Is HERO safe?

Pros

Cons

Is Hero Safe or Scam?

Introduction

Hero, a forex broker, has emerged as a notable player in the online trading market since its inception. Established in 2015, it provides various trading services, including forex, CFDs, and precious metals. However, the increasing number of complaints and regulatory scrutiny surrounding Hero raises significant concerns among traders. In an industry rife with scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations before engaging with any platform. This article aims to assess Hero's credibility by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. Our investigation is based on multiple sources, including user reviews, regulatory databases, and industry analyses, to provide a comprehensive overview of Hero's operations.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is one of the most critical factors in assessing its legitimacy. Hero claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory standards. However, recent reports indicate that Hero's license has been revoked, casting doubt on its compliance with regulatory requirements.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 001296201 | Australia | Revoked |

The revocation of Hero's license is a significant red flag. ASIC is responsible for ensuring that financial services operate fairly and transparently, protecting investors from fraud. A revoked license means that the broker has failed to meet the necessary compliance standards, which can put clients' funds at risk. Furthermore, the lack of a valid license raises questions about the broker's operational integrity and commitment to adhering to industry regulations.

Company Background Investigation

Hero was founded in 2015, with its headquarters situated in the United States. The company aimed to cater to both institutional and individual investors by offering a user-friendly trading platform and flexible leverage options. However, the ownership structure and management team remain somewhat opaque, with limited information available regarding their professional backgrounds.

The lack of transparency raises concerns about the company's accountability and governance. A reputable broker typically provides detailed information about its management team, including their qualifications and experience in the financial industry. Hero's failure to disclose this information may indicate a lack of commitment to transparency, which is crucial for building trust with clients.

Trading Conditions Analysis

Hero's trading conditions are another vital aspect to consider. The broker offers various account types with different minimum deposit requirements, but the overall cost structure appears to be less competitive compared to industry standards.

| Fee Type | Hero | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.2 pips (ECN) | 0.1-0.5 pips |

| Commission Model | Not specified | $6 per lot |

| Overnight Interest Range | Varies | Varies |

While Hero advertises competitive spreads, the lack of clarity regarding commissions and other fees raises concerns. Traders should be wary of hidden costs that could erode their profits. Additionally, the absence of a demo account limits the ability of potential clients to test the platform before committing funds, which is a common practice among reputable brokers.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading industry. Hero claims to implement various safety measures, including segregated accounts and SSL encryption to protect user data. However, the lack of detailed information regarding investor protection schemes and negative balance protection is concerning.

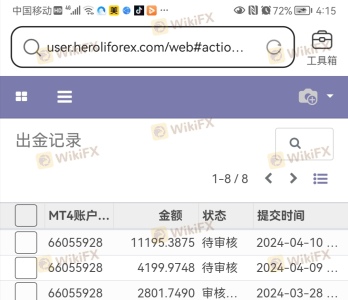

Traders should be aware that without robust safety measures in place, they risk losing their investments. Historical complaints regarding difficulties in withdrawing funds further exacerbate concerns about the broker's reliability. Reports indicate that clients have faced significant challenges when attempting to access their funds, leading to suspicions about the broker's financial health.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Many users have reported negative experiences with Hero, highlighting issues such as unresponsive customer service, difficulties in fund withdrawal, and technical glitches during trading.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Technical Glitches | Medium | Average |

| Customer Support Issues | High | Poor |

Several users have shared their experiences of being unable to withdraw funds for extended periods, raising alarms about the broker's operational practices. The company's response to these complaints has been largely inadequate, further eroding trust among its client base.

Platform and Trade Execution

Hero utilizes the MetaTrader 4 (MT4) platform, a widely recognized trading platform known for its user-friendly interface and advanced charting tools. However, user reviews indicate that the platform has experienced significant stability issues, including order execution delays and instances of slippage.

The quality of trade execution is critical for traders, as delays and re-quotes can lead to substantial financial losses. Reports of platform manipulation, such as artificially widening spreads during volatile market conditions, have raised additional concerns about Hero's trading practices.

Risk Assessment

Engaging with Hero presents several risks that potential traders should consider carefully.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns. |

| Financial Risk | High | Reports of withdrawal issues. |

| Operational Risk | Medium | Stability issues with the trading platform. |

Given the high regulatory and financial risks associated with Hero, traders should exercise extreme caution. Conducting thorough due diligence and considering alternative brokers with solid regulatory backing and positive user experiences is advisable.

Conclusion and Recommendations

Based on the comprehensive analysis, Hero exhibits several characteristics typical of a potentially fraudulent broker. The revocation of its regulatory license, coupled with numerous user complaints regarding fund withdrawal and technical issues, raises significant red flags.

Traders are advised to approach Hero with caution and consider alternative options that offer better regulatory oversight and customer support. Brokers such as Admiral Markets and Plus500 provide more transparent trading conditions and have established reputations in the industry.

In conclusion, while Hero may present itself as a legitimate trading platform, the evidence suggests a need for vigilance and thorough research before engaging with this broker.

Is HERO a scam, or is it legit?

The latest exposure and evaluation content of HERO brokers.

HERO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HERO latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.