INF 2025 Review: Everything You Need to Know

Executive Summary

This inf review presents a comprehensive analysis of INF, an Australian-based online forex and CFD broker established in 2019. INF operates under the regulation of the Australian Securities and Investments Commission (ASIC), providing traders access to multiple financial instruments including forex, commodities, indices, and cryptocurrencies based on available public information and user feedback.

Our evaluation reveals a neutral assessment of INF. This assessment stems primarily from limited publicly available information regarding specific trading conditions, platform features, and comprehensive user experiences. However, the broker demonstrates credibility through its ASIC regulatory status, which ensures a degree of market transparency and operational oversight.

INF appears to target traders seeking portfolio diversification across various asset classes. The broker particularly focuses on those interested in combining traditional forex trading with modern cryptocurrency opportunities. The broker's regulatory compliance with ASIC standards suggests adherence to Australian financial service requirements, though detailed information about trading costs, platform specifications, and customer service quality remains limited in publicly accessible sources.

While INF's multi-asset approach and regulatory standing present potential advantages, prospective clients should note the scarcity of detailed operational information and comprehensive user testimonials available for thorough evaluation.

Important Disclaimer

This inf review is based on publicly available information and user feedback accessible at the time of writing. Trading conditions, regulatory status, and service offerings may vary across different jurisdictions and can change over time.

Readers should note that regulatory policies differ between countries. The services available to traders may vary depending on their location and local financial regulations. The ASIC regulation mentioned applies specifically to Australian operations and may not extend to all international clients.

Our evaluation methodology relies on publicly disclosed information, regulatory filings, and available user testimonials. Where specific details are not available in public sources, this has been clearly indicated. Potential clients are strongly advised to verify all information directly with INF and consult current regulatory databases before making trading decisions.

Overall Rating Framework

Broker Overview

INF was established in 2019 as an online forex and CFD broker. The company has its headquarters located in Sydney, Australia. The company positions itself as a multi-asset trading service provider, focusing on delivering access to diverse financial markets through digital trading platforms. Since its inception, INF has operated under the regulatory framework established by the Australian Securities and Investments Commission, ensuring compliance with local financial service standards.

The broker's business model centers on providing retail and institutional clients access to global financial markets through contracts for difference (CFDs) and foreign exchange trading. INF's approach emphasizes portfolio diversification opportunities. This allows traders to access multiple asset classes through a single trading account. The company's relatively recent establishment in 2019 positions it among newer entrants in the competitive Australian forex brokerage landscape.

INF offers trading access across four primary asset categories: foreign exchange pairs, commodities, stock indices, and cryptocurrencies. This multi-asset approach reflects current market trends where traders increasingly seek diversified exposure beyond traditional forex pairs. The broker operates under ASIC regulation (Australian Securities and Investments Commission), which requires adherence to specific capital adequacy requirements, client fund segregation, and operational transparency standards mandated for Australian financial service providers.

Regulatory Jurisdiction: INF operates under ASIC (Australian Securities and Investments Commission) regulation. This ensures compliance with Australian financial service standards and provides clients with regulatory protection under Australian law.

