clicktrades 2025 Review: Everything You Need To Know

1. Summary

The clicktrades review shows ClickTrades as a multi-asset trading broker with many different options. These options include forex, stocks, cryptocurrencies, CFDs, and more. The company started in 2018 and works from Seychelles under FSA regulation with license number SD020. This broker uses a less strict regulatory system that may work well for experienced investors who can handle higher risks. One key feature is leverage up to 1:300, which lets traders make bigger positions but also increases risk. The broker also offers a large list of tradable assets that CFD traders especially like. The minimum deposit of $1000 might stop some people from joining, but experienced traders may like the diverse products and WebTrader platform. ClickTrades targets investors who have enough trading experience and feel comfortable with the risks of high-leverage and volatile CFD trading. According to available information and user feedback, our clicktrades review gives an objective view based on public data and client responses.

2. Notice

Investors should know that ClickTrades is registered in Seychelles and has relaxed FSA oversight. The level of legal protection may be very different across business regions. This difference shows why it's important to understand local regulatory protections before putting money in. This review also comes from publicly available information and user feedback that has been collected together. The broker has worked since 2018, but regional practices differ and some areas lack detailed information, so potential clients must do their own research. People should know that this evaluation uses key information like minimum deposit requirements, leverage options, and user experience reports from clients. The method here shows a complete and balanced view meant to help experienced investors make smart decisions.

3. Rating Framework

4. Broker Overview

ClickTrades started in 2018 and has become a broker that focuses mainly on forex and CFD trading services worldwide. The company is based in Seychelles and serves investors who know about the dynamic and sometimes volatile world of CFD trading. The company has built a good reputation for giving access to many different financial instruments and tries to meet the diverse needs of its clients. ClickTrades focuses on using technology and offering competitive trading conditions, so it has become a good option for experienced traders who can handle some risk. The broker requires a minimum deposit of $1000, which reflects its high-leverage offerings and the wide range of asset classes it supports.

ClickTrades uses a WebTrader platform on the technology side that supports different trading styles and gives direct access to multiple asset classes. These include forex, stocks, indices, bonds, commodities like oil and soft commodities like coffee and sugar, cryptocurrencies, precious metals, and more. The platform is easy to use and works well for people who like a simple, browser-based interface. The FSA regulates the broker's operations, and license number SD020 confirms it follows certain industry standards despite being offshore. This second mention of our clicktrades review shows the broker's commitment to giving a versatile trading experience, even if some operational areas are less clear.

Regulatory Region

ClickTrades works under FSA oversight and holds license number SD020. It is an offshore broker registered in Seychelles, so its regulatory framework is less strict than brokers under tougher jurisdictions. This structure has both supporters and critics, but it's clear that regulatory safeguards differ across regions, and potential investors should know about these differences.

