Numisma 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Numisma review examines a regulated financial services provider that operates in the wealth management sector. Numisma Group is a privately-owned company group that offers wealth management, fund management, and consulting services to its clients. The broker maintains regulatory compliance. This provides a foundation of legitimacy for its operations.

The key characteristics that define Numisma include its regulated status and diversified approach to financial services beyond traditional forex trading. The company focuses on comprehensive wealth management solutions rather than solely retail forex trading. This sets it apart from many standard brokers in the market.

The primary target audience for Numisma consists of high-net-worth individuals and institutional investors seeking comprehensive wealth management services. Unlike typical retail forex brokers, Numisma appears to cater to clients requiring sophisticated financial planning, asset management, and advisory services. This positioning suggests the broker operates in the premium segment of financial services. It focuses on clients with substantial investment portfolios and complex financial needs.

Important Disclaimer

Numisma operates as a regulated broker. Specific regulatory details across different jurisdictions may vary. Potential clients should verify the regulatory status applicable to their specific region before engaging with the broker's services. Different regions may have varying regulatory requirements and protections.

This review is based on currently available information and market analysis. The financial services industry is subject to frequent regulatory changes. Readers should conduct their own due diligence before making any investment decisions. All trading and investment activities carry inherent risks. Past performance does not guarantee future results.

Rating Framework

Broker Overview

Numisma Group operates as a privately-owned company group specializing in wealth management, fund management, and consulting services. The establishment date is not specifically mentioned in available sources. The company presents itself as an established player in the financial services sector. The group's structure suggests a focus on comprehensive financial solutions rather than simple trading services.

The company's business model centers around three core areas: wealth management for high-net-worth individuals, fund management for institutional clients, and consulting services for various financial planning needs. This diversified approach indicates that Numisma targets sophisticated investors requiring comprehensive financial services beyond basic trading platforms.

According to available information, this Numisma review reveals that the broker operates with regulatory oversight. Specific details about trading platforms, asset classes, and primary regulatory authorities are not extensively detailed in current sources. The company appears to maintain a professional approach to financial services. It focuses on personalized wealth management solutions rather than mass-market retail trading services.

Regulatory Regions

The available sources confirm that Numisma operates as a regulated broker. Specific regulatory jurisdictions and license numbers are not detailed in current materials. Prospective clients should verify regulatory status in their jurisdiction.

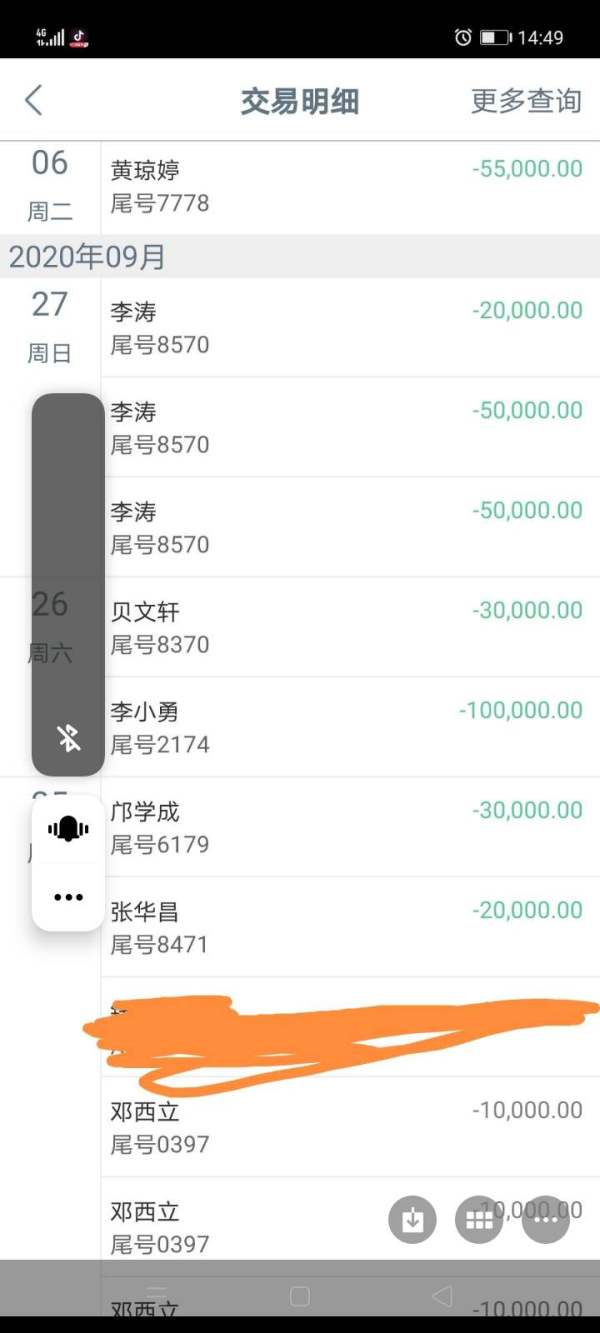

Deposit and Withdrawal Methods

Specific information about deposit and withdrawal methods is not detailed in available sources. High-net-worth focused brokers typically offer premium banking solutions and multiple funding options.

Minimum Deposit Requirements

Minimum deposit requirements are not specified in available materials. Given the wealth management focus, minimum deposits may be substantial compared to retail brokers.

Information about bonuses and promotional offerings is not mentioned in current sources. Wealth management firms typically focus on service quality rather than promotional incentives.

