Is KODDPA safe?

Pros

Cons

Is Koddpa A Scam?

Introduction

Koddpa is a forex broker that has positioned itself in the highly competitive landscape of online trading. As with any broker, potential traders must approach with caution, given the prevalence of scams in the forex market. The need for diligent evaluation arises from the inherent risks associated with trading, including the possibility of losing funds to unregulated entities. This article aims to provide a comprehensive analysis of Koddpa, assessing its legitimacy, regulatory status, and overall reliability. Our investigation is based on a thorough review of available online resources, user feedback, and regulatory information to determine whether Koddpa is safe or a scam.

Regulatory and Legality

The regulatory status of a broker is crucial in determining its credibility and the level of protection it offers to traders. Koddpa claims to be regulated by the Financial Crimes Enforcement Network (FinCEN) in the United States. However, it is essential to scrutinize this claim, as many brokers use regulatory licenses that may not provide adequate protection to clients. Below is a summary of Koddpa's regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| FinCEN | 31000280148528 | United States | Verified |

While being registered with FinCEN is a positive sign, it is important to note that this registration does not equate to full regulatory oversight like that provided by other reputable financial authorities (e.g., FCA, ASIC). The absence of a more stringent regulatory framework raises concerns about the broker's accountability and the potential risks involved in trading with Koddpa. Traders should be aware that unregulated brokers often operate with little oversight, increasing the likelihood of fraudulent activities.

Company Background Investigation

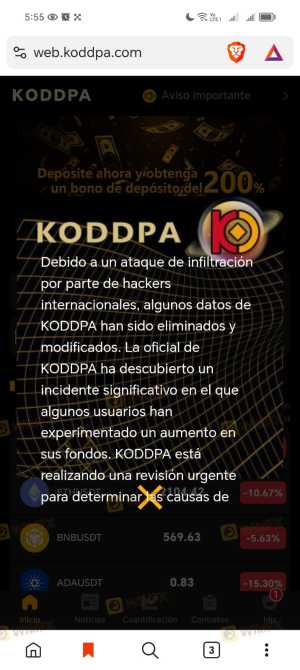

Koddpas company history and ownership structure are critical in assessing its legitimacy. The broker operates under a name that lacks transparency regarding its management team and ownership. This anonymity is a common red flag, as reputable brokers typically provide detailed information about their founders and key personnel, showcasing their experience and qualifications in the financial industry.

The lack of transparency raises questions about Koddpas operational integrity and the potential risks associated with investing through this broker. A thorough examination of the company's history reveals limited information, which is concerning for potential clients. Without clear insights into the organizational structure and the professional backgrounds of its management, traders may find it challenging to trust Koddpa.

Trading Conditions Analysis

Koddpa offers various trading conditions, including spreads, commissions, and overnight fees. Understanding the fee structure is essential for traders, as it directly impacts profitability. The following table outlines Koddpa's core trading costs compared to industry averages:

| Fee Type | Koddpa | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.0 pips |

| Commission Model | No commission | Varies (0-10 USD) |

| Overnight Interest Range | 0.5% | 0.3% |

While Koddpa does not charge a commission, the spreads offered are above the industry average, which may affect the overall trading cost for clients. Additionally, the overnight interest charges are higher than typical rates in the industry, potentially leading to increased costs for traders holding positions overnight. Traders should carefully evaluate these conditions, as they can significantly impact trading outcomes.

Client Funds Security

The security of client funds is paramount when choosing a broker. Koddpa claims to implement various measures to safeguard client deposits. However, the lack of detailed information about fund segregation and investor protection raises concerns.

Traders should inquire about whether Koddpa uses segregated accounts to separate client funds from the companys operational funds, as this is a standard practice among reputable brokers. Additionally, it is essential to assess whether Koddpa offers negative balance protection, which can prevent clients from losing more than their initial investment. The absence of such protections can expose traders to significant financial risks.

Client Experience and Complaints

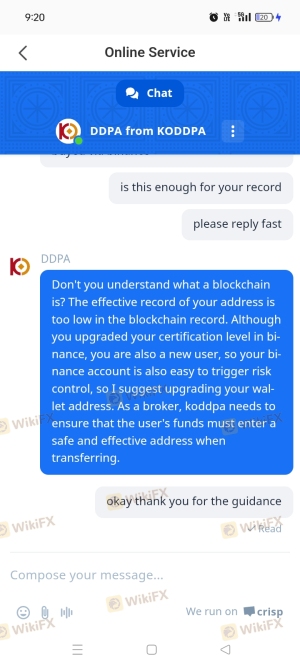

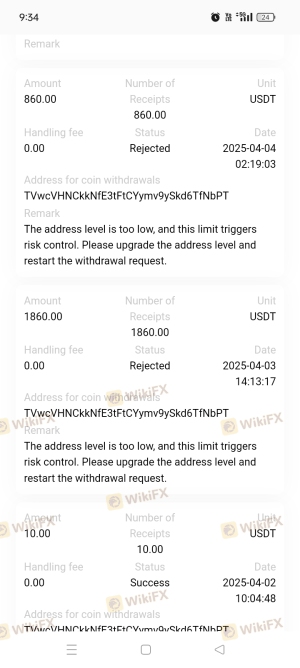

Analyzing client feedback is crucial in determining whether Koddpa is safe or a scam. Numerous reviews from users highlight significant issues, including difficulties with fund withdrawals, aggressive sales tactics, and unresponsive customer support.

The following table summarizes common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| High-Pressure Sales | Medium | Minimal response |

| Customer Support Issues | High | Poor response quality |

Many traders have reported that once they deposited funds, communication with Koddpa's support team became increasingly challenging. This pattern of behavior is often indicative of potential scams, as legitimate brokers typically prioritize customer service and transparency. A few cases illustrate this troubling trend, with clients describing experiences where their accounts were blocked without explanation, leaving them unable to access their funds.

Platform and Trade Execution

The performance of the trading platform is another critical aspect to consider. Koddpa offers a trading platform that users have described as outdated and prone to technical issues. Traders have reported instances of slippage during order execution, which can lead to significant discrepancies between expected and actual trade prices.

Concerns about platform manipulation have also been raised, with some users alleging that their trades were unfairly executed. These issues can severely impact a trader's experience and profitability, raising further doubts about Koddpas reliability as a broker.

Risk Assessment

Using Koddpa presents various risks that traders should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of stringent oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Customer Service Risk | Medium | Poor response to client inquiries |

| Platform Stability Risk | High | Technical issues and execution slippage |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Koddpa. It may also be prudent to limit initial investments and consider using a demo account to assess the platform's reliability.

Conclusion and Recommendations

Based on the comprehensive analysis of Koddpa's regulatory status, company background, trading conditions, client fund security, and user experiences, it is evident that Koddpa raises several red flags. The lack of robust regulation, transparency issues, and numerous complaints suggest that traders should exercise caution.

For those considering trading with Koddpa, it is crucial to understand the potential risks involved. If you are a novice trader or someone who values security, it may be wise to explore alternative brokers with a proven track record and better regulatory oversight. Reputable options include brokers regulated by the FCA or ASIC, which provide a higher level of investor protection and transparency.

In conclusion, while Koddpa may present itself as a viable trading option, the evidence suggests that it is not a safe choice for traders looking to secure their investments.

Is KODDPA a scam, or is it legit?

The latest exposure and evaluation content of KODDPA brokers.

KODDPA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KODDPA latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.