SquaredFinancial 2025 Review: Everything You Need to Know

Executive Summary

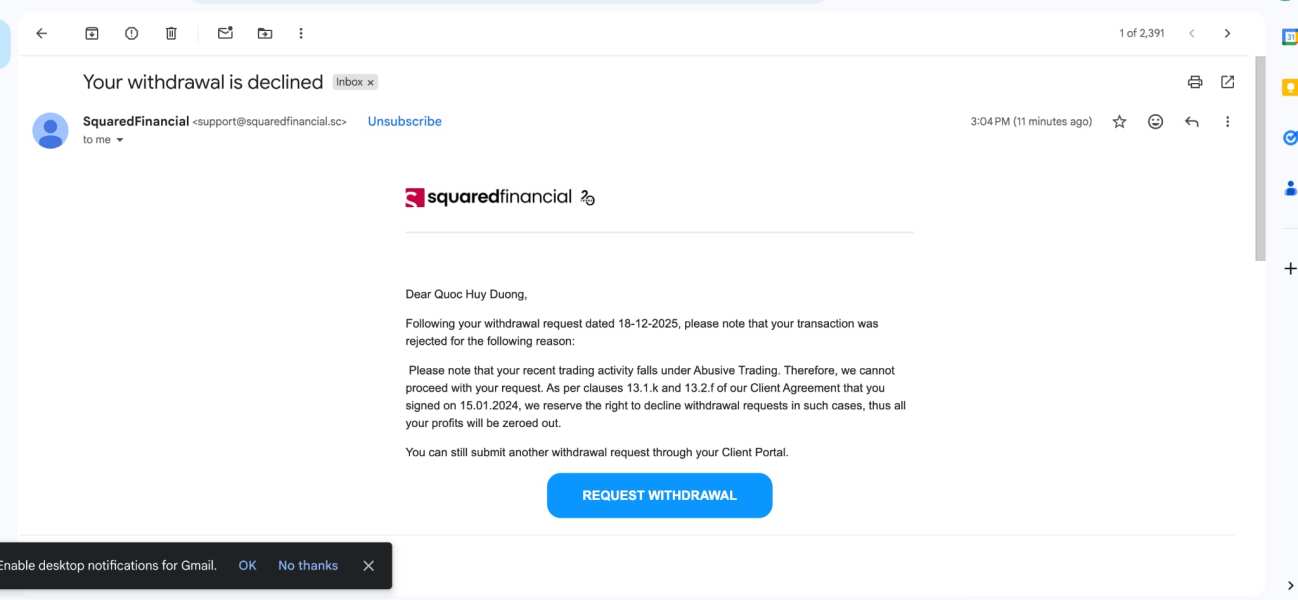

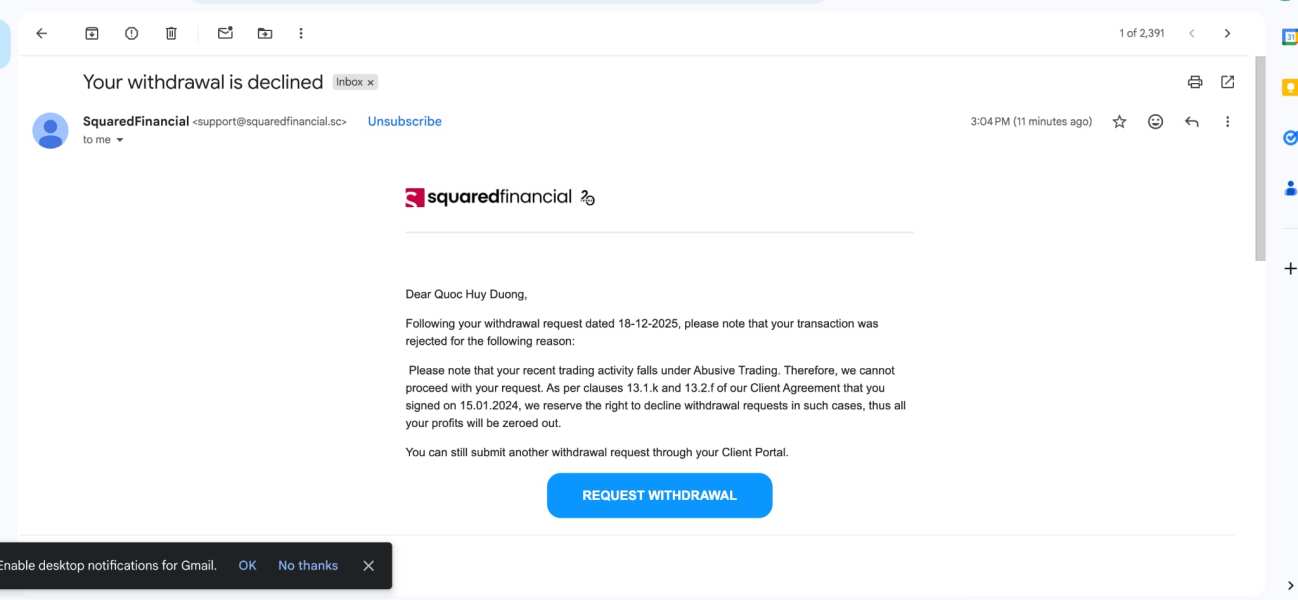

SquaredFinancial is a regulated online trading broker. It has caught attention in the competitive forex and CFD trading world, making its mark through consistent service delivery and regulatory compliance. Market data shows this squaredfinancial review reveals a broker with a mixed but mostly positive reputation among retail traders. The platform earned a user rating of 3.6 out of 5 based on 137 customer reviews. About 66% of reviewers recommend the service to other traders.