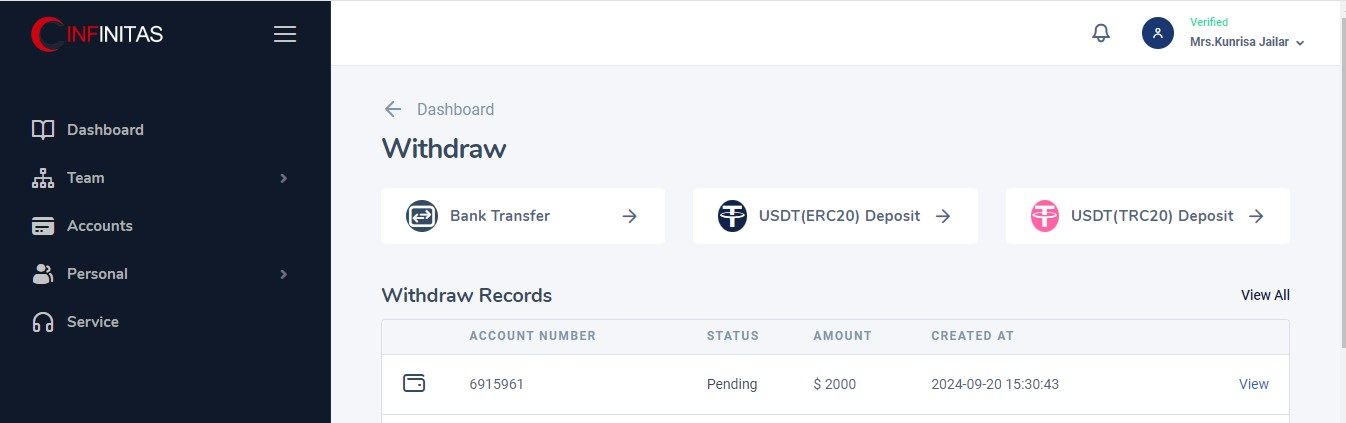

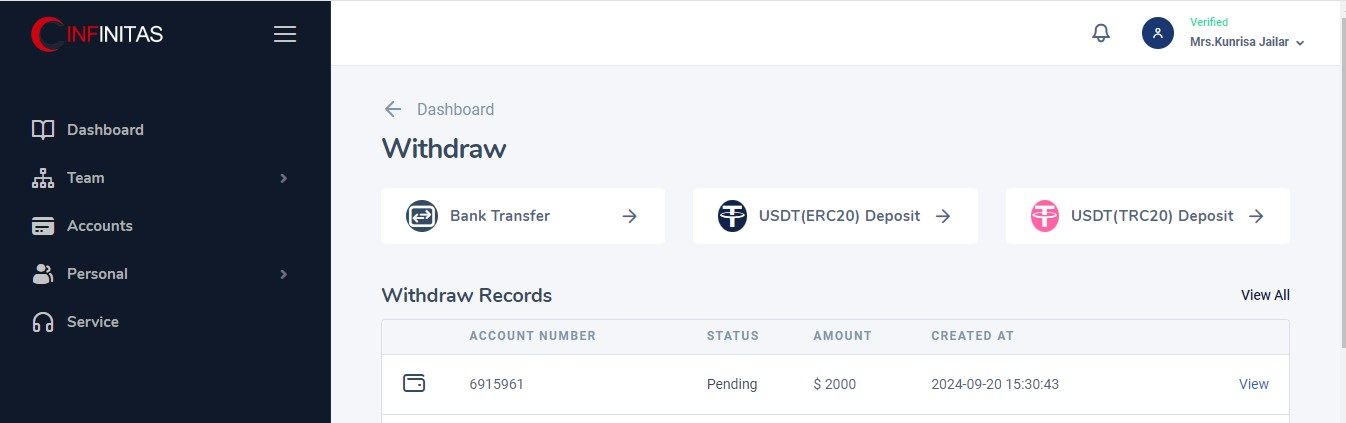

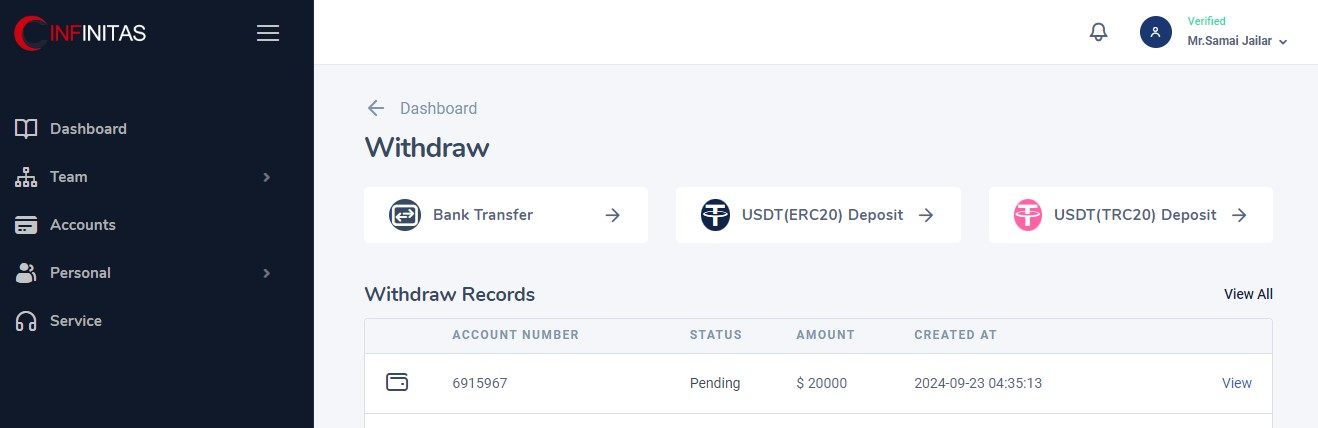

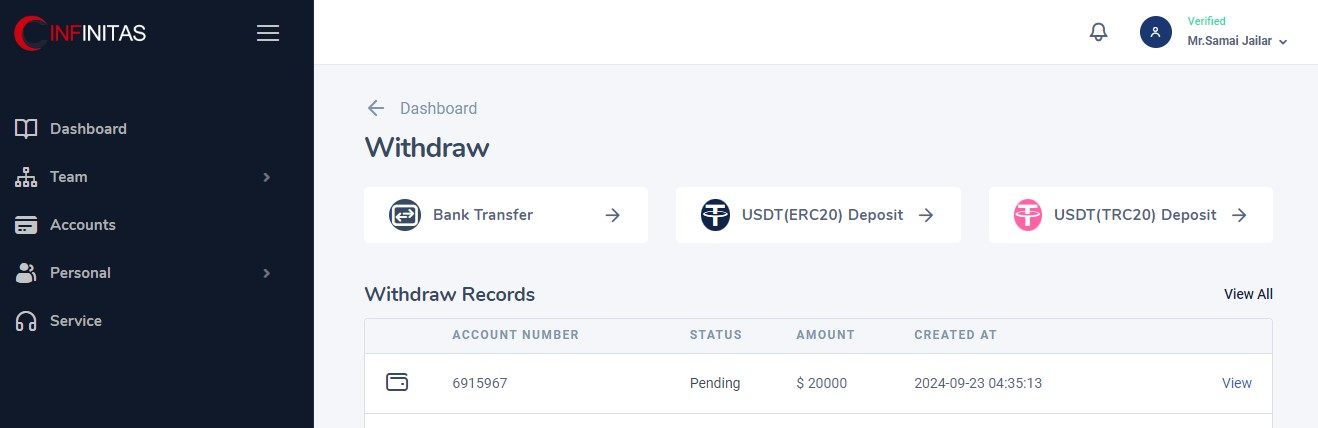

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal options is not detailed in publicly accessible sources. This requires direct verification with the broker.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not specified in available public documentation.

Promotional Offers: Details about current bonus programs, promotional campaigns, or new client incentives are not comprehensively documented in accessible materials.

Tradeable Assets: INF provides access to four main asset classes. These include foreign exchange currency pairs, commodities including precious metals and energy products, major stock indices from global markets, and cryptocurrency CFDs covering popular digital assets.

Cost Structure: Specific information regarding spreads, commissions, overnight financing costs, and other trading fees is not detailed in publicly available sources. This necessitates direct inquiry with the broker for accurate pricing information.

Leverage Ratios: Maximum leverage limits and margin requirements are not specified in accessible public documentation.

Platform Options: Details about available trading platforms, whether proprietary or third-party solutions like MetaTrader, are not comprehensively documented in public sources.

Geographic Restrictions: Specific countries or regions where services may be restricted are not detailed in available materials.

Customer Support Languages: Information about multilingual support options is not specified in accessible documentation.

This inf review indicates that while basic operational information is available, many specific details require direct communication with the broker for comprehensive understanding.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for INF reveals significant information gaps in publicly available documentation. Account type varieties and their specific features are not comprehensively detailed in accessible sources. This makes it challenging to assess the range of options available to different trader categories. Without clear information about standard, premium, or professional account tiers, potential clients cannot easily compare INF's offerings against industry standards.

Minimum deposit requirements across different account types remain unspecified in public materials. This is crucial information for traders planning their initial investment. The account opening process details, including required documentation, verification timelines, and approval procedures, are not thoroughly documented in available sources. Additionally, information about specialized account features such as Islamic/Swap-free accounts for traders requiring Sharia-compliant trading conditions is not readily available.