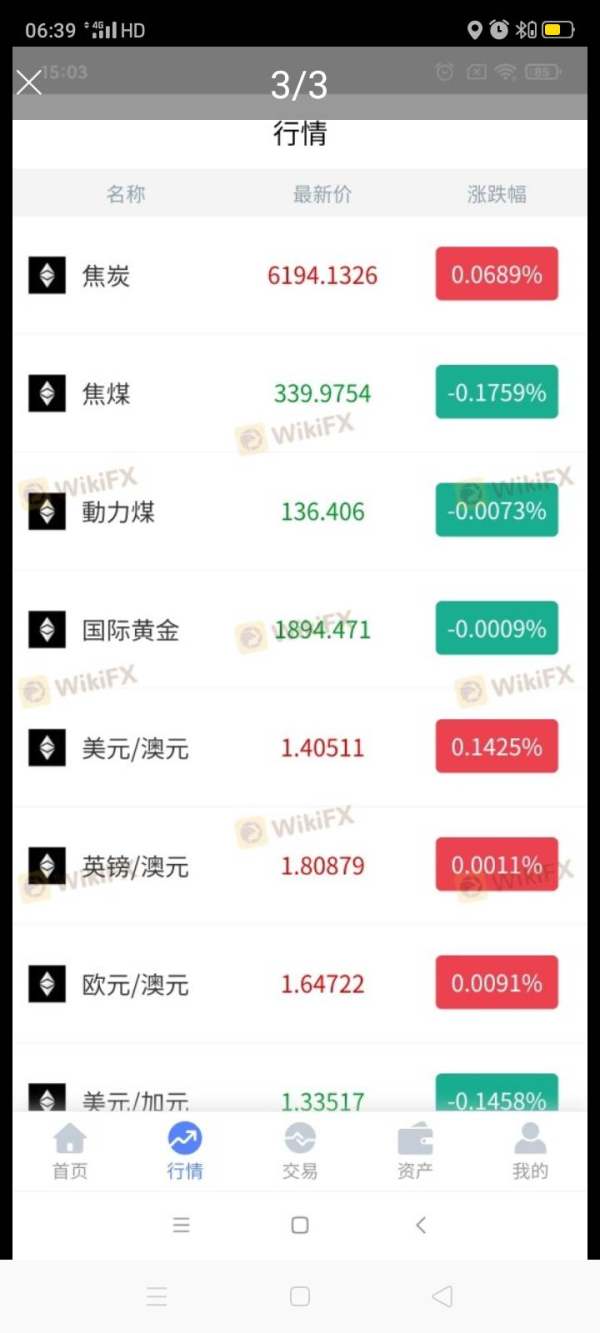

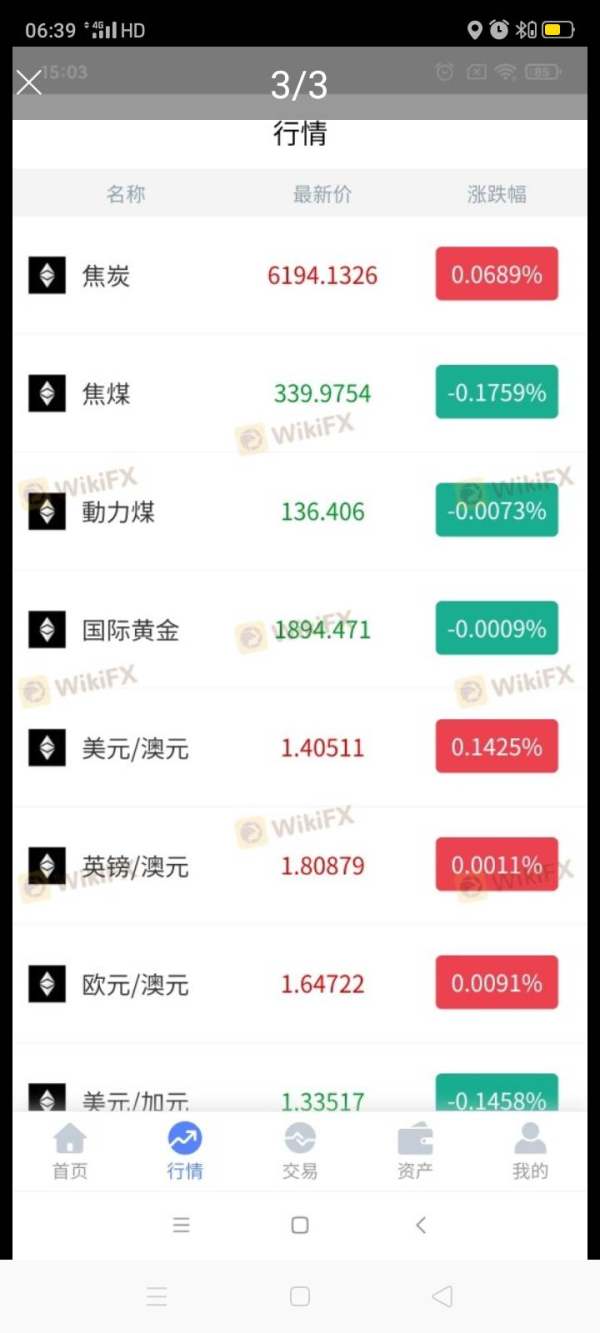

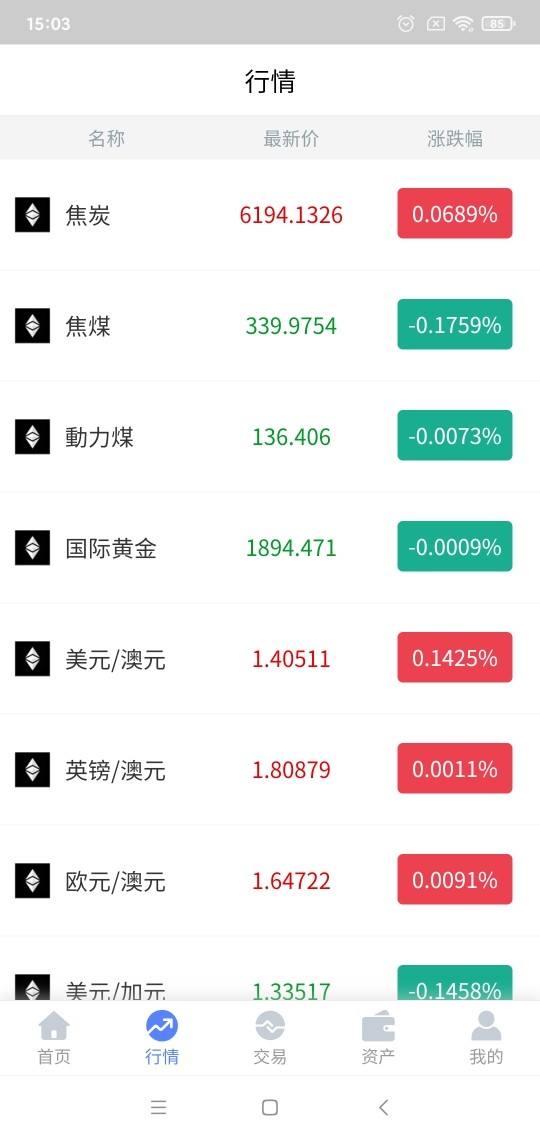

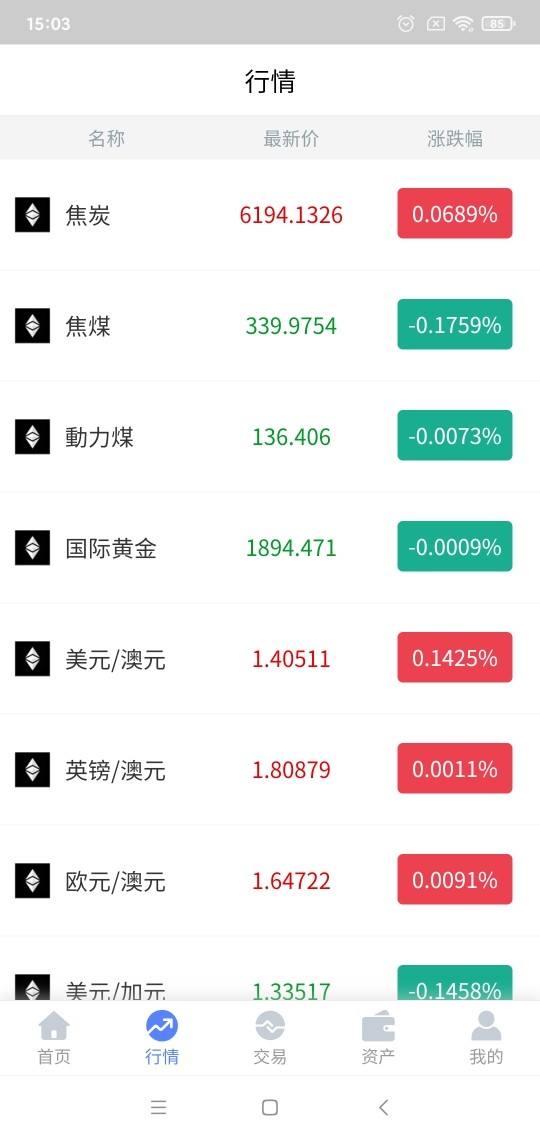

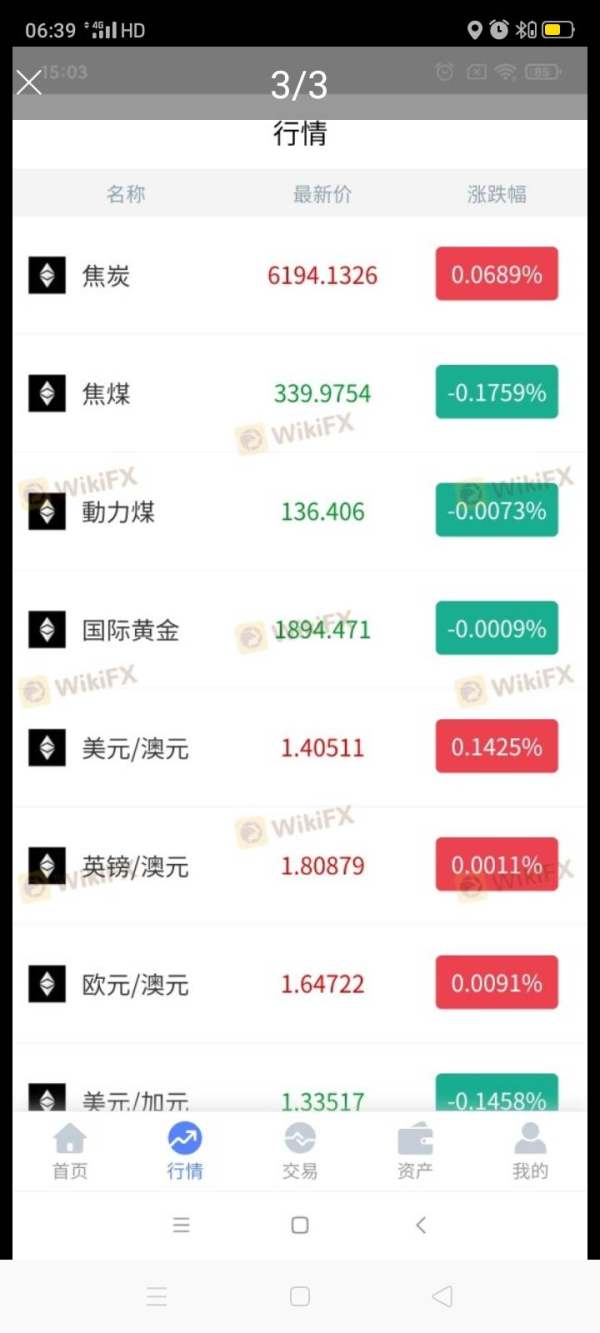

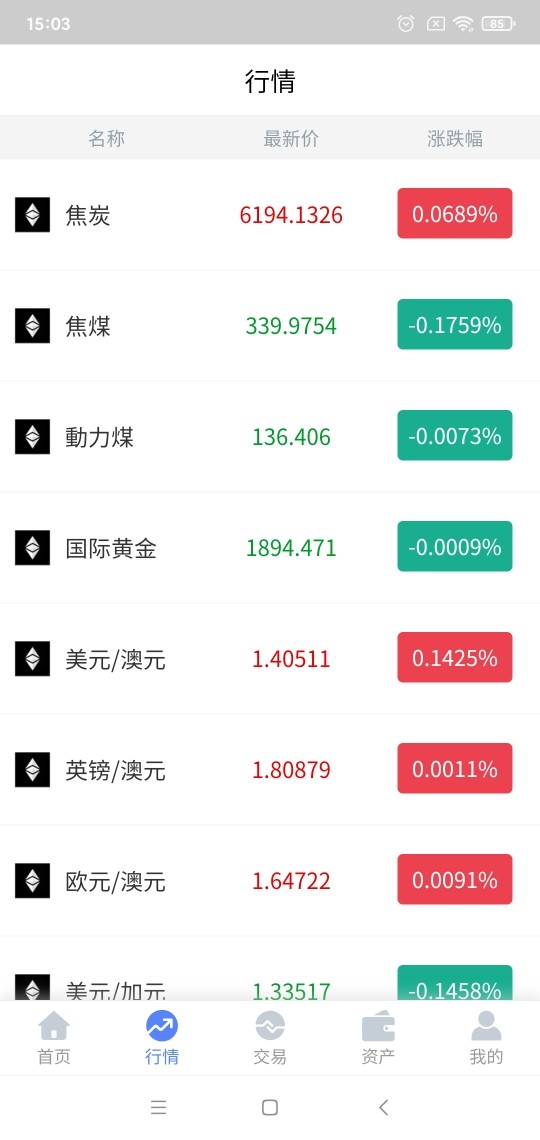

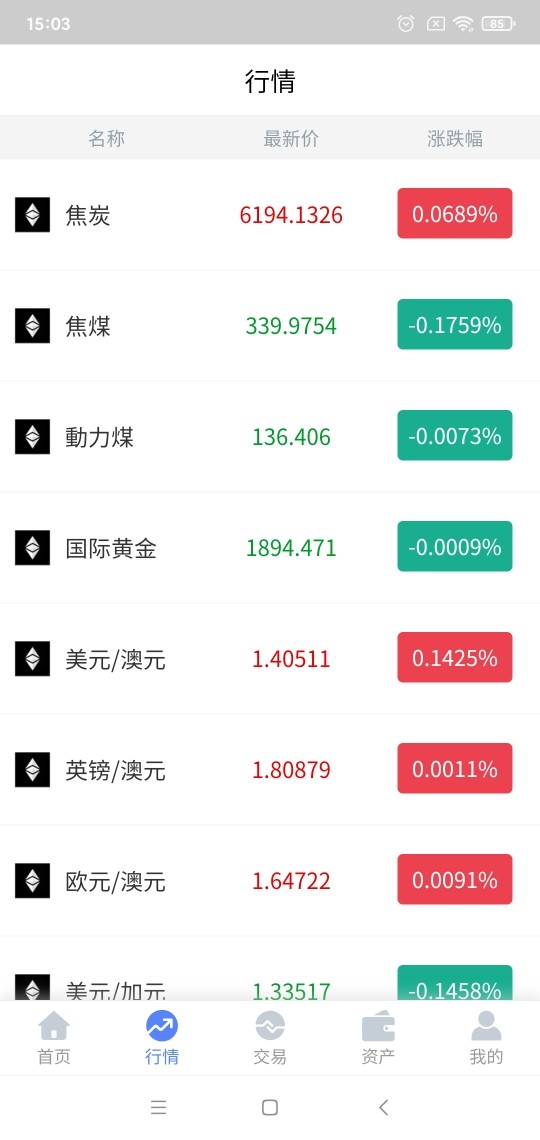

Tradeable Assets

The specific range of tradeable assets is not detailed in available sources. The wealth management focus suggests a comprehensive range of investment options.

Cost Structure

Detailed cost structure information is not available in current sources. Wealth management services typically employ fee-based models rather than spread-based pricing.

Leverage Ratios

Leverage information is not specified in available materials. This Numisma review focuses on wealth management services rather than high-leverage trading.

Specific trading platform information is not detailed in current sources. The wealth management focus suggests professional-grade portfolio management tools.

Geographic Restrictions

Regional restrictions are not specifically outlined in available sources. Regulatory compliance suggests geographic limitations may apply.

Customer Support Languages

