CF 2025 Review: Everything You Need to Know

Summary

This cf review looks at a platform that works in the CFD trading space. The platform offers various tools and services for people who trade in the markets. CF gives users access to Cloud Foundry Command Line Interface tools and supports both standard brokers and space-scoped brokers. The platform seems designed for experienced traders who understand CFD instruments and advanced trading strategies.

CFDs are complex financial tools that let traders bet on price changes without owning the actual assets. These instruments work across many asset types including forex, shares, and cryptocurrencies. However, we found limited information about CF's rules, account details, and trading terms. The platform focuses heavily on technical tools through cf CLI, which suggests it targets more technical users.

Our research shows that CF might work well for experienced traders who want advanced tools. Potential users should be careful because the platform lacks transparency about important things like rules and account terms.

Important Notice

This review uses publicly available information and user feedback from different sources. The platform has limited regulatory and operational details available, so traders should do more research before using it. Our review method includes user experiences, technical documents, and industry standards to give an objective analysis.

We could not find information about differences between regional entities from available sources. Traders should check the regulatory status in their area before starting any trading activities.

Rating Framework

Broker Overview

CF works in the financial services sector and focuses on CFD trading tools and technical solutions. The platform gives access to Contract for Differences, which are tradeable instruments that follow underlying security or asset prices. These financial products work best for experienced traders who understand the risks of leveraged trading and price speculation.

The platform has a strong technical foundation with Cloud Foundry Command Line Interface tools and complete broker management systems. CF supports two different broker types: standard brokers created through cf create-service-broker commands and space-scoped brokers using --space-scoped flags. This technical complexity shows the platform targets users with advanced technical knowledge and trading experience.

We don't have specific information about when the company started or detailed corporate background. The platform's connection with Cloud Foundry infrastructure shows it focuses on scalable, enterprise-level solutions. The cf review process shows a technically-focused approach that may appeal to institutional traders and sophisticated retail clients who want advanced trading infrastructure.

Regulatory Status: Available documents don't detail specific regulatory information, so potential users must verify compliance status on their own.

Deposit and Withdrawal Methods: Current documents don't specify supported payment methods or procedures for fund transfers.

Minimum Deposit Requirements: Available materials don't mention specific minimum deposit amounts.

Promotions and Bonuses: Accessible documents don't detail promotional offers or bonus structures.

Tradeable Assets: The platform focuses on CFD instruments across multiple asset classes including forex, shares, and cryptocurrencies, but specific asset lists aren't provided.

Cost Structure: Current documents don't have detailed information about spreads, commissions, and other trading costs.

Leverage Ratios: Available materials don't mention specific leverage offerings.

Platform Options: The platform uses Cloud Foundry Command Line Interface tools, but traditional trading platform specifications aren't detailed.

Geographic Restrictions: Current documents don't specify regional availability and restrictions.

Customer Support Languages: Available materials don't mention supported languages for customer service.

This cf review shows significant information gaps that potential traders should address through direct platform contact before opening accounts.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for CF shows major information limitations that affect our assessment. Available documents don't specify different account types, minimum deposit requirements, or detailed account features that usually characterize professional trading platforms. This lack of transparency about basic account parameters creates uncertainty for potential traders who want to understand their options.

Documents don't detail account opening procedures and verification requirements, making it hard for prospective users to prepare necessary paperwork or understand timeline expectations. The absence of information about special account types, such as Islamic accounts for religious compliance or professional trader categories, further limits our ability to assess the platform's inclusivity and regulatory compliance. Without specific details about account funding requirements, maintenance fees, or inactivity charges, traders can't accurately assess the total cost of maintaining an account with CF.

This information gap represents a significant concern in our cf review because transparent account conditions are fundamental to informed trading decisions. The platform's focus on technical infrastructure through cf CLI tools suggests a more sophisticated user base, but the lack of clear account tier structures or benefits makes it challenging to determine how the platform serves different trader segments effectively.

CF shows strong technical capabilities through its Cloud Foundry Command Line Interface implementation. The platform supports both standard brokers and space-scoped brokers within its ecosystem. The platform's technical infrastructure appears well-developed, using cf CLI v6 for database schema migrations and task execution.

