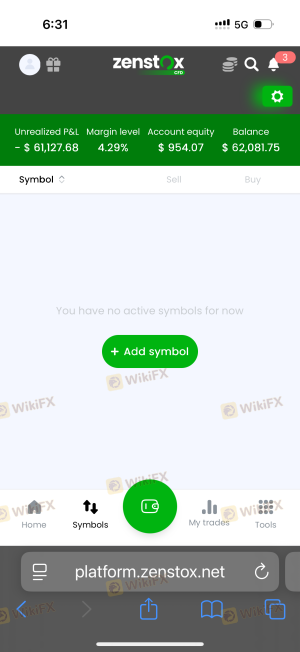

Regarding the legitimacy of zenstox forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is zenstox safe?

Pros

Cons

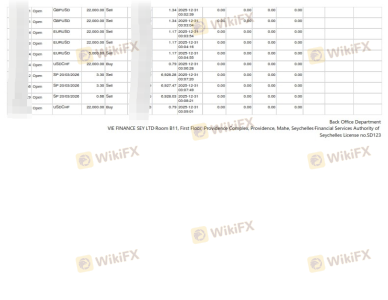

Is zenstox markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

VIE FINANCE SEY LTD

Effective Date:

--Email Address of Licensed Institution:

info@viefinancesey.comSharing Status:

Website of Licensed Institution:

https://www.viefinancesey.com, https://www.zenstox.comExpiration Time:

--Address of Licensed Institution:

Room 10, Deenu's Building, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Zenstox Safe or a Scam?

Introduction

Zenstox is a relatively new player in the forex market, having been established in 2022 and operating under the name Vie Finance Sey Ltd. As a broker, Zenstox offers a variety of trading instruments, including contracts for difference (CFDs) on forex, stocks, indices, commodities, and cryptocurrencies. In an increasingly competitive and often opaque industry, traders must exercise caution when selecting a broker. The potential for scams and unethical practices looms large, making it essential for traders to conduct thorough evaluations of any broker they consider. This article aims to assess the safety and legitimacy of Zenstox by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial in determining its safety and credibility. Zenstox is regulated by the Seychelles Financial Services Authority (FSA), which is known for its relatively lenient regulatory standards compared to more stringent jurisdictions like the UK or the US. The following table summarizes the core regulatory information for Zenstox:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 123 | Seychelles | Verified |

While Zenstox holds a license from the FSA, it is essential to note that the regulatory oversight may not be as robust as that provided by other jurisdictions. The FSA does impose certain requirements on regulated entities, such as maintaining client funds in segregated accounts and adhering to anti-money laundering practices. However, the overall enforcement and compliance mechanisms may not be as rigorous. During our evaluation, no negative regulatory disclosures were found against Zenstox, which may indicate a level of operational integrity. However, traders should remain vigilant, as the offshore nature of the regulation could expose them to higher risks.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its legitimacy. Zenstox, operated by Vie Finance Sey Ltd, is based in Seychelles. The company has been in operation for a short period, which can raise concerns regarding its stability and reliability. The management teams background and experience are also critical factors in evaluating the broker's competence. Unfortunately, specific information about the management team of Zenstox is limited, which may hinder transparency.

In terms of information disclosure, Zenstox does provide basic details about its services and trading conditions on its website. However, a lack of comprehensive information about the management and operational history can be a red flag for potential investors. Transparency is crucial in the financial services industry, and brokers that do not provide adequate information may not be trustworthy. Therefore, while Zenstox operates legally, the limited information available raises questions about its overall transparency and reliability.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact the trading experience. Zenstox has a minimum deposit requirement of $200, which is relatively standard for many brokers. However, the overall fee structure can provide insights into the broker's cost-effectiveness. Below is a comparison of core trading costs associated with Zenstox:

| Fee Type | Zenstox | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.02% | 0.01% - 0.03% |

Zenstox does not charge commissions on trades, which may be appealing to traders. However, the spreads offered are variable, and traders may find them less competitive compared to other brokers. Moreover, the overnight interest rates can add up, especially for traders holding positions for extended periods. It's important for traders to assess these costs carefully, as they can significantly impact profitability, particularly for high-frequency traders.

