Regarding the legitimacy of FXC forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is FXC safe?

Pros

Cons

Is FXC markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

WTG LTD

Effective Date:

--Email Address of Licensed Institution:

fxcentrum@fxcentrum.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fxcentrum.comExpiration Time:

--Address of Licensed Institution:

Office 5B, HIS Building, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 2630501Licensed Institution Certified Documents:

Is FXCentrum A Scam?

Introduction

FXCentrum is a forex and CFD brokerage established in 2019 and based in Seychelles. It positions itself as a low-cost trading platform, offering a wide range of financial instruments, including forex, commodities, indices, and stocks. Given the rapid growth of the forex market and the proliferation of online brokers, traders must exercise caution when selecting a broker. The potential for scams and fraudulent activities in the industry necessitates a thorough evaluation of any trading platform before committing funds. This article aims to provide a comprehensive analysis of FXCentrum, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape is crucial for determining a broker's legitimacy and trustworthiness. FXCentrum operates under the supervision of the Seychelles Financial Services Authority (FSA), which is known for its relatively lenient regulatory framework compared to top-tier authorities like the FCA or ASIC. Below is a summary of FXCentrum's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 055 | Seychelles | Verified |

While FXCentrum is regulated, it is essential to note that the FSA does not provide the same level of investor protection as more stringent regulators. For example, there is no compensation scheme for clients in case of broker insolvency, and the regulatory oversight may not be as rigorous. Historical compliance records show that FXCentrum has not faced any significant regulatory actions, but the overall quality of oversight raises concerns regarding the protection of traders' interests.

Company Background Investigation

FXCentrum is owned by WTG Ltd, a company registered in Seychelles. The firm has made efforts to establish itself in the competitive forex market by offering a bespoke trading platform and various promotional bonuses. The management team comprises individuals with backgrounds in finance and technology, although specific details about their experience and qualifications are limited. Transparency in company operations is vital for building trust with clients. FXCentrum has a basic online presence, but more detailed disclosures about its management and operational practices would enhance its credibility.

Trading Conditions Analysis

FXCentrum offers competitive trading conditions, including low minimum deposits and high leverage options. However, it is crucial to scrutinize the fee structure for any hidden costs. The following table outlines the key trading costs associated with FXCentrum:

| Fee Type | FXCentrum | Industry Average |

|---|---|---|

| Spread on Major Pairs | Starting from 0.3 pips | 1.0 pips |

| Commission Structure | Zero commission | Varies (typically 0.1% to 0.5%) |

| Overnight Interest Range | $0.14 per night | Varies by broker |

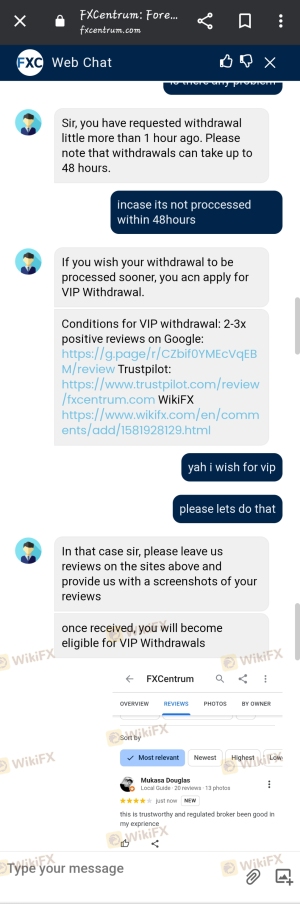

While the spreads appear attractive, the lack of a clear commission structure might lead traders to incur unexpected costs. Additionally, FXCentrum imposes fees on withdrawals after the first free transaction each month, which is not a common practice among reputable brokers. The second withdrawal incurs a $10 fee, and subsequent withdrawals are subject to a 2.5% charge, which could deter frequent traders.

Customer Fund Safety

Customer fund safety is paramount in the trading industry. FXCentrum claims to implement several safety measures, including negative balance protection and segregated accounts for client funds. However, the effectiveness of these measures is contingent upon the regulatory framework under which the broker operates. The FSA does not mandate strict fund segregation, which raises concerns about the potential risk of fund mismanagement. Historically, there have been no significant incidents reported regarding fund safety at FXCentrum, but the absence of higher-tier regulatory oversight leaves room for caution.

Customer Experience and Complaints

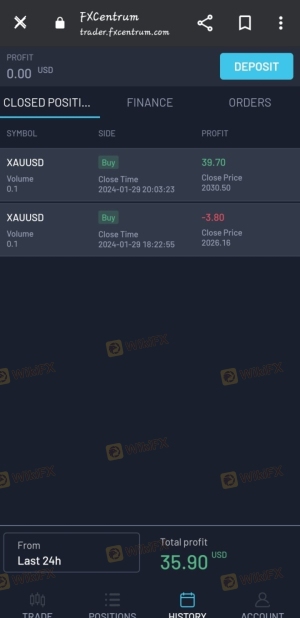

User feedback is a valuable indicator of a broker's reliability. While many reviews praise FXCentrum for its user-friendly platform and prompt customer service, several complaints have emerged regarding withdrawal issues and the handling of bonuses. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow response times |

| Bonus Withdrawal Conditions | Medium | Complicated processes |

| Execution Delays | Medium | Occasional issues reported |

For instance, some users have reported that after reaching a profit level, their withdrawal requests were either delayed or denied, leading to frustration and distrust. Such patterns of complaints should be taken seriously by potential traders considering FXCentrum.

Platform and Trade Execution

FXCentrum utilizes its proprietary trading platform, FXC Trader, which is designed for both desktop and mobile users. The platform is generally well-received for its functionality and ease of use, but it lacks the advanced features offered by popular platforms like MetaTrader 4 and 5. Users have reported mixed experiences regarding order execution quality. While many trades are executed promptly, some have experienced slippage and delays, particularly during high volatility periods. There are no substantial indications of platform manipulation, but the lack of transparency regarding execution metrics is a concern.

Risk Assessment

Using FXCentrum presents several risks that traders should consider. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating under a less stringent regulator may expose traders to higher risks. |

| Withdrawal Risk | Medium | Reports of withdrawal difficulties could indicate potential issues with fund access. |

| Platform Reliability | Medium | While generally stable, execution delays and slippage can impact trading outcomes. |

To mitigate these risks, traders should ensure they are well-informed about the broker's terms and conditions, maintain realistic expectations, and consider starting with a demo account to familiarize themselves with the platform.

Conclusion and Recommendations

In conclusion, while FXCentrum is not overtly a scam, it operates under a regulatory framework that lacks the robustness of more established jurisdictions. The broker offers competitive trading conditions and a user-friendly platform, but potential traders should remain vigilant regarding withdrawal policies and customer feedback. It is advisable for new traders to approach FXCentrum with caution, starting with smaller amounts and thoroughly reviewing the withdrawal process before committing significant funds. For those seeking more robust regulatory protections and a proven track record, alternative brokers such as IG, OANDA, or Forex.com may be more suitable options.

Is FXC a scam, or is it legit?

The latest exposure and evaluation content of FXC brokers.

FXC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXC latest industry rating score is 2.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.