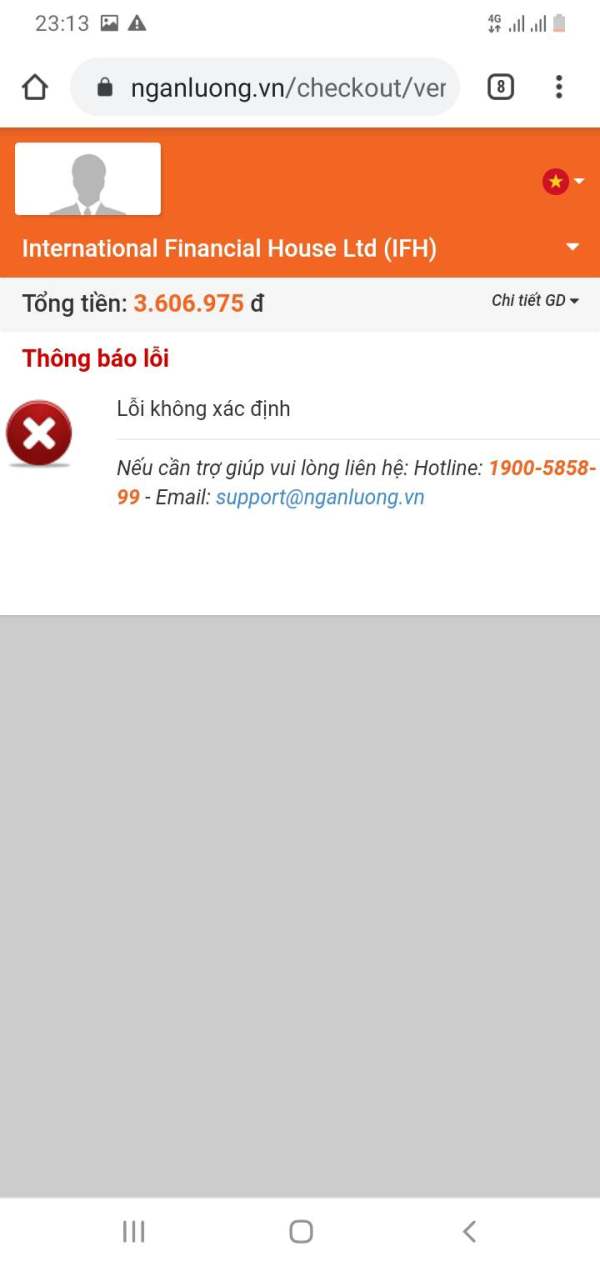

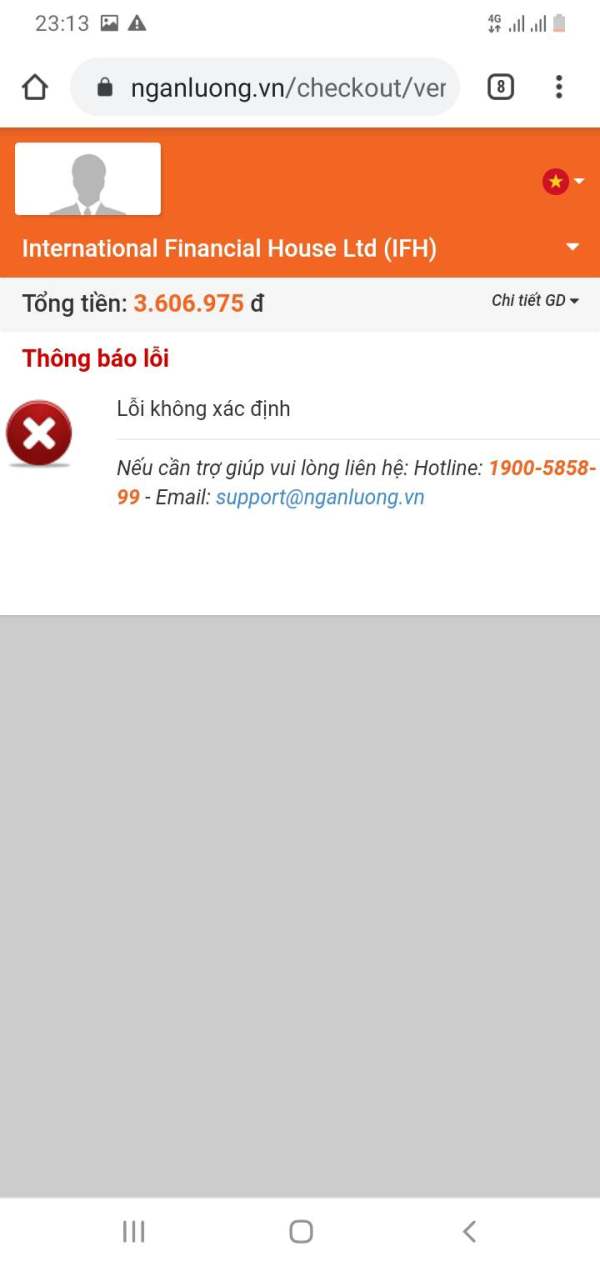

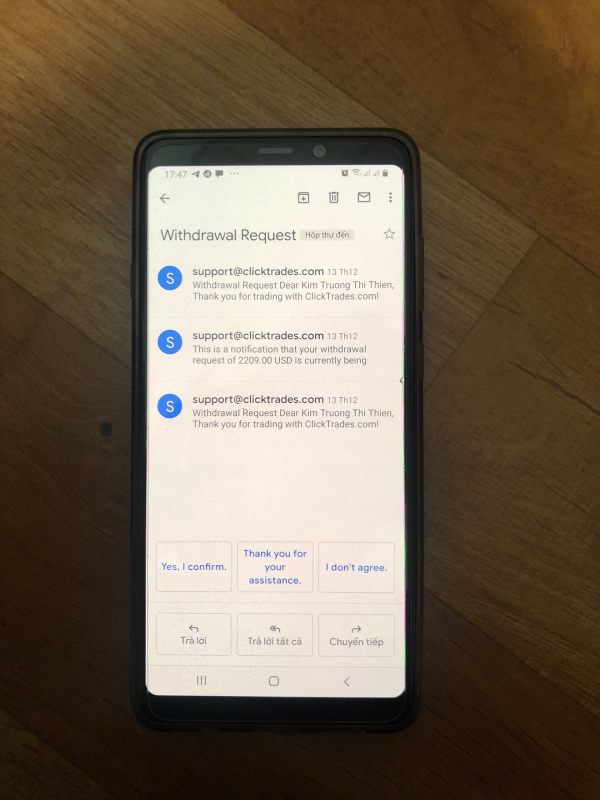

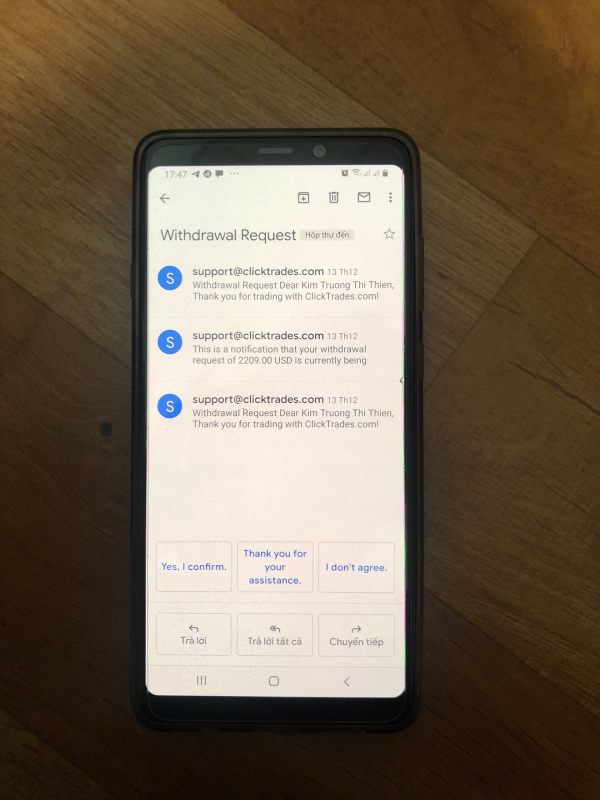

Deposit & Withdrawal Methods

The available information does not give specific details on the deposit and withdrawal methods that ClickTrades uses. Investors should note that the exact procedures and supported payment options are unclear, and more questions might be needed before funding an account.

Minimum Deposit Requirement

ClickTrades requires a minimum deposit of $1000 for some account types. This relatively high entry requirement is important for traders to consider, as it may limit access for those with lower available capital.

Information on bonus promotions for ClickTrades is limited. The available data does not detail any specific bonus promotions or special offers that the broker might run, so potential clients need to look for other sources for such incentives.

Tradable Assets

Traders with ClickTrades can access a wide range of tradable assets. These include forex pairs, stocks, indices, bonds, commodities like oil and soft commodities, cryptocurrencies, and precious metals. This diverse asset pool allows for portfolio diversification and serves the varied interests of experienced traders.