This technical sophistication indicates a robust foundation for trading operations. The broker management system supports encrypted basic authentication for security, with credentials stored securely in the Cloud Controller database. This architecture suggests enterprise-level security considerations and scalable infrastructure design.

The distinction between standard brokers and space-scoped brokers provides flexibility for different operational requirements. However, available documents lack details about traditional trading tools such as charting packages, technical analysis indicators, or automated trading system support. Educational resources, market research, and analysis tools aren't mentioned in current materials, which limits the platform's appeal to traders seeking comprehensive trading support.

The platform's technical orientation may appeal to users with programming backgrounds or institutional clients requiring API access and custom integration capabilities. This focus may exclude traders seeking user-friendly graphical interfaces and educational support.

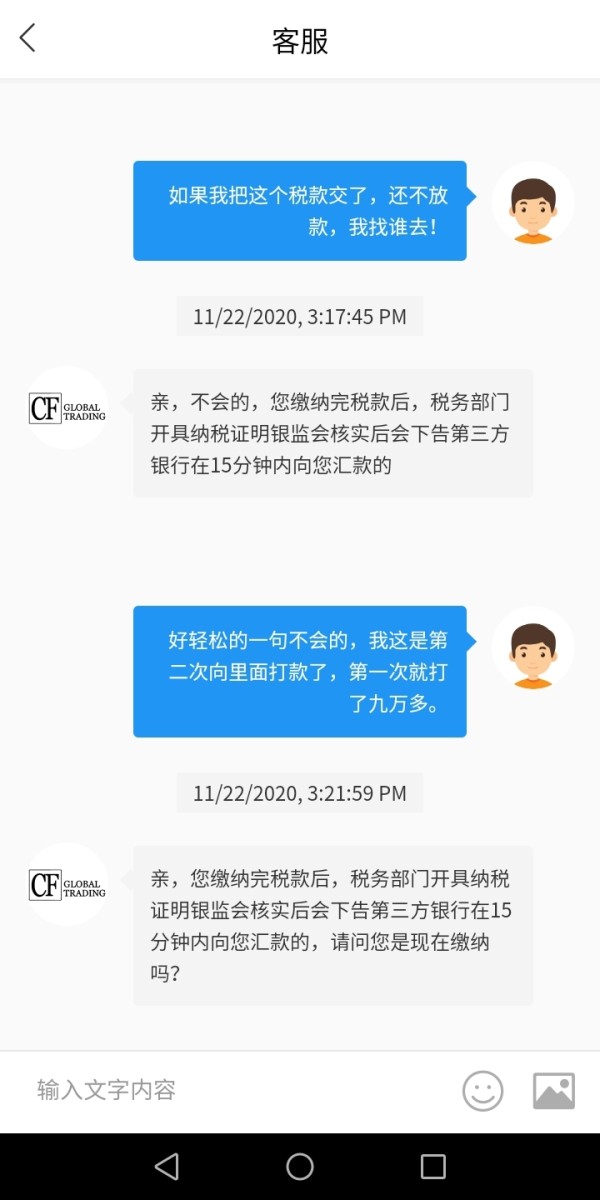

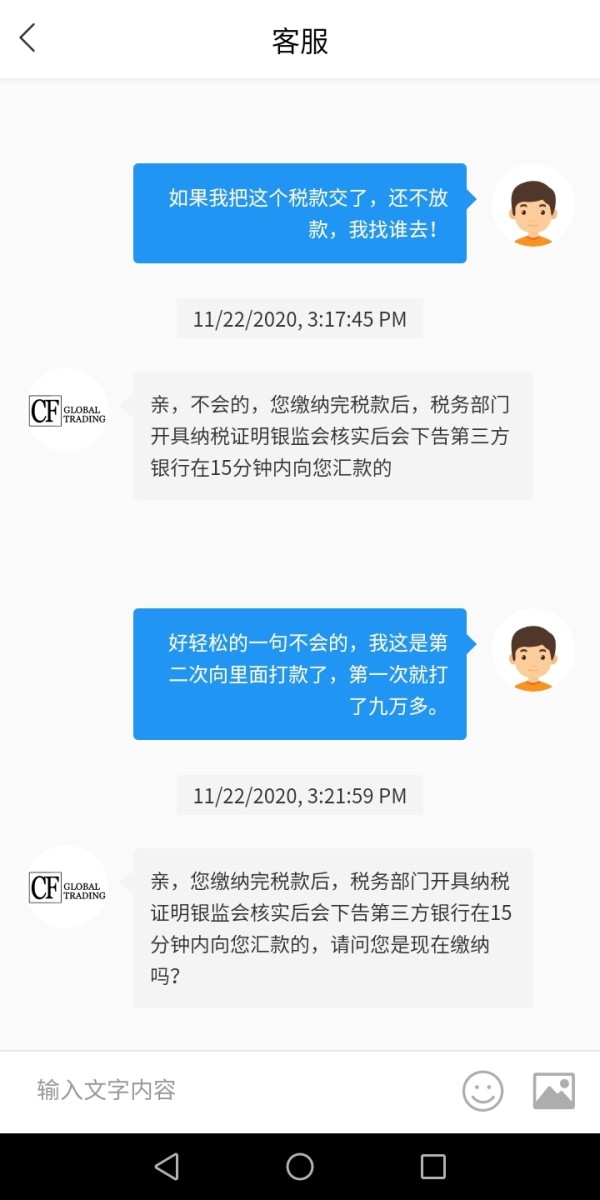

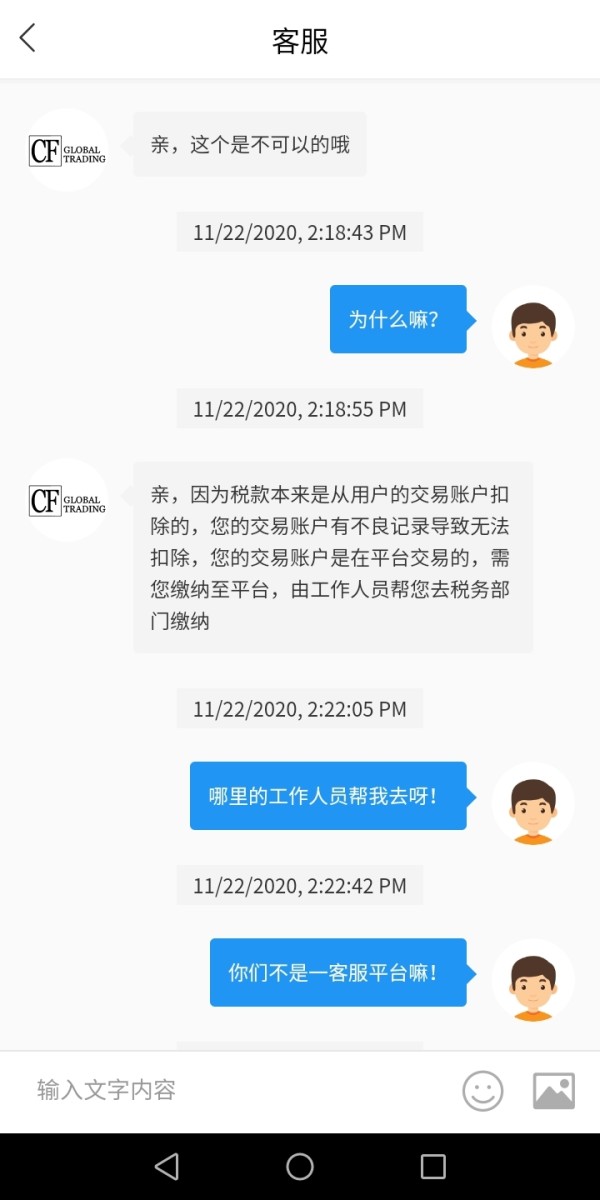

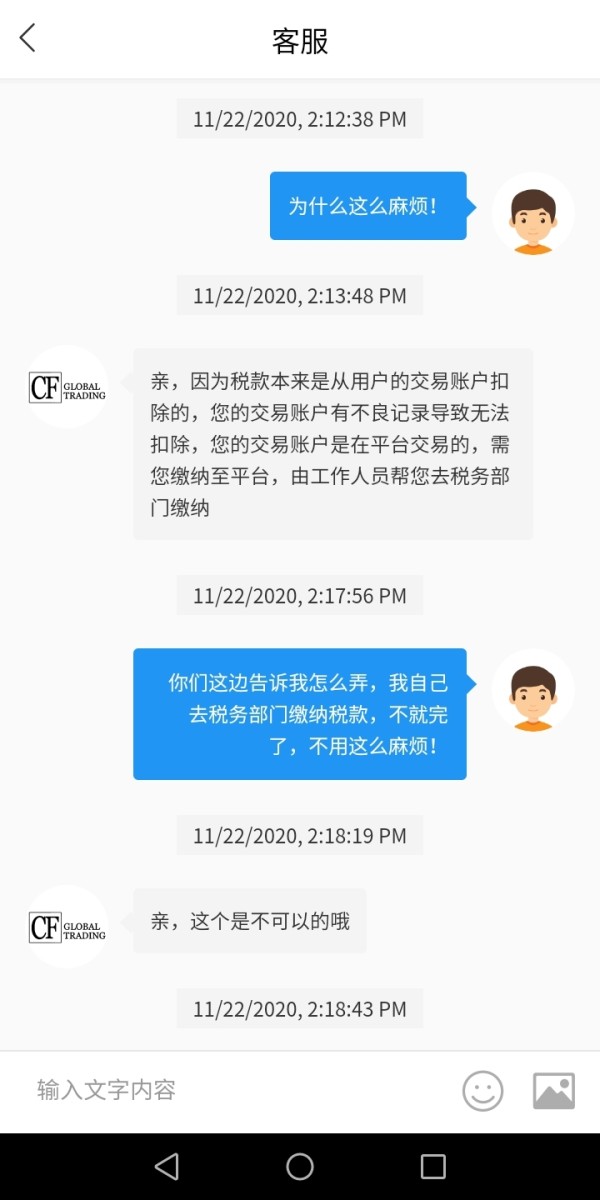

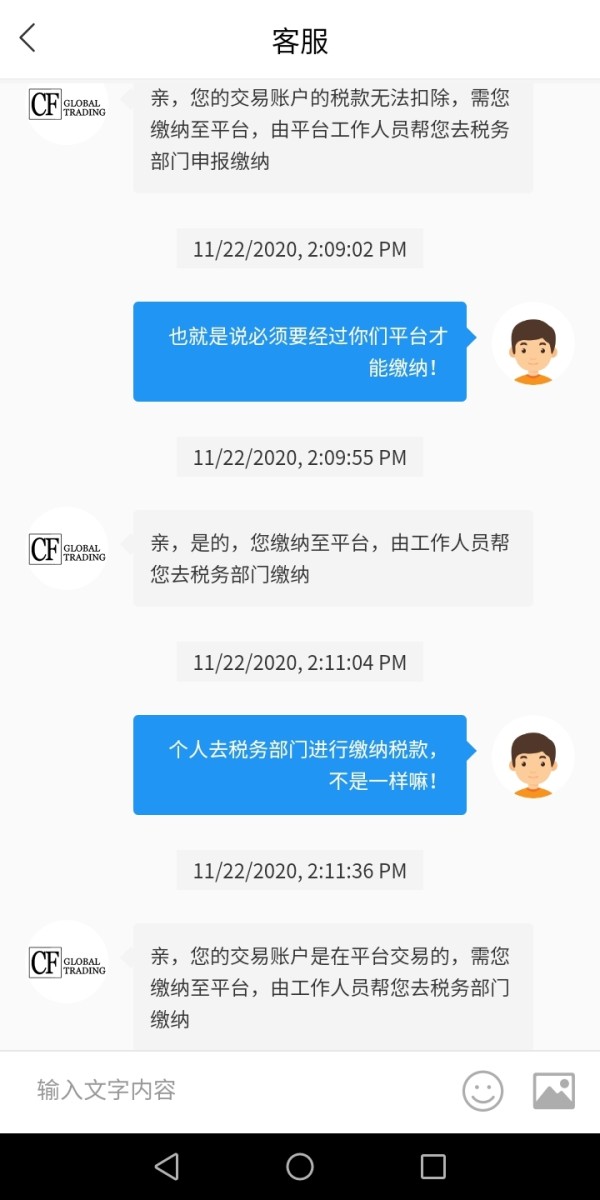

Customer Service and Support Analysis (4/10)

Customer service information is notably absent from available CF documents. This creates significant concerns about support accessibility and quality. No details are provided about contact methods, support hours, or response time expectations, which are crucial factors for active traders requiring assistance.

The lack of information about multilingual support capabilities raises questions about the platform's international accessibility and commitment to serving diverse user bases. Without details about support ticket systems, live chat availability, or telephone support, potential users can't assess whether the