FXCentrum 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fxcentrum review examines one of the emerging players in the online trading landscape. FXCentrum has positioned itself as a broker offering diverse trading opportunities across multiple asset classes, though detailed information about its operations remains somewhat limited in publicly available sources.

Based on available information, FXCentrum appears to cater to traders seeking access to various financial instruments. These include currencies, indices, metals, energies, soft commodities, stocks, and bonds. The broker utilizes web-based trading platforms and offers what appears to be competitive spreads, as indicated by the "low" spread designation found in market data.

The broker targets both novice and experienced traders by providing access to multiple asset classes through their web-specific platform. However, potential users should note that comprehensive details about account conditions, regulatory status, and specific trading terms require further investigation directly with the broker.

According to available sources, FXCentrum operates with a focus on providing diverse trading instruments. Specific details about minimum deposits, leverage ratios, and detailed fee structures are not extensively documented in current market reviews. This fxcentrum review aims to provide traders with available information while highlighting areas where additional research may be necessary.

Important Notice

Regional Entity Differences: Traders should be aware that FXCentrum may operate under different regulatory frameworks depending on the jurisdiction. The specific regulatory status and compliance requirements may vary significantly across different regions, and potential clients should verify the applicable regulatory environment in their specific location before opening an account.

Review Methodology: This evaluation is based on publicly available information, industry reports, and market data. Direct testing of the platform and services has not been conducted for this review. Traders are encouraged to conduct their own due diligence and consider demo testing before committing to live trading accounts.

Rating Framework

Broker Overview

FXCentrum operates as an online trading broker providing access to multiple financial markets through web-based trading platforms. The company positions itself in the competitive online trading space by offering access to a comprehensive range of trading instruments across various asset classes. According to available market data, the broker emphasizes providing low spreads to its clients, which suggests a focus on cost-effective trading solutions.

The broker's business model appears to center around providing multi-asset trading capabilities. This allows clients to trade currencies, indices, metals, energies, soft commodities, stocks, and bonds through their platform infrastructure. This diversified approach indicates an attempt to serve traders with varying interests and strategies across different financial markets.

FXCentrum utilizes web-specific trading platforms, suggesting a focus on browser-based trading solutions rather than downloadable software. This approach can offer advantages in terms of accessibility and cross-platform compatibility, though the specific features and capabilities of their trading technology require further investigation. The broker's market positioning appears to target traders seeking straightforward access to multiple markets through a unified platform interface.

This fxcentrum review notes that while the broker offers a range of trading instruments, detailed information about company background, establishment date, and specific operational history is not extensively documented in currently available public sources.

Regulatory Status: Available information does not provide clear details about FXCentrum's specific regulatory oversight or licensing arrangements. Potential clients should independently verify the broker's regulatory status in their jurisdiction before proceeding with account opening.

