Regarding the legitimacy of VONWAY forex brokers, it provides AOFA and WikiBit, (also has a graphic survey regarding security).

Is VONWAY safe?

Pros

Cons

Is VONWAY markets regulated?

The regulatory license is the strongest proof.

AOFA Forex Trading License (EP)

Anjouan Offshore Finance Authority

Anjouan Offshore Finance Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

VONWAY GLOBAL LIMITED

Effective Date:

2025-02-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Vonway A Scam?

Introduction

Vonway is a forex broker that has positioned itself in the competitive landscape of online trading, offering a variety of trading instruments including forex, commodities, indices, and cryptocurrencies. Established in 2017, it claims to provide traders with attractive conditions such as low spreads and high leverage options. However, the forex market is rife with risks, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective analysis of Vonway, assessing its legitimacy and safety by examining its regulatory status, company background, trading conditions, customer experiences, and overall risks.

To ensure a comprehensive evaluation, this investigation draws upon a variety of online sources, including expert reviews, regulatory databases, and customer feedback. The assessment framework focuses on key aspects such as regulation, company history, trading conditions, customer fund safety, and user experience.

Regulation and Legitimacy

One of the most critical factors in determining a broker's credibility is its regulatory status. Regulatory bodies exist to protect investors, ensuring that brokers adhere to strict guidelines that promote transparency and fair trading practices. In the case of Vonway, the broker claims to operate under the auspices of various regulatory authorities, including the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA) and the Hong Kong Securities and Futures Commission (SFC). However, investigations reveal discrepancies in these claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 24611 IBC 2018 | St. Vincent & the Grenadines | Not Validated |

| SFC | N/A | Hong Kong | Not Licensed |

The SVG FSA does not regulate forex trading, and the registration number associated with Vonway has been found to belong to a different entity, raising significant red flags. Furthermore, a search of the SFC's database shows no record of Vonway being authorized to operate as a forex broker in Hong Kong. This lack of credible regulatory oversight leaves traders vulnerable, as their funds are not protected by any legal framework. Consequently, the absence of regulation is a major concern for potential investors, suggesting that Vonway may operate outside the bounds of legal trading practices.

Company Background Investigation

Vonway's history is relatively short, having been established in 2017. The company claims to be registered in Hong Kong, and its official address is listed as Room 606, 6/F, Hollywood Centre, 77-91 Queen's Road West, Sheung Wan, Hong Kong. However, the opacity surrounding its ownership structure and management team raises questions about its operational transparency.

While the company presents itself as a legitimate broker, the lack of detailed information regarding its founders and management team is a cause for concern. A reputable broker typically provides insights into its leadership, including their professional backgrounds and expertise in the financial industry. The absence of such information may indicate a lack of accountability and transparency, further eroding trust among potential clients.

Moreover, Vonway's communication regarding its regulatory status has been inconsistent, shifting from claims of being registered with the SVG FSA to its current assertion of being incorporated in Hong Kong. This inconsistency can be perceived as a tactic to mislead potential clients about its legitimacy and operational compliance. Therefore, the company's lack of transparency and the dubious nature of its regulatory claims significantly undermine its credibility in the forex market.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. Vonway offers two primary account types: a standard account and a raw spread account. The standard account claims to have competitive spreads starting from 0.6 pips with no commission, while the raw spread account boasts spreads from 0.0 pips with a commission of $7 per lot.

| Fee Type | Vonway | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 0.5 - 1.0 pips |

| Commission Model | $7 per lot (Raw) | $5 - $10 per lot |

| Overnight Interest Range | Not Specified | Varies by broker |

The fee structure appears competitive, particularly with the raw spread account. However, potential traders should be cautious of the actual execution conditions, as advertised spreads may not reflect real market conditions. Moreover, the lack of clarity regarding overnight interest rates and other possible hidden fees could lead to unexpected trading costs.

Additionally, the promise of low spreads and high leverage (up to 1:2000) is often a marketing tactic used by brokers to attract traders. While high leverage can amplify profits, it also increases the risk of significant losses. Thus, traders must carefully consider their risk tolerance and trading strategies before engaging with Vonway.

Customer Fund Safety

The safety of customer funds is a crucial aspect of any trading platform. Vonway claims to implement various safety measures, including fund segregation and negative balance protection. Fund segregation ensures that client funds are kept separate from the broker's operational funds, theoretically protecting them in the event of insolvency. However, the effectiveness of these measures is questionable given the broker's lack of regulatory oversight.