Customer support language options are not detailed in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for Numisma are not extensively detailed in available sources. This limits a comprehensive evaluation of this aspect. Given the company's focus on wealth management and consulting services, it's likely that account structures differ significantly from typical retail forex brokers. Wealth management firms typically offer customized account solutions tailored to individual client needs rather than standardized account types.

The absence of specific information about account types, minimum deposit requirements, and account opening procedures suggests that Numisma may operate on a more personalized basis. Account conditions are likely negotiated individually with clients. This approach is common among private wealth management firms that cater to high-net-worth individuals and institutional investors.

Without detailed user feedback or specific account information available in current sources, it's challenging to provide a definitive assessment of how competitive or attractive Numisma's account conditions are compared to industry standards. This Numisma review cannot provide specific comparisons due to limited available data about account structures and requirements.

The evaluation of Numisma's tools and resources is limited by the lack of detailed information in available sources. As a wealth management and consulting firm, the company likely provides sophisticated analytical tools and research resources. Specific details about these offerings are not comprehensively documented in current materials.

Wealth management firms typically offer comprehensive research capabilities, portfolio analysis tools, and market intelligence resources to support their advisory services. However, without specific information about Numisma's technological infrastructure, research capabilities, or educational resources, it's difficult to assess the quality and comprehensiveness of their tools and resources.

The absence of detailed information about trading platforms, analytical software, or educational materials in available sources suggests that these details may be provided directly to clients during the consultation process rather than being publicly marketed. Professional wealth management firms often customize their tool offerings based on individual client requirements and portfolio complexity.

