Is KATOPRIME safe?

Pros

Cons

Is Kato Prime A Scam?

Introduction

Kato Prime is a relatively new player in the forex trading market, having launched in January 2021. Positioned as an online broker offering a range of financial instruments including forex, commodities, and cryptocurrencies, it aims to attract both novice and experienced traders. However, the influx of online brokers has led to a heightened need for traders to exercise caution and thoroughly evaluate the legitimacy and safety of these platforms. The forex market is rife with risks, and selecting an unregulated or poorly regulated broker can lead to significant financial losses.

In this article, we will investigate Kato Primes regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk profile. Our analysis is based on a comprehensive review of various sources, including user feedback, regulatory information, and expert assessments, to provide a balanced perspective on whether Kato Prime is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory landscape is crucial for any broker's credibility. Kato Prime claims to be regulated by the International Financial Services Commission (IFSC) of Belize. While the IFSC does provide a framework for oversight, it is generally regarded as a less stringent regulatory body compared to top-tier regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| IFSC | 000392/498 | Belize | Verified |

The quality of regulation is paramount, as it directly impacts the safety of client funds and the overall trading environment. Brokers regulated by more robust authorities are typically required to meet higher standards in terms of capital adequacy, reporting, and operational transparency. In contrast, the IFSC's regulations may not provide the same level of investor protection, raising concerns about Kato Prime's credibility.

Historically, many brokers operating under the IFSC have faced scrutiny due to a lack of stringent oversight. Consequently, traders should approach Kato Prime with caution, given that its regulatory framework does not inspire confidence in terms of fund safety and operational integrity.

Company Background Investigation

Kato Prime is owned and operated by Kato Prime Belize Limited, which is registered in Belize. The company's history is relatively short, having been established in 2021. The ownership structure and management team details are not extensively disclosed on their website, which raises questions about transparency and accountability.

The lack of information regarding the management team's qualifications and experience in the financial industry is concerning. A knowledgeable and experienced management team is vital for the effective operation of a trading platform and for ensuring compliance with regulatory standards. The absence of such details may indicate a lack of professionalism or a deliberate attempt to obscure information from potential clients.

Transparency in operations is essential for building trust with clients. Kato Prime's limited information disclosure could deter potential traders who seek a broker with a clear operational framework and a well-defined management structure.

Trading Conditions Analysis

Kato Prime offers a tiered account structure with varying minimum deposit requirements, allowing traders to choose accounts that suit their trading needs. The broker provides access to popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their advanced trading features. However, the overall fee structure and trading conditions warrant closer examination.

| Fee Type | Kato Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1.0 - 2.0 pips |

| Commission Model | $7 per lot (for premium accounts) | $5 - $10 per lot |

| Overnight Interest Range | Not specified | Varies by broker |

The absence of clearly defined spread rates and overnight interest fees on Kato Primes website is a notable red flag. Traders typically expect transparency regarding trading costs, as hidden fees can significantly impact profitability. The commission structure appears competitive, but the lack of clarity on spreads raises concerns about potential costs that could be incurred during trading.

Moreover, traders should be wary of any unusual or excessive fees that may arise during the withdrawal process. Many reviews indicate that withdrawal issues are common with brokers operating in offshore jurisdictions, further emphasizing the need for caution.

Client Fund Safety

The safety of client funds is a critical aspect of any brokerage firm. Kato Prime claims to hold client funds in segregated trust accounts at international banks, which is a positive indicator of their commitment to fund security. However, the effectiveness of such measures is contingent upon the regulatory environment in which the broker operates.

Kato Prime does not provide information regarding investor protection schemes or negative balance protection, which are essential for safeguarding traders' investments. The absence of these protections could expose traders to significant risks, especially in volatile market conditions.