The absence of detailed account condition information in this inf review suggests that prospective clients need to engage directly with INF's sales team. They must do this to understand specific terms, minimum deposits, and account features. This lack of transparency in publicly available materials impacts the overall assessment of account conditions, as traders typically prefer clear, upfront information about trading terms and account requirements before committing to a broker.

The evaluation of trading tools and resources provided by INF encounters limitations due to insufficient publicly available information. Trading tool varieties and quality assessments cannot be comprehensively evaluated. Specific details about technical analysis tools, charting packages, and trading calculators are not detailed in accessible sources. The absence of clear information about proprietary tools or third-party integrations makes it difficult to assess INF's technological offerings.

Research and analysis resources, including market commentary, economic calendars, and analytical reports, are not thoroughly documented in public materials. Educational resources such as trading guides, webinars, video tutorials, and market education programs that many brokers provide to support client development are not clearly outlined in available information about INF.

Automated trading support, including Expert Advisor compatibility, algorithmic trading options, and API access for institutional clients, remains unspecified in publicly accessible documentation. Without detailed information about platform capabilities and integrated tools, traders cannot adequately assess whether INF's technological infrastructure meets their analytical and automated trading requirements. This information gap significantly impacts the tools and resources evaluation in this review.

Customer Service and Support Analysis (5/10)

