Regarding the legitimacy of HTFX forex brokers, it provides VFSC and WikiBit, (also has a graphic survey regarding security).

Is HTFX safe?

Pros

Cons

Is HTFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

HTFX VU LIMITED

Effective Date: Change Record

2024-02-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is HTFX Safe or Scam?

Introduction

HTFX is a forex broker that has garnered attention in the trading community for its claimed services and offerings in the forex market. Established in 2023 and headquartered in Australia, HTFX positions itself as a platform for both retail and institutional traders, offering various financial instruments, including forex, cryptocurrencies, and indices. However, with the rise of online trading, the need for traders to carefully evaluate brokers has never been more critical. The potential for fraud and mismanagement of funds is significant, making it essential for traders to conduct thorough research before committing their capital.

This article investigates the credibility of HTFX, examining its regulatory status, company background, trading conditions, and customer experiences. Our assessment is based on a thorough review of online resources, including regulatory filings, customer reviews, and industry reports.

Regulation and Legitimacy

HTFX claims to be regulated by the Australian Securities and Investments Commission (ASIC), but it has also been flagged as a suspicious clone by various sources, raising concerns about its legitimacy. Regulation is a crucial aspect of any trading platform, as it provides a level of oversight intended to protect traders from fraud and malpractice. Below is a summary of HTFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 332890 | Australia | Suspicious Clone |

| CySEC | Not Available | Cyprus | Not Verified |

| FCA | Not Available | United Kingdom | Not Verified |

The claims of ASIC regulation are particularly concerning, as HTFX is identified as a clone of a legitimate entity. This means that while it may present itself as a regulated broker, it operates without the necessary oversight, putting investors at risk. Furthermore, the absence of verification from other reputable regulatory bodies such as the FCA and CySEC raises additional red flags.

Regulatory quality is paramount; brokers with robust oversight are less likely to engage in fraudulent activities. The lack of transparency regarding HTFX's regulatory status should make potential investors wary, as unregulated brokers often operate with little accountability, increasing the risk of financial loss.

Company Background Investigation

HTFX was established in 2023, and its operational base is located in Australia. However, there is a noticeable lack of information regarding its ownership structure and management team. This opacity raises questions about the company's credibility and commitment to transparency.

The absence of identifiable executives or a management team with a proven track record in the financial industry is concerning. A strong management team is essential for any broker, as it often reflects the company's operational integrity and reliability. Transparency in ownership and management is crucial for fostering trust among potential clients; without it, HTFX appears to lack the necessary accountability.

Moreover, the company's website has faced accessibility issues, which further complicates the ability to gather vital information about its operations and services. A broker that is unwilling or unable to provide clear information about its management and operational practices should be approached with caution, as this can often indicate potential fraudulent activity.

Trading Conditions Analysis

HTFX offers a variety of trading conditions that may initially appear attractive to potential clients. However, a closer examination reveals several concerning aspects. The broker claims to provide competitive spreads and leverage options, but the actual trading costs and fees may not be as favorable as advertised.

Heres a comparison of HTFX's trading costs with industry averages:

| Fee Type | HTFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.0 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While HTFX advertises tight spreads, actual trading conditions may vary significantly based on market conditions and account type. Moreover, the commission structure is less favorable compared to many regulated brokers, which typically offer lower commissions or even commission-free trading.

Unusual fee policies, such as high withdrawal fees or deposit minimums, can also deter traders from using the platform. For instance, HTFX requires a minimum deposit of $1,000, which is considerably higher than the average for regulated brokers, making it less accessible for new traders.

Customer Fund Security

The security of customer funds is a critical consideration for any trading platform. HTFX claims to implement several measures to protect client funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Funds segregation is a practice where client funds are kept separate from the broker's operational funds, ensuring that they are not used for the broker's expenses. This is a vital protection mechanism, especially if the broker faces financial difficulties. Negative balance protection ensures that traders cannot lose more than their deposited funds, which is an essential safeguard in volatile markets.

