Is INF safe?

Pros

Cons

Is INF a Scam?

Introduction

INF, operated by Infinitas Global Limited, is a relatively new player in the forex market, having been established in 2019. Positioned as an online forex and CFD broker, INF offers trading in various financial instruments, including forex, commodities, indices, and cryptocurrencies. The significance of evaluating forex brokers cannot be overstated; traders must ensure that they engage with trustworthy and regulated entities to safeguard their investments. The forex market is rife with both legitimate opportunities and fraudulent schemes, making it crucial for traders to conduct thorough due diligence. This article aims to provide a comprehensive assessment of INF by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a primary indicator of a broker's legitimacy. INF claims to be regulated by the Australian Securities and Investments Commission (ASIC), a well-respected financial authority known for its stringent oversight of financial markets. Regulation by ASIC implies that the broker adheres to high standards of financial practice, which is a positive aspect for potential traders. The following table summarizes the core regulatory information for INF:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001300014 | Australia | Verified |

ASIC's regulation is crucial as it provides a layer of protection for traders, ensuring that the broker maintains proper financial practices and transparency. However, while INF is regulated, there are concerns regarding the transparency of its operations and the information available on its website. Some reports suggest that INF has faced issues related to trade execution and customer complaints, which raises questions about its compliance history and overall reliability.

Company Background Investigation

INF is operated by Infinitas Global Limited, with its headquarters located in Hong Kong. The company was founded in 2019 and has since positioned itself as a broker catering to both retail and institutional clients. However, details about the company's ownership structure and management team are somewhat opaque, which raises concerns about transparency. A lack of publicly available information about the management's qualifications and experience can lead to skepticism among potential clients.

The company's history is relatively short, and while it has managed to attract a customer base, the rapid growth may not necessarily correlate with stability or reliability. Transparency in operations is vital for building trust, and the limited information available about the company's leadership and operational practices is a point of concern. Traders should be cautious and seek out more information before committing their funds to INF.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. INF offers the popular MetaTrader 4 (MT4) trading platform, which is known for its user-friendly interface and advanced trading tools. However, details regarding the overall fee structure and trading costs remain unclear.

Heres a comparison of core trading costs for INF against industry averages:

| Cost Type | INF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1 pip |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding spreads, commissions, and other fees is concerning. Traders often rely on this information to assess the potential profitability of their trades, and without clear data, it becomes challenging to make informed decisions. Reports of high spreads and unclear commission structures could be indicative of potential issues that might arise during trading.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. INF claims to have measures in place for client fund protection, including segregated accounts. This practice ensures that client funds are kept separate from the broker's operational funds, which is essential for minimizing risk in the event of financial difficulties.

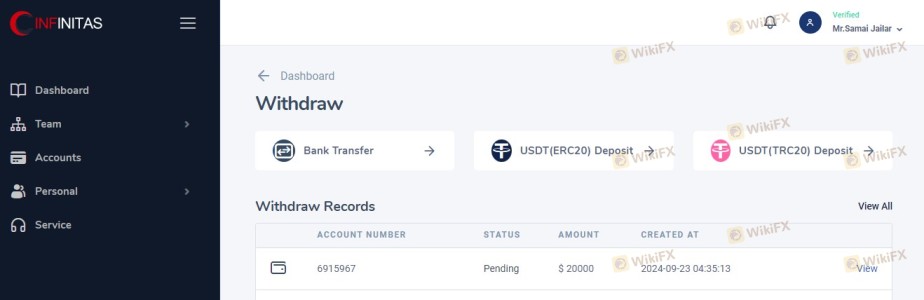

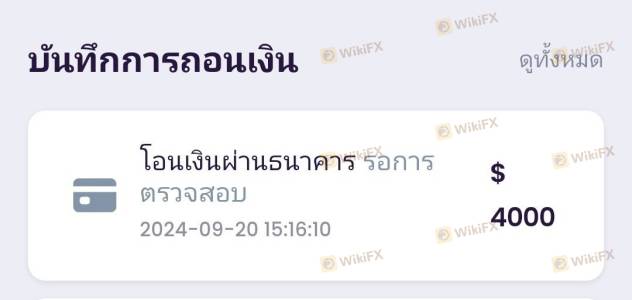

However, it is crucial to evaluate the effectiveness of these measures. There have been reports of withdrawal issues and delays, which can raise red flags regarding the broker's ability to manage funds securely. The history of any past disputes or financial issues should also be considered when assessing the safety of client funds.

Customer Experience and Complaints

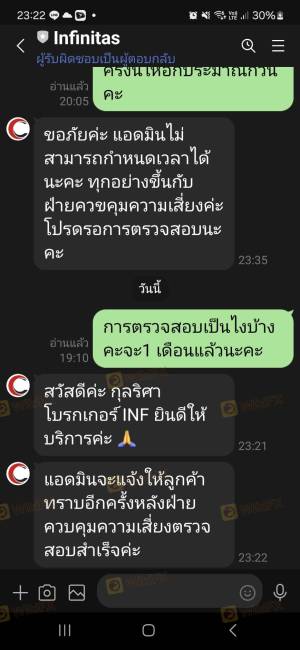

Customer feedback plays a significant role in evaluating a broker's reliability. Reviews of INF indicate a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised concerns about withdrawal issues and unresponsive customer service.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Service | Medium | Slow response |

| Trading Execution Issues | High | Vague explanations |

Typical cases include clients reporting delays in processing withdrawals, with some stating that their requests were met with vague responses from customer service. Such complaints highlight the importance of responsive support and efficient fund management, which are critical for maintaining trust in a trading environment.

Platform and Trade Execution

The performance of the trading platform is another critical factor in assessing a broker. INF utilizes the MT4 platform, which is widely regarded for its reliability and advanced features. However, user experiences vary, with some traders reporting issues such as slippage and execution delays.

Order execution quality is essential for traders, especially in a fast-moving market. Any signs of manipulation or significant delays in order execution could indicate underlying issues with the broker's operations. A thorough evaluation of the platform's performance, including its stability and user experience, is necessary for potential clients.

Risk Assessment

Using INF as a broker presents several risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by ASIC, but concerns exist |

| Fund Safety | High | Reports of withdrawal issues |

| Transparency | High | Limited information available |

| Customer Support | Medium | Mixed feedback on response times |

Traders should consider implementing risk mitigation strategies, such as setting limits on their investments and conducting regular reviews of their trading activities. Engaging with well-established and regulated brokers may also provide a safer trading environment.

Conclusion and Recommendations

In conclusion, while INF is regulated by ASIC, the broker's overall transparency, customer service, and historical compliance issues raise significant concerns. The mixed customer feedback and reports of withdrawal difficulties suggest that traders should exercise caution.

For those considering trading with INF, it is essential to remain vigilant and conduct thorough research. If you are a beginner or risk-averse trader, it may be advisable to explore alternative brokers with a stronger reputation for customer service and transparency. Trusted options include brokers with a well-established regulatory history and positive user reviews. Always prioritize safety and transparency when choosing a trading partner.

Is INF a scam, or is it legit?

The latest exposure and evaluation content of INF brokers.

INF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INF latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.