OspreyFX Review 2025: Opportunity or Trap?

Executive Summary

OspreyFX is a burgeoning offshore forex and CFD broker established in 2018 and based in Saint Vincent and the Grenadines. The broker markets itself as a frontier for high-leverage trading, offering leverage as high as 1:500, which is particularly enticing for traders seeking amplified exposure. With a low minimum deposit requirement of just $25, it becomes accessible to a broader range of individuals looking to dip their toes into the forex market.

However, while these features present attractive opportunities for high-risk market participants, potential investors must weigh them against serious concerns regarding regulatory oversight and the broker's operational practices. OspreyFX operates without a license from recognized financial authorities, raising notable alarms about fund safety and the reliability of withdrawals, evidenced by a plethora of user complaints. Thus, while OspreyFX may offer appealing trading conditions for the daring transaction, the substantial risks imply that traders ought to tread cautiously.

⚠️ Important Risk Advisory & Verification Steps

Before proceeding with OspreyFX, potential users are strongly advised to consider the following essential warnings:

- Unregulated Status: OspreyFX is not overseen by any credible financial regulatory body, exposing clients to significant risk of fund mismanagement.

- Withdrawal Issues: Numerous reviews highlight withdrawal complications, with complaints suggesting delayed processing and unresponsive customer support.

- Scam Allegations: Mixed reviews contribute to a narrative where some users allege the broker operates in a scam-like manner, requiring extensive due diligence before commitment.

Self-Verification Steps

If you still consider trading with OspreyFX, take these steps for self-verification:

- Visit official regulatory websites to confirm the broker's licensing status.

- Search for independent broker reviews on forums such as Forex Peace Army or Trustpilot.

- Engage with community discussions to gather real user experiences.

- Test the broker with a minimal deposit while planning for potential withdrawals.

Rating Framework

Broker Overview

Company Background and Positioning

OspreyFX was founded in 2018 and bases its operations in Saint Vincent and the Grenadines. Situated in an area known for lax regulatory measures, the brokerage capitalizes on these benefits to offer impressive trading options, including the allure of high leverage, which appeals to risk-tolerant traders globally. However, the absence of proper licensing and oversight raises questions about the broker's integrity and operational practices.

Core Business Overview

The broker offers a diverse array of trading instruments, ranging from over 55 forex currency pairs to 30 cryptocurrencies, alongside commodities, indices, and stocks via CFDs. OspreyFX supports various trading styles, including scalping and algorithmic trading, through its Trade Locker platform and popular MT4/MT5 environments. However, its reliance on cryptocurrency deposits and withdrawals indicates a trend that leans towards speculative trading, which may not suit traditional investors.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

OspreyFX's lack of regulatory sanction raises significant concerns for potential traders.

The brokers operational jurisdiction in Saint Vincent and the Grenadines does not guarantee adequate supervision, exposing traders to considerable risks.

Regulatory Information Conflicts: OspreyFX claims to operate under a governance framework; yet, it lacks licenses from reputable authorities such as the FCA, ASIC, or CySEC. This unregulated status means that disputes arising with the broker can leave clients without recourse for compensation.

User Self-Verification Guide:

Check the regulatory status through reliable financial oversight bodies websites.

Review traders experiences and complaints documented on platforms like Trustpilot and Forex Peace Army.

Engage in discussions on trading forums to inquire about others experiences with fund safety and withdrawal reliability.

Industry Reputation and Summary: User feedback often highlights significant concerns about the brokers trustworthiness. "The absence of regulation makes your money vulnerable," stated a user review on Forex Peace Army, encapsulating fears prevalent among potential clients.

Trading Costs Analysis

OspreyFX features a low commission structure but potential hidden fees must be considered.

Advantages in Commissions: The broker provides competitive commissions that can attract new traders. Users have reported spreads starting from 0.4 pips for major pairs, such as EUR/USD, making it appealing for active trading strategies.

The "Traps" of Non-Trading Fees: Users have expressed concerns over high withdrawal fees and operational costs; certain complaints illustrate instances where traders reported unexpected charges when attempting to withdraw funds.

