Taishin Securities 2025 Review: Everything You Need to Know

Executive Summary

This taishin securities review gives you a complete look at Taishin Securities. The company is a subsidiary of Taishin Financial Holding Co. based in Taiwan. As a financial services provider, it offers investment advice, brokerage services, and other financial solutions to help people with their money needs. Taishin Securities works within Taiwan's financial market. The company has electronic trading platforms and runs different types of financial services.

Our review shows big gaps in important information about rules, trading details, and what users really think. The company is part of a larger financial group, which sounds good. But we don't have enough details about costs, fees, minimum deposits, and who watches over the company, making it hard for investors who want clear information. This review stays neutral because we don't have enough solid facts about trading terms. The company's connection to Taishin Financial Holding does suggest it has backing from a bigger institution and offers different services.

Important Notice

This review uses limited information about how Taishin Securities works and what services it offers. People thinking about investing should know that we couldn't find complete information about regulations, trading conditions, and detailed services in sources we could access. Our review method uses publicly available data, which might not show the complete picture of what the broker currently offers and its regulatory status.

Different regions might have different rules and services, but we don't have details about these differences in the materials we found. Future clients should strongly consider checking on their own about regulatory status, trading conditions, and what services are available before working with any financial services provider.

Rating Framework

Broker Overview

Taishin Securities works as a subsidiary of Taishin Financial Holding Co. It operates in Taiwan's financial services sector. The company's business includes investment advice, brokerage work, and other financial services. Being part of a larger financial holding company gives Taishin Securities institutional backing and access to different types of financial expertise across multiple service areas.

The broker uses electronic trading platforms, but we don't have specific details about what types of platforms they use, what assets they support, or what trading technologies they offer. The company works within the broader Taishin Financial system, which suggests it might have access to complete financial services, including insurance and investment management through other companies in the holding structure.

Based on what we know, Taishin Securities runs its main operations within Taiwan's regulatory environment. However, we don't have detailed information about specific regulatory permissions and compliance rules in sources we can access. The company seems to focus on giving integrated financial services to clients who want complete investment and advisory solutions within Taiwan's market.

Regulatory Jurisdiction: We don't have detailed regulatory information in available sources, but the company operates within Taiwan's financial regulatory system as part of Taishin Financial Holding Co.