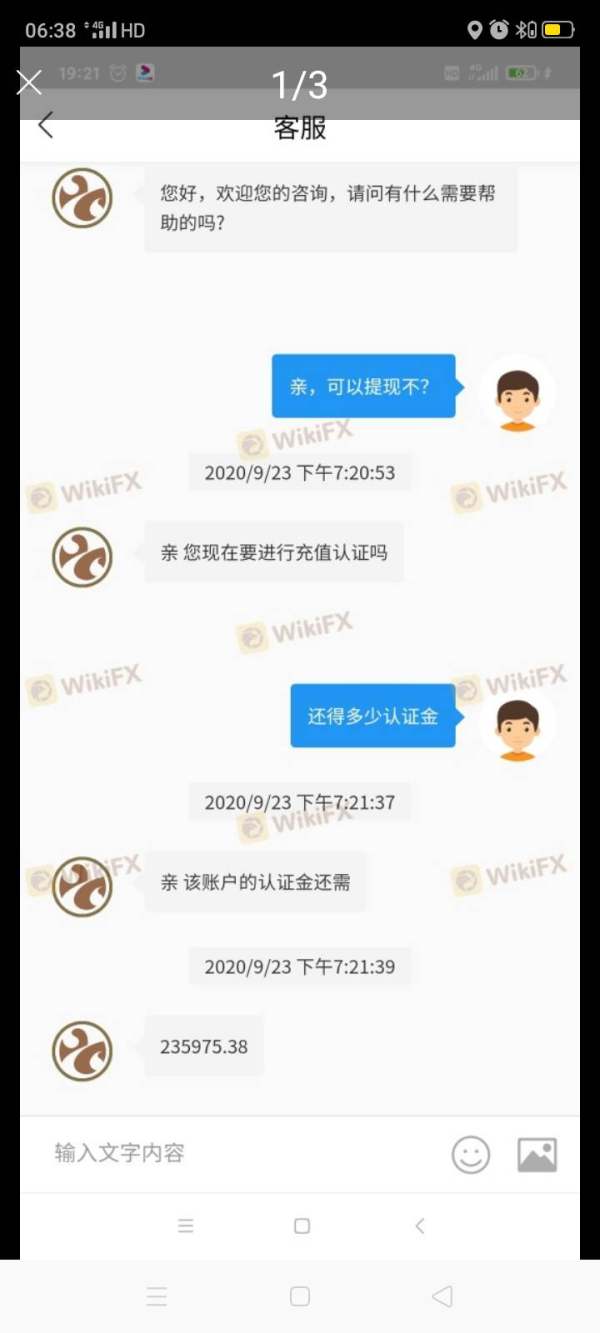

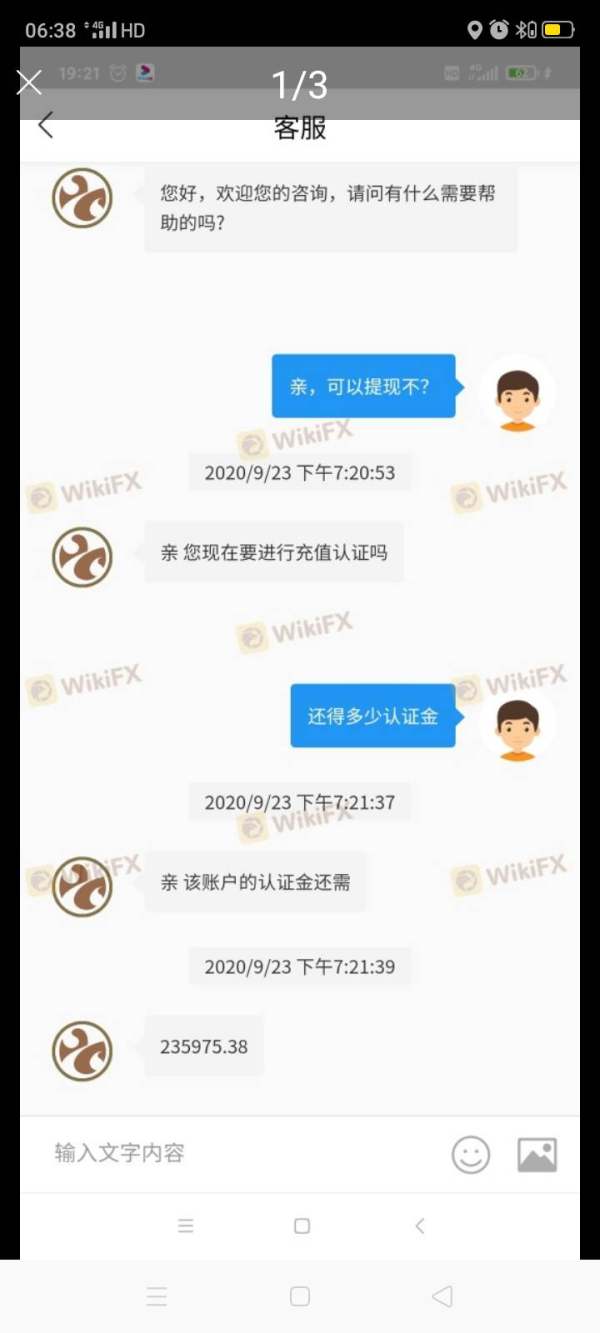

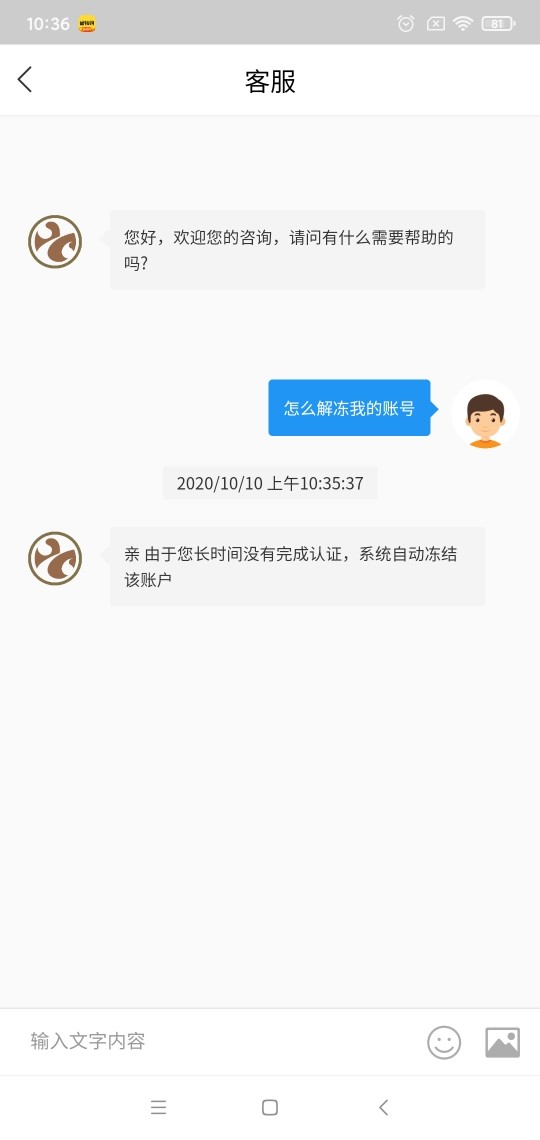

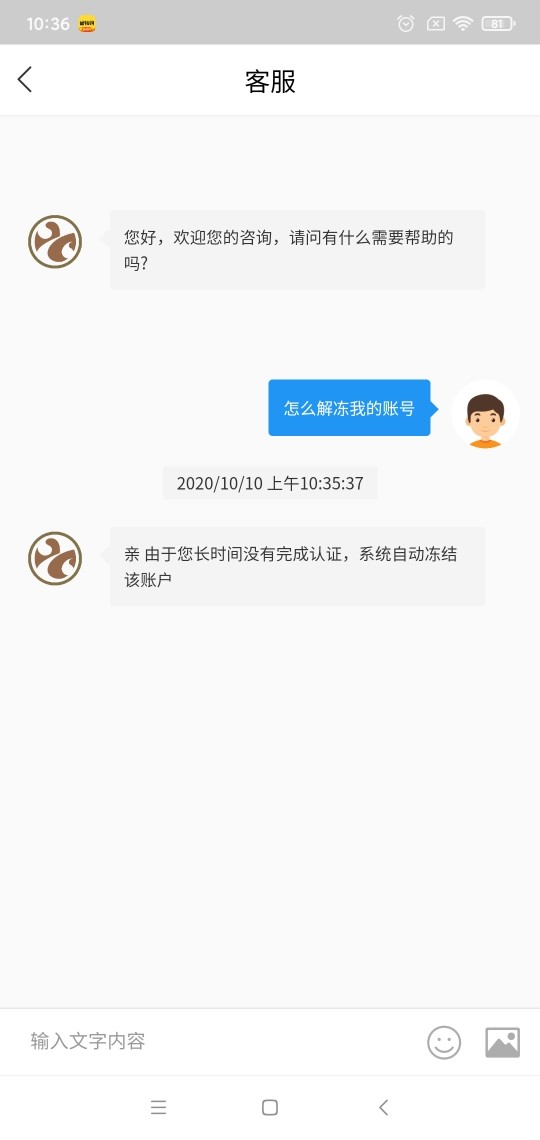

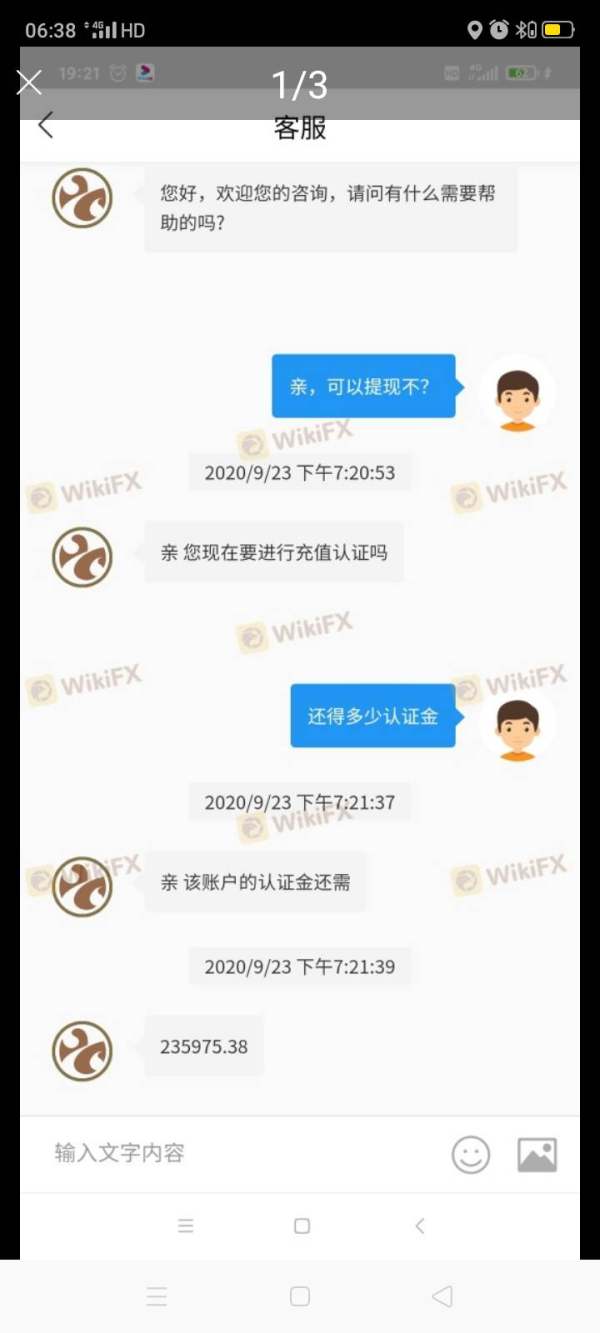

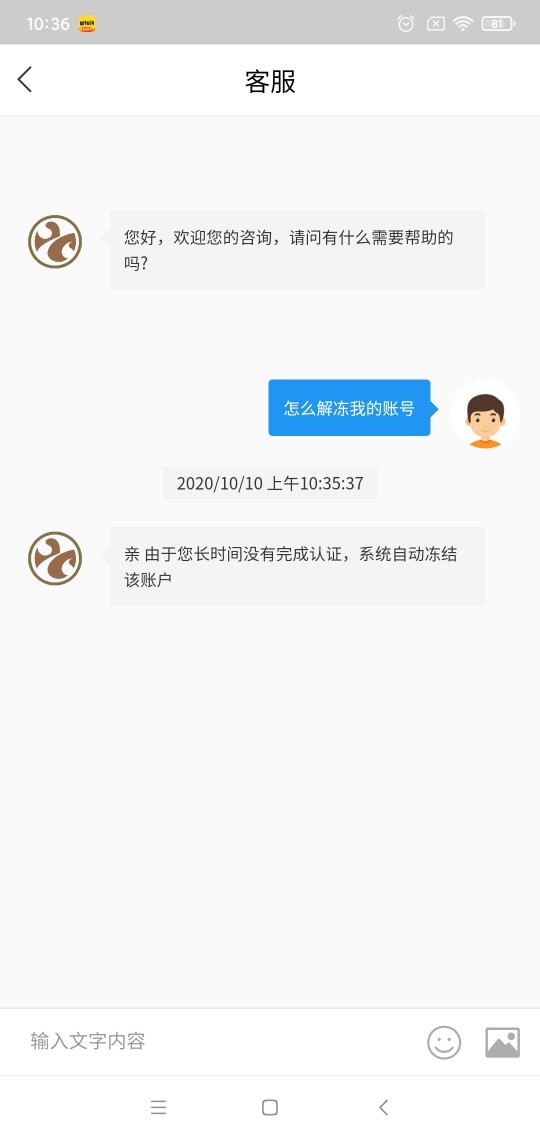

Customer Service and Support Analysis

Customer service and support details for Numisma are not extensively covered in available sources. This limits the ability to provide a thorough evaluation of this crucial aspect. Wealth management firms typically prioritize personalized service and dedicated relationship management. Specific information about Numisma's customer service structure is not detailed in current materials.

The lack of information about customer service channels, response times, availability hours, and multilingual support makes it challenging to assess how well Numisma serves its clients' support needs. Professional wealth management firms often provide dedicated account managers and personalized service rather than traditional customer support structures.

Without user feedback or testimonials available in current sources, it's difficult to evaluate the quality of customer service or identify any common issues that clients might encounter. The absence of detailed customer service information suggests that prospective clients should inquire directly about support structures and service level expectations during initial consultations.

Trading Experience Analysis

The trading experience evaluation for Numisma is constrained by limited information in available sources about platform performance, execution quality, and user interface design. As a wealth management firm, Numisma's approach to trading may differ significantly from typical retail forex brokers. It focuses more on portfolio management and investment advisory services.

Without specific information about platform stability, order execution speeds, or mobile trading capabilities, it's challenging to assess the technical quality of the trading experience. Wealth management firms often use institutional-grade platforms and execution systems. Details about Numisma's technological infrastructure are not comprehensively documented.

The absence of user feedback about trading experiences, platform functionality, or technical performance in available sources limits the ability to provide insights into real-world user experiences. This Numisma review cannot offer specific assessments of trading conditions, execution quality, or platform reliability due to insufficient detailed information in current materials.

