Regarding the legitimacy of PRIMEXBT forex brokers, it provides FSCA and WikiBit, .

Is PRIMEXBT safe?

Pros

Cons

Is PRIMEXBT markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

PRIMEXBT (PTY) LTD

Effective Date:

2015-02-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

180 LANCASTER ROAD GORDONS BAY WESTERN CAPE 7140Phone Number of Licensed Institution:

0710804392Licensed Institution Certified Documents:

Is PrimeXBT A Scam?

Introduction

PrimeXBT is a cryptocurrency trading platform that has gained popularity since its inception in 2018. It positions itself as a multi-asset trading platform, allowing users to trade cryptocurrencies, forex, commodities, and stock indices all in one place. However, as with any trading platform, it is essential for traders to exercise caution and conduct thorough research before committing their funds. The financial industry is rife with scams and unregulated brokers, making it crucial for traders to assess the legitimacy and trustworthiness of platforms like PrimeXBT. This article aims to provide an objective analysis of PrimeXBT, utilizing data from various sources to evaluate its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk.

Regulation and Legitimacy

The regulatory status of a trading platform is one of the most critical factors in determining its legitimacy. Regulation serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices that protect customer funds and promote transparency. Unfortunately, PrimeXBT operates without a valid regulatory framework, which raises concerns about its legitimacy and the safety of traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory license means that PrimeXBT does not fall under the supervision of any recognized financial authority, such as the FCA in the UK or the SEC in the US. This lack of regulation can expose traders to potential risks, including fraud, mismanagement of funds, and lack of recourse in case of disputes. While PrimeXBT claims to operate under the laws of Seychelles and Saint Vincent and the Grenadines, these jurisdictions are often criticized for their lax regulatory environments. Therefore, traders should be cautious and consider the implications of trading with an unregulated broker.

Company Background Investigation

PrimeXBT was founded in 2018 and has quickly established itself as a global trading platform. The company is registered in Seychelles and operates under the name PrimeXBT Trading Services Ltd. However, details regarding its ownership structure and management team are somewhat scarce. The lack of transparency about the management team raises questions about the experience and qualifications of those running the platform.

The absence of a robust corporate governance framework can be a red flag for potential investors. A well-structured management team with a proven track record in finance and trading can significantly enhance a broker's credibility. Additionally, the company's commitment to transparency and disclosure of information is vital for building trust with its users. Unfortunately, PrimeXBT's limited information disclosure may deter some traders from engaging with the platform.

Trading Conditions Analysis

PrimeXBT offers a competitive trading environment with a variety of assets available for trading. However, it is essential to examine the overall fee structure and any potentially unusual or problematic fees that may affect traders.

| Fee Type | PrimeXBT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.05% | 0.1% - 0.5% |

| Commission Model | 0.001% - 0.005% | 0.1% - 0.3% |

| Overnight Interest Range | Variable (0.1% - 0.3%) | Variable (0.1% - 0.5%) |

The trading fees on PrimeXBT are relatively low compared to industry standards, particularly for cryptocurrency trades, which are charged at 0.05%. However, the platform also imposes overnight financing fees for positions held overnight, which can vary based on market conditions. Traders should be aware that these fees can accumulate and impact profitability, especially for those who engage in long-term trading strategies.

Moreover, PrimeXBT does not charge deposit fees, but the withdrawal fee is set at 0.0005 BTC, which can be significant for smaller withdrawals. This fee structure is relatively transparent, but traders should remain vigilant regarding any changes or hidden costs that may arise.

Customer Funds Safety

The safety of customer funds is paramount for any trading platform. PrimeXBT implements several security measures to protect user assets, including cold storage for the majority of customer funds, two-factor authentication (2FA), and SSL encryption for data transmission. These measures are designed to minimize the risk of hacking and unauthorized access to accounts.