platform meets their service expectations. Problem resolution procedures and escalation processes aren't documented, leaving traders uncertain about how issues would be addressed.

This absence of support information is particularly concerning for CFD trading, where technical issues or account problems can have immediate financial implications. The platform's technical focus suggests users may need substantial self-service capabilities, but without documented support resources or community forums, even technically proficient users may face challenges when encountering platform-specific issues.

Trading Experience Analysis (6/10)

The trading experience evaluation centers on CF's CFD offerings, which are specifically designed for experienced traders familiar with leveraged trading risks. CFDs allow price speculation without asset ownership, providing flexibility for various trading strategies across multiple asset classes including forex, shares, and cryptocurrencies. Platform stability and execution quality can't be assessed from available documents, though the Cloud Foundry infrastructure suggests enterprise-level reliability standards.

The technical architecture supporting broker management and database operations indicates robust backend systems, though user-facing trading interface quality remains unclear. Mobile trading capabilities and platform accessibility across different devices aren't detailed in current materials, which is increasingly important for active traders requiring constant market access. The absence of information about order types, execution speeds, and trading tools limits our ability to assess the complete trading experience.

This cf review notes that while the underlying CFD instruments are suitable for experienced traders, the lack of detailed platform specifications makes it difficult to evaluate whether the trading environment meets modern trader expectations for functionality and user experience.

