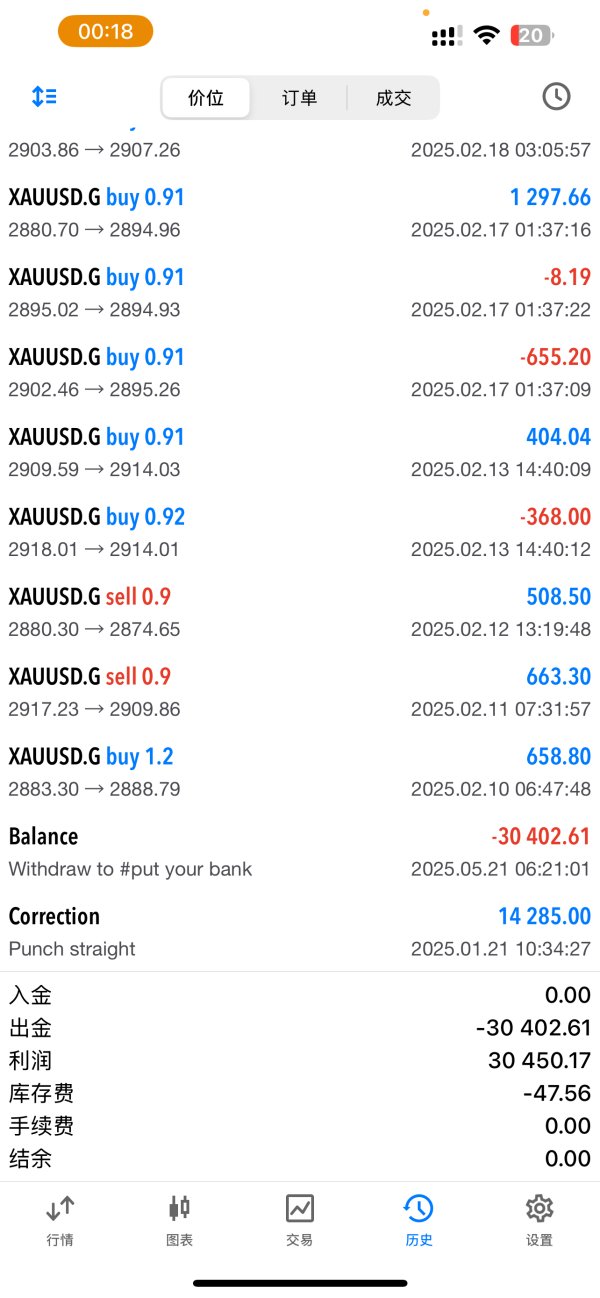

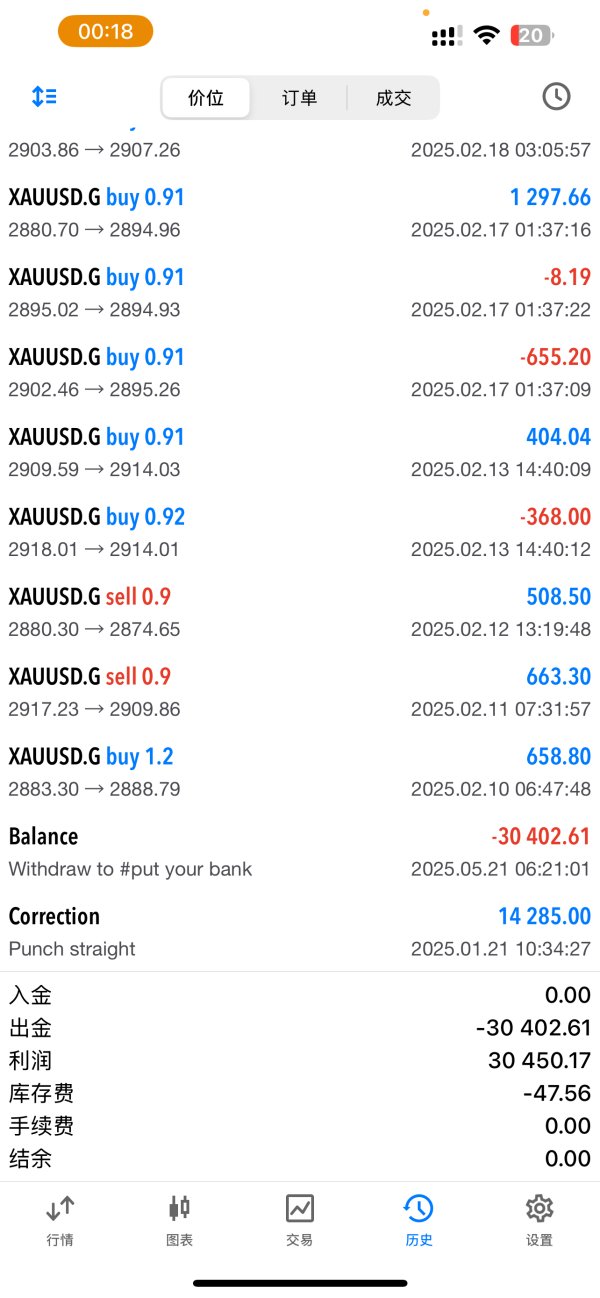

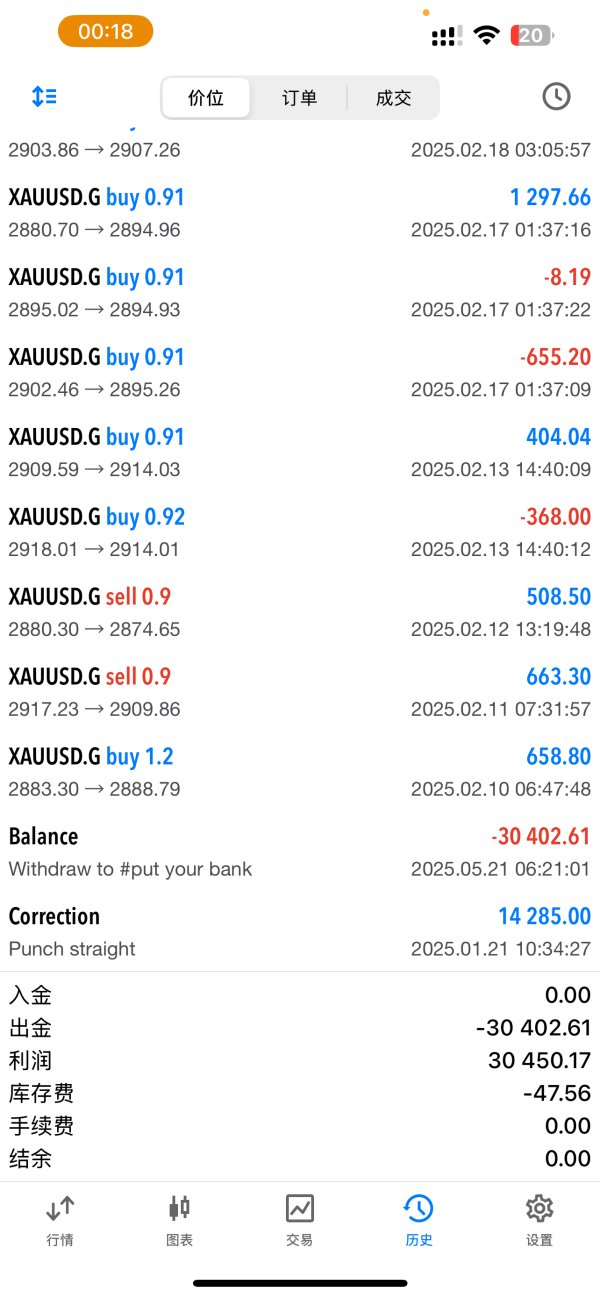

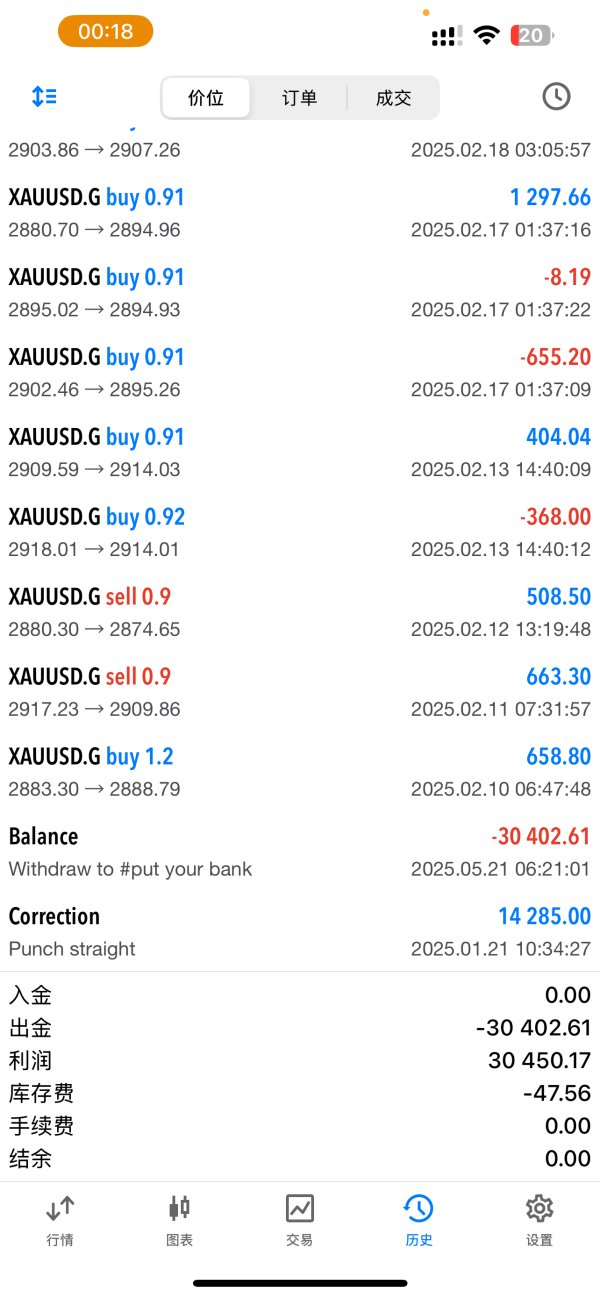

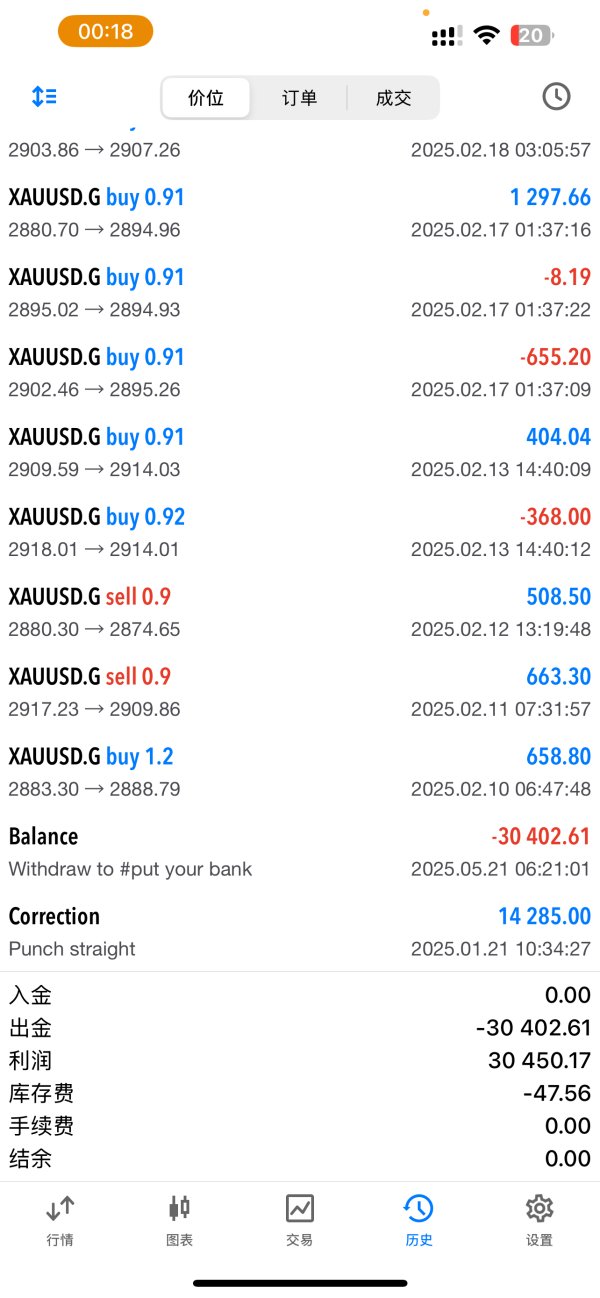

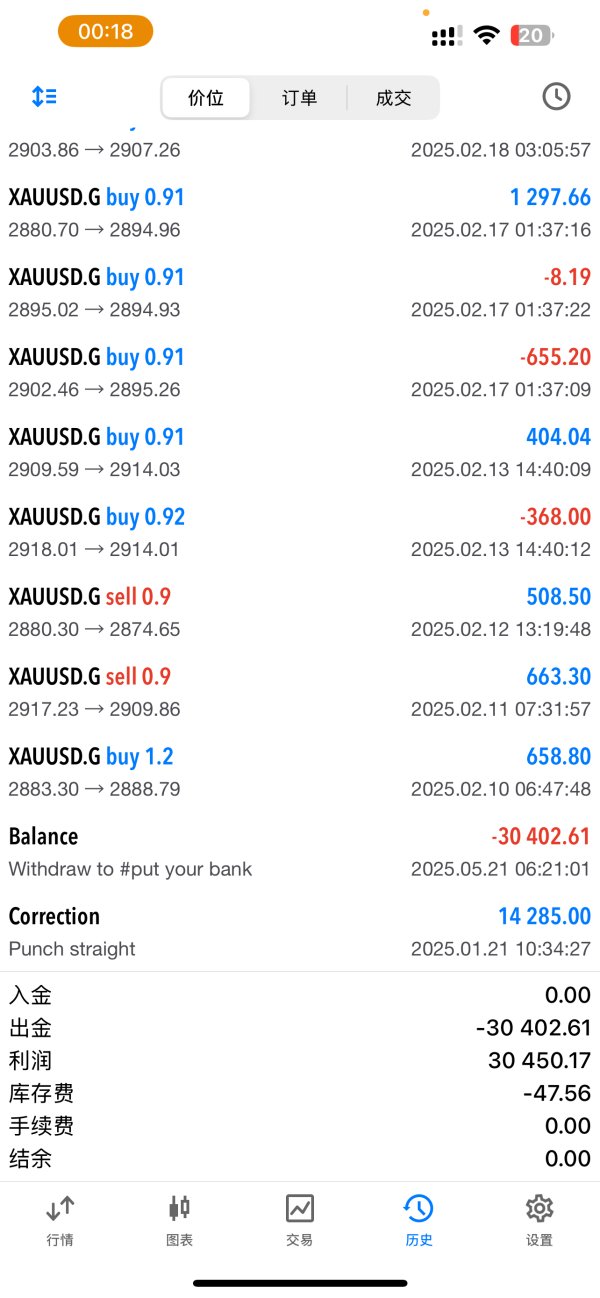

The user feedback pattern further reinforces these safety concerns. There are only 2 positive reviews compared to 33 exposure reviews - a ratio that strongly suggests systematic problems with the broker's operations. Exposure reviews typically indicate serious issues such as withdrawal problems, unfair trading practices, or other forms of client mistreatment that have prompted users to publicly warn others about their negative experiences.

Without regulatory protection, clients have extremely limited recourse if they experience problems with fund security, unfair trading conditions, or disputes with the broker. The absence of oversight also means there are no external audits of the broker's financial stability, no requirements for segregated client funds, and no compensation schemes to protect clients in case of broker insolvency.