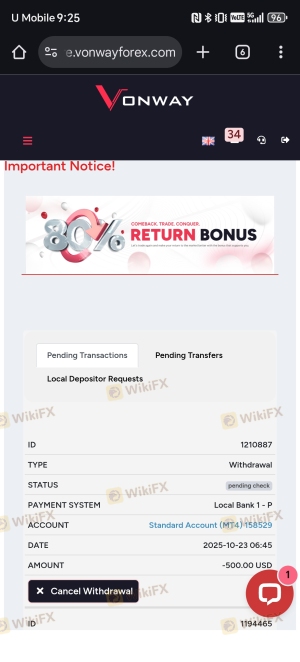

Moreover, the absence of a robust investor protection scheme raises concerns about the safety of funds deposited with Vonway. Regulatory bodies typically enforce strict requirements for fund management, ensuring that brokers maintain sufficient capital reserves and adhere to best practices in fund handling. In Vonway's case, the lack of such oversight means that traders have limited recourse if issues arise regarding fund mismanagement or withdrawal difficulties.

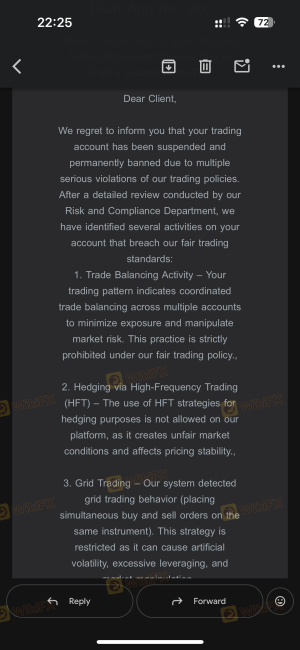

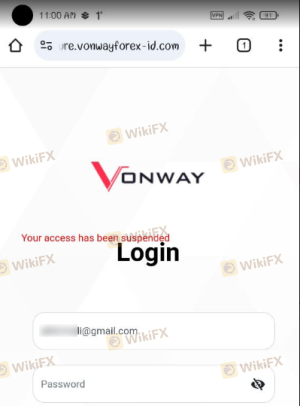

Historically, there have been complaints from users regarding difficulties in withdrawing funds, which points to potential operational issues within the broker. This history of withdrawal problems is a significant red flag, indicating that traders may face challenges accessing their funds when needed.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Vonway are mixed, with many users expressing dissatisfaction with the platform's customer service and withdrawal processes. Common complaints include difficulty in retrieving funds, unresponsive customer support, and issues related to bonus claims.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Unresponsive |

| Bonus Mismanagement | Medium | Limited Clarity |

One notable case involved a trader who reported significant delays in withdrawing their funds, leading to frustration and loss of trust in the platform. Another user expressed disappointment with the lack of clarity regarding bonus terms, which contributed to their negative experience.

These patterns of complaints highlight a concerning trend that potential investors should consider when evaluating Vonway. A reliable broker should offer responsive customer support and transparent policies, ensuring that clients feel secure in their trading environment.

Platform and Trade Execution

The performance of a broker's trading platform is critical for a successful trading experience. Vonway utilizes the widely popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and extensive features. However, the stability and execution quality of the platform are paramount.

Feedback from users suggests that while the MT4 platform is functional, there have been instances of slippage and order rejections, which can significantly impact trading outcomes. Traders have reported experiencing delays during high volatility periods, raising concerns about the platform's reliability.

Furthermore, the absence of clear evidence regarding the broker's order execution practices—such as the potential for price manipulation or requotes—adds to the uncertainty surrounding Vonway's operations. A broker that lacks transparency in its execution policies may not be trustworthy, especially for high-frequency traders or those employing automated strategies.

Risk Assessment

Engaging with an unregulated broker like Vonway poses several risks for traders. The absence of oversight means that there are no guarantees regarding the safety of funds or the integrity of trading practices.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No credible regulation or oversight. |

| Fund Safety | High | Potential for mismanagement of client funds. |

| Withdrawal Difficulties | Medium | Historical complaints about withdrawal issues. |

| Execution Quality | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research before choosing to engage with Vonway. It is advisable to start with a demo account, if available, to gauge the platform's performance without risking real funds. Additionally, traders should consider setting strict risk management protocols and only investing amounts they can afford to lose.

Conclusion and Recommendations

In summary, the evidence suggests that Vonway raises significant concerns regarding its legitimacy and reliability as a forex broker. The lack of regulatory oversight, coupled with a history of customer complaints related to withdrawals and service quality, paints a troubling picture.

While Vonway offers competitive trading conditions, the risks associated with trading through an unregulated broker cannot be overlooked. Traders are advised to exercise extreme caution and consider alternative, more reputable brokers that are subjected to regulatory scrutiny.

For those seeking safer trading environments, consider exploring brokers with established regulatory frameworks, such as IG, OANDA, or Forex.com, which provide the necessary protections and transparency that Vonway lacks. In the world of forex trading, prioritizing safety and reliability is paramount to ensuring a successful trading experience.

Is VONWAY a scam, or is it legit?

The latest exposure and evaluation content of VONWAY brokers.

VONWAY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VONWAY latest industry rating score is 2.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.