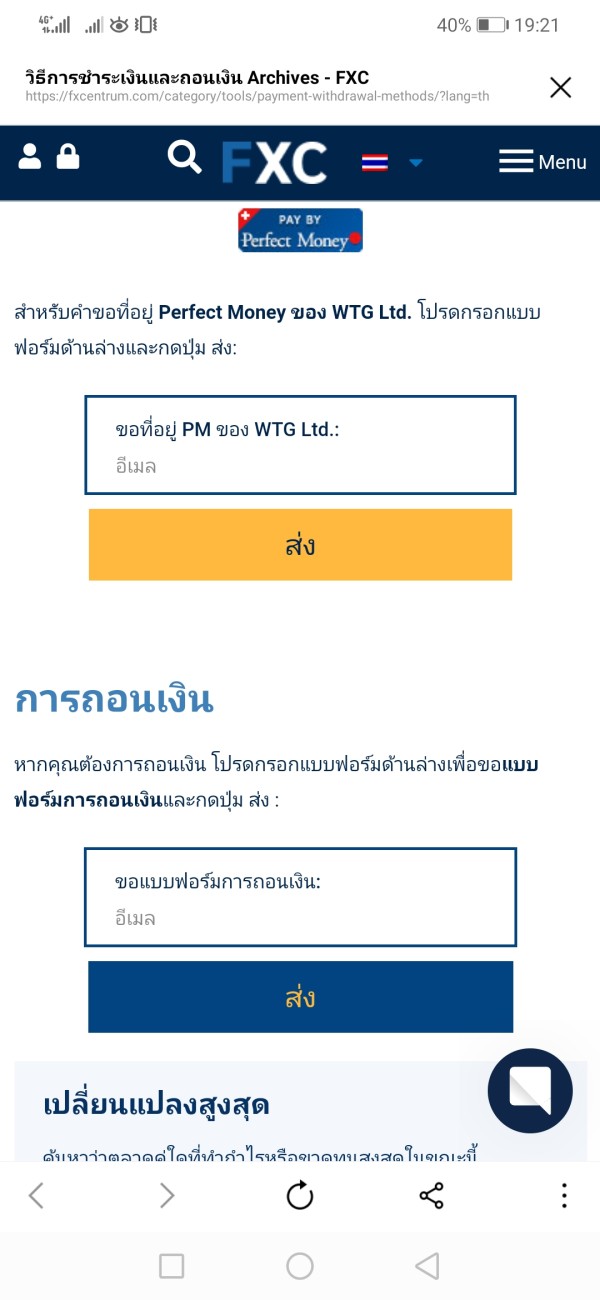

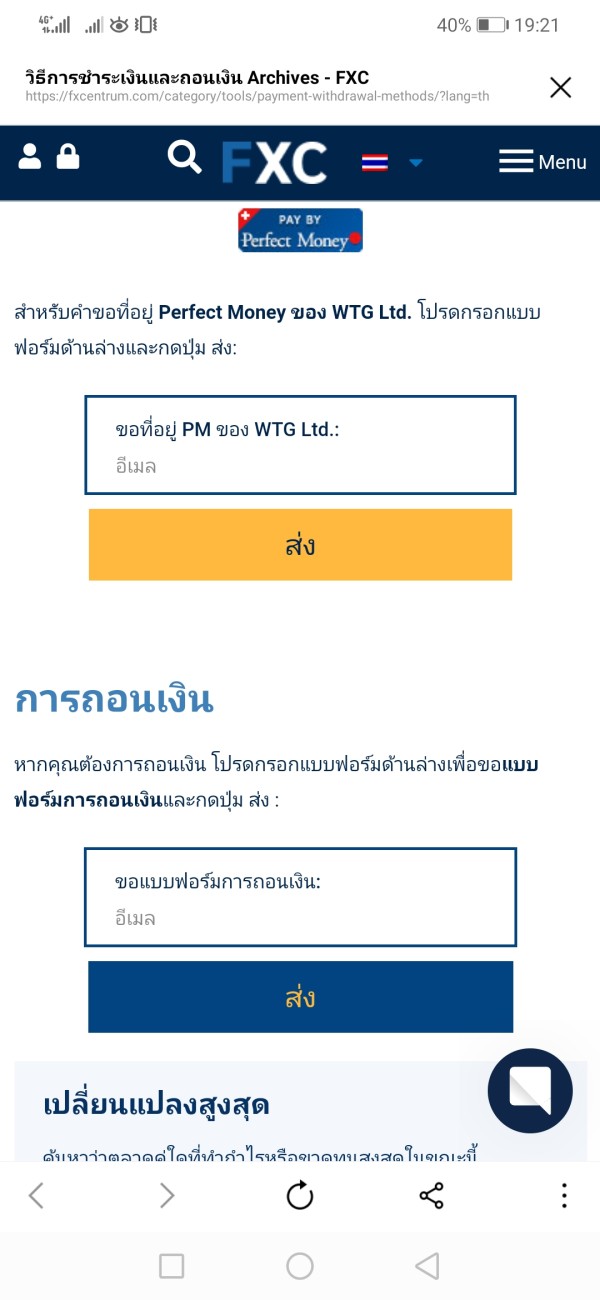

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees is not detailed in available public sources. Traders should contact the broker directly for comprehensive information about financial transactions.

