Regarding the legitimacy of GTSEnergyMarkets forex brokers, it provides CYSEC, ASIC and WikiBit, (also has a graphic survey regarding security).

Is GTSEnergyMarkets safe?

Software Index

Risk Control

Is GTSEnergyMarkets markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 16

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

GTSE Capital Group Ltd

Effective Date: Change Record

2017-08-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

gteprime.comExpiration Time:

--Address of Licensed Institution:

Joanna Court, Office 201, Floor 2, 61 Omirou Street, 3096 Mesa Geitonia, Limassol, CyprusPhone Number of Licensed Institution:

+357 22 222 804Licensed Institution Certified Documents:

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

HARMOVEST CAPITAL AUS PTY LTD

Effective Date: Change Record

2019-04-01Email Address of Licensed Institution:

services@hmvestcapital.comSharing Status:

No SharingWebsite of Licensed Institution:

hmvestcapital.comExpiration Time:

--Address of Licensed Institution:

L 5 115 PITT ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0451661833Licensed Institution Certified Documents:

Is GTSEnergyMarkets A Scam?

Introduction

GTSEnergyMarkets is an online trading platform that positions itself as a provider of foreign exchange and various financial instruments. In an industry where transparency and trust are paramount, traders must exercise caution when evaluating any forex broker. The potential for scams and fraudulent activities is significant, which necessitates thorough due diligence. This article aims to assess the credibility of GTSEnergyMarkets through a comprehensive investigation of its regulatory status, company background, trading conditions, client feedback, and overall risk profile. Our evaluation draws from multiple online sources, including reviews and regulatory information, to provide a balanced and informed perspective on whether GTSEnergyMarkets is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its legitimacy and operational integrity. GTSEnergyMarkets claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). However, the lack of verification from these regulatory bodies raises significant concerns about the broker's authenticity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001284404 | Australia | Not Verified |

| CySEC | N/A | Cyprus | Not Verified |

The absence of a verified license from ASIC or CySEC suggests that GTSEnergyMarkets may not be operating under the stringent regulatory frameworks that these authorities enforce. Furthermore, the Financial Conduct Authority (FCA) in the UK has issued warnings against GTSEnergyMarkets, indicating that this broker may be providing services without proper authorization. The lack of a transparent regulatory framework is a significant red flag, as it implies that traders may not have access to the protections typically afforded by regulated entities, such as segregated accounts and compensation schemes.

Company Background Investigation

GTSEnergyMarkets was established in 2018 and claims to operate from the United Kingdom. However, the information regarding its ownership structure and management team is notably sparse. The broker's website lacks comprehensive details about its history, including any significant milestones or achievements that would lend credibility to its operations.

Additionally, the management team's qualifications and experience are not disclosed, which is a common practice among reputable brokers. The absence of this information contributes to a perception of opacity, making it difficult for potential clients to assess the broker's reliability. Transparency in company operations is crucial in the financial industry, and GTSEnergyMarkets' failure to provide such information raises concerns about its overall legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its competitiveness and fairness. GTSEnergyMarkets advertises a range of trading instruments, including forex pairs, commodities, and indices, with leverage ratios of up to 1:500. However, the lack of clarity regarding spreads, commissions, and other fees is concerning.

| Fee Type | GTSEnergyMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific fee structures is a significant drawback, as traders typically rely on this information to make informed decisions. Furthermore, the high leverage ratio, while potentially attractive, carries inherent risks that can lead to substantial losses, particularly for inexperienced traders. The lack of transparency regarding these critical aspects of trading conditions raises doubts about the broker's commitment to fair trading practices.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. GTSEnergyMarkets claims to implement various security measures; however, the lack of regulatory oversight undermines these claims. The broker does not provide information about segregated accounts, investor protection schemes, or negative balance protection, which are standard practices among regulated brokers.

The absence of these safety measures means that traders' funds may be at risk, especially in the event of financial difficulties faced by the broker. Historical accounts of fund withdrawal issues and complaints about the broker's practices further exacerbate concerns regarding the safety of client funds. Without robust protection mechanisms in place, traders may find themselves vulnerable to potential losses.

