Kato Prime 2025 Review: Everything You Need to Know

Executive Summary

Kato Prime is a forex broker that started in 2019. It has its main office in Belize and follows rules set by the International Financial Services Commission (IFSC). Users on different review websites generally trust the platform, but it needs better resources and support. This kato prime review looks at what the broker offers and how users feel about it.

The broker gives traders leverage up to 1:500, spreads that change, and only needs $15 to start an account. This makes it good for people who want flexible trading. Kato Prime works as a market maker and lets traders use MetaTrader 4, MetaTrader 5, and cTrader platforms. You can trade forex, indices, stocks, commodities, and cryptocurrencies with them.

Most users are beginners and intermediate traders who want to start with small amounts of money. Reviews show the platform works well for trading, but users want better educational materials and customer support.

Important Disclaimers

Since Kato Prime operates offshore, it carries some regulatory risks that investors need to think about carefully. The IFSC provides some oversight, but offshore rules are not as strong as those in major financial centers. This review uses public information and user feedback from different sources, so it might not show every user's experience.

Trading can cause you to lose a lot of money. Potential clients should do their own research before making investment decisions.

Rating Framework

Broker Overview

Kato Prime started in 2019 with its headquarters in Belize. It works as a market maker to attract investors with flexible trading conditions. Even though it has only been around for a short time, the broker has good business practices and regulatory credentials. According to TradingBrokers.com, the company helps traders who want easy ways to enter financial markets.

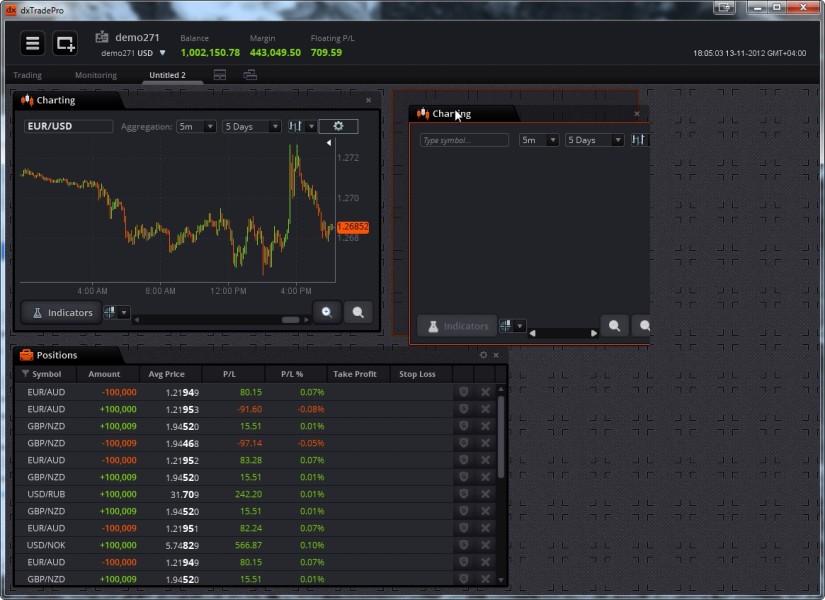

The broker supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms. You can trade forex, indices, stocks, commodities, and cryptocurrencies, which gives you many investment options. The International Financial Services Commission (IFSC) regulates them with license number 000392/498, as confirmed by multiple review sources. This kato prime review finds that having multiple platforms and many assets to trade are the broker's main advantages.

Regulatory Jurisdictions: Kato Prime operates under IFSC regulation with license number 000392/498. This provides oversight for its trading operations in Belize and international markets.