Cost Structure Summary: For high-frequency traders, OspreyFX can be beneficial due to low spreads, but hidden fees may deter casual investors, particularly those trading cryptocurrencies where higher transaction costs have been reported.

OspreyFX utilizes both proprietary and widely accepted trading environments.

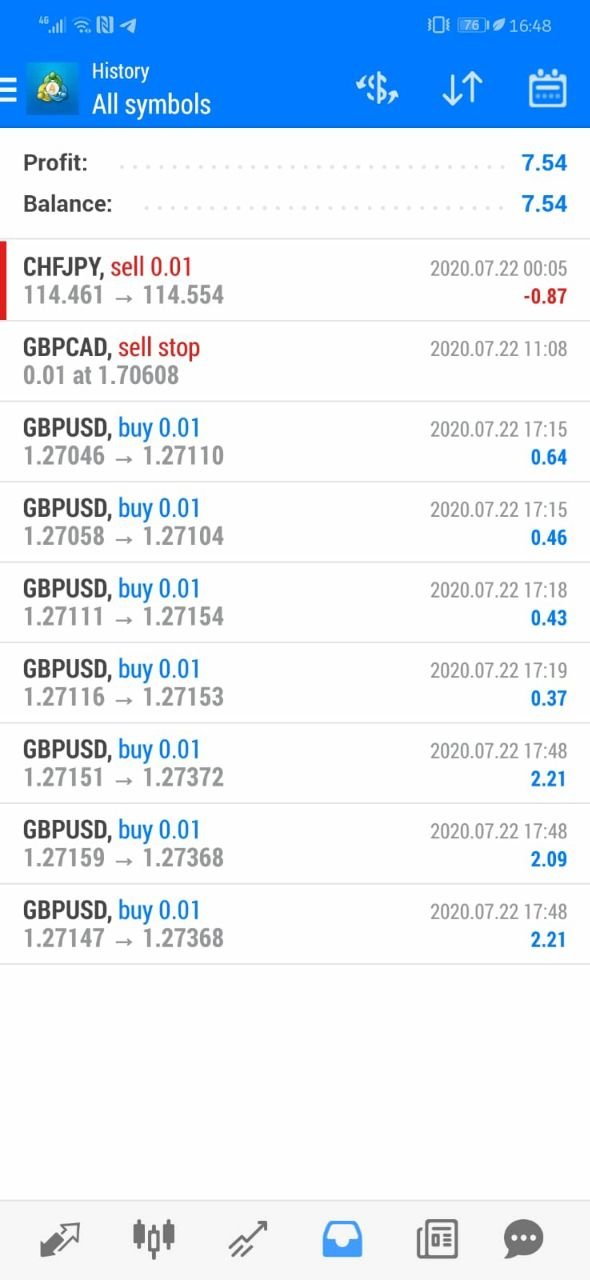

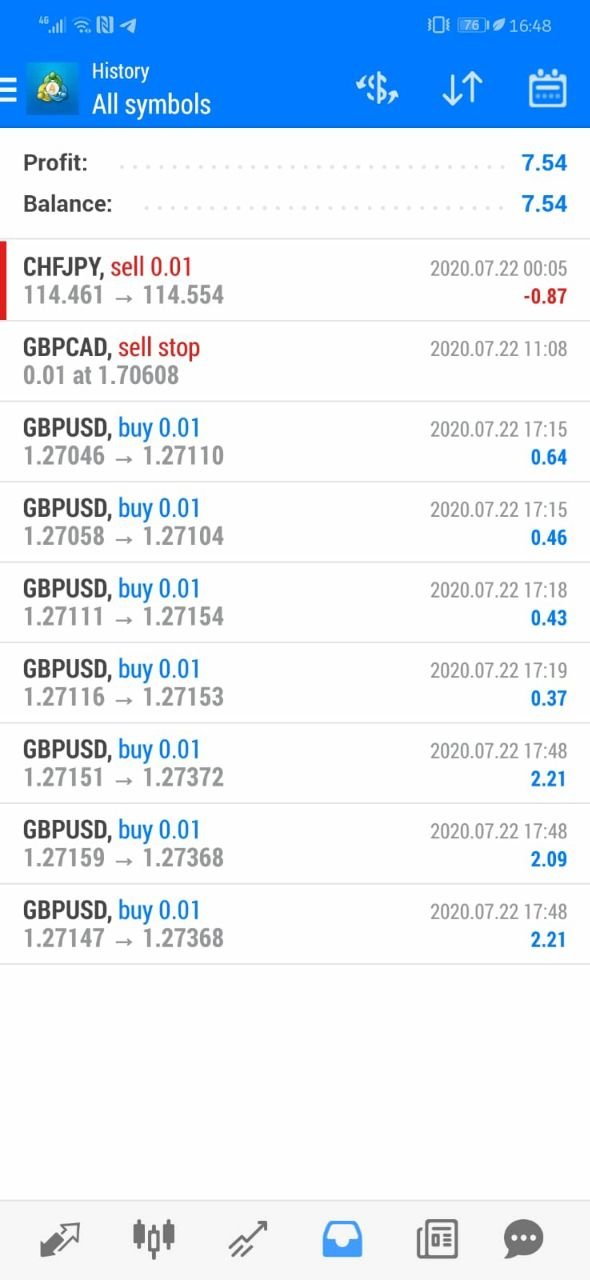

Platform Diversity: The broker provides access to MetaTrader 4 and 5 alongside its proprietary Trade Locker, offering traders various functionalities and tools to enhance trading experiences across platforms.

Quality of Tools and Resources: Users have noted that while the trading interfaces are robust, the quality of educational resources is limited; "More tutorials would enhance user knowledge," one trader remarked.

Platform Experience Summary: Feedback regarding usability seems favorable, though the mixed commentary around reliability suggests traders should prepare for potential issues with interface performance.

User Experience Analysis

The experience of OspreyFX users varies significantly.

User Reviews and Feedback: The complexities and risks of trading with an unregulated broker like OspreyFX often overwhelm new traders seeking seamless trading experiences. Casual investors may find themselves unprepared for the brokers operational practices.

Website Usability: While the website is generally straightforward, users have reported challenges in finding essential information regarding withdrawals and account management.

Overall Satisfaction: While some traders appreciate the trading conditions, complaints about service and responsiveness overshadow many users' experiences, leading to significant dissatisfaction.

Customer Support Analysis

OspreyFXs customer service appears to be lacking in responsiveness.