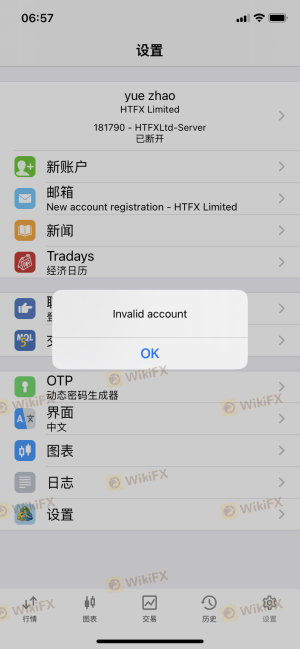

However, given HTFX's classification as a suspicious clone and the lack of transparency regarding its operational practices, the actual implementation of these security measures remains uncertain. Historical issues with fund security, such as complaints regarding withdrawal difficulties and potential fraud, further exacerbate concerns about the safety of funds deposited with HTFX.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. A review of customer experiences with HTFX reveals a pattern of complaints that highlights significant issues with the broker's operations.

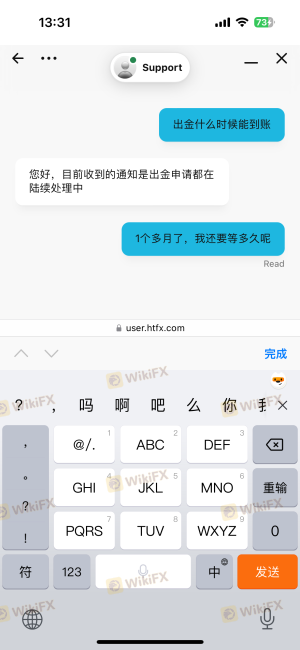

Common complaints include withdrawal difficulties, lack of customer support, and unexpected fees. Below is a summary of the major complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/no response |

| Lack of Customer Support | High | Limited availability |

| Unexpected Fees | Medium | Inconsistent replies |

For example, some users have reported being unable to withdraw their funds, with claims of being asked to pay additional fees before processing withdrawals. This pattern of complaints is a significant red flag, indicating potential fraudulent practices.

Moreover, the lack of timely and effective responses from HTFX regarding these complaints raises concerns about the broker's commitment to customer service and support. A broker that fails to address customer grievances promptly may not be trustworthy, as it suggests a lack of accountability.

Platform and Execution

HTFX uses the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust analytical tools. However, the overall performance and stability of the platform are crucial for traders, as any issues can directly affect trading outcomes.

User experiences regarding order execution have been mixed, with some reporting instances of slippage and rejected orders. These issues can significantly impact trading performance, especially for strategies that rely on precise execution. Transparency regarding execution quality and any potential manipulation is essential for building trust with clients.

Risk Assessment

Using HTFX carries several risks that potential traders should consider. Below is a summary of key risk categories associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated or suspicious status |

| Fund Security Risk | High | Potential issues with fund protection |

| Customer Support Risk | Medium | Complaints about slow response times |

| Trading Conditions Risk | Medium | Unfavorable fees and withdrawal policies |

To mitigate these risks, potential clients are advised to conduct thorough research, consider using regulated alternatives, and be cautious with their investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that HTFX operates under several red flags that warrant caution. The broker's questionable regulatory status, lack of transparency, and numerous customer complaints indicate potential risks for traders.

While HTFX may offer attractive trading conditions at first glance, the underlying issues regarding fund security and customer support raise significant concerns. Therefore, it is advisable for traders to approach HTFX with caution or consider alternative, more regulated brokers for their trading needs.

For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA or ASIC should be prioritized, ensuring a safer trading environment.

Is HTFX a scam, or is it legit?

The latest exposure and evaluation content of HTFX brokers.

HTFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HTFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.