Regarding the legitimacy of CF forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is CF safe?

Business

Risk Control

Is CF markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

CF Global (HK) Limited

Effective Date:

2005-03-30Email Address of Licensed Institution:

hkcompliance-cfghk@statestreet.comSharing Status:

No SharingWebsite of Licensed Institution:

www.cfglobal.comExpiration Time:

--Address of Licensed Institution:

香港中環金融街8號國際金融中心二期68樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CF Safe or Scam?

Introduction

CF Broker, often referred to simply as CF, has emerged as a player in the foreign exchange market, offering a wide range of trading services. As the online trading landscape continues to grow, traders are increasingly confronted with numerous brokers vying for their attention. However, the proliferation of options also brings the risk of encountering unscrupulous operators. Therefore, it is crucial for traders to conduct thorough evaluations of forex brokers before entrusting their capital. This article aims to provide an objective assessment of CF Broker, analyzing its regulatory status, company background, trading conditions, customer fund safety, customer experiences, platform performance, and associated risks. The findings are based on comprehensive research, including reviews from various financial watchdogs and user testimonials.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors that traders must consider. Regulated brokers are subject to oversight by financial authorities, which helps ensure the safety of traders' funds and the integrity of the trading environment. Unfortunately, CF Broker operates without any regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

CF Broker is associated with Widdershins Group Ltd, based in the Commonwealth of Dominica, a jurisdiction known for its lenient regulatory environment. The absence of a regulatory license means that CF Broker does not have to adhere to any financial standards or practices that protect traders. Furthermore, multiple financial regulators, including the Luxembourg CSSF, the Spanish CNMV, and the Austrian FMA, have issued warnings against CF Broker, identifying it as a potential scam. The lack of regulatory oversight and the existence of warnings from reputable financial authorities strongly suggest that CF is not a safe trading option.

Company Background Investigation

CF Broker was established in 2020, positioning itself as an online trading platform. However, its rapid rise has been overshadowed by allegations of fraudulent activity and a lack of transparency regarding its ownership and operational practices. The company claims to be owned by Widdershins Group Ltd, but there is little verifiable information about this entity, leading to questions about its legitimacy.

The management team behind CF Broker remains largely anonymous, with no publicly available details regarding their qualifications or previous experience in the financial industry. This lack of transparency is concerning, as it raises doubts about the broker's commitment to ethical trading practices. Without a clear understanding of the company's leadership and operational structure, traders are left vulnerable to potential risks associated with unregulated brokers.

Trading Conditions Analysis

CF Broker presents a range of trading conditions that may initially seem attractive to potential clients. However, a closer examination reveals several concerning practices. The broker claims to offer competitive spreads and various account types, but there are significant discrepancies in its fee structure.

| Fee Type | CF Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.0 pips | 1.0-1.5 pips |

| Commission Model | None | Varies (typically $5 per lot) |

| Overnight Interest Range | High | Moderate |

The spreads offered by CF Broker are considerably higher than the industry average, indicating a lack of competitiveness. Additionally, there are reports of unexpected fees and commissions, particularly related to dormant accounts, which can further erode traders' profits. Such practices raise red flags about the broker's transparency and fairness in executing trades.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. Unfortunately, CF Broker's lack of regulation translates to inadequate safety measures for client deposits. There is no evidence to suggest that customer funds are kept in segregated accounts, a standard practice among regulated brokers. This lack of protection means that traders' funds could be at risk in the event of financial difficulties faced by the broker.

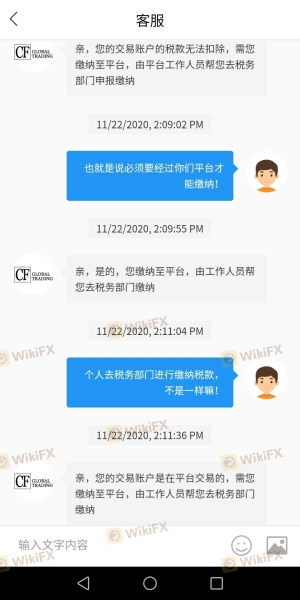

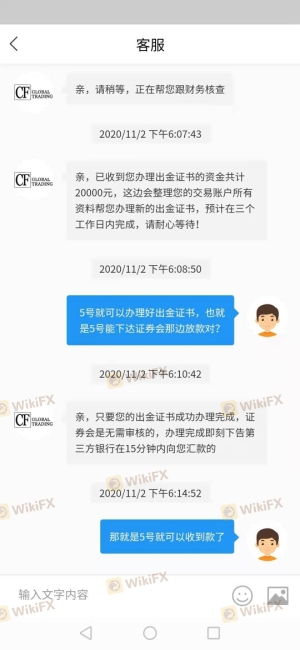

Furthermore, CF Broker does not provide negative balance protection, a crucial safeguard that prevents traders from losing more than their initial investment. Historical reports of withdrawal issues and frozen accounts further exacerbate concerns about the safety of funds with CF Broker. Traders have reported instances where they were unable to access their funds, raising alarms about the broker's reliability.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability and quality of service. Unfortunately, CF Broker has garnered a significant number of negative reviews, with many users reporting issues related to withdrawals and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Accessibility | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

Typical complaints include difficulties in withdrawing funds, lack of communication from customer service, and issues accessing trading accounts. Many users have expressed frustration over the broker's unresponsiveness, further highlighting the challenges traders face when dealing with CF Broker.

Case studies reveal that several clients have reported being unable to withdraw their initial deposits, leading to suspicions of fraudulent activity. Such experiences underscore the need for traders to exercise caution when considering CF Broker as a trading partner.

Platform and Trade Execution

The trading platform offered by CF Broker has been described as unstable and unreliable. Traders have reported frequent issues with order execution, including slippage and rejected orders.

The absence of a robust trading platform can significantly impact a trader's ability to execute trades effectively. Reports of technical glitches and a lack of user-friendly features further diminish the trading experience. Traders looking for a reliable and efficient trading environment are likely to be disappointed with the performance of CF Broker's platform.

Risk Assessment

Using CF Broker comes with a range of risks that traders must be aware of. The unregulated nature of the broker, coupled with numerous complaints and negative reviews, paints a concerning picture.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns about fund safety. |

| Financial Risk | High | High spreads and unexpected fees can lead to significant losses. |

| Operational Risk | High | Unstable trading platform and poor execution quality. |

To mitigate these risks, traders should consider alternative brokers that are regulated and have a proven track record of reliability and transparency. Engaging with well-established brokers can provide a safer trading environment and better customer support.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that CF Broker is not a safe trading option. The lack of regulatory oversight, numerous complaints from users, and concerns regarding fund safety all point to significant risks associated with this broker. Traders are advised to exercise extreme caution and consider alternative, regulated brokers that prioritize client safety and transparency.

For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA in the UK or ASIC in Australia are recommended. These brokers typically offer better protections for client funds and more transparent trading conditions. In light of the findings, it is clear that CF is not safe, and potential traders should look elsewhere for their trading needs.

Is CF a scam, or is it legit?

The latest exposure and evaluation content of CF brokers.

CF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CF latest industry rating score is 5.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.