Additionally, historical issues related to fund security and withdrawal problems have been reported by users, raising further concerns about the reliability of Kato Prime's financial practices. Traders should prioritize brokers that offer comprehensive protections for client funds and have a proven track record of maintaining financial integrity.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability. Reviews of Kato Prime reveal a mixed bag of experiences, with many users expressing dissatisfaction regarding withdrawal processes and customer support responsiveness. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

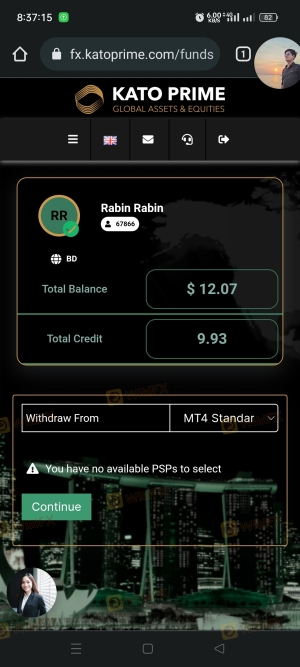

| Withdrawal Delays | High | Limited response |

| Lack of Customer Support | Medium | Slow to address |

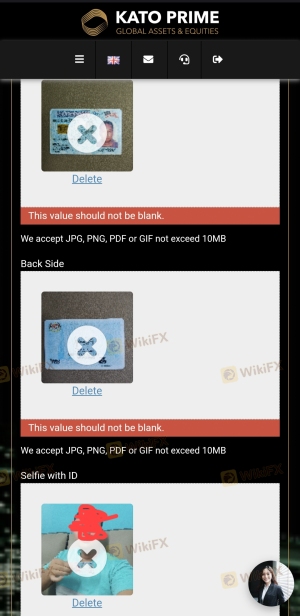

| Account Verification Issues | Medium | Inconsistent response |

Many users report difficulties in withdrawing their funds, which is a significant red flag for any broker. A broker‘s ability to process withdrawals quickly and efficiently is paramount to maintaining client trust. The slow response times and lack of effective communication from Kato Prime’s customer support further exacerbate these issues, leading to frustration among traders.

For instance, one user reported attempting to withdraw funds for several weeks, only to receive vague responses from customer service. Such experiences can lead to a loss of confidence in the broker and may indicate deeper operational issues.

Platform and Trade Execution

Kato Prime offers trading through the widely recognized platforms, MT4 and MT5. These platforms are known for their reliability and advanced features, providing traders with tools for technical analysis and automated trading. However, the performance and stability of these platforms are crucial for a seamless trading experience.

Users have reported mixed experiences regarding order execution quality, with some noting instances of slippage and delays during high volatility periods. Any signs of platform manipulation or execution issues can significantly impact trading outcomes and should be closely monitored.

The lack of mobile trading options may also detract from user experience, as many traders prefer the flexibility of managing their accounts on the go. Overall, while Kato Prime utilizes reputable trading platforms, the execution quality and accessibility could be improved to enhance the overall trading experience.

Risk Assessment

Engaging with Kato Prime comes with inherent risks that potential traders should carefully consider. The following risk assessment summarizes key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Limited regulatory oversight from IFSC |

| Financial Risk | High | Lack of investor protection measures |

| Operational Risk | Medium | Issues with withdrawals and customer support |

| Market Risk | Medium | Exposure to volatile financial markets |

To mitigate these risks, traders should conduct thorough due diligence before opening an account with Kato Prime. It is advisable to start with a demo account to assess the broker's trading environment and execution quality without risking real funds. Additionally, traders should consider diversifying their investments to reduce exposure to any single broker.

Conclusion and Recommendations

In conclusion, the investigation into Kato Prime reveals several concerning factors that potential traders should consider before engaging with this broker. While it is technically regulated by the IFSC, the quality of oversight is questionable, and the overall operational transparency is lacking. The mixed customer feedback, particularly regarding withdrawal issues and customer support, further raises red flags about the broker's reliability.

For traders seeking a trustworthy and secure trading environment, it is advisable to consider alternatives that are regulated by more reputable authorities such as the FCA or ASIC. Brokers like FP Markets, Pepperstone, and Avatrade offer robust regulatory frameworks and favorable trading conditions, making them more suitable options for traders looking to enter the forex market safely.

Is KATOPRIME a scam, or is it legit?

The latest exposure and evaluation content of KATOPRIME brokers.

KATOPRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KATOPRIME latest industry rating score is 2.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.