Midori FX 2025 Review: Everything You Need to Know

Executive Summary

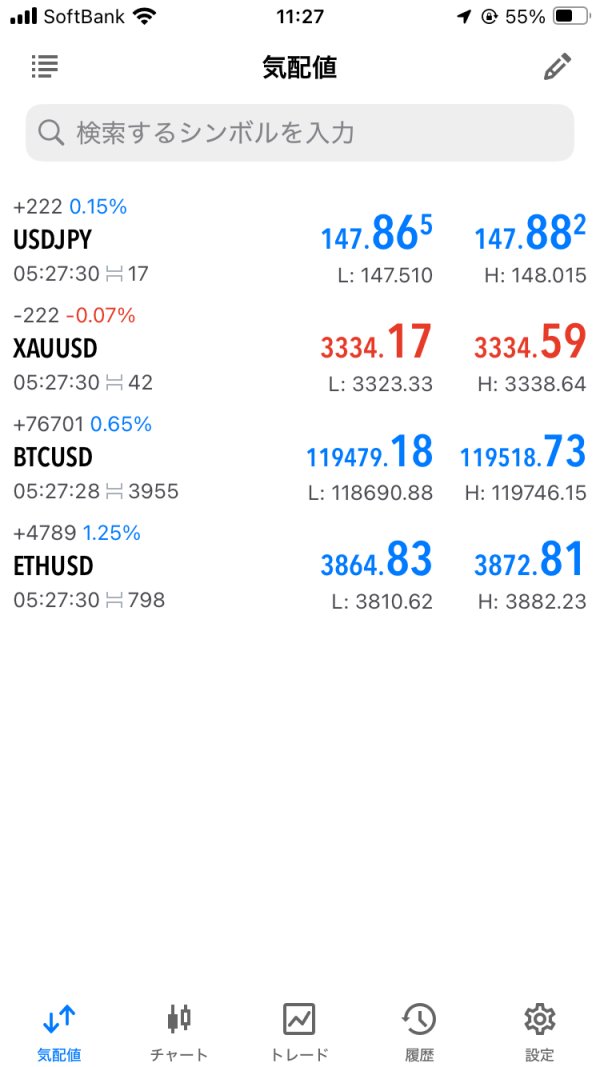

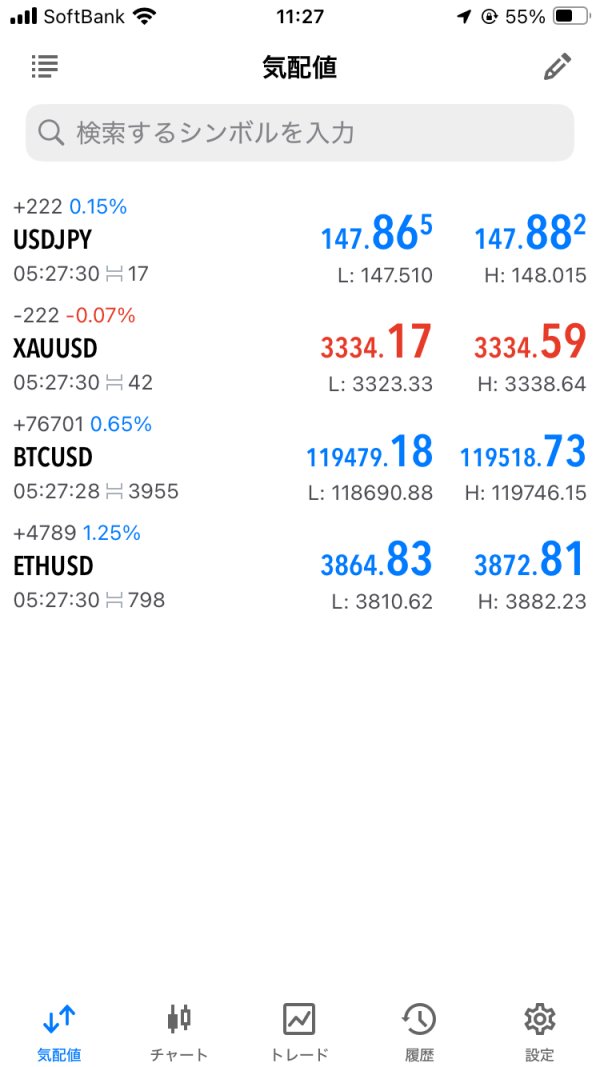

Midori FX emerges as a new player in the online forex brokerage landscape. The company positions itself as a platform designed for traders seeking high leverage opportunities and diverse trading instruments. This midori fx review reveals a broker that offers leverage up to 1:2000 and claims a 99% execution rate. The platform targets experienced traders who prioritize high-risk, high-reward trading strategies. The broker operates primarily through the MT5 trading platform. It supports over 57 forex currency pairs, stock indices, and commodities.

