Is JM FINANCIAL safe?

Pros

Cons

Is JM Safe or a Scam?

Introduction

In the ever-evolving world of forex trading, JM has emerged as a broker that attracts attention with its promises of high leverage and diverse trading options. However, the question remains: is JM safe or a scam? As traders navigate a landscape filled with both legitimate and fraudulent brokers, it is crucial to conduct thorough evaluations before committing funds. This article aims to provide an in-depth analysis of JM, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our investigation is based on a comprehensive review of various credible sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing any forex broker's legitimacy. A broker's adherence to regulatory standards ensures a level of protection for traders, safeguarding their investments against potential fraud. In the case of JM, it has been found lacking in this regard.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

JM operates without oversight from any recognized financial authority, which raises significant concerns about its operational integrity and the safety of client funds. The absence of regulation means that there are no legal protections in place for investors, making it a risky option for traders. Furthermore, regulatory bodies have warned against engaging with brokers that lack proper licenses, as this often indicates potential fraudulent activity. The lack of a robust regulatory framework surrounding JM suggests that traders should exercise caution and consider safer alternatives.

Company Background Investigation

Understanding the company behind a broker is essential in evaluating its reliability. JM claims to operate under the auspices of JM Financial Services Co., which allegedly has ties to the Ministry of Commerce in Kuwait. However, the Central Bank of Kuwait has clarified that it does not regulate forex trading, leaving JM effectively unregulated.

The ownership structure of JM remains opaque, with little information available about its management team or their professional backgrounds. This lack of transparency can be a red flag, as reputable brokers typically provide detailed information about their leadership and operational history. The absence of such disclosures raises questions about the broker's accountability and trustworthiness.

Moreover, the company's website does not provide adequate information about its history or performance, which further complicates the assessment of its legitimacy. Overall, the lack of transparency and regulatory oversight surrounding JM creates a highly questionable environment for potential investors, leading many to conclude that JM is not safe.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. JM offers various trading instruments, including forex pairs and precious metals, with a minimum deposit requirement of $250. However, the trading costs associated with JM raise concerns.

| Fee Type | JM | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable (not disclosed) | 0.1 - 1.0 pips |

| Commission Model | None (claims to be commission-free) | Varies widely |

| Overnight Interest Range | Not specified | 0.5% - 3% |

While the broker touts competitive spreads and a commission-free model, the lack of transparency regarding specific costs is troubling. Traders may encounter hidden fees or unfavorable trading conditions that are not disclosed upfront. Additionally, the absence of clear information on overnight interest rates can lead to unexpected costs for traders holding positions overnight. This opacity in trading conditions contributes to the perception that JM may not be a safe choice for forex trading.

Customer Funds Safety

The safety of customer funds is a critical consideration for any broker. In the case of JM, the lack of regulation means there are no mandated protections in place for client deposits. Regulatory frameworks typically require brokers to segregate client funds from their operational capital, providing an additional layer of security. However, without oversight, there is no guarantee that JM adheres to such practices.

Moreover, the absence of investor protection schemes, such as compensation funds, leaves traders vulnerable in the event of the broker's insolvency. Historical complaints and reports of withdrawal issues further underscore the potential risks associated with trading with JM. Clients have reported difficulties in accessing their funds, raising alarms about the broker's reliability. Given these factors, it is evident that JM does not prioritize customer funds safety, making it a risky option for traders.

Customer Experience and Complaints

Analyzing customer feedback is essential in understanding a broker's reputation. Reviews of JM reveal a pattern of dissatisfaction among users, with common complaints revolving around withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Inadequate |

| Misleading Information | High | Ignored |

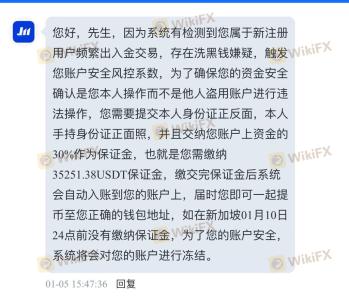

Many users have reported difficulties when attempting to withdraw their funds, with some claiming that their requests were either delayed or outright ignored. This lack of responsiveness is a significant red flag, as effective customer support is crucial for resolving issues that may arise during trading. Furthermore, the prevalence of complaints regarding misleading information and unfulfilled promises adds to the concerns surrounding JM's trustworthiness.

For instance, one user reported that after making a deposit, they were unable to withdraw their funds despite multiple attempts to contact customer support. This experience highlights the potential risks associated with trading through JM, reinforcing the notion that traders should be cautious when considering this broker.

Platform and Trade Execution

The quality of the trading platform and execution is another critical aspect to evaluate. JM claims to offer a user-friendly platform; however, user experiences suggest otherwise. Traders have reported issues with platform stability, including lagging performance during critical trading times.

Moreover, concerns regarding order execution quality have been raised, with some users experiencing slippage and rejected orders. Such issues can severely impact trading outcomes, particularly for those employing strategies that rely on precise execution.

Given these reports, it is essential for potential traders to consider whether the platform's reliability aligns with their trading needs. The lack of positive feedback regarding execution quality raises doubts about whether JM can be considered a safe trading environment.

Risk Assessment

Engaging with JM carries several inherent risks, primarily due to its lack of regulation and transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized authorities. |

| Financial Risk | High | Potential for loss of funds due to lack of protections. |

| Operational Risk | Medium | Platform stability and execution issues. |

The overall risk profile of trading with JM is concerning. The absence of regulatory oversight increases the likelihood of encountering fraudulent practices, while the lack of transparent trading conditions can lead to unexpected costs. Traders must approach JM with caution and consider the potential ramifications of engaging with an unregulated broker.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that JM is not safe for traders. The lack of regulation, transparency, and customer protection raises significant red flags that should not be ignored. While JM may offer attractive trading conditions and high leverage, the risks associated with trading through this broker far outweigh the potential benefits.

For traders seeking safer alternatives, it is advisable to consider brokers that are regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better protections for customer funds, transparent trading conditions, and responsive customer support. Ultimately, conducting thorough research and prioritizing safety should be paramount for any trader navigating the forex market.

Is JM FINANCIAL a scam, or is it legit?

The latest exposure and evaluation content of JM FINANCIAL brokers.

JM FINANCIAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JM FINANCIAL latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.