Minimum Deposit Requirements: Current publicly available information does not specify minimum deposit amounts for different account types. This represents an important consideration for potential clients in planning their trading capital allocation.

Bonus and Promotional Offers: Available sources do not detail any specific promotional offers, welcome bonuses, or ongoing incentive programs. Traders interested in promotional benefits should inquire directly with the broker.

Available Trading Instruments: FXCentrum offers access to multiple asset classes including currencies (forex), indices, metals, energies, soft commodities, stocks, and bonds. This diverse range provides opportunities for portfolio diversification and various trading strategies across different market sectors.

Cost Structure: While sources indicate "low" spreads, specific spread ranges, commission structures, overnight fees, and other trading costs are not detailed in available information. Understanding the complete cost structure is crucial for evaluating trading profitability.

Leverage Options: Specific leverage ratios for different instrument types are not documented in current sources. Leverage policies can significantly impact trading strategies and risk management approaches.

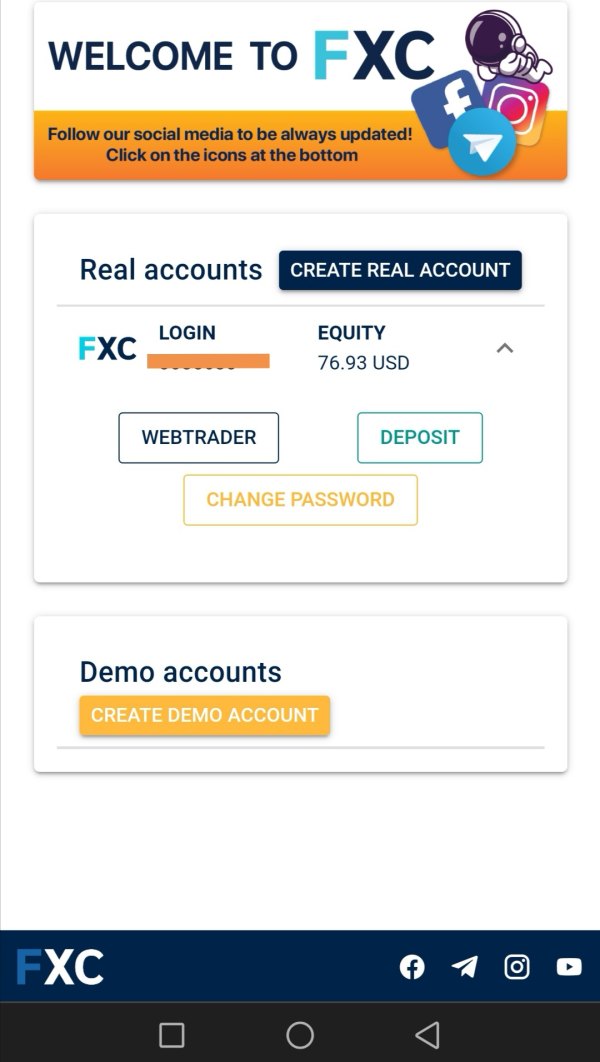

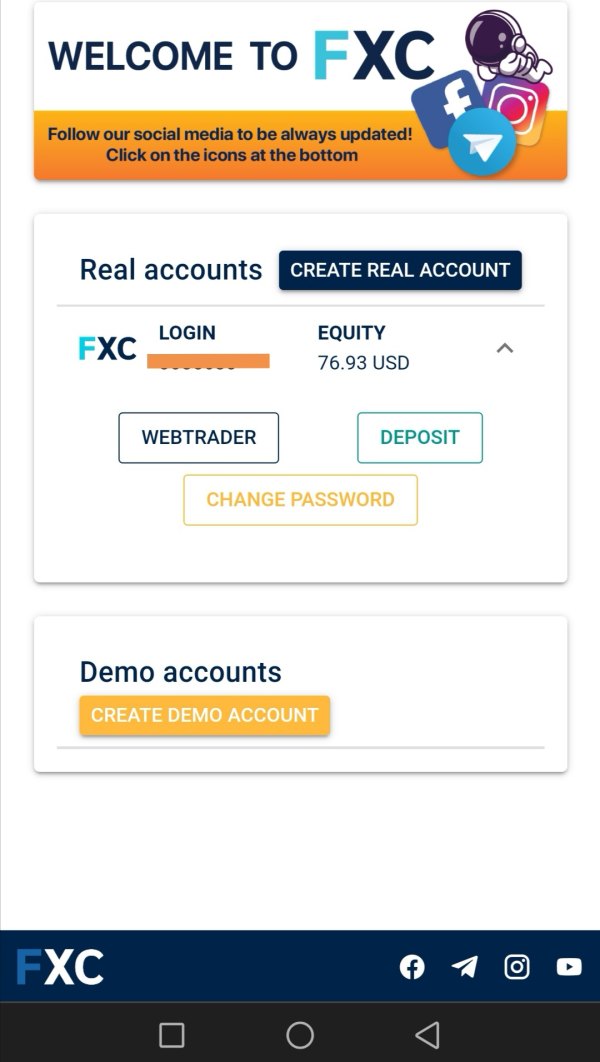

Platform Options: FXCentrum utilizes web-specific platforms, indicating browser-based trading solutions. However, details about platform features, mobile accessibility, and advanced trading tools require further investigation.

This fxcentrum review emphasizes the importance of obtaining detailed information directly from the broker regarding these critical trading parameters.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

FXCentrum's account conditions present a mixed picture based on available information. The broker appears to offer standard online trading account structures, though specific details about account tiers, minimum balance requirements, and account-specific benefits are not comprehensively documented in public sources.

The lack of detailed publicly available information about account opening procedures, verification requirements, and specific account types represents a significant limitation for potential clients attempting to evaluate suitability. While the broker offers access to multiple trading instruments, the absence of clear account condition details makes it difficult to assess competitiveness against industry standards.

Potential clients should be aware that account conditions can significantly impact trading experience. These include factors such as spread markups, commission structures, and access to advanced trading features. The limited transparency in available documentation suggests that interested traders should engage directly with the broker to obtain comprehensive account information.

