Is Numisma safe?

Pros

Cons

Is Numisma Safe or a Scam?

Introduction

Numisma is a forex broker based in Cyprus, established in 2013, and has positioned itself within the competitive landscape of the foreign exchange market. As more traders venture into forex trading, the need for thorough broker evaluations becomes paramount. With numerous reports of scams and fraudulent activities in the industry, traders must exercise caution when selecting a broker. This article aims to provide an objective assessment of whether Numisma is a safe trading platform or a potential scam. The investigation draws on various online sources, including user reviews, regulatory information, and expert analyses, to present a comprehensive overview of Numismas credibility.

Regulation and Legitimacy

The regulatory status of a broker is crucial, as it provides a framework for investor protection and operational integrity. Numisma claims to be regulated by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. However, the presence of multiple regulatory statuses, including "suspicious clone," raises concerns about its legitimacy.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 122/10 | Cyprus | Regulated |

| FCA | 605023 | UK | Regulated |

| BaFin | 133282 | Germany | Suspicious Clone |

Despite being regulated, the mixed reviews on its regulatory compliance suggest that traders should remain vigilant. Notably, there have been numerous complaints filed against Numisma, with allegations ranging from withdrawal issues to claims of fraud. This duality in regulatory status necessitates a careful evaluation of Numisma's operational practices and historical compliance.

Company Background Investigation

Numisma operates under the ownership of Numisma Capital Ltd, which is registered in Cyprus. The company has been in operation for over a decade, but its relatively short history in the market raises questions about its long-term viability. The management team comprises professionals with backgrounds in finance and investment, including PhDs in quantitative finance and actuarial science. However, the level of transparency regarding their operational practices is somewhat lacking, as detailed information about their investment strategies and financial health is not readily available.

The lack of comprehensive disclosure about the companys ownership structure and operational history further complicates the assessment of its legitimacy. While the management team appears qualified, potential clients may find it challenging to gauge the company's reliability based on the available information.

Trading Conditions Analysis

The trading conditions offered by Numisma are another critical aspect to consider when evaluating its safety. The broker's fee structure is not explicitly detailed on its website, which can lead to confusion among potential traders. Reports indicate that there may be hidden fees or unfavorable trading conditions that could impact profitability.

| Fee Type | Numisma | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The absence of clear information regarding trading costs may deter some traders, as transparency is a key factor in establishing trust. Additionally, the potential for unexpected fees can create a negative trading experience, leading to further skepticism about whether Numisma is safe for trading.

Client Fund Security

Client fund security is paramount in the forex trading landscape. Numisma claims to adhere to strict fund management protocols, including the segregation of client funds from company operating funds. However, the efficacy of these measures has been called into question due to the numerous complaints regarding withdrawal issues.

The broker's policies on investor protection and negative balance protection are also unclear. Without robust measures in place, clients may face significant risks if the broker faces financial difficulties or operational challenges. Historical issues with fund safety, including allegations of fraud, further exacerbate concerns about Numismas reliability.

Customer Experience and Complaints

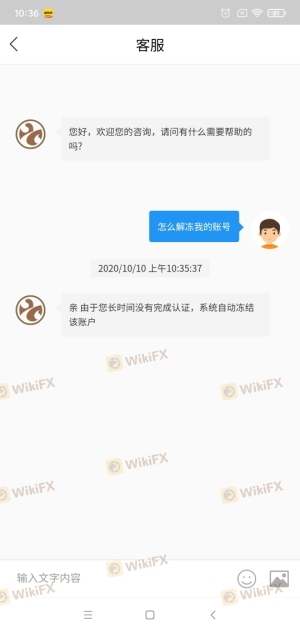

Customer feedback provides valuable insights into the operational integrity of a broker. Numerous reports indicate that clients have faced challenges with withdrawals, often citing difficulties in accessing their funds. These complaints highlight a pattern of dissatisfaction among users, raising red flags about Numisma's customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Fraud Allegations | High | Poor |

| Customer Service Delays | Medium | Average |

Case studies reveal that some clients have been unable to withdraw their funds despite repeated attempts to contact customer service. This lack of effective communication and resolution is a significant concern for potential investors considering whether Numisma is safe.

Platform and Execution

The performance of a trading platform is crucial for a positive trading experience. Numisma provides access to a proprietary trading platform, but reviews indicate mixed experiences regarding its stability and user-friendliness. Concerns have been raised about order execution quality, including instances of slippage and rejected orders.

Traders have reported that execution delays can lead to missed opportunities, particularly in volatile market conditions. Signs of potential platform manipulation, such as sudden price changes that do not align with market trends, have also been noted, warranting further investigation into the platform's reliability.

Risk Assessment

Engaging with Numisma presents several risks that traders should be aware of. The mixed regulatory status, combined with numerous complaints about fund access and customer service, creates a precarious trading environment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Mixed reviews and complaints indicate potential risks. |

| Fund Security | High | Issues with withdrawals raise concerns about fund safety. |

| Customer Support | Medium | Poor responsiveness may lead to unresolved issues. |

To mitigate these risks, potential traders should conduct thorough research, consider starting with a minimal deposit, and remain vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, while Numisma presents itself as a regulated forex broker, the evidence suggests that potential traders should approach with caution. Numerous complaints regarding withdrawal issues and a lack of transparency raise significant concerns about whether Numisma is safe for trading.

Investors should be particularly wary of hidden fees and the brokers overall reliability. For those seeking safer alternatives, it is advisable to consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Ultimately, the decision to engage with Numisma should be made with a clear understanding of the associated risks and potential drawbacks.

Is Numisma a scam, or is it legit?

The latest exposure and evaluation content of Numisma brokers.

Numisma Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Numisma latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.