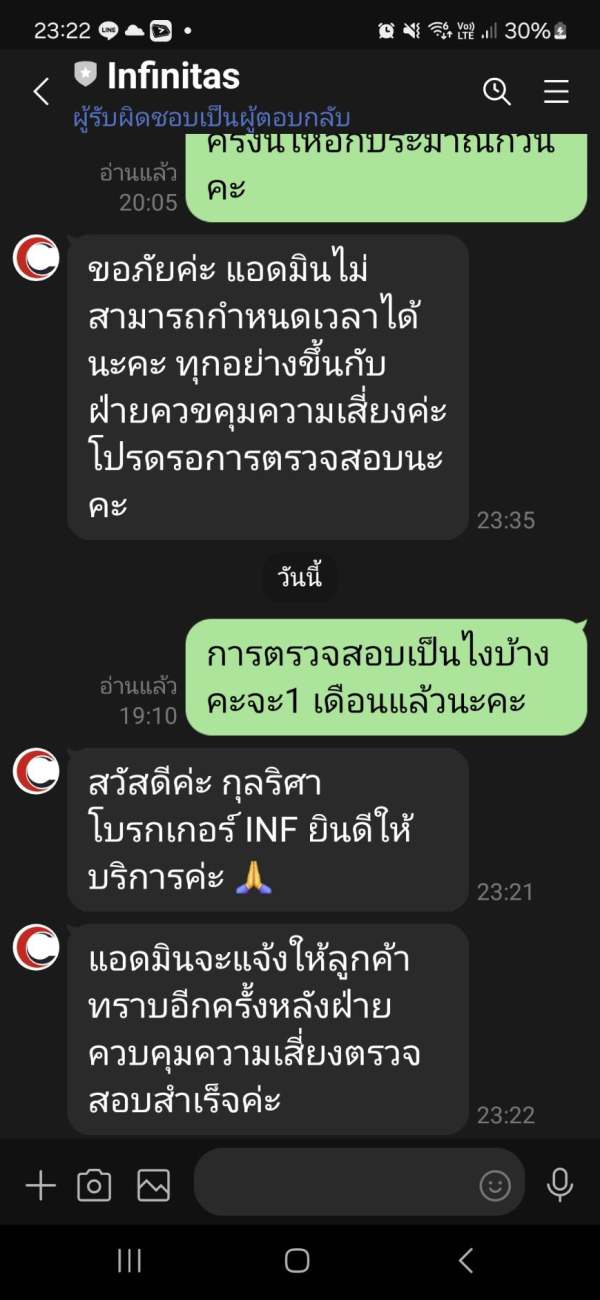

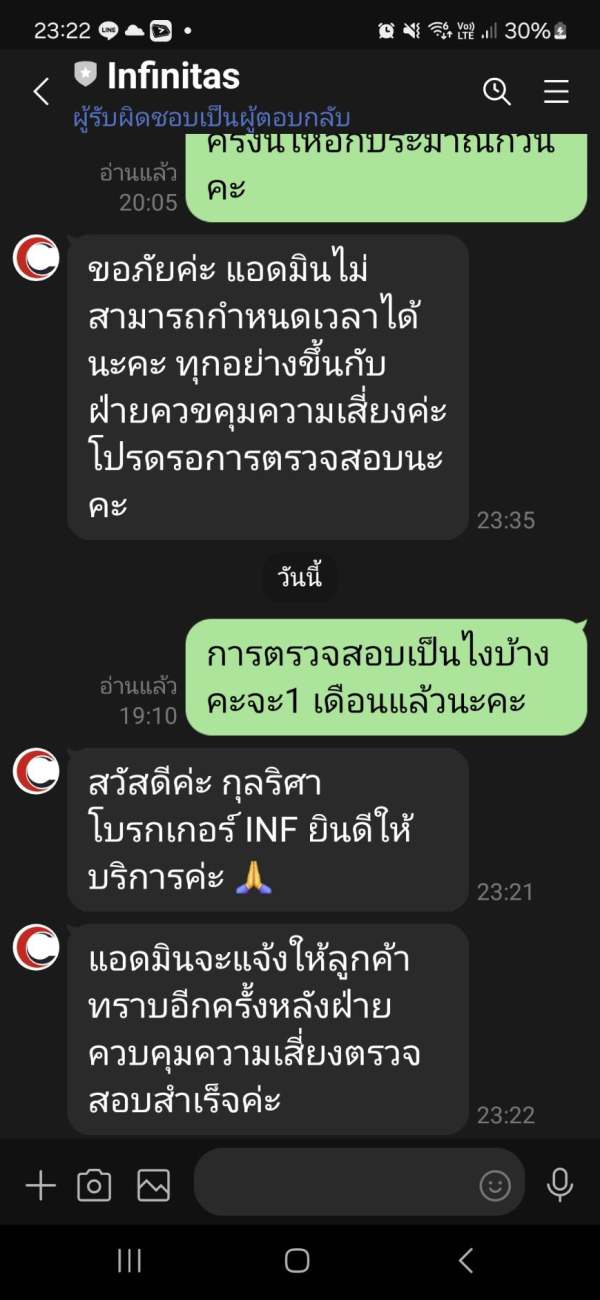

The customer service evaluation for INF faces challenges due to limited publicly available feedback and detailed service information. Available customer service channels such as live chat, telephone support, email ticketing systems, and their respective availability hours are not comprehensively documented in accessible sources. This makes it difficult to assess the convenience and accessibility of support options for traders across different time zones.

Response time performance metrics, including average resolution times for different inquiry types and service level agreements, are not detailed in public materials. Service quality assessments based on user testimonials and satisfaction surveys are not extensively available in public reviews. This limits the ability to evaluate actual customer experience quality.

Multilingual support capabilities and the range of languages available for customer assistance are not specified in accessible documentation. Customer service operating hours and coverage across different global markets remain unclear from available information. The absence of comprehensive user feedback regarding problem resolution effectiveness, staff knowledge levels, and overall satisfaction with support services impacts this evaluation. Without substantial user testimonials and detailed service specifications, assessing INF's customer service quality remains challenging in this inf review.