The broker appears to cater specifically to sophisticated traders who understand the risks associated with high leverage trading. With three distinct account types - Standard, Raw, and Bull accounts - Midori FX attempts to accommodate different trading styles and capital requirements. However, our analysis reveals significant gaps in regulatory transparency and limited user feedback. Potential clients should carefully consider these factors before committing funds.

While the broker promotes attractive trading conditions including tight spreads starting from zero and high execution rates, several concerns remain. The lack of comprehensive regulatory information and minimal user testimonials raise questions about its overall reliability and market standing.

Important Notice

This review is based on publicly available information as of 2025. Traders should note that Midori FX operates with headquarters in South Africa, which may present different regulatory frameworks and client protection measures compared to brokers in other jurisdictions. The regulatory landscape for forex brokers varies significantly across regions. South African-based brokers may not offer the same level of investor protection as those regulated by tier-one authorities such as the FCA or CySEC.

Our evaluation methodology relies on current market information, official broker communications, and available user feedback. Given the limited historical data and user reviews for this relatively new broker, potential clients face additional uncertainty. We strongly advise conducting additional due diligence before opening trading accounts.

Rating Framework

Broker Overview

Midori FX presents itself as an online trading broker headquartered in South Africa. The company focuses on forex and related financial instruments. The company's business model centers around providing high leverage trading opportunities, with maximum leverage reaching 1:2000. This positions it among the more aggressive offerings in the retail forex market. The broker emphasizes a "User First" philosophy, claiming to create a supportive environment that enables both confident trading initiation and long-term engagement.

The company's operational structure revolves around offering multiple account types to accommodate different trading preferences and capital levels. Their Standard, Raw, and Bull accounts are designed to serve various trader segments. These range from those seeking straightforward trading conditions to those requiring more sophisticated execution models. The broker's commitment to high execution rates, claiming 99% successful order fulfillment, suggests a focus on technical infrastructure and trading reliability.

Midori FX utilizes the MetaTrader 5 platform as its primary trading interface. The platform supports advanced technical analysis tools and algorithmic trading capabilities. The platform facilitates trading across more than 57 forex currency pairs, along with stock indices and commodity instruments. However, specific regulatory oversight details remain unclear from available public information. This represents a significant consideration for potential clients evaluating the broker's credibility and client fund protection measures.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing Midori FX operations. This represents a critical information gap for potential clients seeking regulated trading environments.

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in current public information. Clients must contact the broker directly for comprehensive details.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available materials. Direct contact becomes necessary for precise requirements.

Bonus and Promotional Offers: According to available information, Midori FX conducts regular promotional activities including deposit bonuses and new account opening incentives. Specific terms and conditions require verification.

Tradeable Assets: The platform supports over 57 forex currency pairs, stock indices, and commodity trading instruments. This provides diverse market exposure opportunities for traders across different asset classes.

Cost Structure: Spreads reportedly begin from zero. However, comprehensive commission structures and additional fees are not detailed in current public information, requiring further investigation for complete cost analysis.

Leverage Options: Maximum leverage available reaches 1:2000. This positions the broker among high-leverage providers in the retail forex market, suitable for experienced traders understanding associated risks.

Platform Options: The primary trading platform is MetaTrader 5. MT5 offers advanced charting capabilities, technical analysis tools, and expert advisor support for automated trading strategies.

Geographic Restrictions: Specific country restrictions and regulatory limitations are not detailed in available information. Verification becomes necessary for international accessibility.

Customer Support Languages: Available support languages are not specified in current midori fx review materials. Direct inquiry becomes necessary for multilingual support capabilities.

Account Conditions Analysis

Midori FX offers three distinct account types: Standard, Raw, and Bull accounts. Each type is designed to serve different trading preferences and strategies. The Standard account appears positioned for general retail traders seeking straightforward trading conditions. The Raw account likely targets traders prioritizing minimal spread environments. The Bull account suggests optimization for specific trading strategies, though detailed specifications for each account type require direct verification with the broker.

