Regarding the legitimacy of squaredfinancial forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is squaredfinancial safe?

Software Index

Risk Control

Is squaredfinancial markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Squared Financial (CY) Ltd

Effective Date:

2017-06-23Email Address of Licensed Institution:

info@squaredfinancial.euSharing Status:

No SharingWebsite of Licensed Institution:

www.squaredfinancial.com, www.squareddirect.comExpiration Time:

--Address of Licensed Institution:

Archiepiskopou Makariou 205, Victory House, Block A, 5th floor, 3030 Limassol, CyprusPhone Number of Licensed Institution:

+357 22 090 227Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SQ Sey Ltd

Effective Date:

--Email Address of Licensed Institution:

support@sqfin.comSharing Status:

No SharingWebsite of Licensed Institution:

www.sqfin.comExpiration Time:

--Address of Licensed Institution:

Commercial House 1, Office no 4, Eden Island, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4671943Licensed Institution Certified Documents:

Is SquaredFinancial A Scam?

Introduction

SquaredFinancial is a forex and CFD broker that has been operating since 2005, with its headquarters located in Cyprus and an additional entity in Seychelles. It positions itself as a technology-driven broker, providing access to various financial instruments including forex, stocks, commodities, and cryptocurrencies. In an industry where trust and transparency are paramount, it is crucial for traders to thoroughly evaluate brokers before investing their hard-earned money.

The forex market is rife with opportunities, but it is also fraught with risks, especially when it comes to choosing the right broker. Unscrupulous brokers can exploit unsuspecting traders, leading to significant financial losses. Therefore, potential clients must consider a broker's regulatory status, operational history, and customer service quality before making a decision. This article aims to provide an objective assessment of SquaredFinancial by examining its regulatory compliance, company background, trading conditions, customer safety measures, user experiences, platform performance, and associated risks.

The evaluation process for this review involved analyzing various online sources, industry expert opinions, and user feedback. By synthesizing this information, we aim to present a comprehensive overview of SquaredFinancial's legitimacy and reliability in the forex trading landscape.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. SquaredFinancial operates under two regulatory authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) of Seychelles. While CySEC is considered a reputable tier-1 regulator, the FSA is often viewed as a tier-3 regulator, which raises questions about the level of oversight and protection afforded to clients.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 329/17 | Cyprus | Verified |

| FSA | SD 024 | Seychelles | Verified |

CySEC's stringent regulations require brokers to adhere to strict capital requirements, segregate client funds, and provide negative balance protection. This means that clients cannot lose more money than they have deposited. On the other hand, the FSA's oversight is less stringent, which could lead to potential risks for clients trading through the Seychelles entity.

Historically, SquaredFinancial has maintained compliance with CySEC regulations, which adds a layer of credibility to its operations. However, the broker's offshore presence in Seychelles could be a red flag for some traders, as it may lack the same level of investor protection that comes with more established regulatory frameworks.

Company Background Investigation

SquaredFinancial has a history that dates back to 2005, initially operating under the name Probus FX before rebranding to SquaredDirect and eventually to its current name, SquaredFinancial. The company is owned and operated by Squared Financial (Cy) Limited, with a corporate structure that includes multiple offices across different jurisdictions.

The management team at SquaredFinancial comprises seasoned professionals with extensive experience in the financial services industry. This expertise is crucial for the broker's operational success and helps in establishing trust with clients. The company's transparency in disclosing its ownership and management details is commendable, as it allows potential clients to assess the broker's credibility.

In terms of information disclosure, SquaredFinancial provides a wealth of resources on its website, including details about its regulatory compliance, trading conditions, and educational materials. This level of transparency is essential for building trust with clients, as it demonstrates the broker's commitment to ethical practices and accountability.

Trading Conditions Analysis

Analyzing the trading conditions offered by SquaredFinancial reveals a mixed picture. The broker provides two primary account types: the Squared Pro account, which features no commissions but higher spreads, and the Squared Elite account, which offers lower spreads with a fixed commission per trade.

The overall fee structure is competitive, but traders should be aware of any unusual or potentially problematic fees. For instance, while there are no deposit or withdrawal fees, there is a $50 inactivity fee that could affect traders who do not actively engage in trading.

| Fee Type | SquaredFinancial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | $0 (Pro) / $5 (Elite) | $6 |

| Overnight Interest Range | Variable | Variable |

The spreads on the Squared Pro account start at 1.2 pips, which is slightly above the industry average. However, the Elite account offers spreads starting from 0.0 pips, making it more attractive for high-volume traders. This flexibility in account types allows traders to choose a structure that best fits their trading strategy and financial goals.

Customer Funds Security

Customer funds' safety is paramount when choosing a broker. SquaredFinancial employs several measures to ensure the security of client funds. Both regulatory authorities, CySEC and FSA, require brokers to segregate client funds from their operational funds, which SquaredFinancial complies with. This segregation helps protect clients' assets in the event of the broker's insolvency.

