Is IFX safe?

Pros

Cons

Is IFX Brokers A Scam?

Introduction

IFX Brokers is a South African forex broker that has gained attention in the trading community since its inception in 2018. Positioned as a provider of various trading instruments, including forex, indices, commodities, and cryptocurrencies, IFX Brokers aims to cater to both novice and experienced traders. Given the volatile nature of the forex market and the prevalence of scams, it is crucial for traders to meticulously evaluate any broker before committing their funds. This article seeks to provide a comprehensive analysis of IFX Brokers by examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and associated risks. The findings are based on a thorough review of multiple sources, including regulatory disclosures, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors influencing its credibility. IFX Brokers operates under the supervision of the Financial Sector Conduct Authority (FSCA) of South Africa, which is responsible for overseeing financial institutions and ensuring market integrity. The importance of regulation cannot be overstated, as it provides a layer of protection for traders and ensures that brokers adhere to strict operational standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 48021 | South Africa | Verified |

The FSCA is recognized for enforcing stringent compliance measures, which include regular audits and requirements for transparency. However, it is essential to note that IFX Brokers holds a Tier-2 license, which may not offer the same level of protection as Tier-1 regulators like the FCA (UK) or ASIC (Australia). Despite this, IFX Brokers has maintained a clean regulatory record, with no significant compliance issues reported since its establishment. This regulatory oversight adds a level of legitimacy to its operations, but traders should remain cautious and conduct their due diligence.

Company Background Investigation

IFX Brokers was founded in 2018 and is registered as IFX Brokers Holdings (Pty) Ltd. The company is headquartered in Jeffreys Bay, South Africa. The ownership structure of IFX Brokers is not extensively disclosed, which could raise transparency concerns for potential clients. The management team comprises individuals with relevant experience in the financial services sector, although detailed profiles of the executives are not readily available. This lack of transparency regarding the management team may be a red flag for some traders, as it is essential to know who is steering the company.

In terms of information disclosure, IFX Brokers provides basic details about its services and trading conditions on its website. However, the absence of comprehensive educational resources or market research tools may hinder traders, especially beginners, from gaining a complete understanding of the trading environment. This lack of transparency can be seen as a downside, as it limits traders' ability to make informed decisions.

Trading Conditions Analysis

IFX Brokers offers competitive trading conditions, including a low minimum deposit requirement, which is set at $10 for several account types. The broker provides a variety of accounts, including standard, premium, VIP, Islamic, and cent accounts, each with distinct features and fee structures. However, it is crucial to analyze the overall fee structure carefully.

| Fee Type | IFX Brokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 - 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | $6 (VIP only) | $3 - $5 |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by IFX Brokers are competitive, they are slightly higher than the industry average for certain account types. Additionally, the commission structure, particularly for the VIP account, could be seen as a drawback, especially when compared to other brokers that offer lower commission fees. Traders should be vigilant about understanding the full cost of trading, as hidden fees can significantly impact profitability.

Customer Fund Security

The safety of customer funds is paramount in the forex trading environment. IFX Brokers claims to implement several safety measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, reducing the risk of misappropriation. Negative balance protection limits clients' losses to their deposited amounts, which is a crucial safeguard in volatile market conditions.

However, it is essential to verify the effectiveness of these measures through independent reviews and reports. While there have been no significant historical issues regarding fund security reported by IFX Brokers, potential clients should remain cautious and consider the implications of trading with a broker that operates under a Tier-2 regulatory framework.

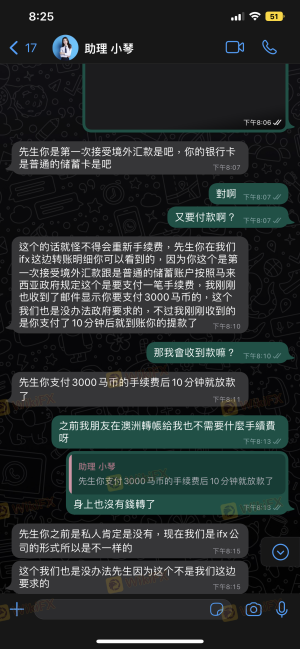

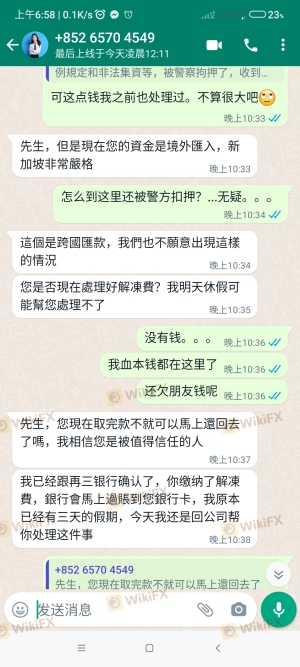

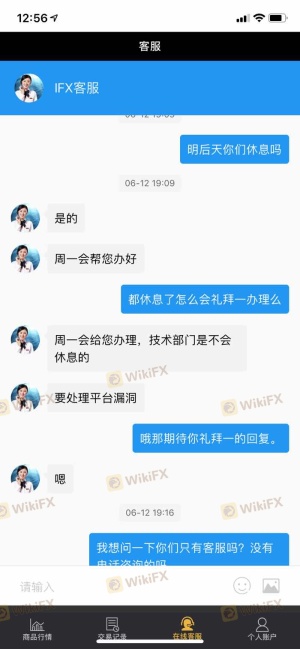

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of IFX Brokers reveal a mixed bag of experiences. While some users praise the broker for its user-friendly platform and responsive customer service, others have reported issues related to withdrawal delays and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Average response |

Common complaints include difficulties in withdrawing funds and problems with account closures. For instance, a user reported that their withdrawal request took longer than expected, raising concerns about the broker's operational efficiency. Additionally, feedback from users indicates that while customer support is available, response times can vary, leading to frustration among traders.

Platform and Trade Execution

IFX Brokers utilizes the widely recognized MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and reliability. The platforms offer advanced charting tools, a variety of technical indicators, and support for automated trading strategies. However, the execution quality has been a point of contention, with some users reporting instances of slippage and order rejections.

The broker claims to maintain a high order execution speed, but traders should remain vigilant for any signs of potential manipulation or unfair practices. Monitoring execution quality is essential, especially for high-frequency traders who rely on precise execution.

Risk Assessment

Trading with IFX Brokers carries inherent risks, as with any forex broker. The lack of Tier-1 regulation may expose traders to higher risks, particularly concerning fund security and operational transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Tier-2 regulation may not provide sufficient protection. |

| Fund Security Risk | Medium | While measures are in place, independent verification is necessary. |

| Customer Service Risk | Medium | Mixed reviews indicate potential issues with responsiveness. |

To mitigate risks, traders should conduct thorough research, utilize demo accounts before committing real funds, and ensure that they fully understand the broker's terms and conditions.

Conclusion and Recommendations

In conclusion, while IFX Brokers is a regulated entity operating under the FSCA of South Africa, potential traders should approach with caution. The broker's Tier-2 regulatory status, combined with mixed customer feedback, suggests that while it is not a scam, there are areas of concern that warrant careful consideration.

Traders, particularly beginners, are advised to conduct thorough research and consider alternative options if they prioritize higher regulatory protections and more comprehensive customer service. For those interested in exploring other brokers, options such as IG, OANDA, or Forex.com may provide better security and customer support. Ultimately, the decision should be based on individual risk tolerance and trading needs.

Is IFX a scam, or is it legit?

The latest exposure and evaluation content of IFX brokers.

IFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.