Despite these precautions, the lack of regulatory oversight raises concerns about the overall security of funds. Traders should consider whether the security measures in place are sufficient to mitigate the risks associated with trading on an unregulated platform. Additionally, there have been no reported incidents of significant security breaches or fund mismanagement, which may provide some reassurance to potential users.

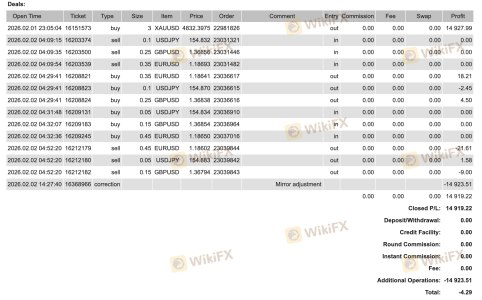

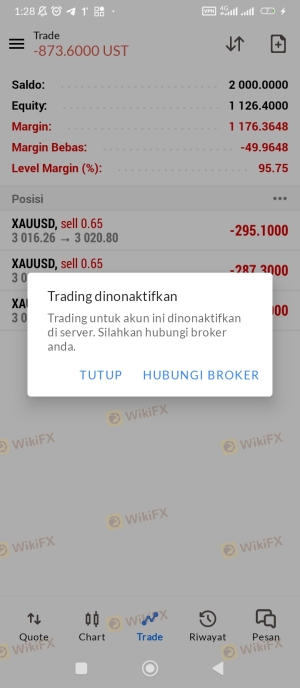

Customer Experience and Complaints

User feedback is a critical component of evaluating a trading platform's reliability. Overall, PrimeXBT has received mixed reviews from users, with many praising its user-friendly interface and low fees. However, common complaints include limited customer support options and issues related to withdrawal processing times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Limited Customer Support | Medium | Improved over time |

| Lack of Transparency | High | No clear answers |

For instance, some users have reported delays in withdrawing funds, leading to frustration and dissatisfaction. While the company has made efforts to improve its customer support, the absence of a dedicated phone line and live chat option can hinder timely assistance.

Platform and Trade Execution

PrimeXBT's trading platform is designed to be intuitive and accessible, featuring advanced charting tools and a customizable user interface. However, the execution quality and potential signs of manipulation warrant scrutiny. Users have reported fast execution speeds, which is crucial for trading in volatile markets like cryptocurrencies.

Nevertheless, traders should remain vigilant for any signs of slippage or order rejections, as these can significantly impact trading outcomes. While PrimeXBT's platform appears to function well, a lack of independent reviews or audits raises concerns about the overall integrity of the trading environment.

Risk Assessment

Engaging with PrimeXBT comes with inherent risks, primarily due to its unregulated status and lack of transparency. Traders should carefully consider the following risk factors:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Security Risk | Medium | Despite security measures, funds are not insured |

| Operational Risk | Medium | Potential for withdrawal delays and customer support issues |

To mitigate these risks, traders should consider diversifying their investments and not committing more capital than they can afford to lose. Additionally, staying informed about the platform's updates and any changes in its operational practices is advisable.

Conclusion and Recommendations

In conclusion, while PrimeXBT offers a range of attractive features, including low trading fees and a user-friendly platform, its lack of regulation and transparency raises significant concerns. The absence of a valid regulatory framework means that traders may be exposed to higher risks, including potential fraud and mismanagement of funds.

Traders should exercise caution when considering PrimeXBT and may want to explore alternative platforms with stronger regulatory oversight and proven track records. Some recommended alternatives include well-regulated brokers like IG, AvaTrade, and eToro, which provide a safer trading environment and comprehensive customer support.

Ultimately, the decision to trade with PrimeXBT should be made with careful consideration of the associated risks and the trader's individual risk tolerance.

Is PRIMEXBT a scam, or is it legit?

The latest exposure and evaluation content of PRIMEXBT brokers.

PRIMEXBT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRIMEXBT latest industry rating score is 6.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.