The absence of specific minimum deposit information in publicly available materials creates uncertainty for potential clients planning their initial investment. This lack of transparency regarding entry requirements makes it difficult to assess the broker's accessibility for different capital levels. Most established brokers clearly communicate minimum deposit requirements across their account tiers. This information gap represents a notable deficiency in Midori FX's public communications.

Account opening procedures and verification requirements are not detailed in current materials. This leaves questions about the onboarding process timeline and documentation requirements. Modern traders typically expect streamlined, digital account opening processes with clear timelines and requirements. The absence of this information suggests potential clients may need to invest significant time in preliminary inquiries before understanding the full account setup process.

Special account features, such as Islamic accounts for Sharia-compliant trading or professional account designations for qualified traders, are not mentioned in available information. Given the diverse global trader base that most forex brokers serve, the absence of information about specialized account options may limit the broker's appeal to specific trader segments. This midori fx review finds that comprehensive account condition transparency remains a significant improvement area for the broker.

Midori FX's primary trading platform, MetaTrader 5, represents a solid foundation for technical analysis and automated trading strategies. MT5 offers advanced charting capabilities, multiple timeframe analysis, and extensive technical indicator libraries that appeal to serious traders. The platform's support for Expert Advisors and trading signals provides opportunities for both algorithmic trading and signal-based strategies. This can benefit traders seeking automation or additional market insights.

The broker's claim of supporting over 57 forex currency pairs provides reasonable market coverage for most trading strategies. The coverage encompasses major, minor, and exotic currency combinations. Additionally, the inclusion of stock indices and commodity instruments expands trading opportunities beyond pure forex, allowing for portfolio diversification and different market exposure strategies. This asset diversity can appeal to traders seeking comprehensive market access through a single platform.

However, specific information about research and analysis resources remains limited in available materials. Modern traders typically expect comprehensive market analysis, economic calendars, and educational resources to support their trading decisions. The absence of detailed information about these supplementary resources suggests either limited offerings or inadequate communication of available tools.

Educational resources and trader development programs are not mentioned in current public information. This represents a significant gap for brokers targeting long-term client relationships. Established brokers typically offer webinars, trading guides, and market analysis to support trader development and engagement. The lack of visible educational infrastructure may limit the broker's appeal to developing traders seeking comprehensive support beyond basic platform access.

Customer Service and Support Analysis

Information regarding Midori FX's customer service infrastructure remains notably limited in publicly available materials. The absence of specific details about support channels, such as live chat, telephone support, or email response systems, creates uncertainty about client assistance availability. Modern forex brokers typically provide multiple contact methods with clearly communicated availability hours and response time expectations.

Response time commitments and service quality metrics are not detailed in current broker communications. This makes it difficult to assess the level of support traders can expect. Professional trading environments require reliable, timely support for technical issues, account inquiries, and trading-related questions. The lack of transparent service level commitments suggests potential clients may face uncertainty about support quality until after account opening.

Multilingual support capabilities are not specified. This could limit accessibility for international traders. Given the global nature of forex markets, successful brokers typically offer support in multiple languages to serve diverse client bases effectively. This information gap may indicate limited international support infrastructure or simply inadequate communication of available services.

The absence of user testimonials or service quality feedback in available materials prevents assessment of actual client experiences with customer support. Established brokers often showcase client feedback and support quality metrics as part of their credibility building. The lack of such information in Midori FX's public presence suggests either limited operational history or gaps in client relationship management communication.

Trading Experience Analysis

Midori FX claims a 99% execution rate. If accurate, this would represent competitive order fulfillment performance in the retail forex market. High execution rates are crucial for traders implementing time-sensitive strategies or operating in volatile market conditions. However, the absence of independent verification or detailed execution statistics makes it difficult to validate these claims comprehensively.

The MT5 platform foundation provides robust technical capabilities for serious traders. Features include advanced order types, multiple timeframe analysis, and comprehensive charting tools. The platform's stability and feature set have been proven across numerous brokers, suggesting that Midori FX clients should have access to professional-grade trading tools. However, specific customizations or enhancements made by the broker are not detailed in available information.

Spread stability and pricing transparency represent critical factors for trading experience quality. Yet detailed spread information beyond "starting from zero" is not provided. Traders typically require comprehensive spread schedules, commission structures, and pricing during different market conditions to evaluate total trading costs accurately. This midori fx review finds that pricing transparency requires significant improvement for informed decision-making.