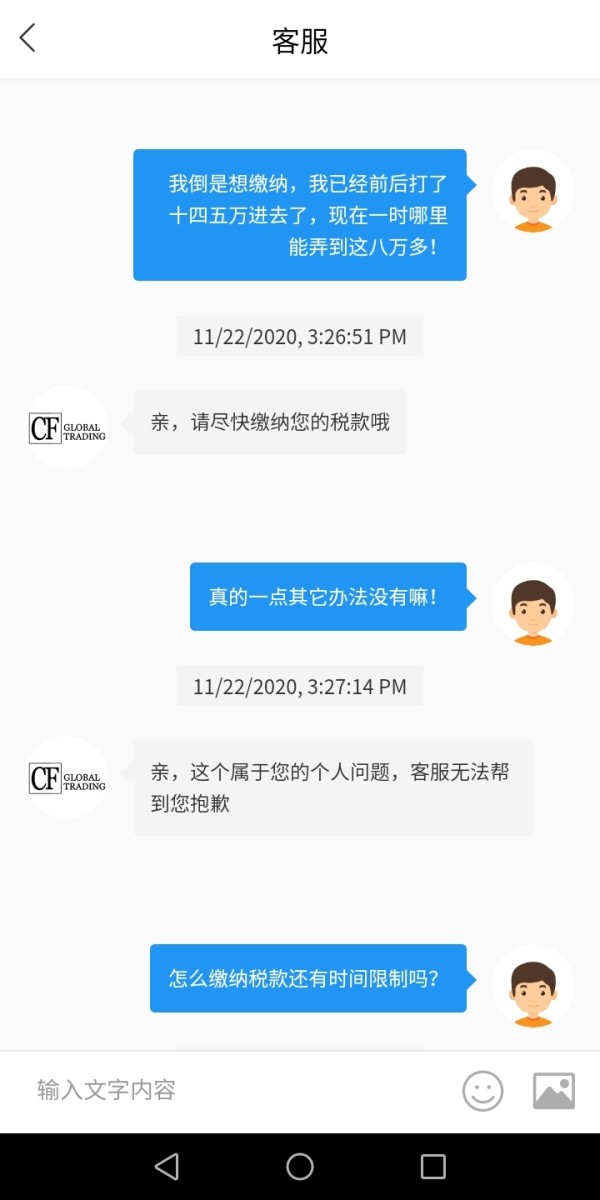

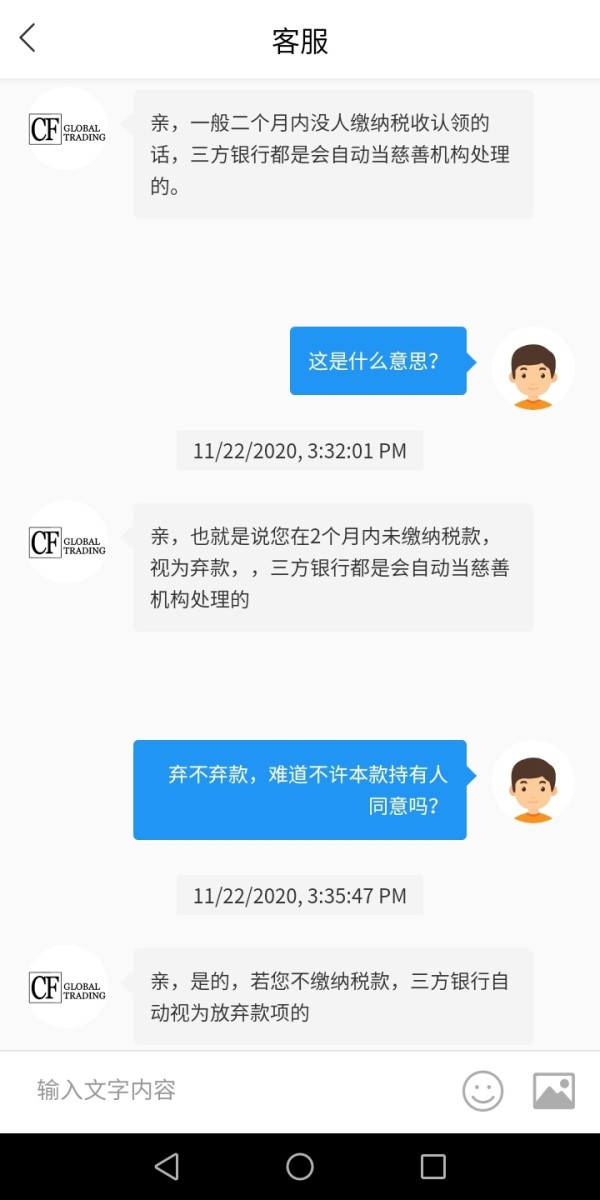

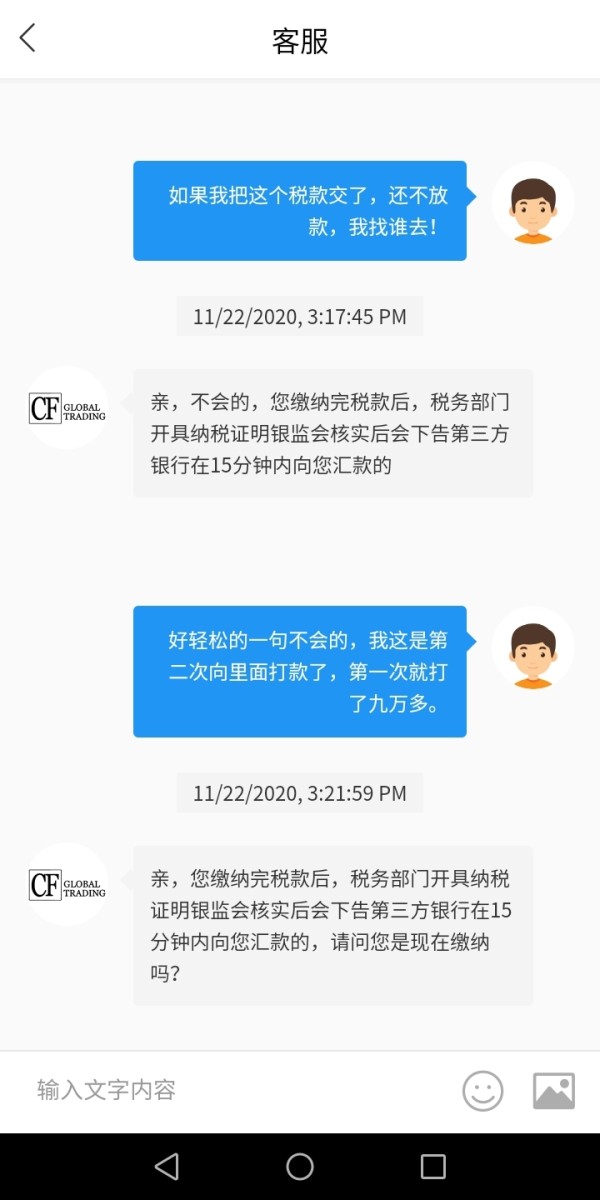

Trust and Security Analysis (3/10)

Trust and security assessment reveals significant information gaps about regulatory oversight and fund protection measures. No specific regulatory licenses or compliance certifications are mentioned in available documents, creating uncertainty about the platform's legal status and operational oversight. Fund segregation policies, deposit protection schemes, and regulatory capital requirements aren't detailed, which are fundamental security considerations for any trading platform.

The absence of information about third-party audits, financial reporting, or regulatory compliance monitoring raises concerns about transparency and accountability. Company ownership structure, management team information, and corporate governance details aren't available, limiting users' ability to assess the platform's stability and leadership credibility. Without clear regulatory framework information, traders can't determine what protections may be available in case of disputes or operational issues.

The platform's technical security measures, while including encrypted authentication for broker communications, lack comprehensive documentation about user data protection, cybersecurity protocols, and financial transaction security measures that modern traders expect from professional platforms.

User Experience Analysis (5/10)

User experience evaluation reveals mixed feedback patterns, particularly about understanding and expectations. Available information suggests some users experience confusion about platform concepts and functionality, indicating potential onboarding or communication challenges. One source notes "many wrong perspectives and understandings" suggesting that user education and platform clarity may need improvement.