The broker stands out through several key features. These include attractive first deposit bonuses and professional customer support that has earned client satisfaction across multiple service areas. SquaredFinancial operates under CySEC (Cyprus Securities and Exchange Commission) regulation. This provides traders with essential regulatory protections and compliance standards expected in the European trading environment.

The platform targets retail investors seeking exposure to forex and CFD markets. It offers a range of trading instruments suitable for both novice and experienced traders, creating opportunities for diverse trading strategies. While the broker shows solid fundamentals in regulatory compliance and customer service quality, some aspects need more transparent disclosure. This particularly applies to fee structures and detailed account specifications.

Based on comprehensive analysis of user feedback and market positioning, SquaredFinancial works well for traders prioritizing regulatory safety and responsive customer support. However, potential clients should carefully evaluate the complete cost structure before committing to the platform.

Important Disclaimers

This comprehensive squaredfinancial review uses publicly available information, user feedback, and market analysis current as of 2025. Readers should note that regulatory requirements and trading conditions may vary significantly depending on the client's jurisdiction. The specific SquaredFinancial entity serving their region may also affect these conditions.

As a CySEC-regulated entity, SquaredFinancial must comply with European securities regulations. This may result in different product offerings, leverage limits, and client protections compared to brokers operating under alternative regulatory frameworks. The evaluation methodology employed in this review combines user testimonials, regulatory disclosures, and industry-standard assessment criteria. This approach provides a balanced perspective on the broker's services.

Prospective traders should verify current terms, conditions, and regulatory status directly with SquaredFinancial before making trading decisions. Market conditions and regulatory requirements continue to evolve rapidly in the online trading sector.

Rating Framework

Broker Overview

SquaredFinancial has built itself as a regulated online trading broker specializing in forex and CFD trading services. The company serves both retail and institutional clients with dedication to quality service. While specific founding details are not extensively documented in available sources, the broker has built a presence in the competitive online trading market. This success comes through its commitment to regulatory compliance and customer-focused service delivery.

The company operates primarily as an online trading platform. It provides clients with access to global financial markets through web-based and potentially mobile trading interfaces, ensuring flexibility for different trading styles. SquaredFinancial's business model centers on facilitating client trading activities across major currency pairs, commodities, indices, and other CFD instruments. The company generates revenue through spreads and potentially commission structures.

Operating under CySEC regulation provides SquaredFinancial with credibility and legal framework necessary to serve European clients. This regulatory status ensures adherence to client fund segregation requirements, fair trading practices, and dispute resolution mechanisms that protect trader interests. The broker's regulatory compliance demonstrates commitment to maintaining high operational standards.

The platform targets diverse clientele ranging from beginning traders to experienced professionals. Beginning traders are attracted by educational resources and first deposit bonuses, while experienced traders seek reliable execution and professional customer support. This squaredfinancial review indicates that the broker has successfully built a reputation for trustworthiness and service quality. However, some operational aspects could benefit from enhanced transparency and feature development.

Regulatory Jurisdiction: SquaredFinancial operates under CySEC (Cyprus Securities and Exchange Commission) regulatory oversight. This ensures compliance with European financial services regulations and provides clients with established investor protection frameworks.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in current available sources. Clients should verify complete payment processing options directly with the broker.

Minimum Deposit Requirements: The exact minimum deposit threshold for opening trading accounts with SquaredFinancial is not specified in available documentation. Potential clients should confirm this information directly with the broker.

Bonus and Promotional Offers: The broker provides first deposit bonuses designed to attract new clients and enhance initial trading capital. Specific terms and conditions require direct verification with the company.

Available Trading Assets: SquaredFinancial offers access to forex currency pairs and CFDs across multiple asset classes. This provides traders with diversification opportunities suitable for various trading strategies and risk appetites.

