Regarding the legitimacy of ClickTrades forex brokers, it provides FSA and WikiBit, .

Is ClickTrades safe?

Pros

Cons

Is ClickTrades markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

KW Investments Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@kwinvestmentsltd.comSharing Status:

Website of Licensed Institution:

https://clicktrades.com, www.capex.comExpiration Time:

--Address of Licensed Institution:

Unit G, F28 Eden Plaza, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4346119Licensed Institution Certified Documents:

Is ClickTrades A Scam?

Introduction

ClickTrades is an online forex and CFD broker that has been operating since 2018. It is positioned in the financial market as a platform that offers a wide range of trading instruments, including forex pairs, commodities, stocks, and cryptocurrencies. However, the broker's reputation has been mixed, with varying opinions about its legitimacy and reliability. Given the potential risks associated with trading in the forex market, it is crucial for traders to carefully evaluate any broker before committing their funds. This article aims to provide an objective assessment of ClickTrades by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The investigation is based on data collected from multiple credible sources, including broker reviews, regulatory filings, and user testimonials.

Regulation and Legitimacy

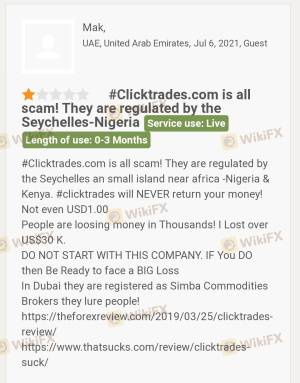

The regulatory status of a broker is a critical factor in determining its legitimacy and safety. ClickTrades operates under the Seychelles Financial Services Authority (FSA) and holds a license number SD020. While the FSA provides some level of oversight, it is generally considered a weaker regulatory body compared to top-tier regulators such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD020 | Seychelles | Verified |

The quality of regulation at ClickTrades raises concerns among traders, especially given the offshore nature of its operations. Offshore regulators often have less stringent requirements, which can lead to increased risks for investors. Furthermore, there have been reports of ClickTrades experiencing compliance issues, which could affect its reliability as a trading platform. Traders should be cautious and consider the implications of trading with a broker regulated by a less reputable authority.

Company Background Investigation

ClickTrades is operated by KW Investments Limited, a company registered in Seychelles. The broker's ownership structure and management team are crucial for understanding its operational integrity. Unfortunately, detailed information about the management team is limited, which raises questions about transparency. A broker's history and the experience of its management team can significantly impact its service quality and reliability.

The absence of comprehensive information regarding ClickTrades‘ management and operational history is a red flag for potential investors. Transparency in a broker’s operations is essential for building trust, and the lack of this can make traders hesitant to deposit funds. Furthermore, the company's commitment to providing clear and accessible information about its services is vital for fostering a trustworthy trading environment.

Trading Conditions Analysis

Understanding the trading conditions offered by ClickTrades is essential for evaluating its overall attractiveness to traders. The broker has a relatively high minimum deposit requirement of $1,000, which may deter novice traders. ClickTrades claims to have competitive spreads, but user experiences indicate that spreads can vary significantly depending on market conditions.

| Fee Type | ClickTrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips (approx.) | 1.0 - 1.5 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | 0.5% - 2.0% | 0.5% - 1.5% |

The absence of a commission structure may initially seem appealing; however, the spreads offered by ClickTrades are generally higher than those provided by many competitors. Additionally, the broker imposes inactivity fees, which could further diminish traders' potential profits. Overall, the trading conditions at ClickTrades may not be as favorable as those offered by more established brokers, particularly for those who prefer lower minimum deposits and tighter spreads.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. ClickTrades claims to implement several safety measures, including segregated accounts for client funds and negative balance protection. Segregated accounts are essential for ensuring that clients' funds are kept separate from the broker's operational funds, providing an extra layer of security.

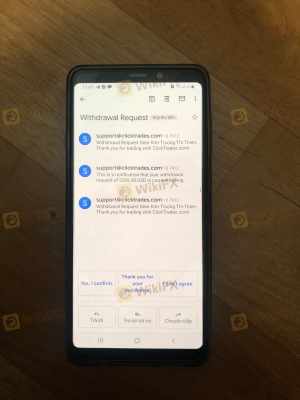

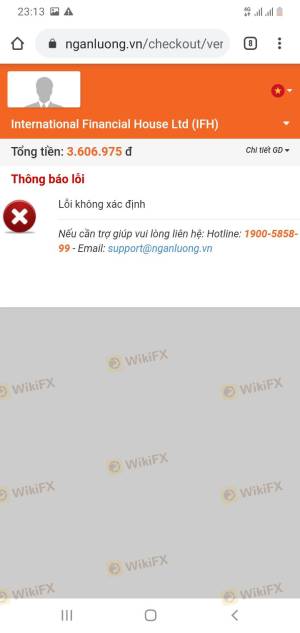

However, the effectiveness of these measures can vary widely among brokers. While ClickTrades asserts that it employs modern cryptographic methods to protect client data, the lack of robust regulatory oversight raises concerns about the actual implementation of these safety protocols. In the past, there have been instances where clients reported difficulties in withdrawing funds, which could indicate potential issues with the brokers financial practices.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews of ClickTrades reveal a mixed bag of experiences. While some users praise the platform for its user-friendly interface and diverse trading instruments, others have reported significant issues, particularly regarding the withdrawal process.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| High Minimum Deposit | Medium | Limited |

| Customer Support Issues | Medium | Slow response |

Typical complaints include difficulties in withdrawing funds, slow customer support responses, and high minimum deposit requirements. For instance, one user reported being unable to withdraw their funds for several weeks, leading to frustration and distrust. These complaints highlight potential operational weaknesses within ClickTrades, making it essential for prospective traders to consider these factors before engaging with the broker.

Platform and Execution

The quality of the trading platform is another critical aspect of a broker's service. ClickTrades offers a proprietary web-based platform and supports MetaTrader 5 (MT5). While the platform is generally user-friendly, there have been reports of execution delays and slippage during volatile market conditions.

Traders have expressed concerns about the reliability of order execution, particularly during high-impact news events. Instances of rejected orders and significant slippage can severely impact a trader's profitability, making it essential for ClickTrades to address these issues to improve user experience.

Risk Assessment

Engaging with ClickTrades carries inherent risks, particularly due to its regulatory status and user complaints. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with less oversight. |

| Withdrawal Risk | High | Reports of delayed withdrawals and complaints. |

| Trading Condition Risk | Medium | High minimum deposit and spreads compared to competitors. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a demo account, and only invest funds they can afford to lose. It may also be prudent to explore alternative brokers with stronger regulatory oversight and better user reviews.

Conclusion and Recommendations

In conclusion, ClickTrades presents a mixed picture regarding its legitimacy and reliability. While it is a regulated broker, the oversight provided by the Seychelles Financial Services Authority is not as robust as that of more reputable regulatory bodies. The high minimum deposit requirement, coupled with user complaints about withdrawal issues, raises concerns about the broker's trustworthiness.

For traders seeking a reliable trading experience, it may be advisable to consider alternative brokers with stronger regulatory frameworks and better customer feedback. Brokers such as eToro, IG, or Forex.com may offer more favorable trading conditions and a higher level of investor protection. Ultimately, traders should carefully evaluate their options and conduct comprehensive research before choosing to trade with ClickTrades or any other broker.

Is ClickTrades a scam, or is it legit?

The latest exposure and evaluation content of ClickTrades brokers.

ClickTrades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ClickTrades latest industry rating score is 3.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.