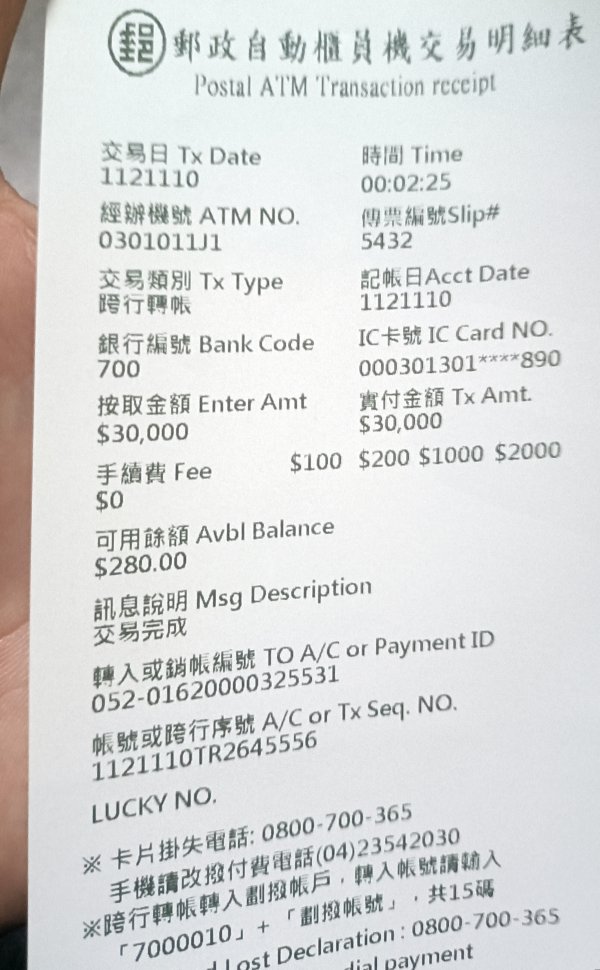

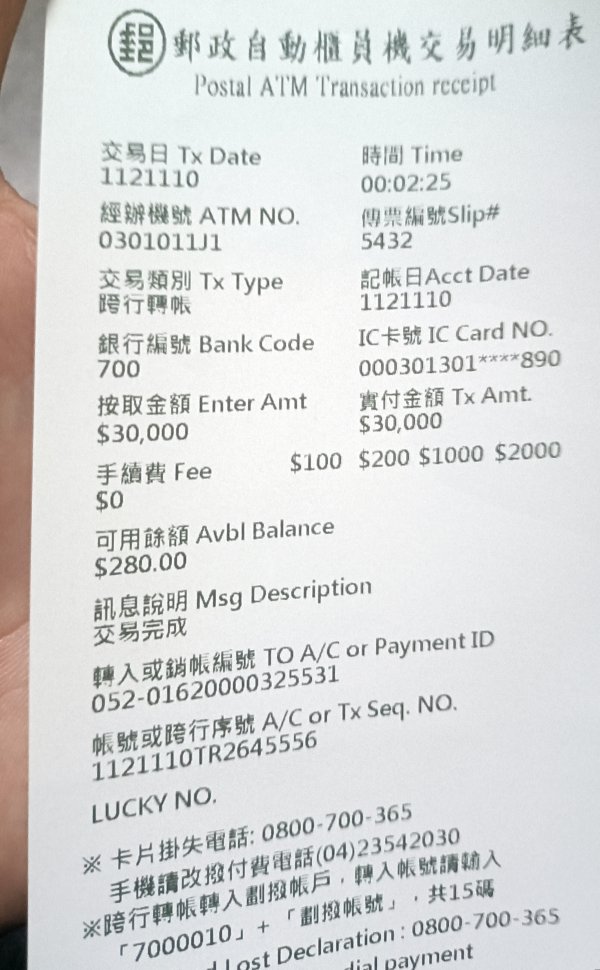

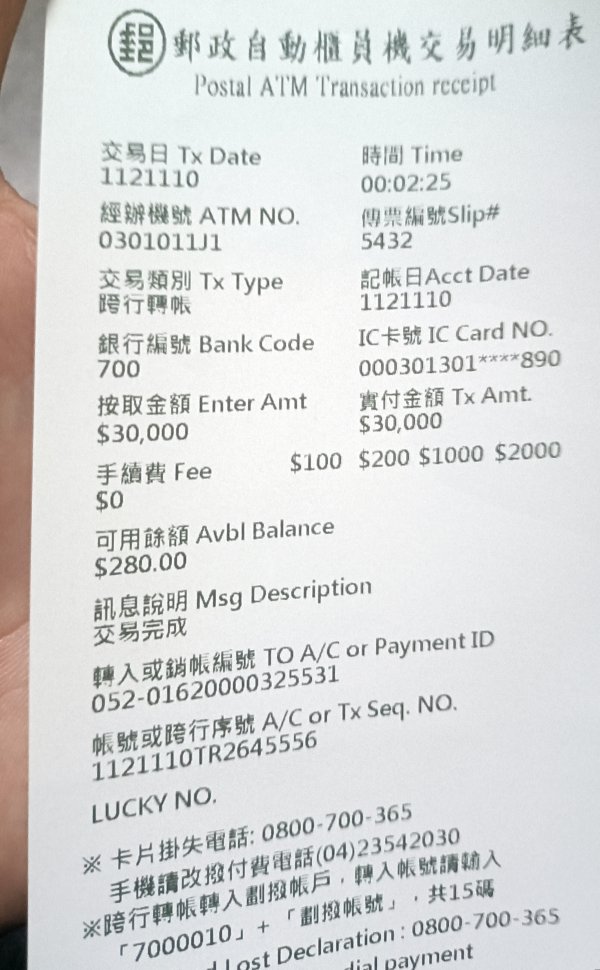

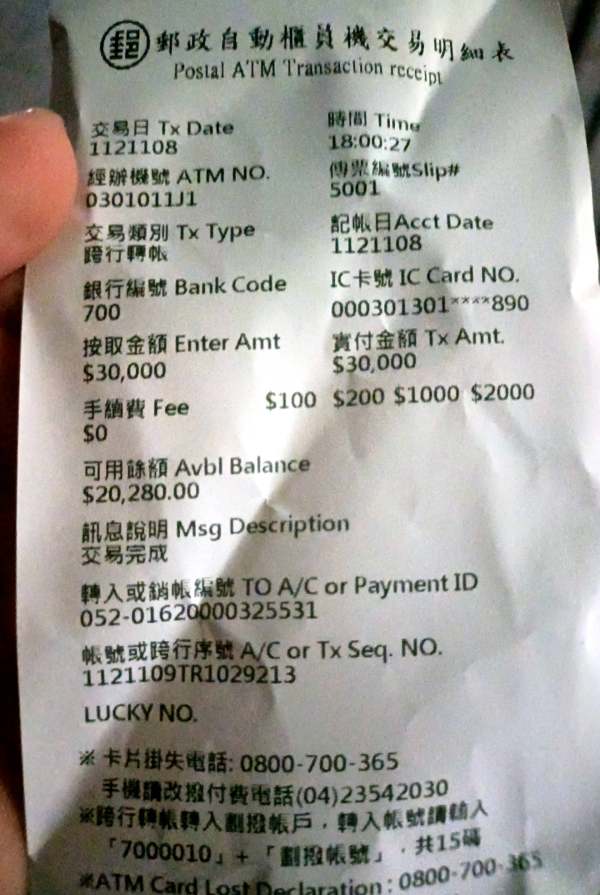

Deposit and Withdrawal Methods: We couldn't find information about supported payment methods, processing times, and fees in accessible documentation.

Minimum Deposit Requirements: Available materials don't provide specific minimum deposit amounts for different account types.

Bonus and Promotions: Accessible sources don't mention details about promotional offers, welcome bonuses, or ongoing incentive programs.

Tradeable Assets: Available information doesn't specify the range of financial instruments, including forex pairs, commodities, indices, or other asset classes.

Cost Structure: Accessible documentation doesn't detail comprehensive information about spreads, commissions, overnight fees, and other trading costs, which creates a significant transparency gap for this taishin securities review.

Leverage Ratios: Available sources don't specify maximum leverage offerings and margin requirements.

Platform Options: The company provides electronic trading platforms, but specific platform names, features, and technological capabilities aren't detailed.

Regional Restrictions: Accessible materials don't have information about geographical limitations or restricted jurisdictions.

Customer Support Languages: Available documentation doesn't specify supported languages for customer service.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions review for Taishin Securities faces big limitations because we don't have enough information about account types, requirements, and features. We can't assess how competitive and accessible the broker's account offerings are without specific details about minimum deposit requirements, account levels, or special features.

Not having clear information about account opening procedures, verification requirements, and how long things take creates uncertainty for potential clients. Also, we don't have details about account maintenance fees, inactivity charges, or other account-related costs, which prevents us from fully evaluating the overall account value.

The company's connection to Taishin Financial Holding suggests institutional structure and potential account security. However, the lack of transparent information about specific account conditions limits our ability to make informed comparisons with industry standards. The average rating reflects this information gap rather than any specific problems with actual account offerings.

This taishin securities review notes that prospective clients would benefit from contacting the broker directly to get detailed account information. Publicly available sources don't provide enough clarity about account structures and requirements.

Taishin Securities' tools and resources evaluation benefits from the company providing electronic trading platforms. This suggests some level of technological infrastructure for client trading activities. The broker's integration within the Taishin Financial system potentially provides access to broader research capabilities and analytical resources through the holding company structure.

However, we don't have specific details about trading tools, charting capabilities, technical analysis features, and automated trading support in available documentation. Not having information about educational resources, market research provision, or analytical tools limits our comprehensive assessment of the broker's resource offerings.

The slightly above-average rating acknowledges the electronic platform provision and potential access to institutional research capabilities through the parent company structure. It also recognizes the significant information gaps regarding specific tool offerings and resource quality.

Clients seeking advanced trading tools and comprehensive market analysis may need to ask directly about available resources and their specific functions. We don't have detailed information about platform features, third-party tool integration, or proprietary research capabilities.