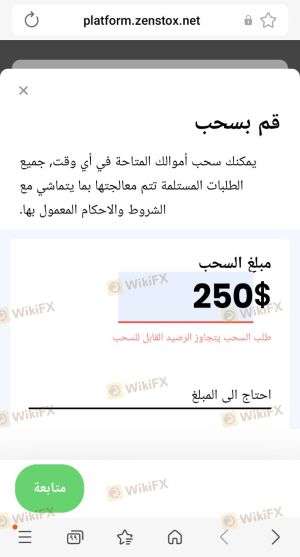

Client Fund Security

The safety of client funds is a paramount concern for any trader. Zenstox claims to implement several measures to protect client funds, including holding them in segregated accounts. This means that client funds are kept separate from the broker's operational funds, which is a standard practice aimed at safeguarding investor capital. Furthermore, Zenstox operates under the regulatory oversight of the Seychelles FSA, which requires brokers to adhere to certain financial standards.

Despite these measures, there have been reports of difficulties experienced by clients attempting to withdraw their funds. Such issues raise concerns about the broker's commitment to fund security. Historical disputes or complaints related to fund withdrawals can indicate potential risks associated with a broker. Therefore, while Zenstox has established some protocols for client fund safety, the effectiveness of these measures remains to be fully evaluated based on user experiences.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation and reliability. Zenstox has received mixed reviews from users, with some praising its user-friendly platform and range of trading instruments, while others have reported negative experiences, particularly concerning fund withdrawals. Below is a summary of common complaint types associated with Zenstox:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Lockouts | Medium | Unclear explanations |

| Customer Support Delays | Medium | Inconsistent |

One notable case involved a trader who reported being unable to withdraw their profits after multiple attempts. This trader expressed frustration over the lack of communication from Zenstox regarding the status of their withdrawal request. Such experiences highlight the importance of effective customer support and transparent communication in maintaining a trustworthy trading environment.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors that can influence a trader's success. Zenstox offers a custom-built trading platform designed for ease of use. However, user experiences indicate that the platform may experience occasional stability issues. Additionally, the execution quality, including slippage and rejection rates, is vital for traders, especially in fast-moving markets. Reports of slippage during critical market events could indicate potential manipulation or inefficiencies within the platform.

Risk Assessment

Trading with Zenstox involves several inherent risks, primarily due to its offshore regulatory status and mixed user reviews. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack stringent oversight. |

| Fund Security Risk | Medium | Reports of withdrawal issues raise concerns. |

| Platform Reliability | Medium | User feedback indicates occasional stability issues. |

To mitigate these risks, traders are advised to conduct thorough research before investing, maintain realistic expectations, and consider diversifying their investments across different brokers.

Conclusion and Recommendations

In conclusion, while Zenstox is a regulated broker, the quality of its regulation, mixed user feedback, and reports of withdrawal issues raise significant concerns about its overall safety and reliability. Traders should approach Zenstox with caution, particularly those who are new to forex trading or have limited experience. It is essential to weigh the potential risks against the broker's offerings and consider alternative options if necessary.

For traders seeking reliable alternatives, it may be beneficial to explore brokers that are regulated in more stringent jurisdictions, such as those in the UK or Australia, where regulatory oversight is more robust. Ultimately, thorough research and careful consideration of individual trading needs will be crucial in making an informed decision about whether to engage with Zenstox.

In summary, is Zenstox safe? The evidence suggests that while it operates legally, potential traders should be aware of the risks involved and consider all aspects before committing their funds.

Is zenstox a scam, or is it legit?

The latest exposure and evaluation content of zenstox brokers.

zenstox Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

zenstox latest industry rating score is 2.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.