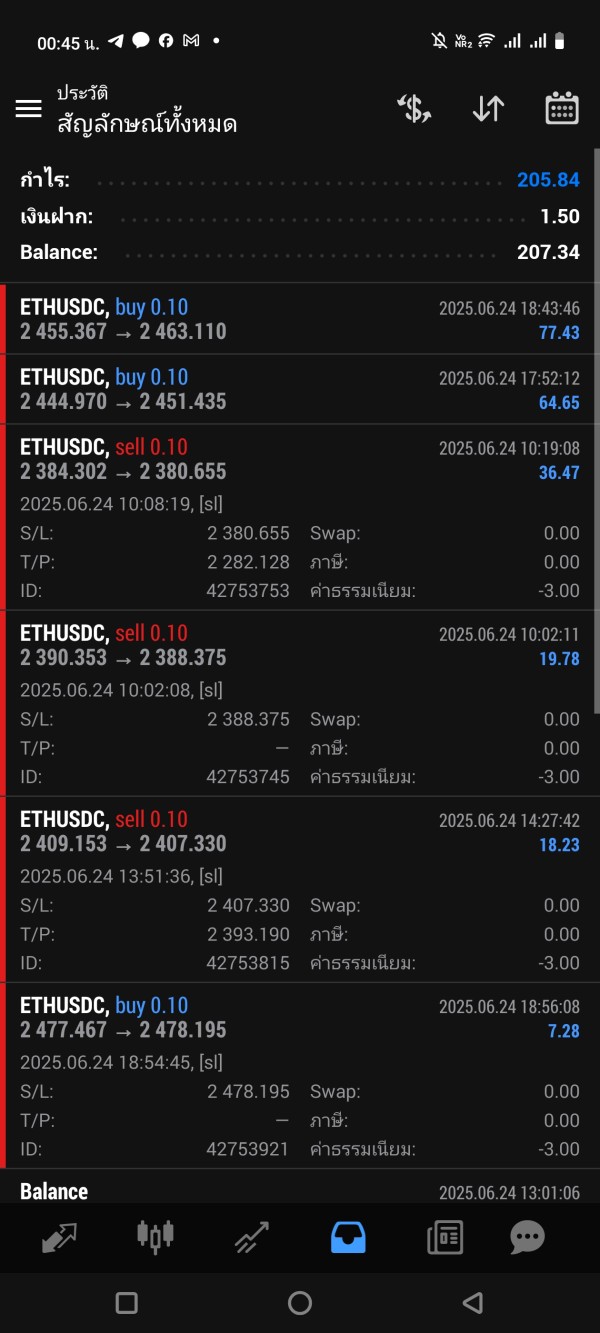

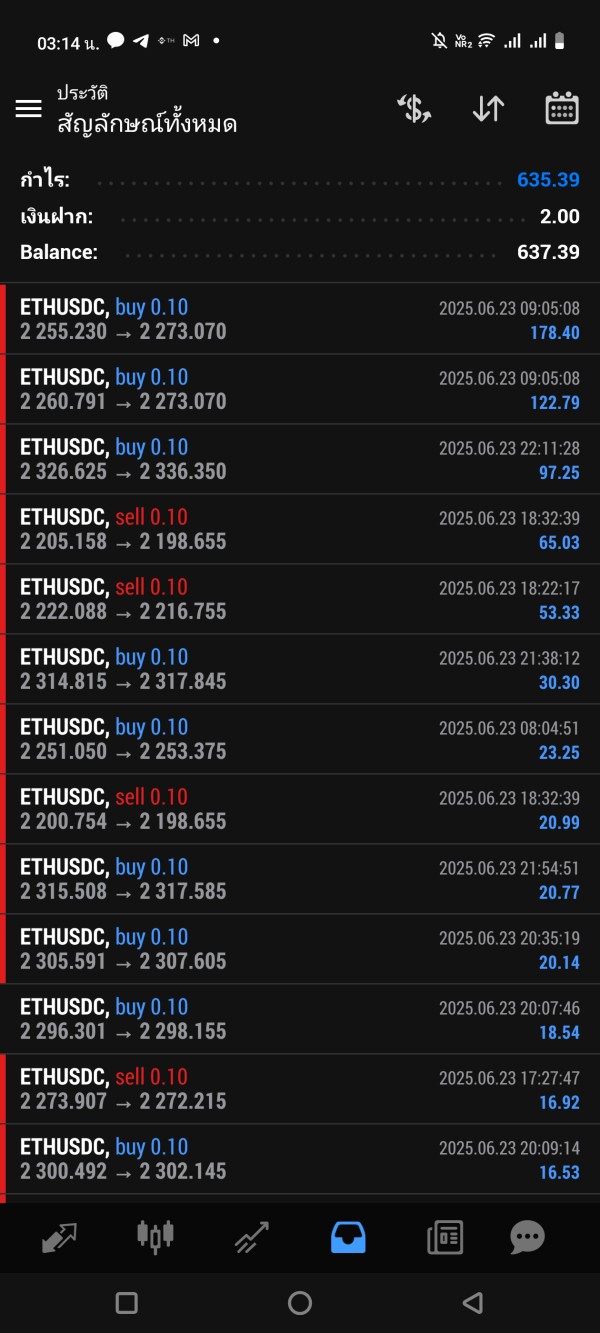

Trading Experience Analysis (5/10)

The trading experience assessment for INF encounters significant limitations due to insufficient publicly available performance data and user feedback. Platform stability and execution speed metrics, including server uptime statistics, order execution latency, and system reliability during high-volatility periods, are not documented in accessible sources. These technical performance indicators are crucial for evaluating actual trading conditions.