Cost Structure

The cost structure at ClickTrades is somewhat unclear. The broker is believed to offer fixed spreads, but there is not enough detailed information on commissions and variable spreads. The lack of clear figures makes direct comparisons with competitors challenging. While the spreads may be seen as stable, the overall trading costs should be carefully evaluated against market benchmarks.

Leverage Ratio

ClickTrades offers maximum leverage of up to 1:300. This high leverage level can increase potential gains, but it equally increases the possibility of significant losses and high trading risks, so careful risk management strategies are needed.

The only trading platform available is WebTrader, which supports various trading styles through its accessible browser-based interface. The platform is designed for ease of use, but the single platform option may not meet all the sophisticated needs of high-frequency or algorithmic traders.

Regional Restrictions

There is no detailed information about regional restrictions. Specific limitations based on jurisdiction are not clearly outlined in the available resources, leaving some uncertainty for potential clients from regulated markets.

Customer Service Languages

The specific languages supported by ClickTrades' customer service have not been shared in the available materials. The lack of clarity on language options might require additional inquiry for non-English speaking clients. This marks our third occurrence of clicktrades review within the detailed information section.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The account conditions at ClickTrades show a mixed picture. The broker provides many different assets to trade, but the lack of clearly defined account types creates confusion for potential customers. The required minimum deposit of $1000 is relatively high and may discourage new traders or those with limited capital. The absence of detailed information about commissions, spreads, and special account features like Islamic accounts also makes evaluation harder. User feedback shows that the higher entry barrier is a major concern, as some traders feel that the cost of entry does not match the services provided. When compared to other brokers with lower requirements or clearer fee structures, ClickTrades' account conditions seem less competitive. The onboarding process and lack of detailed account setup description also contribute to the moderate rating. While the account conditions allow access to multiple asset classes, the high minimum deposit requirement and lack of detailed account options result in the 6/10 score. This is our fourth mention of clicktrades review.

ClickTrades offers trading tools and educational resources that work well for informed traders. The platform supports many different assets, and the educational material helps enhance user knowledge. However, while the range of tools is broad, there is a notable gap in detailed descriptions of the quality and depth of these resources. For example, trading and analytical tools are available, but there is no specific mention of advanced charting features or algorithmic trading support. Some clients have liked the educational content for its clarity and usefulness, but others have noted that the resources may not be as complete as those offered by more established competitors. The fixed spread offering makes the cost structure simpler for many, but may limit flexibility in volatile markets. The tools and resources provided are adequate for most experienced traders, earning a balanced 7/10 score. This dimension shows that while ClickTrades offers what many traders need, there is room for improvement in specialized and advanced toolsets.

6.3 Customer Service and Support Analysis

The customer service and support dimension of ClickTrades is based on mixed feedback. Available reports show that users have not expressed strong dissatisfaction, but the lack of detailed descriptions about customer support channels and response times creates some uncertainty. There is no confirmed information on the variety of contact methods like live chat, phone support, or email and the specific hours when assistance is available. Details on whether support is offered in multiple languages also remain unknown, further limiting the appeal to a global clientele. User reviews suggest that the support is good enough to address basic questions, but the absence of clear documentation on the service's depth contributes to a middling score of 6/10. This moderate rating reflects a service that is neither exceptionally strong nor particularly weak, meaning that while current users are generally satisfied, there is plenty of potential for improvement in transparency and responsiveness.

6.4 Trading Experience Analysis

The overall trading experience at ClickTrades appears to be mixed. User feedback points to concerns about the reliability and speed of order execution and platform stability, with several reports showing a significant loss rate among retail investor accounts. The WebTrader platform is functional and user-friendly, but it does not offer extensive features often wanted by advanced traders, such as mobile trading app capabilities or complex automated trading functions. The observed high account loss rate, ranging between 74% and 89% for retail investors, suggests that the platform's trading conditions may not provide the strong support needed in highly volatile markets. Issues such as delayed order execution and platform lags have been noted by some users, taking away from the overall trading experience. These factors contribute to the moderate rating of 5/10, showing the need for potential improvements in the technical and operational aspects of the trading environment.