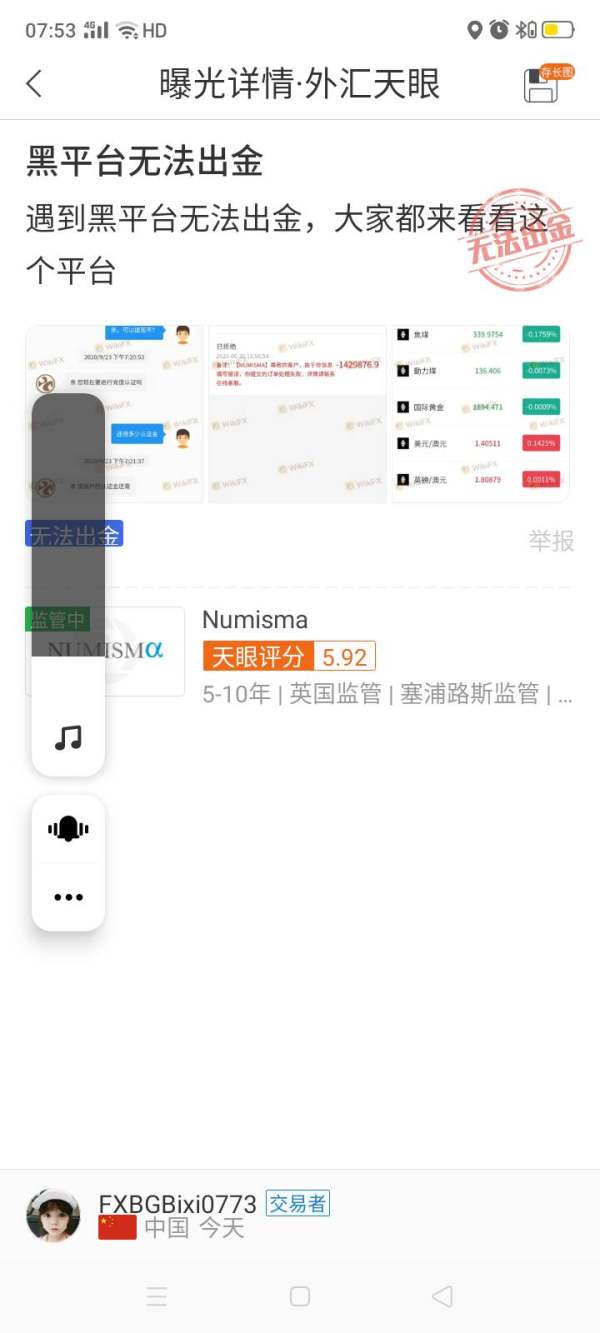

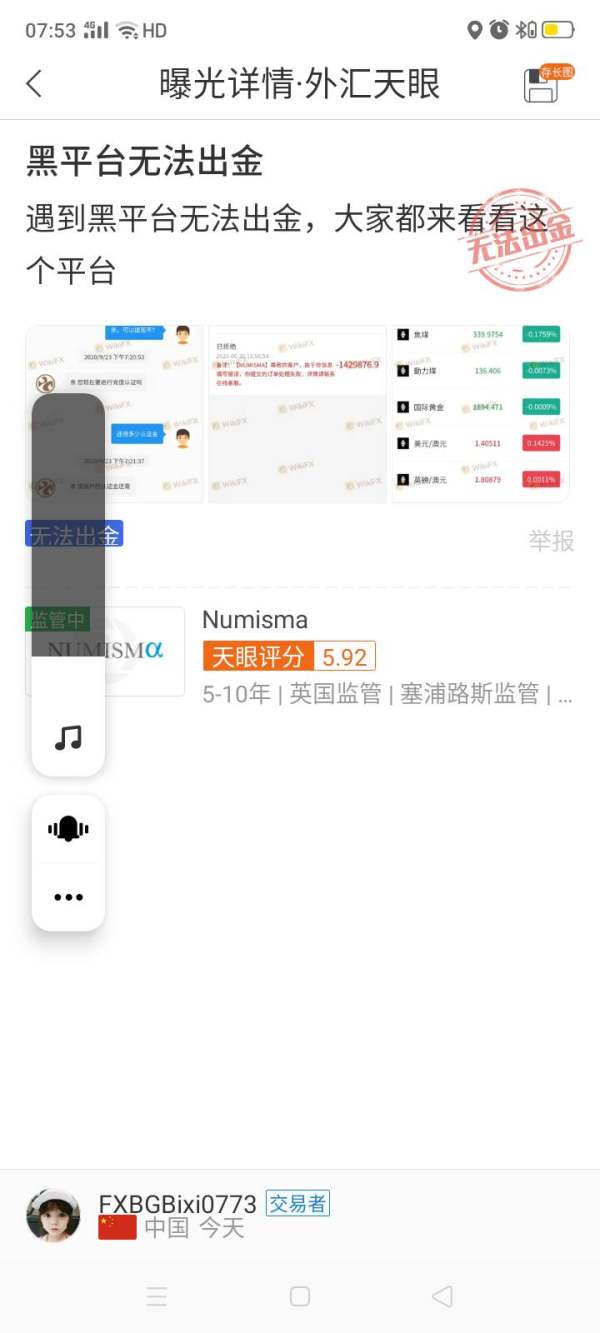

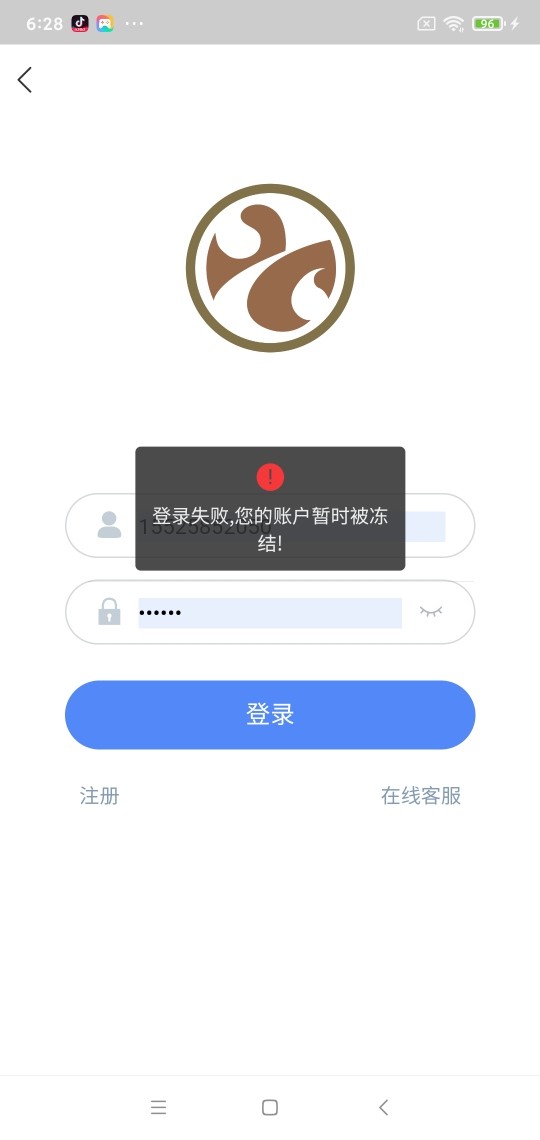

Trust Factor Analysis

Numisma's trust factor benefits from its status as a regulated broker. This provides a fundamental level of credibility and legal compliance. The regulatory oversight offers clients some protection and ensures that the company operates within established financial services frameworks. Specific regulatory details and license numbers are not extensively documented in available sources.

The company's positioning as a privately-owned group focusing on wealth management, fund management, and consulting services suggests a professional approach to financial services. However, without detailed information about specific regulatory authorities, capital adequacy measures, or client fund protection schemes, it's difficult to provide a comprehensive assessment of the trust factors.

The absence of detailed information about the company's track record, industry recognition, or third-party certifications in available sources limits the ability to fully evaluate trust factors. Professional wealth management firms typically maintain high standards of transparency and regulatory compliance. Specific details about Numisma's trust and safety measures require further investigation by prospective clients.

User Experience Analysis

The user experience assessment for Numisma is limited by the lack of detailed information about client interfaces, service delivery processes, and overall user satisfaction in available sources. Wealth management firms typically focus on providing seamless, personalized experiences for their high-net-worth clientele. Specific details about Numisma's user experience are not comprehensively documented.

