Is MTRADING safe?

Pros

Cons

Is MTrading A Scam?

Introduction

MTrading is an online forex broker that has positioned itself as a player in the global trading arena since its inception in 2012. Operating primarily from Saint Vincent and the Grenadines, MTrading offers a range of financial instruments, including forex pairs, commodities, indices, and cryptocurrencies, through the widely-used MetaTrader 4 platform. However, as with any broker, it is essential for traders to exercise caution and conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate brokers and scams, making it imperative for traders to assess the credibility and reliability of their chosen broker.

This article aims to provide a comprehensive analysis of MTrading by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The evaluation is based on a review of various credible sources, including user reviews, regulatory filings, and expert opinions.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in determining its legitimacy and safety for traders. MTrading is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, it is essential to note that the FSA does not regulate forex trading activities, which raises concerns regarding investor protection. The lack of a robust regulatory framework can expose traders to higher risks of fraud and malpractice.

Regulatory Information Table

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of a serious regulatory body, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US, is a significant red flag. While MTrading claims to be a member of the Financial Commission, which is a self-regulatory organization, it does not offer the same level of protection as tier-1 regulators. This means that, in the event of a dispute, traders may have limited recourse.

Company Background Investigation

MTrading was founded in 2012 and has since grown its presence in various emerging markets across Asia-Pacific, Africa, and Latin America. The company operates under the ownership of Finvest Solutions Limited, which is registered in Saint Vincent and the Grenadines. While the broker has made strides in expanding its client base, which reportedly exceeds 260,000 active traders, the transparency of its operations and ownership structure is questionable.

The management team of MTrading is not extensively detailed in public disclosures, making it challenging to assess their qualifications and experience. This lack of transparency can be concerning for potential clients, as a well-qualified management team is often indicative of a broker's reliability and operational integrity.

Trading Conditions Analysis

MTrading offers various trading accounts, including the M.Cent, M.Premium, and M.Pro accounts, catering to different trader needs. The broker employs a commission structure that varies across account types, which can impact overall trading costs.

Core Trading Costs Comparison Table

| Fee Type | MTrading | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.0 pips | From 0.5 pips |

| Commission Model | $4 per lot (Pro) | $3 per lot |

| Overnight Interest Range | Varies by position | Varies by position |

MTrading's spreads start from 1.0 pips, which is relatively high compared to industry averages. Additionally, the M.Pro account incurs a commission of $4 per lot, which may not be appealing to all traders. Furthermore, the broker charges a $50 monthly inactivity fee, which can be burdensome for less active traders.

Client Fund Security

The safety of client funds is paramount for any trading institution. MTrading claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's unregulated status.

MTrading states that client funds are held in reputable financial institutions, which is a positive aspect. However, the absence of a compensation scheme, such as those offered by tier-1 regulators, means that traders may not have adequate protection in the event of broker insolvency.

Customer Experience and Complaints

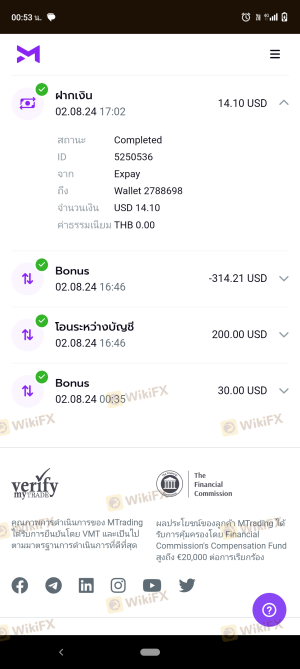

Customer feedback is a vital component in evaluating a broker's reliability. MTrading has received mixed reviews from users, with some praising the trading conditions and execution speed, while others have reported difficulties in withdrawing funds.

Common Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Verification Delays | Medium | Moderate response |

| Customer Support Quality | Medium | Variable response |

Many complaints revolve around withdrawal delays, with some users alleging that their withdrawal requests were either denied or took an excessively long time to process. The broker's customer support has been criticized for being slow and lacking in communication, which can exacerbate frustrations for traders facing issues.

Platform and Trade Execution

MTrading primarily utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, the platform's performance can vary, with reports of slippage and execution delays during high volatility periods.

The broker claims to provide market execution with no requotes, but users have noted instances of slippage, particularly during significant market events. This can be detrimental to traders, especially those employing scalping strategies.

Risk Assessment

Traders should be aware of the risks associated with using MTrading. The lack of stringent regulation and the broker's focus on high leverage can lead to significant potential losses.

Key Risk Areas Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | Medium | Limited protection for client funds. |

| Withdrawal Risk | High | Complaints about withdrawal delays. |

| Platform Performance Risk | Medium | Reports of slippage and execution issues. |

To mitigate these risks, traders are advised to start with a demo account, use risk management strategies, and avoid over-leveraging their positions.

Conclusion and Recommendations

In conclusion, while MTrading offers a variety of trading instruments and competitive trading conditions, the broker's lack of stringent regulation and mixed customer feedback raises significant concerns. The absence of a robust regulatory framework, coupled with reported withdrawal issues, suggests that traders should exercise caution.

For those seeking a reliable trading experience, it may be advisable to consider alternative brokers that are regulated by reputable authorities such as the FCA or ASIC. Brokers like eToro, IG, or Interactive Brokers may provide a more secure trading environment with better customer support and regulatory oversight.

Ultimately, traders should conduct thorough research, weigh the pros and cons, and consider their risk tolerance before deciding to engage with MTrading or any other broker in the forex market.

Is MTRADING a scam, or is it legit?

The latest exposure and evaluation content of MTRADING brokers.

MTRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MTRADING latest industry rating score is 2.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.