Customer Service and Support Analysis (5/10)

The customer service evaluation for Taishin Securities encounters substantial information limitations regarding support channels, availability, and service quality metrics. It becomes difficult to assess the broker's commitment to client service excellence without specific details about customer support hours, available communication methods, or response time standards.

Not having information about multilingual support capabilities, dedicated account management, or specialized support for different client segments creates uncertainty about service accessibility and quality. Also, the lack of available user feedback regarding support experiences prevents validation of service effectiveness and client satisfaction levels.

The institutional backing from Taishin Financial Holding suggests potential for structured customer service operations. However, the lack of transparent information about support procedures and service standards limits confidence in service quality assessment. The average rating reflects this information uncertainty rather than any confirmed service problems.

Prospective clients would benefit from directly evaluating customer service responsiveness and quality through initial contact before committing to account opening. We have limited publicly available information about support capabilities and service standards.

Trading Experience Analysis (5/10)

The trading experience assessment for Taishin Securities faces significant challenges due to limited available information about platform performance, execution quality, and user interface design. The company provides electronic trading platforms, but specific details about platform stability, execution speeds, and order processing capabilities remain unclear.

It becomes difficult to evaluate the overall trading environment quality without comprehensive user feedback about trading conditions, platform functionality, or mobile trading capabilities. Not having information about slippage rates, execution policies, or platform downtime statistics prevents thorough assessment of trading reliability and performance.

The average rating acknowledges the electronic platform provision while recognizing substantial information gaps regarding actual trading experience quality. This taishin securities review notes that platform performance and trading conditions represent critical factors for trader satisfaction that require further investigation.

Potential clients seeking reliable trading environments would benefit from platform demonstration or trial access to evaluate execution quality, interface usability, and overall trading experience before making commitment decisions. We have limited available performance data.

Trust and Reliability Analysis (4/10)

The trust and reliability evaluation presents significant concerns due to the absence of specific regulatory information and transparency limitations regarding compliance frameworks. Taishin Securities operates as part of Taishin Financial Holding Co., but the lack of detailed regulatory authorization information creates uncertainty about oversight and client protection measures.

It becomes challenging to assess the broker's commitment to client protection and regulatory adherence without specific information about regulatory compliance, client fund segregation, or dispute resolution procedures. Not having detailed information about insurance coverage, compensation schemes, or regulatory reporting creates additional transparency concerns.

The below-average rating reflects these information gaps and the importance of regulatory clarity for broker trust assessment. The institutional backing suggests some level of corporate structure and potential oversight, but the lack of specific regulatory details limits confidence in comprehensive client protection measures.

This evaluation emphasizes the critical importance of regulatory verification and transparency for broker selection. Fund security and dispute resolution capabilities are particularly significant in financial services relationships.

User Experience Analysis (5/10)

The user experience evaluation encounters substantial limitations due to insufficient available user feedback and interface information. It becomes difficult to assess the overall client experience quality comprehensively without specific details about platform design, navigation ease, or user satisfaction metrics.

Not having detailed information about registration processes, account verification procedures, or fund management experiences prevents thorough evaluation of user journey quality. Also, the lack of specific user testimonials or experience reports limits understanding of actual client satisfaction levels and common user concerns.

The electronic platform provision suggests some attention to user interface development. However, the lack of specific usability information and user feedback prevents confident assessment of experience quality. The average rating reflects this information limitation rather than confirmed user experience problems.

Prospective users would benefit from direct platform evaluation and user experience assessment through demo access or initial account setup to determine interface suitability and overall user experience quality. We have limited available user experience documentation.

Conclusion

This comprehensive taishin securities review reveals a broker operating within Taiwan's financial services sector as part of the Taishin Financial Holding structure, but with significant information transparency limitations. The institutional backing suggests some level of corporate stability and potential service diversification, but the absence of detailed regulatory information, trading conditions, and comprehensive user feedback creates substantial evaluation challenges.

The broker may be suitable for investors seeking integrated financial services within Taiwan's market context and those comfortable with conducting detailed research before engagement. However, the lack of transparent information about trading costs, regulatory oversight, and service quality metrics requires careful consideration and direct verification before account opening.

The primary advantages include institutional backing and business diversification potential. The main disadvantages center on information transparency limitations and unclear regulatory positioning, emphasizing the importance of comprehensive independent verification for prospective clients.