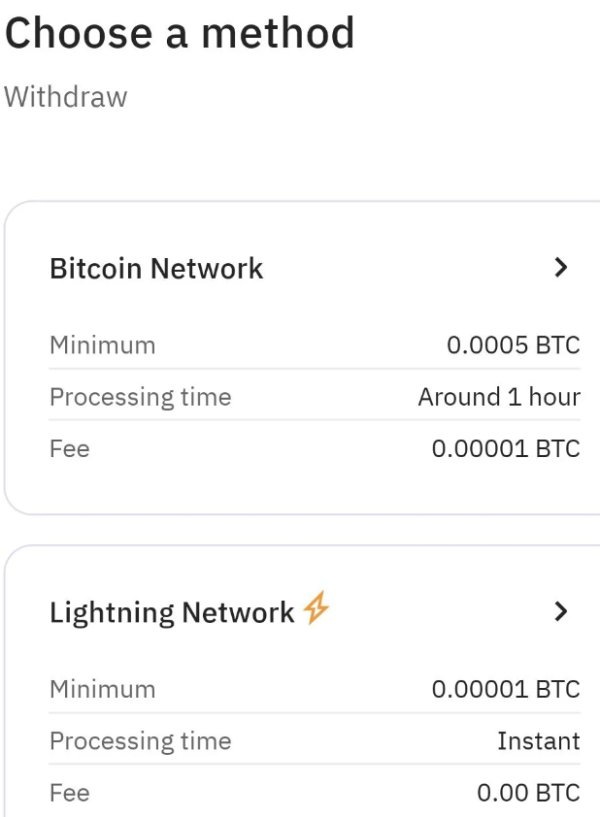

Deposit and Withdrawal Methods: The broker accepts bank transfers, credit/debit cards, e-wallets, and cryptocurrency deposits. However, specific processing times are not detailed in available sources.

Minimum Deposit Requirements: You only need $15 to start an account. This makes it very easy for beginning traders and those testing the platform with small amounts of money.

Bonus Promotions: Information about bonus promotions and incentive programs was not found in the available sources.

Tradeable Assets: The platform lets you trade forex pairs, stock indices, individual stocks, commodities, and cryptocurrency instruments. This gives you access to many different markets.

Cost Structure: The broker uses variable spreads and commission structures starting from $0. User feedback generally considers the cost structure competitive within the industry.

Leverage Ratios: Maximum leverage reaches 1:500. This works for traders with different risk preferences and capital management strategies.

Platform Options: Traders can use MT4, MT5, and cTrader platforms. These meet different technical analysis and automated trading needs.

Geographic Restrictions: Some regional restrictions apply. However, specific excluded jurisdictions are not detailed in available documentation.

Customer Service Languages: Multiple language support is available. But specific language options were not listed in source materials.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Kato Prime offers good account conditions with its very low $15 minimum deposit requirement. This makes it especially attractive for people new to forex trading. According to TradingBrokers.com, this low barrier helps more people access financial markets. The account opening process is fairly straightforward, so users can complete registration and verification quickly.

The broker offers commission structures starting from $0, which appeals to traders who watch costs carefully. However, the variable spread structure means trading costs can change with market conditions. User feedback from review platforms shows that while people like the low minimum deposit, traders want more detailed information about different account types and their benefits.

There is no specific information about Islamic accounts or other special account features in available sources. This suggests the broker could expand its offerings in this area. Overall, the account conditions get high marks for being accessible while maintaining professional standards. This kato prime review finds the account structure works well for beginning and intermediate traders.

The platform provides standard trading tools including technical indicators and charting capabilities across its supported platforms. MT4, MT5, and cTrader each offer comprehensive analytical tools, giving traders flexibility in how they analyze markets. However, user feedback consistently shows that educational resources and market research materials need significant improvement.

According to review sites, while the technical tools meet basic trading requirements, the educational content is not as good as industry leaders. Traders who want comprehensive learning materials or detailed market analysis may find the current offerings insufficient for their development needs.

The multi-platform approach strengthens the tool offering because each platform brings unique capabilities. MT5's advanced features and cTrader's easy-to-use interface provide options for different trading styles. However, the lack of unique tools means Kato Prime relies mainly on third-party platform capabilities rather than developing its own competitive advantages.

