Is PXBT safe?

Pros

Cons

Is PXBT Safe or Scam?

Introduction

PXBT, an online trading platform, has emerged in the forex market, positioning itself as a competitive player for traders interested in various financial instruments, including forex, commodities, and indices. As with any trading platform, it is crucial for potential investors to conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it is also fraught with risks, including the potential for fraud and mismanagement. Therefore, understanding the regulatory environment, company history, trading conditions, and customer feedback is essential for making an informed decision. This article aims to provide a comprehensive evaluation of PXBT, utilizing various sources and structured analysis to assess its credibility and safety for traders.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and offer a level of protection in case of disputes or misconduct. Unfortunately, PXBT operates under the Seychelles Financial Services Authority (FSA), which is known for its lenient regulations compared to other jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD162 | Seychelles | Verified |

While the presence of a license from the Seychelles FSA indicates that PXBT is recognized as a legal entity, the lack of oversight from more stringent regulators, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, raises significant concerns. Traders should be wary, as unregulated brokers often operate without the necessary checks and balances, leaving clients vulnerable to potential fraud or mismanagement. The absence of a robust regulatory framework means that there are limited avenues for recourse in the event of a dispute, which is a significant risk factor for traders.

Company Background Investigation

PXBT is operated by PXBT Trading Ltd, which is registered in Seychelles. The companys history and ownership structure are essential to understanding its reliability. However, detailed information about the company's founding and management team is somewhat scarce. The lack of transparency regarding its operational history can be a red flag for potential investors.

The management team's background is crucial in assessing the company's credibility. A team with extensive experience in finance and trading typically indicates a higher level of professionalism and reliability. Unfortunately, there is limited publicly available information on the qualifications and experience of PXBT's management team, which may raise concerns regarding its operational competence.

Moreover, the company's transparency in disclosing information about its operations, fees, and policies is critical for building trust with clients. The use of a personal email address for customer support, as opposed to a professional business email, further complicates the perception of professionalism and raises questions about the company's commitment to maintaining high standards of communication and service.

Trading Conditions Analysis

When evaluating a trading platform, understanding its fee structure and trading conditions is vital. PXBT claims to offer competitive trading conditions, including spreads as low as 0.1 pips and leverage up to 1:1000. However, the overall fee structure lacks clarity, which can be a concern for traders looking for transparent pricing.

| Fee Type | PXBT | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.1 pips | 1.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The absence of detailed information regarding commissions, annual fees, or minimum balance requirements is troubling. Traders may find themselves facing unexpected costs that could significantly impact their profitability. Additionally, the lack of transparency in fee disclosure can lead to misunderstandings and disputes regarding costs, which further emphasizes the importance of careful evaluation before opening an account.

Client Fund Safety

The safety of client funds is paramount when choosing a trading platform. PXBT claims to implement various safety measures, including segregated accounts for client funds and negative balance protection. However, without rigorous regulatory oversight, the enforcement of these measures is questionable.

Traders should assess whether their funds are held in separate accounts, which can protect them in the event of the broker's insolvency. Additionally, the presence of investor protection schemes, such as compensation funds, plays a crucial role in safeguarding client assets. Unfortunately, the lack of information regarding these protections at PXBT raises concerns about the overall safety of client funds.

Historically, there have been instances of unregulated brokers facing financial difficulties, leading to significant losses for their clients. Therefore, it is essential for potential investors to weigh these risks carefully and consider whether they are comfortable with the level of safety provided by PXBT.

Customer Experience and Complaints

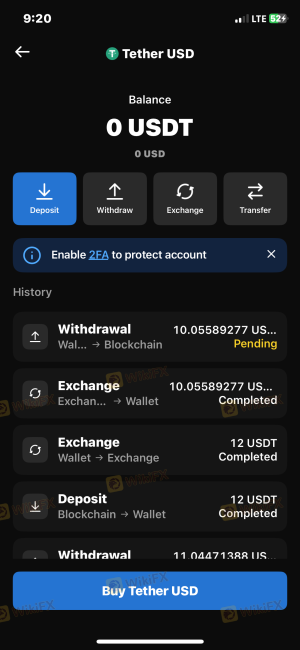

Analyzing customer feedback can provide valuable insights into the overall experience of trading with PXBT. While some reviews praise the platform's user-friendly interface and trading conditions, others have raised concerns regarding withdrawal difficulties and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited channels |

Common complaints include difficulties in withdrawing funds, which is a significant red flag for any broker. If traders encounter issues accessing their funds, it can indicate potential fraud or mismanagement. A lack of effective customer support can exacerbate these issues, leaving traders feeling frustrated and vulnerable.

Several user experiences highlight the challenges faced when attempting to withdraw funds, with some reports indicating that accounts were locked without clear explanations. Such incidents raise alarms about the broker's reliability and whether it operates with integrity.

Platform and Trade Execution

The performance and stability of the trading platform are critical for traders. PXBT utilizes the MetaTrader 5 (MT5) platform, which is widely recognized for its advanced features and user-friendly interface. However, the overall execution quality, including slippage and order rejection rates, is essential for assessing the platform's reliability.

Traders have reported varying experiences with order execution, with some noting instances of slippage during high volatility periods. While slippage is common in the forex market, excessive slippage can negatively impact trading performance and profitability.

Additionally, any signs of platform manipulation, such as delayed order execution or systematic rejections, should raise concerns for traders. Ensuring that the platform operates transparently and without interference is essential for maintaining trust.

Risk Assessment

Using PXBT comes with inherent risks that traders must consider before opening an account. The combination of limited regulation, transparency issues, and customer complaints contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under lenient regulations |

| Financial Risk | Medium | Potential for fund mismanagement |

| Customer Service Risk | High | Issues with responsiveness and support |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and ensure they fully understand the terms and conditions before committing significant funds. Additionally, diversifying investments and using risk management strategies can help protect against potential losses.

Conclusion and Recommendations

In conclusion, while PXBT presents itself as an appealing trading platform with competitive conditions, significant concerns regarding its regulatory status, transparency, and customer feedback raise red flags. The lack of stringent oversight and the presence of common complaints about withdrawal issues and customer service responsiveness suggest that traders should exercise caution.

For those considering trading with PXBT, it is essential to weigh the risks carefully and consider whether the potential benefits outweigh the concerns. If you are a trader looking for a more secure and regulated environment, it may be wise to explore alternative brokers that offer stronger regulatory oversight and a more transparent operational framework.

Potential alternatives include brokers regulated by top-tier authorities, which provide more robust protections for traders. Always prioritize safety and conduct thorough research before investing with any broker.

Is PXBT a scam, or is it legit?

The latest exposure and evaluation content of PXBT brokers.

PXBT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PXBT latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.