The scoring reflects the uncertainty surrounding specific account terms and conditions, which represents an important consideration for traders evaluating broker selection criteria. This fxcentrum review recommends thorough due diligence regarding account conditions before proceeding with account opening procedures.

FXCentrum demonstrates strength in instrument diversity, offering access to currencies, indices, metals, energies, soft commodities, stocks, and bonds. This comprehensive asset coverage provides traders with opportunities for portfolio diversification and exposure to various market sectors, which represents a significant advantage for traders seeking multi-asset trading capabilities.

The inclusion of traditional forex pairs alongside commodities, equity indices, and individual stocks suggests a comprehensive approach to market access. This diversity can be particularly valuable for traders implementing cross-asset strategies or seeking to capitalize on correlations between different market sectors.

However, the evaluation is limited by insufficient information about analytical tools, research resources, economic calendars, and educational materials. Modern traders increasingly expect comprehensive research support, market analysis, and educational resources as part of their broker relationship, and the absence of detailed information about these resources represents a notable gap.

Additionally, specific details about charting capabilities, technical indicators, automated trading support, and advanced order types are not documented in available sources. These tools are essential for many trading strategies and their availability significantly impacts platform utility.

Customer Service and Support Analysis (Score: 5/10)

Customer service represents a critical area where FXCentrum's public information is particularly limited. Available sources do not provide specific details about support channels, availability hours, response times, or service quality metrics. This lack of transparency regarding customer support capabilities represents a significant concern for potential clients.

Effective customer service is essential for addressing technical issues, account inquiries, and trading-related questions. The absence of detailed information about support infrastructure, including whether the broker offers phone support, live chat, email assistance, or multilingual capabilities, makes it difficult to assess service quality expectations.

Modern traders expect responsive, knowledgeable customer support, particularly when dealing with time-sensitive trading issues or technical platform problems. The limited available information about FXCentrum's customer service capabilities suggests that potential clients should specifically evaluate support quality during any preliminary discussions with the broker.