Customer Service and Support Analysis (6/10)

Customer support needs substantial improvement according to user feedback across multiple review platforms. While the broker offers standard communication channels including phone, email, and online chat, response times and problem resolution get mixed reviews from users.

BrokerJudge and other review platforms show that while basic questions are handled adequately, complex technical issues or account problems sometimes take too long to resolve. The skill level of support staff varies, with some users reporting good experiences while others express frustration with the level of expertise available.

Language support capabilities are mentioned as available but lack specific details about which languages are supported. This creates uncertainty for international clients about the quality of support they can expect in their preferred language.

The support system appears designed for basic needs but may struggle with the comprehensive service expectations of more sophisticated traders.

Trading Experience Analysis (8/10)

User feedback consistently highlights Kato Prime's platform stability and order execution quality as positive aspects of the trading experience. The multi-platform approach allows traders to select environments that best match their trading styles and technical requirements. TradingBrokers.com notes that the broker's execution model provides competitive performance for its target market.

The variable spread structure gets mixed feedback, with users liking competitive spreads during good market conditions while worrying about spread widening during volatile periods. This is typical for market maker models but can impact trading costs during high-impact news events or market stress.

Mobile trading capabilities are available through the supported platforms' mobile applications. These benefit from the established functionality of MT4, MT5, and cTrader mobile versions. However, specific performance improvements or unique mobile features developed by Kato Prime are not detailed in available sources.

The overall trading environment appears well-suited for beginning to intermediate traders. It provides sufficient functionality without overwhelming complexity. This kato prime review finds the trading experience meets reasonable expectations for the broker's positioning and fee structure.

Trustworthiness Analysis (7/10)

Kato Prime's regulatory status under IFSC provides a foundation for legitimate operations. However, offshore regulation has inherent limitations compared to major financial center oversight. License number 000392/498 can be verified through IFSC records, confirming the broker's authorized status within its jurisdiction.

Fund security measures are not detailed extensively in available sources. This creates some uncertainty about client fund protection protocols. While user feedback generally expresses confidence in the broker's reliability, the lack of detailed information about segregated accounts or compensation schemes may concern security-conscious traders.

Company transparency about ownership, financial backing, and operational history could be enhanced to build stronger trust relationships with potential clients. The relatively short operating history since 2019 means the broker has limited track record during various market conditions or stress periods.

Industry reputation building remains in progress. User reviews show generally positive sentiment tempered by calls for improvements in service delivery and resource provision. The broker appears committed to legitimate operations while working to establish stronger market credibility.

User Experience Analysis (6/10)

Overall user satisfaction reflects a platform that meets basic requirements while leaving substantial room for enhancement in several key areas. Interface design and usability get generally positive feedback, with users liking the straightforward approach to platform navigation and trade execution.

The registration and verification process is described as convenient and efficient. This allows new users to begin trading relatively quickly. However, users consistently request improvements in educational resources, market analysis, and customer support responsiveness to enhance their overall experience.

Funding operations get adequate ratings, though users want faster processing times for both deposits and withdrawals. The variety of funding methods provides flexibility, but specific processing timeframes and potential fees could be communicated more clearly.

The user demographic appears well-matched to the broker's offerings. Beginning and intermediate traders find the platform accessible and functional for their needs. However, more experienced traders may find the resource limitations constraining for advanced trading strategies or comprehensive market analysis requirements.

Conclusion

Kato Prime presents itself as a legitimate forex broker suitable for traders seeking low-cost market entry with flexible trading conditions. The combination of minimal deposit requirements, multiple platform options, and diverse asset access creates an attractive proposition for beginning and intermediate traders.

The broker's strengths include competitive account conditions, stable trading infrastructure, and accessibility for new market participants. However, significant opportunities exist for improvement in customer support responsiveness, educational resource development, and overall service depth.

This kato prime review recommends the broker primarily for cost-conscious traders who prioritize low barriers to entry over comprehensive service offerings. While the platform provides legitimate trading capabilities, potential clients should carefully consider their support and educational needs when evaluating Kato Prime against alternative brokers in the market.