The combination of regulatory deficiencies and concerning user feedback creates a risk profile that is unsuitable for most traders. This is particularly true for those who prioritize capital preservation and regulatory protection. The low trust score reflects these fundamental safety concerns that potential clients must carefully consider.

User Experience Analysis (Score: 4/10)

The user experience analysis reveals significant concerns based on the available feedback data. With only 2 positive reviews against 33 exposure reviews, GTSEnergyMarkets demonstrates a pattern of user dissatisfaction that extends well beyond typical trading complaints. This overwhelming negative feedback suggests systematic issues with the broker's operations that affect multiple clients across different aspects of the trading experience.

Exposure reviews typically indicate serious problems such as difficulties with fund withdrawals, unfair trading practices, poor customer service, or platform reliability issues. The high volume of such reviews relative to positive feedback suggests that negative experiences with GTSEnergyMarkets are not isolated incidents. Rather, they are indicative of broader operational problems that potential clients should expect to encounter.

The neutral review, while not explicitly negative, fails to provide sufficient positive counterweight to the concerning pattern of exposure reviews. This suggests that even clients who haven't experienced severe problems may not be sufficiently satisfied with their experience to provide strong positive recommendations.

For potential clients considering GTSEnergyMarkets, this user experience pattern should serve as a strong warning signal. The broker appears to struggle with fundamental aspects of client satisfaction, which combined with the lack of regulatory oversight, creates an environment where negative experiences are likely and resolution options are limited.

Conclusion

This comprehensive gtsenergymarkets review reveals a broker that presents significant risks and concerns that far outweigh any potential benefits. While GTSEnergyMarkets offers access to multiple trading instruments including forex, precious metals, energy, and indices, this singular positive aspect is completely overshadowed by fundamental deficiencies in regulatory oversight, transparency, and user satisfaction.

The broker's most suitable user base would be extremely limited to highly experienced traders who fully understand and accept the substantial risks associated with unregulated brokers. These traders would need the expertise to navigate potential problems independently. However, even for this limited demographic, the overwhelming negative user feedback pattern suggests that better alternatives are readily available in the regulated broker space.

The primary advantages of GTSEnergyMarkets are limited to its variety of trading instruments. The disadvantages include lack of regulatory approval, concerning user feedback patterns, limited transparency about operational procedures, and absence of client protection measures. These significant shortcomings make GTSEnergyMarkets unsuitable for most traders, particularly those who prioritize capital security and regulatory protection in their broker selection process.