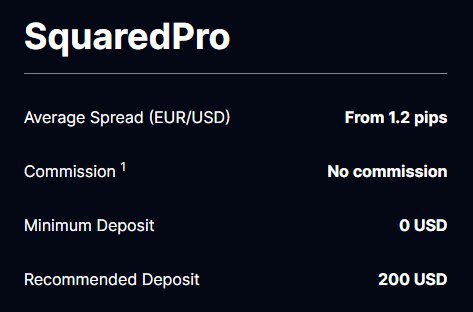

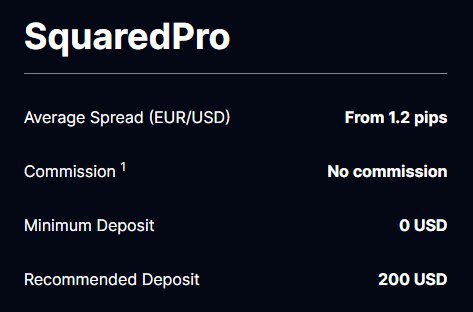

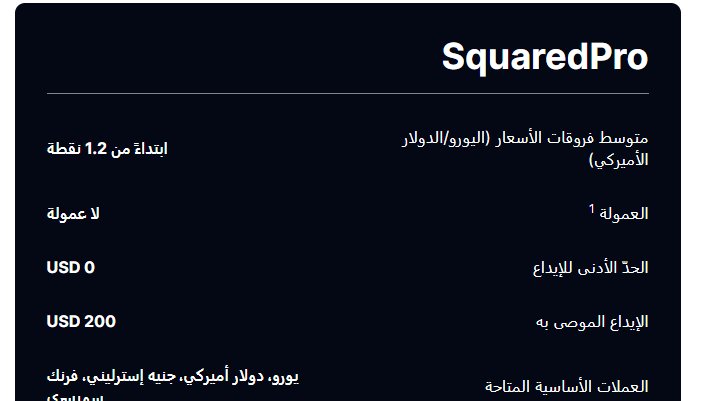

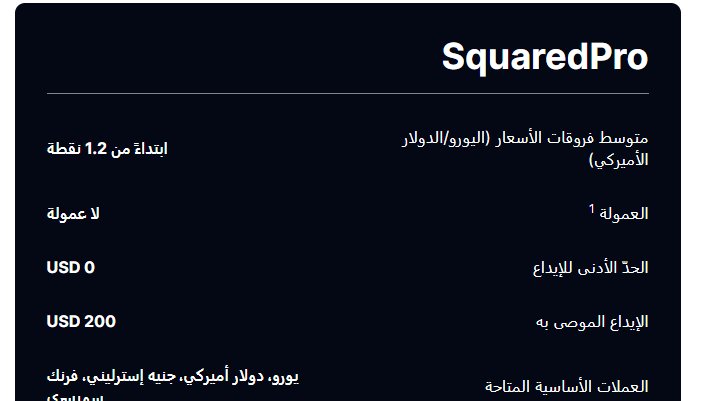

Cost Structure: Detailed information about spreads, commissions, and additional fees is not comprehensively available in current sources. Traders should make direct inquiry for complete cost transparency before opening accounts.

Leverage Ratios: Specific leverage offerings are not detailed in available materials. As a CySEC-regulated entity, the broker must comply with European leverage restrictions for retail clients.

Trading Platform Options: While the broker provides trading platform access, specific platform types and technological specifications are not detailed in current squaredfinancial review materials. Interested traders should request detailed platform information directly from the broker.

Geographic Restrictions: Information about geographic trading restrictions and prohibited jurisdictions is not specified in available sources. Potential clients should verify their eligibility based on location.

Customer Service Languages: The range of languages supported by SquaredFinancial's customer service team is not detailed in current documentation. Multilingual support availability should be confirmed directly with the broker.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 6/10)

SquaredFinancial's account conditions present a mixed picture for potential traders. Several areas require greater transparency and detail to meet modern client expectations. The broker's approach to account structuring appears standard for the industry. However, specific information about account types, minimum deposits, and tier-based benefits remains insufficiently documented in publicly available sources.

The absence of clearly published minimum deposit requirements creates uncertainty for prospective clients. This makes it difficult for traders to evaluate the accessibility of the platform effectively. This lack of transparency contrasts with industry best practices where leading brokers provide comprehensive account specification details upfront. While the broker offers first deposit bonuses, the specific terms, conditions, and eligibility criteria require direct verification. This potentially complicates the decision-making process for new traders.

Account opening procedures and verification requirements are not extensively detailed in available materials. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process for new clients. The lack of information about Islamic accounts or other specialized account features may limit the broker's appeal. Traders with specific religious or trading requirements may find this particularly concerning.

Despite these transparency challenges, SquaredFinancial's CySEC regulation provides assurance that account conditions must meet European regulatory standards. This includes client fund segregation and fair treatment protocols that protect trader interests. This squaredfinancial review suggests that while the fundamental account structure likely meets regulatory requirements, enhanced disclosure would significantly improve client confidence. Better transparency would also enhance decision-making capabilities for potential clients.

SquaredFinancial shows solid capabilities in providing essential trading tools and resources. However, the scope and sophistication of these offerings require more detailed evaluation to fully assess their competitive position. The broker's focus on forex and CFD trading instruments suggests a comprehensive approach to major market segments. This provides traders with access to currency pairs, commodities, indices, and other derivative products suitable for diverse trading strategies.

The platform appears to offer standard trading functionality expected in modern online brokers. However, specific details about advanced charting capabilities, technical analysis tools, and automated trading support are not extensively documented in available sources. This limitation makes it challenging to assess how SquaredFinancial's technological offerings compare to industry leaders. The comparison becomes particularly difficult in terms of innovation and user experience.

Educational resources and market analysis materials are not specifically detailed in current information. This represents a potential area for improvement given the importance of trader education in building long-term client relationships. Many successful brokers differentiate themselves through comprehensive educational programs, daily market analysis, and trading webinars. These resources support client development and engagement significantly.

Research capabilities and third-party integrations are not clearly specified in available documentation. However, the broker's regulatory standing suggests access to essential market data and execution infrastructure necessary for effective trading. The absence of detailed information about mobile trading capabilities and cross-platform synchronization may concern traders. Those who prioritize flexibility and accessibility in their trading activities may find this particularly limiting.

Customer Service and Support Analysis (Score: 8/10)

Customer service represents one of SquaredFinancial's strongest performance areas. User feedback consistently highlights the professionalism and effectiveness of the support team across various service interactions. According to available user testimonials, clients express satisfaction with the quality of assistance received. This suggests that the broker has invested appropriately in building capable customer service infrastructure.

The emphasis on professional customer support appears to be a key differentiator for SquaredFinancial. Clients note positive experiences in their interactions with support representatives, creating a competitive advantage in service quality. This focus on service quality contributes significantly to the broker's overall trust rating and client retention capabilities. It demonstrates understanding of the importance of responsive customer care in the competitive online trading environment.