Without information about onboarding processes, digital interfaces, account management systems, or client portal functionality, it's challenging to evaluate how user-friendly and efficient Numisma's services are. The absence of user testimonials or satisfaction surveys in available sources further limits the ability to assess real-world user experiences.

The lack of detailed information about common user complaints, service improvement initiatives, or client retention rates makes it difficult to identify potential areas of concern or excellence in user experience. Prospective clients should inquire directly about service delivery methods, communication processes, and user interface quality during initial consultations with Numisma representatives.

Conclusion

This Numisma review reveals a regulated financial services provider that focuses on wealth management, fund management, and consulting services rather than traditional retail forex trading. The company appears to target high-net-worth individuals and institutional investors seeking comprehensive financial advisory services and sophisticated investment management solutions.

The main strength of Numisma lies in its regulated status and professional positioning in the wealth management sector. However, the limited availability of detailed information about trading conditions, user experiences, and specific service offerings represents a significant limitation for potential clients seeking comprehensive broker comparisons.

Numisma appears most suitable for investors seeking personalized wealth management services and professional financial advisory support rather than active retail traders looking for competitive spreads and high-leverage trading opportunities. Prospective clients should conduct direct consultations with Numisma representatives to obtain detailed information about services, fees, and account conditions that align with their specific investment needs and objectives.