Order execution quality, including slippage rates, requote frequency, and fill rates during different market conditions, lacks detailed documentation in public materials. Platform functionality completeness, covering chart analysis capabilities, order management features, and mobile trading app performance, cannot be thoroughly assessed without comprehensive platform specifications.

Mobile trading experience details, including app store ratings, mobile platform features, and cross-device synchronization capabilities, are not extensively documented in available sources. Trading environment factors such as dealing desk operations, market maker versus ECN execution models, and liquidity provider relationships are not clearly specified in public information.

The absence of detailed user testimonials specifically addressing platform performance, execution quality, and overall trading satisfaction limits the comprehensive evaluation of INF's trading experience. This inf review indicates that potential clients would need to test platform performance through demo accounts or direct experience to adequately assess trading conditions.

Trust and Reliability Analysis (8/10)

INF's trust and reliability evaluation scores favorably primarily due to its ASIC regulatory status. This demonstrates adherence to Australian financial service standards and regulatory oversight. The Australian Securities and Investments Commission requires licensed brokers to maintain specific capital adequacy ratios, segregate client funds, and operate under strict compliance frameworks, providing a solid foundation for client protection.

Regulatory compliance with ASIC indicates that INF must adhere to established financial service requirements. These include professional indemnity insurance, dispute resolution mechanisms, and regular regulatory reporting. This regulatory framework provides clients with access to Australian financial service complaint resolution processes and compensation schemes where applicable.

However, detailed information about additional security measures such as client fund segregation specifics, insurance coverage amounts, and cybersecurity protocols are not comprehensively documented in publicly available sources. Company transparency regarding ownership structure, financial statements, and corporate governance practices could be more extensively detailed in public materials.

Industry reputation and third-party evaluations are limited in available sources. This makes it challenging to assess peer recognition and industry standing comprehensively. The relatively recent establishment in 2019 means INF has a shorter operational history compared to more established brokers, though no significant negative incidents are documented in accessible public records.

User Experience Analysis (5/10)

The user experience evaluation for INF faces substantial limitations due to insufficient publicly available user feedback and detailed interface assessments. Overall user satisfaction metrics from comprehensive surveys or review platforms are not extensively documented. This makes it difficult to gauge general client sentiment and satisfaction levels across different user categories.

Interface design and usability assessments, including platform navigation efficiency, visual design quality, and user-friendly features, lack detailed documentation in accessible sources. Registration and verification process user feedback, including account opening simplicity, document submission procedures, and approval timeframes, are not comprehensively available in public testimonials.

Funding operation experiences, covering deposit processing times, withdrawal efficiency, and payment method satisfaction, are not extensively documented in available user reviews. Common user complaints and frequently reported issues that might affect the overall trading experience are not clearly identified in publicly accessible feedback.

The absence of detailed user journey analysis, satisfaction surveys, and comprehensive testimonials significantly impacts the user experience assessment. Without substantial feedback from actual users covering various aspects of the trading experience, from onboarding through ongoing platform usage, this inf review cannot provide a comprehensive user experience evaluation. Prospective clients would benefit from seeking direct user testimonials and testing platform features through demo accounts.

Conclusion

This inf review concludes with a neutral overall assessment of INF as a forex and CFD broker. This assessment primarily reflects the limited comprehensive information available in public sources. While INF demonstrates regulatory credibility through its ASIC oversight and offers access to diversified asset classes, the scarcity of detailed operational information, user testimonials, and specific trading conditions prevents a more definitive evaluation.

INF appears most suitable for traders seeking portfolio diversification across forex, commodities, indices, and cryptocurrencies. The broker particularly appeals to those who value regulatory compliance and are comfortable conducting thorough due diligence directly with the broker. The ASIC regulatory framework provides a foundation of credibility, though prospective clients should verify all trading conditions, costs, and service features directly with INF.

Primary advantages include ASIC regulatory oversight and multi-asset trading access. Notable limitations center on the lack of transparent, publicly available information regarding trading costs, platform specifications, and comprehensive user experiences. Potential clients are advised to request detailed information directly from INF, test platform functionality through demo accounts, and verify all trading conditions before committing funds.