However, specific details about customer service channels, availability hours, and response time metrics are not comprehensively documented in available sources. The absence of information regarding live chat availability, phone support options, and email response timeframes makes it difficult for potential clients. They cannot set appropriate expectations for support accessibility and response quality.

Multilingual support capabilities are not detailed in current materials. This could be relevant for international clients seeking assistance in their native languages for complex trading issues. Additionally, information about specialized support for different account types or trading issues is not specified. However, the generally positive user feedback suggests adequate coverage of common client needs and concerns.

Trading Experience Analysis (Score: 6/10)

The trading experience offered by SquaredFinancial appears to meet basic industry standards. However, specific details about platform performance, execution quality, and user interface design are not extensively documented in available sources. This lack of detailed information makes it challenging to provide a comprehensive assessment of the actual trading environment. It also limits evaluation of suitability for different trader profiles.

Platform stability and execution speed are critical factors for trading success. Yet current available information does not provide specific performance metrics or user feedback regarding these essential technical aspects. The absence of detailed execution statistics, slippage data, or platform uptime information limits the ability to evaluate SquaredFinancial's technological infrastructure. Comparison against industry benchmarks becomes particularly difficult without this data.

Order execution quality and pricing transparency are fundamental concerns for serious traders. However, specific information about execution methods, price feeds, and potential conflicts of interest is not readily available in current sources. This transparency gap may concern experienced traders who prioritize understanding the complete trading environment. They typically want comprehensive information before committing capital to any platform.

Mobile trading capabilities and cross-device functionality are increasingly important in modern trading environments. Yet specific details about SquaredFinancial's mobile offerings are not documented in available materials. The lack of information about platform customization options, advanced order types, and automated trading support may limit the platform's appeal. Sophisticated traders requiring advanced functionality may find these limitations particularly concerning.

This squaredfinancial review indicates that while the basic trading infrastructure appears functional, enhanced transparency about technical capabilities would significantly improve trader confidence. Better disclosure of performance metrics would also improve platform evaluation processes for potential clients.

Trust and Safety Analysis (Score: 9/10)

SquaredFinancial demonstrates strong credentials in trust and safety. These are primarily anchored by its CySEC regulatory status which provides essential investor protections and operational oversight for client security. The Cyprus Securities and Exchange Commission maintains rigorous standards for licensed brokers. This includes capital adequacy requirements, client fund segregation protocols, and regular compliance monitoring that significantly enhance trader security.

The broker's regulatory standing ensures adherence to European financial services directives. This includes MiFID II compliance requirements that mandate fair treatment of clients, appropriate product suitability assessments, and transparent fee disclosure. These regulatory protections provide substantial safeguards for client interests and establish clear dispute resolution mechanisms. Clients can access these mechanisms through established regulatory channels when needed.

Client fund protection measures inherent in CySEC regulation include mandatory segregation of client deposits from operational funds. This ensures that trader capital remains protected even in adverse circumstances affecting the broker's business operations. This regulatory framework provides confidence that SquaredFinancial operates within established legal boundaries and maintains appropriate financial safeguards.