Mobile trading capabilities and cross-device synchronization are not specifically addressed in available materials. Mobile trading represents an increasingly important component of modern trading infrastructure. Professional traders expect seamless access across desktop, web, and mobile platforms with synchronized account information and order management capabilities.

Trust and Reliability Analysis

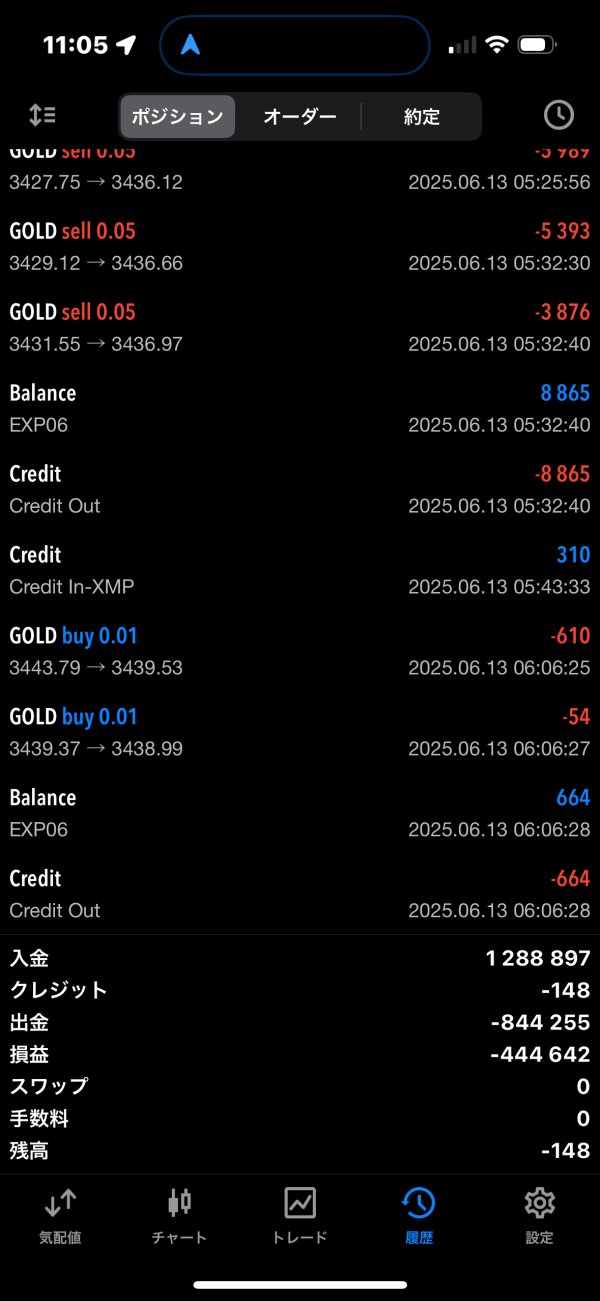

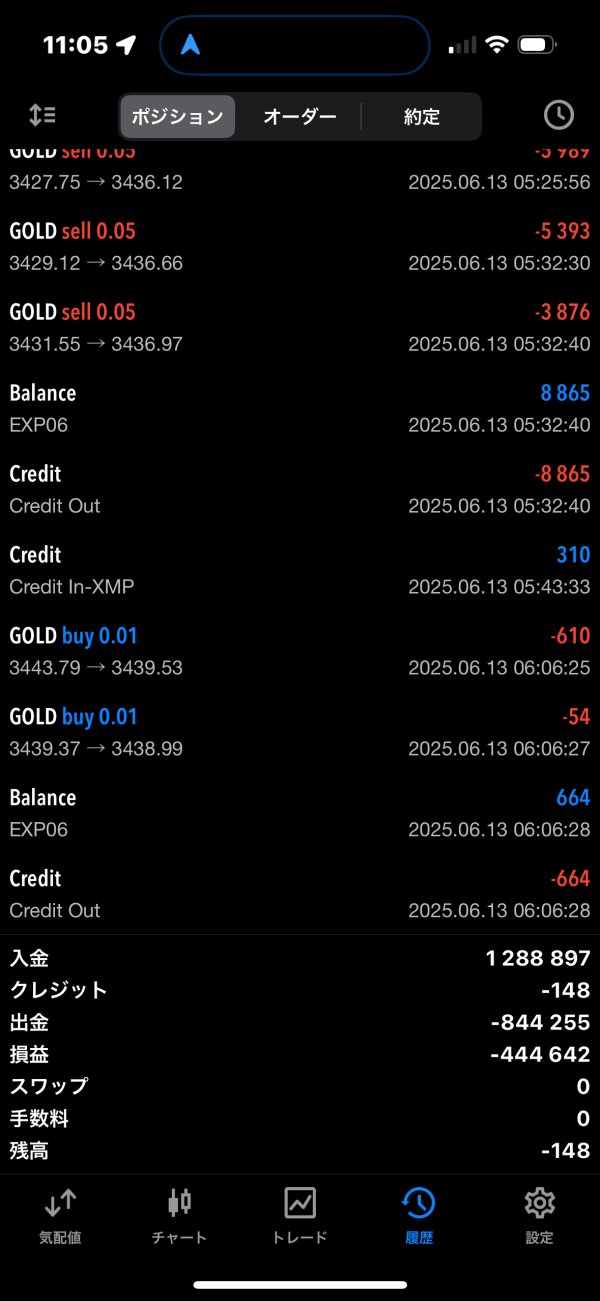

The most significant concern in evaluating Midori FX's trustworthiness stems from the lack of clear regulatory information in publicly available materials. Regulatory oversight provides crucial client protections including segregated fund requirements, compensation schemes, and operational oversight. The absence of specific regulatory authority mentions creates uncertainty about client fund safety and dispute resolution mechanisms.

Fund security measures and client money protection protocols are not detailed in current public communications. Established brokers typically highlight segregated account arrangements, insurance coverage, and regulatory compliance measures as key trust-building elements. The absence of such information in Midori FX's materials represents a significant transparency gap that potential clients should address before funding accounts.

Company transparency regarding ownership structure, management team, and operational history is limited in available information. Professional trading relationships typically benefit from understanding the broker's background, leadership experience, and business track record. The lack of comprehensive company information may indicate either a very new operation or limited commitment to transparency.

Industry reputation and third-party evaluations are not evident in current market presence. This may reflect the broker's relatively recent market entry. Established brokers typically accumulate industry recognition, awards, and independent reviews over time. The absence of such credentials suggests clients should exercise additional caution and conduct thorough due diligence before committing significant trading capital.

User Experience Analysis

Current user rating information shows zero feedback scores. This indicates either very limited operational history or minimal client base development. The absence of user testimonials, reviews, or satisfaction metrics makes it extremely difficult to assess actual client experiences with the broker's services. Established brokers typically accumulate substantial user feedback that provides insights into service quality, platform reliability, and overall client satisfaction.