Additionally, SquaredFinancial provides negative balance protection for its CySEC-regulated accounts, ensuring that clients cannot lose more money than they have deposited. However, the FSA-regulated entity does not offer this protection, which could expose traders to higher risks.

Despite these protections, some historical concerns regarding the broker's operations may still linger. It's essential for potential clients to conduct their due diligence and consider the risks associated with trading through an offshore entity.

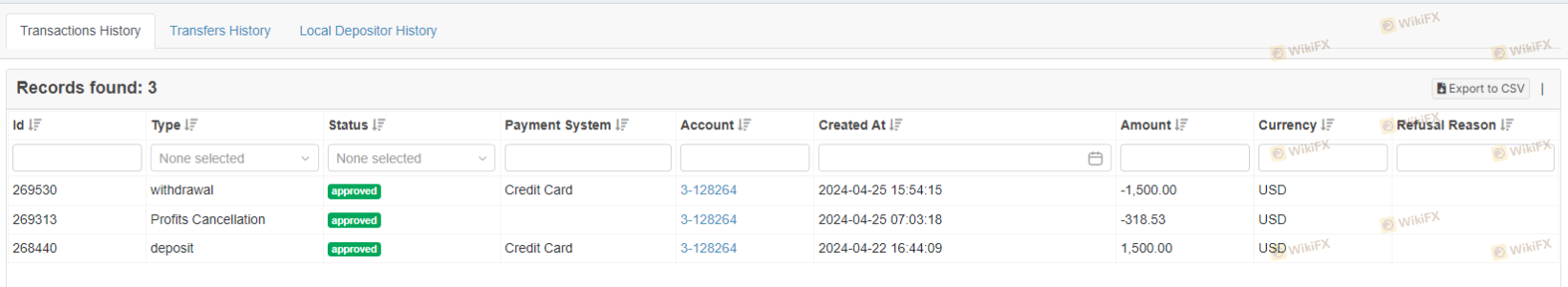

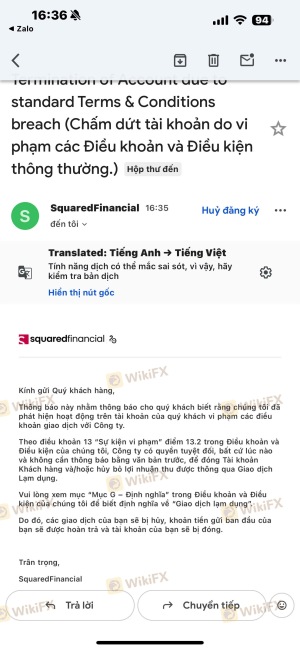

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. SquaredFinancial has garnered a mix of reviews online, with some users praising its trading conditions and customer support, while others cite issues related to account verification and withdrawal processes.

Common complaints include delays in customer service responses and difficulties with the withdrawal process.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Verification Issues | Medium | Generally Responsive |

For instance, some traders have reported waiting several days for their withdrawal requests to be processed, which can be frustrating for those looking for quick access to their funds. Additionally, there have been instances where users faced challenges during the account verification process, leading to delays in trading.

Platform and Trade Execution

The trading platforms offered by SquaredFinancial, including MetaTrader 4 and MetaTrader 5, are widely regarded as industry standards. These platforms provide users with advanced charting tools, technical indicators, and automated trading capabilities.

However, users have reported mixed experiences regarding order execution quality. While many traders appreciate the platforms' functionality, there are concerns about slippage and rejected orders during high volatility periods.

It is essential to assess the execution quality and stability of the platforms when considering a broker, as these factors can significantly impact trading performance.

Risk Assessment

Using SquaredFinancial comes with inherent risks, particularly due to its dual regulatory status. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Oversight | Medium | Offshore regulation may lack robustness |

| Withdrawal Process | High | Complaints about delays and issues |

| Negative Balance Protection | Medium | Not available for FSA-regulated accounts |

To mitigate these risks, traders should ensure they are fully aware of the broker's regulatory status and consider trading through the CySEC-regulated entity whenever possible. Additionally, maintaining clear communication with customer support can help address any potential issues promptly.

Conclusion and Recommendations

In conclusion, SquaredFinancial is not a scam; it operates under legitimate regulatory frameworks and offers a range of trading instruments and competitive conditions. However, the dual regulatory structure and the lack of negative balance protection for its Seychelles entity may raise concerns for some traders.

Potential clients should weigh the benefits against the risks and consider their trading preferences. For beginners, SquaredFinancial offers an accessible entry point with a low minimum deposit and a wealth of educational resources. However, those seeking a more robust regulatory environment might want to explore alternative brokers with top-tier licenses and comprehensive customer protection measures.

Overall, while SquaredFinancial has many strengths, including a solid trading platform and competitive fees, traders must conduct thorough research and consider their risk tolerance before opening an account. If you're looking for alternatives, brokers like Pepperstone or IG may offer more robust regulatory protections and a wider range of services.

Is squaredfinancial a scam, or is it legit?

The latest exposure and evaluation content of squaredfinancial brokers.

squaredfinancial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

squaredfinancial latest industry rating score is 6.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.