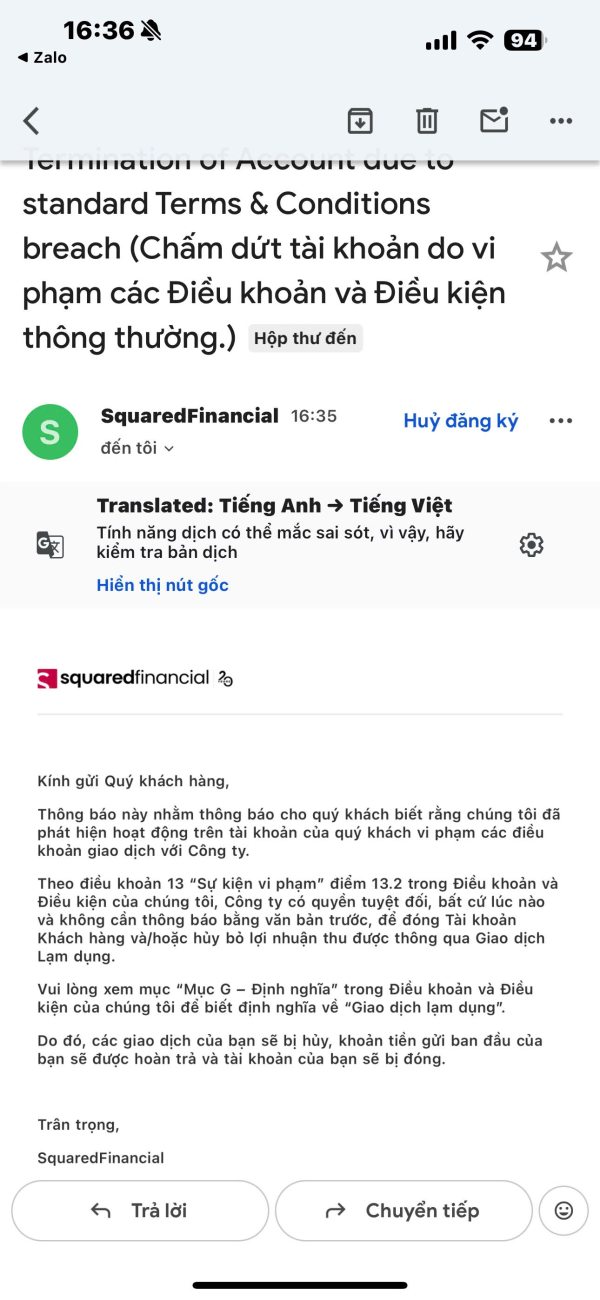

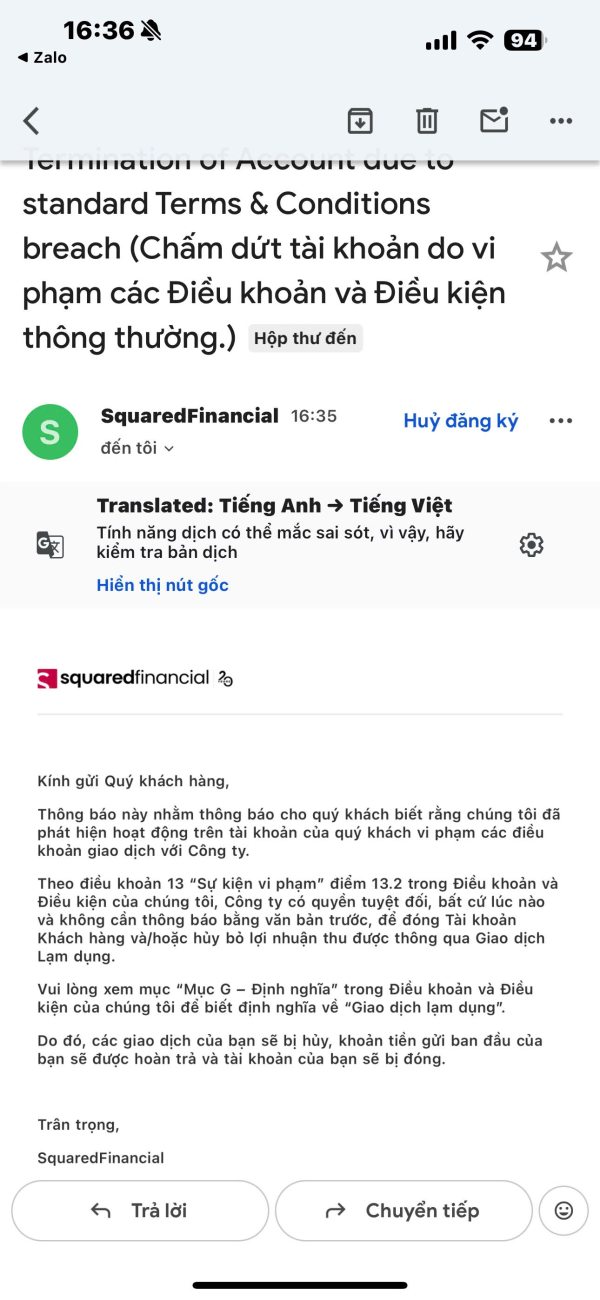

While specific information about additional security measures is not detailed in available sources, the regulatory framework provides fundamental protections that meet European standards. These measures include encryption protocols, two-factor authentication, and cyber security certifications that protect client data and transactions. The absence of documented negative regulatory events or significant client disputes suggests a clean operational record. This supports the broker's trustworthiness credentials in the competitive trading market.

User Experience Analysis (Score: 6/10)

User experience evaluation reveals moderate satisfaction levels among SquaredFinancial clients. This is reflected in the 3.6 out of 5 user rating based on 137 reviews from actual platform users. The 66% recommendation rate indicates that while many clients find value in the broker's services, substantial room remains for improvement. Overall user satisfaction and platform optimization could benefit from focused enhancement efforts.

The moderate user ratings suggest that SquaredFinancial meets basic expectations for online trading services. However, the platform may lack sophisticated features and seamless user experience that characterize leading industry competitors. This performance gap represents an opportunity for enhancement in areas such as platform design, functionality integration, and overall service delivery optimization.

Account registration and verification processes are not specifically detailed in available sources. This makes it difficult to assess the efficiency and user-friendliness of the onboarding experience for new clients. Streamlined account opening procedures and clear verification requirements are essential components of positive user experience. These factors influence initial client impressions and long-term satisfaction significantly.