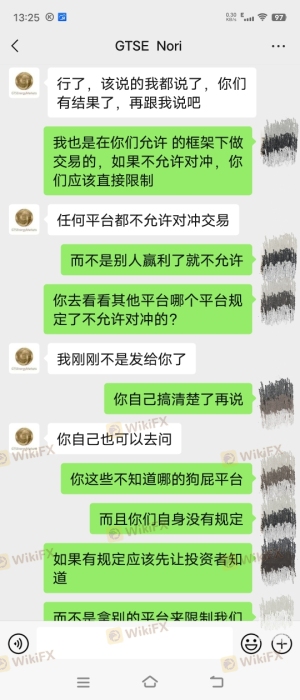

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of GTSEnergyMarkets reveal a troubling pattern of complaints, particularly concerning withdrawal difficulties and unresponsive customer service. Many users have reported being unable to access their funds, with some alleging that their accounts were blocked without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Account Blocking | High | No Clear Response |

| Customer Service Quality | Medium | Inconsistent |

Typical complaints involve lengthy withdrawal processes and inadequate customer support, which can significantly impact traders' experiences. A lack of responsiveness from the broker in addressing these issues raises further doubts about its operational integrity. Potential clients should be wary of these red flags, as they indicate systemic problems within the broker's operations.

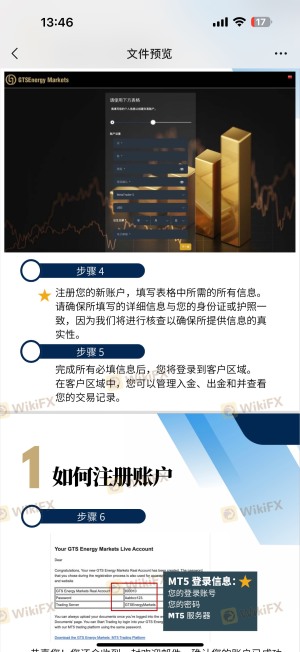

Platform and Trade Execution

The trading platform is a crucial component of a trader's experience. GTSEnergyMarkets claims to offer the popular MetaTrader 5 (MT5) platform, known for its advanced features. However, user experiences suggest that the platform may not function as advertised, with reports of technical issues and instability.

Traders have expressed concerns over order execution quality, including instances of slippage and rejected orders. These issues can severely impact trading performance and profitability. Additionally, any indications of platform manipulation or unfair practices would further erode trust in the broker.

Risk Assessment

Engaging with GTSEnergyMarkets involves several risks that potential traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unverified claims of regulation |

| Fund Safety Risk | High | Lack of investor protection measures |

| Withdrawal Risk | High | Reports of difficulties accessing funds |

| Platform Reliability Risk | Medium | Technical issues with the trading platform |

To mitigate these risks, traders are advised to conduct thorough research and consider utilizing regulated brokers with established reputations. Understanding the risks associated with high leverage and ensuring that ones trading strategy aligns with risk tolerance is crucial for long-term success.

Conclusion and Recommendations

In conclusion, the evidence suggests that GTSEnergyMarkets exhibits several concerning traits that warrant caution. The lack of verified regulation, transparency regarding company operations, and numerous customer complaints indicate that this broker may not be a safe option for trading. Potential traders should be particularly wary of the reported withdrawal issues and the brokers overall opacity.

For those considering forex trading, it may be prudent to explore alternative brokers that are well-regulated and offer clear, transparent trading conditions. Some reputable alternatives include brokers regulated by ASIC, FCA, or CySEC, which provide robust investor protections and a more reliable trading environment. Ultimately, the decision to engage with GTSEnergyMarkets should be approached with careful consideration of the associated risks and potential red flags.

Is GTSEnergyMarkets a scam, or is it legit?

The latest exposure and evaluation content of GTSEnergyMarkets brokers.

GTSEnergyMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTSEnergyMarkets latest industry rating score is 5.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.