The scoring reflects the uncertainty surrounding customer service quality and availability, which represents an important risk factor for traders who may require assistance during their trading activities. Comprehensive customer support evaluation should be a priority for potential clients considering this broker.

Trading Experience Analysis (Score: 6/10)

FXCentrum's trading experience centers around web-based platform technology, which offers certain advantages in terms of accessibility and cross-platform compatibility. Browser-based trading can eliminate the need for software downloads and provide consistent access across different devices and operating systems.

The indication of "low" spreads suggests competitive pricing for trading costs, which is an important factor in overall trading experience. However, the absence of specific spread ranges, execution speed data, and platform stability information limits the ability to comprehensively evaluate trading quality.

Platform functionality details, including available order types, charting capabilities, technical analysis tools, and mobile accessibility, are not well-documented in available sources. These features significantly impact daily trading activities and strategy implementation capabilities.

Additionally, information about execution quality, slippage rates, requotes frequency, and platform uptime statistics would be valuable for assessing the technical trading environment. The limited availability of such performance metrics represents a gap in evaluating the overall trading experience quality.

This fxcentrum review notes that platform performance and trading experience quality are best evaluated through demo testing and direct platform interaction before committing to live trading activities.

Trust and Reliability Analysis (Score: 5/10)

Trust and reliability assessment for FXCentrum is significantly hampered by limited publicly available information about regulatory oversight, company background, and operational transparency. The absence of clear regulatory information represents a primary concern for traders prioritizing broker safety and compliance.

Regulatory oversight provides important protections for traders, including segregated client funds, dispute resolution mechanisms, and operational compliance standards. The lack of detailed regulatory information in available sources suggests that potential clients must independently verify the broker's regulatory status and associated protections.

Company transparency, including information about management, operational history, financial stability, and business practices, is not extensively documented in current public sources. This limited transparency can make it difficult for traders to assess the broker's long-term stability and operational reliability.

Additionally, information about client fund protection measures, insurance coverage, and segregation practices is not detailed in available documentation. These protections are essential considerations for traders evaluating broker safety and fund security.

The scoring reflects the significant uncertainty surrounding regulatory status and operational transparency, which represents important risk factors for potential clients.

User Experience Analysis (Score: 6/10)

User experience evaluation for FXCentrum is limited by the absence of comprehensive user feedback and detailed platform interface information in available sources. The web-based platform approach suggests a focus on accessibility and ease of use, though specific interface design and usability features are not well-documented.

Account opening procedures, verification processes, and onboarding experience details are not extensively covered in available information. These initial interactions significantly impact user experience and can influence trader satisfaction with the broker relationship.

Platform navigation, trade execution procedures, account management capabilities, and mobile accessibility represent important user experience factors that require further investigation. The absence of detailed user interface information makes it difficult to assess ease of use and functional efficiency.

User feedback and satisfaction ratings would provide valuable insights into real-world experience quality, but such information is not comprehensively available in current sources. This represents a significant limitation in evaluating actual user satisfaction and platform performance.

The scoring reflects the limited available information about user experience quality and the importance of conducting independent platform evaluation before committing to live trading activities.

Conclusion

This fxcentrum review reveals a broker offering multi-asset trading capabilities with competitive spread indications, but significant information gaps regarding regulatory status, detailed trading conditions, and operational transparency. FXCentrum appears suitable for traders seeking access to diverse trading instruments through web-based platforms, though the limited publicly available information necessitates careful due diligence.

The broker's strength lies in its multi-asset offering, including currencies, indices, metals, energies, commodities, stocks, and bonds, providing opportunities for diversified trading strategies. However, the absence of detailed information about account conditions, customer service quality, and regulatory oversight represents important considerations for potential clients.

Recommended user types include traders comfortable with conducting extensive independent research and those prioritizing instrument diversity over comprehensive broker transparency. The limited available information makes FXCentrum less suitable for traders requiring detailed upfront information about all aspects of the broker relationship.

Prospective clients should prioritize direct communication with the broker to obtain comprehensive information about regulatory status, account conditions, trading costs, and platform capabilities before making commitment decisions.