Contact Options: Though there are multiple methods to reach out for support, such as email and live chat, users often report delays in obtaining responses.

Quality of Service: Users often complained about the inefficiency of customer service, particularly concerning withdrawal queries—a critical aspect of trading.

Proactive Support Measures: Despite the availability of a FAQs and support ticket system, responsiveness issues persist, contributing to higher customer dissatisfaction.

Account Conditions Analysis

OspreyFX provides various flexible account types tailored to different trader preferences.

Diversity of Account Types: With mini, standard, pro, and variable accounts, OspreyFX facilitates traders with varying budgets; however, the implications of trading under potentially unsafe conditions can be concerning.

Trading Requirements: Margin calls and stop-out rules are consistent across the accounts but may introduce unique operational risks for users not accustomed to high-leverage trading environments.

Incentives and Trading Limits: The low minimum deposit and various promotional incentives like funded accounts can captivate traders but require informed risk management.

Conclusion

OspreyFX presents itself as a promising platform for high-leverage trading, attracting risk-tolerant individuals through competitive trading conditions and extensive instrument offerings. Nevertheless, the absence of solid regulatory oversight and documented issues regarding client withdrawals and customer service necessitate a cautious approach.

While OspreyFX may offer opportunities for seasoned traders with the know-how and appetite for risk, many users should consider carefully whether the potential rewards outweigh the tangible threats associated with unregulated trading environments. As always in the world of forex and CFDs, prudence and thorough research are paramount.