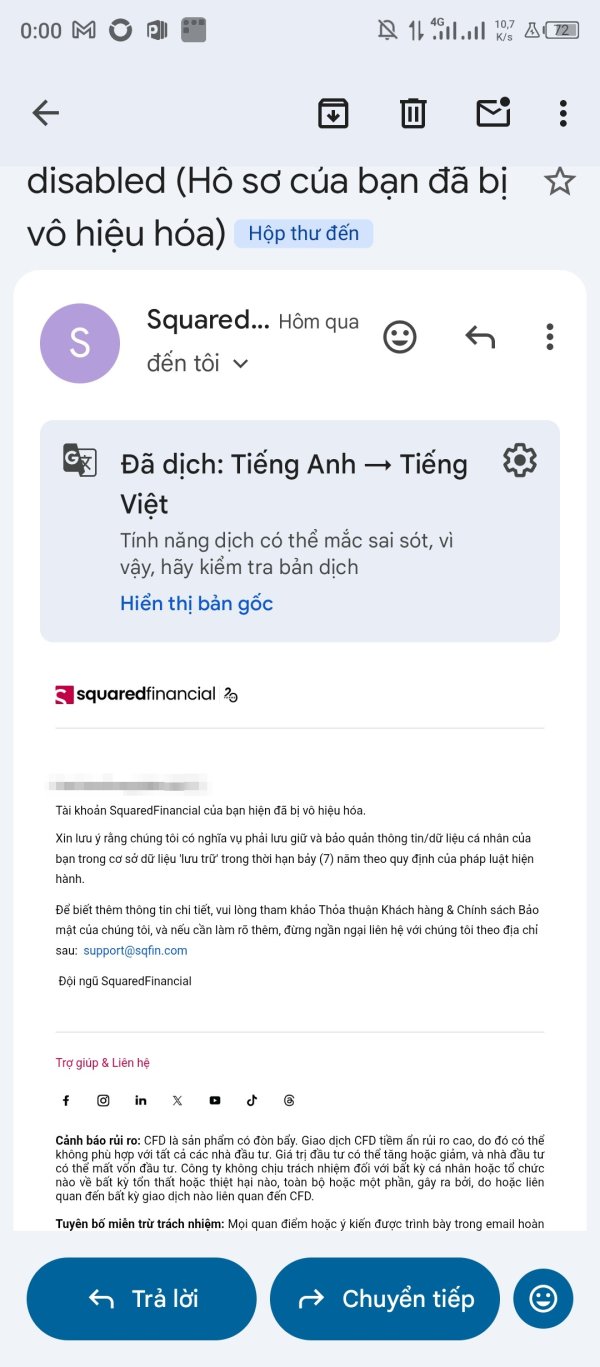

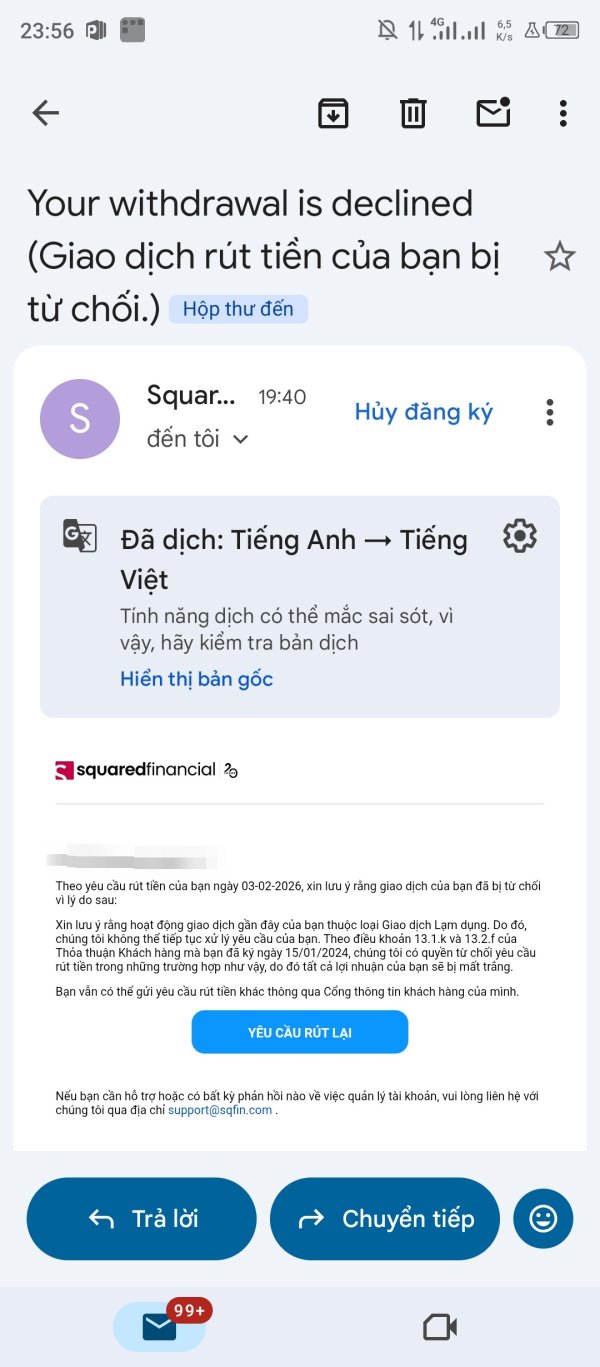

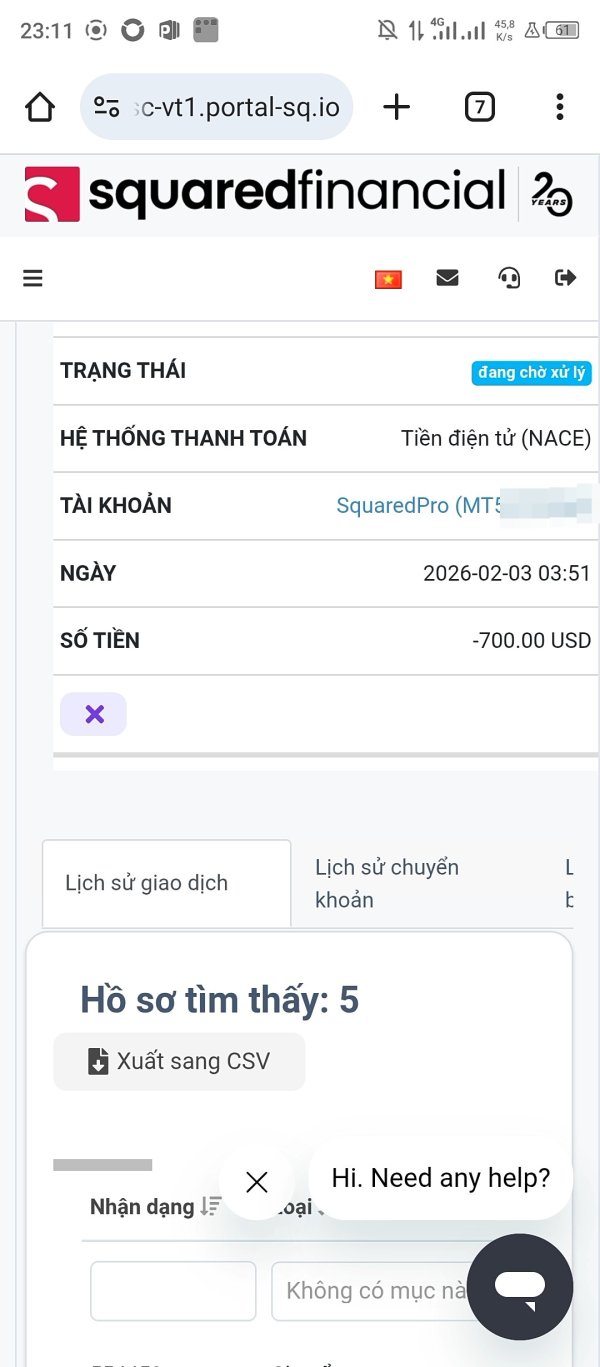

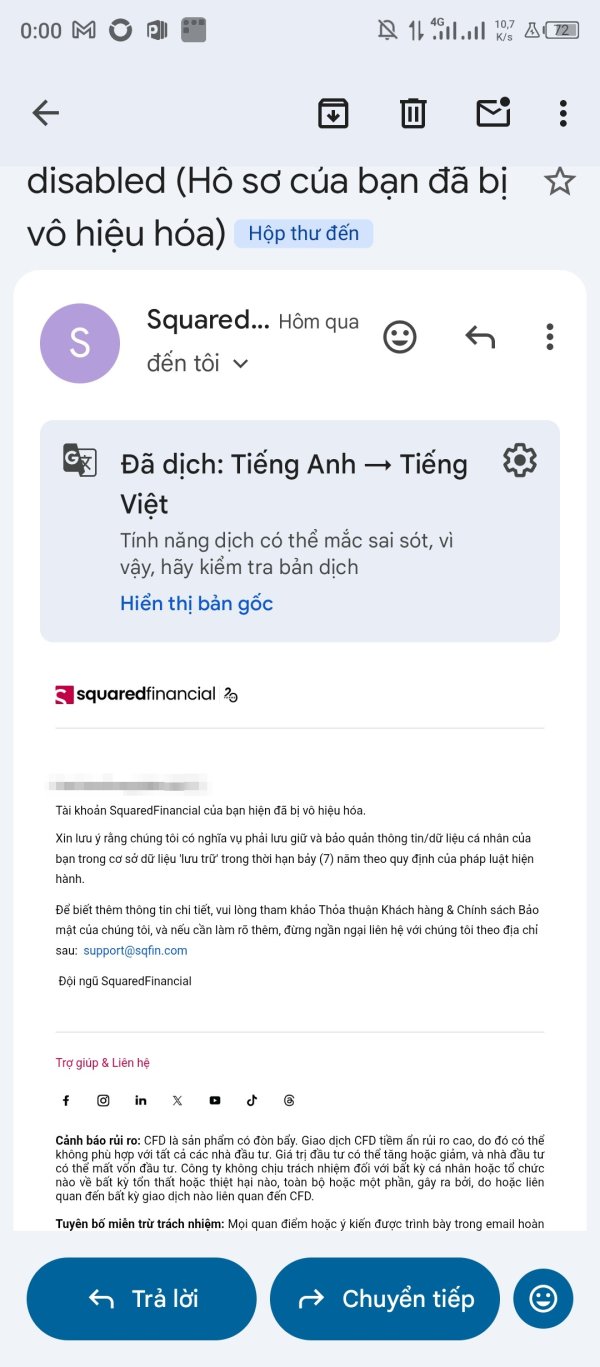

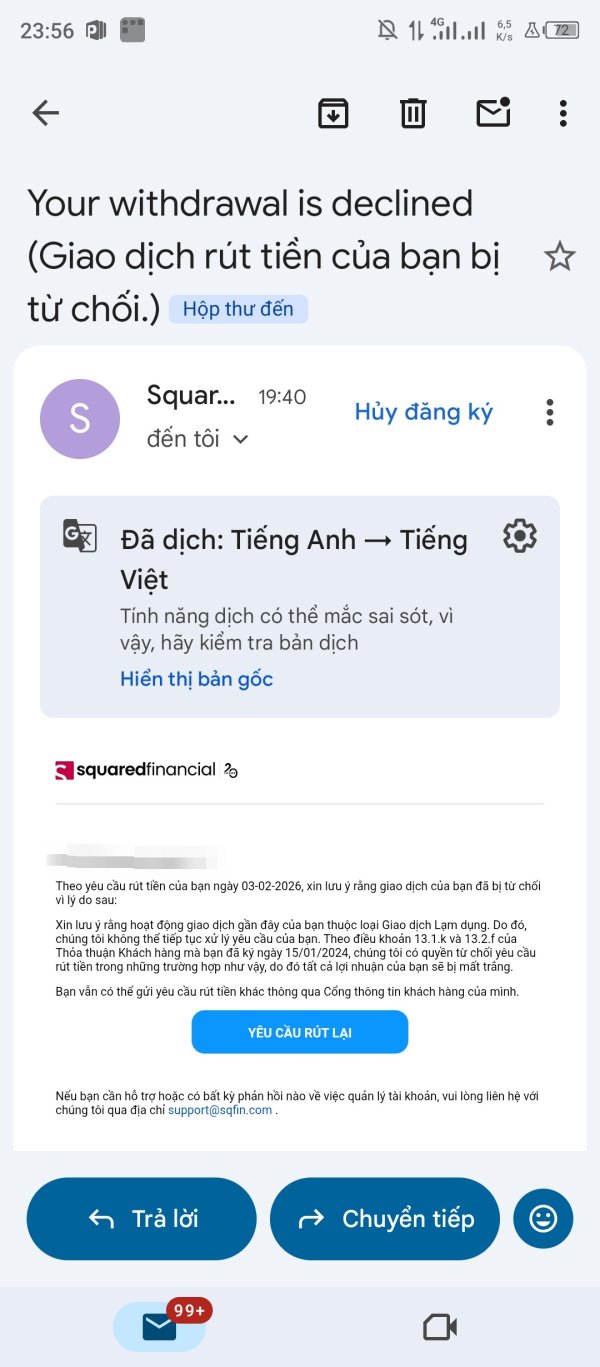

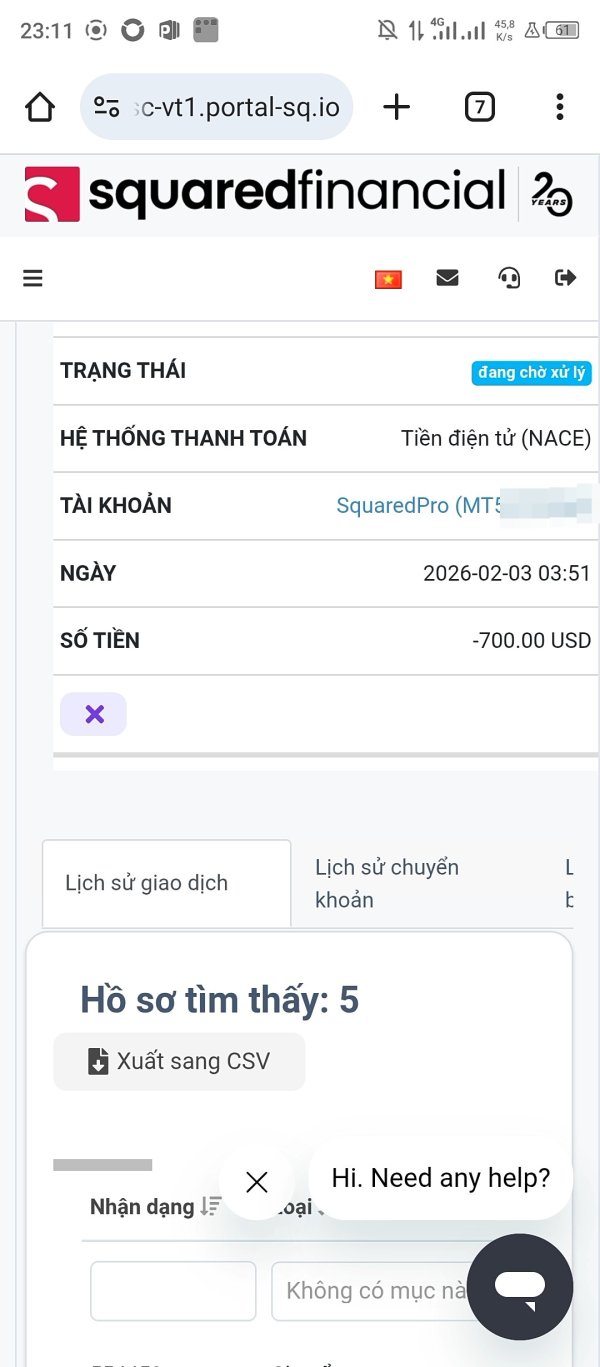

Fund management processes, including deposit and withdrawal experiences, are not comprehensively documented in current materials. However, these operational aspects significantly impact overall user satisfaction and platform usability. Efficient payment processing, clear fee disclosure, and responsive transaction support are critical elements. These factors influence client retention and recommendation rates substantially.

The mixed user feedback suggests that SquaredFinancial provides functional trading services with particular strength in customer support quality. However, comprehensive platform improvements and enhanced feature development could significantly improve overall client satisfaction. These enhancements would also strengthen competitive positioning in the dynamic online trading market.

Conclusion

This comprehensive squaredfinancial review reveals a regulated online broker that shows solid fundamentals in regulatory compliance and customer service quality. The platform also presents opportunities for improvement in transparency and platform development areas. SquaredFinancial's CySEC regulation provides essential investor protections and operational credibility. This forms a strong foundation for client trust and confidence in the trading environment.

The broker appears well-suited for traders who prioritize regulatory safety, responsive customer support, and access to standard forex and CFD trading instruments. The positive user feedback regarding customer service professionalism and attractive first deposit bonus offerings create value propositions. These may appeal to both novice and experienced traders seeking reliable trading partners.

However, limited transparency regarding fee structures, account specifications, and detailed platform capabilities represents areas requiring improvement. These enhancements are necessary to meet evolving client expectations and industry standards for broker transparency. Potential clients should conduct thorough due diligence regarding costs, platform functionality, and specific trading conditions. This research should be completed before committing to the platform.

Overall, SquaredFinancial presents a legitimate and regulated trading option with particular strengths in trust and customer service. However, enhanced transparency and platform development could significantly improve its competitive positioning and client satisfaction levels. These improvements would be valuable in the dynamic online trading market.