Interface design and platform usability information is not detailed beyond the MT5 platform foundation. While MT5 provides proven functionality, broker-specific customizations, educational integration, and user experience enhancements can significantly impact overall trading satisfaction. The lack of detailed interface information suggests potential clients may need to open demo accounts to evaluate usability thoroughly.

Account registration and verification processes are not clearly outlined in available materials. This creates uncertainty about onboarding efficiency and requirements. Modern traders expect streamlined, digital verification processes with clear timelines and document requirements. The absence of detailed onboarding information may indicate either underdeveloped processes or inadequate communication of existing procedures.

Common user concerns and complaint resolution procedures are not addressed in current public information. Professional brokers typically maintain transparent complaint handling processes and demonstrate responsiveness to client concerns. The lack of visible client feedback mechanisms or resolution procedures suggests potential gaps in client relationship management infrastructure.

Conclusion

This midori fx review reveals a broker with potentially attractive trading conditions, including high leverage options and competitive execution claims. However, significant transparency and credibility gaps raise concerns for potential clients. While the MT5 platform foundation and diverse asset offerings provide solid technical capabilities, the absence of clear regulatory oversight and minimal user feedback create substantial uncertainty about client protection and service quality.

Midori FX may appeal to highly experienced traders who prioritize high leverage access and are comfortable with elevated risk levels, including regulatory uncertainty. However, the lack of comprehensive information about account conditions, fee structures, and client protections makes it difficult to recommend for most retail traders seeking regulated, transparent trading environments.

The broker's main advantages include high leverage availability up to 1:2000 and support for diverse trading instruments through a professional platform. Primary concerns center on regulatory transparency, limited user feedback, and gaps in service information that prevent comprehensive evaluation of client protection and service quality standards.