The technical nature of cf CLI tools and broker management systems may create accessibility barriers for traders seeking straightforward, intuitive trading interfaces. While this technical approach may appeal to sophisticated users, it could alienate retail traders expecting user-friendly graphical interfaces and simplified navigation. Registration and verification processes aren't detailed in available documents, making it impossible to assess the user onboarding experience.

Without information about account setup procedures, document requirements, or verification timelines, potential users can't prepare adequately for the registration process. The platform appears designed for experienced traders familiar with CFD instruments and technical trading concepts, which naturally limits its appeal to broader retail markets but may provide value for its target demographic seeking advanced trading infrastructure and technical capabilities.

Conclusion

This comprehensive cf review reveals a platform with strong technical infrastructure but significant transparency limitations that impact overall assessment. CF appears designed for experienced traders seeking CFD trading opportunities and advanced technical tools, particularly those comfortable with Cloud Foundry Command Line Interface systems and broker management protocols. The platform's main strengths include robust technical architecture and sophisticated broker support systems, making it potentially suitable for institutional clients or technically proficient retail traders.

However, substantial information gaps about regulatory status, account conditions, customer support, and detailed trading terms create significant concerns for potential users. Our analysis suggests CF may serve experienced traders seeking technical trading solutions, but the lack of comprehensive platform information makes it difficult to recommend without additional due diligence. Prospective users should conduct thorough research and direct platform contact to obtain missing operational details before proceeding with account opening procedures.