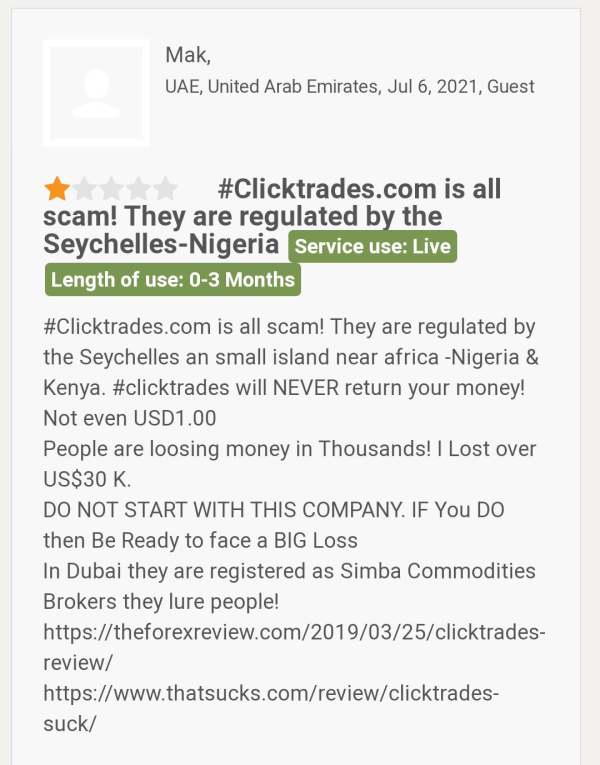

6.5 Trustworthiness Analysis

Trust is a critical factor for any broker, and ClickTrades' offshore status puts it in a complex position. The broker operates under FSA regulation with license number SD020, but its classification as an offshore entity raises concerns about the strength of investor protection measures typically associated with stricter regulatory jurisdictions. There is limited disclosure on comprehensive funds protection or transparent reporting standards, which leaves some investors cautious about potential risks. Industry reports and user feedback reflect general mixed feelings about the broker's trustworthiness, with some users highlighting the relatively relaxed regulatory framework as a drawback. The overall 5/10 score in this category reflects the delicate balance between accessibility and consumer risk, emphasizing that while ClickTrades does provide a regulated trading environment, the measures in place may not fully satisfy those seeking top-tier security and transparency.

6.6 User Experience Analysis

User experience at ClickTrades is characterized by mixed reviews that show moderate satisfaction among its clients. The WebTrader platform is designed for simplicity and ease of use, but the absence of extensive customization options or a mobile trading alternative could hurt overall convenience. The registration and verification processes are not well-documented, and the limited information about deposit and withdrawal procedures also adds to reported user frustrations. The interface's design is functional, but it does not seem to include innovative features that might enhance user engagement over the long term. Feedback highlights that users appreciate the diversity of tradable instruments but remain critical of the platform's operational smoothness and the clarity of its procedural guidelines. The user experience is rated 6/10, suggesting that while the platform meets basic expectations, there is plenty of room for improvements to meet modern trading demands.

7. Conclusion

In summary, ClickTrades stands as an offshore broker that offers a diverse array of tradable assets including forex, CFDs, stocks, cryptocurrencies, and more. Its offering of up to 1:300 leverage and a simple WebTrader platform may appeal to experienced and risk-tolerant traders, but the high minimum deposit requirement and moderate customer service, trading experience, and transparency levels are notable drawbacks. Our clicktrades review suggests that the broker may suit those who are already experienced in advanced trading dynamics and are comfortable with the associated risks. For investors considering ClickTrades, it is essential to weigh the benefits of asset diversity against the potential problems of a lenient regulatory framework and higher risk exposure.