JMI 2025 Review: Everything You Need to Know

In the ever-evolving world of forex trading, JMI Brokers has emerged as a noteworthy player since its inception in 2016. However, user experiences and expert analyses present a mixed bag of opinions, with some praising its features while others express significant concerns regarding its reliability and regulatory status. This review will delve into the essential aspects of JMI Brokers, highlighting both its strengths and weaknesses, to help potential traders make informed decisions.

Note: It is crucial to recognize that JMI operates under various regional entities, which can impact its regulatory oversight. Our review aims to provide a balanced perspective based on available information and user feedback.

Rating Summary

How We Rated the Broker: Our ratings are based on a comprehensive analysis of user experiences, expert opinions, and factual data gathered from various sources.

Broker Overview

Founded in 2016, JMI Brokers is headquartered in the United Arab Emirates and regulated by the Vanuatu Financial Services Commission (VFSC). While it offers a range of trading platforms, including the popular MetaTrader 4 (MT4), it primarily focuses on forex pairs, indices, commodities, and CFDs. Despite its appealing features, the offshore regulation raises concerns about investor protection and the overall trustworthiness of the broker.

Detailed Analysis

Regulatory Framework

JMI Brokers operates under the jurisdiction of Vanuatu, which is known for its lenient regulatory environment. While this may attract some traders, it also poses risks, as the VFSC does not provide the same level of oversight as more stringent regulators like the UK's FCA or Australia's ASIC. This lack of robust regulation has led to skepticism among potential investors regarding the safety of their funds.

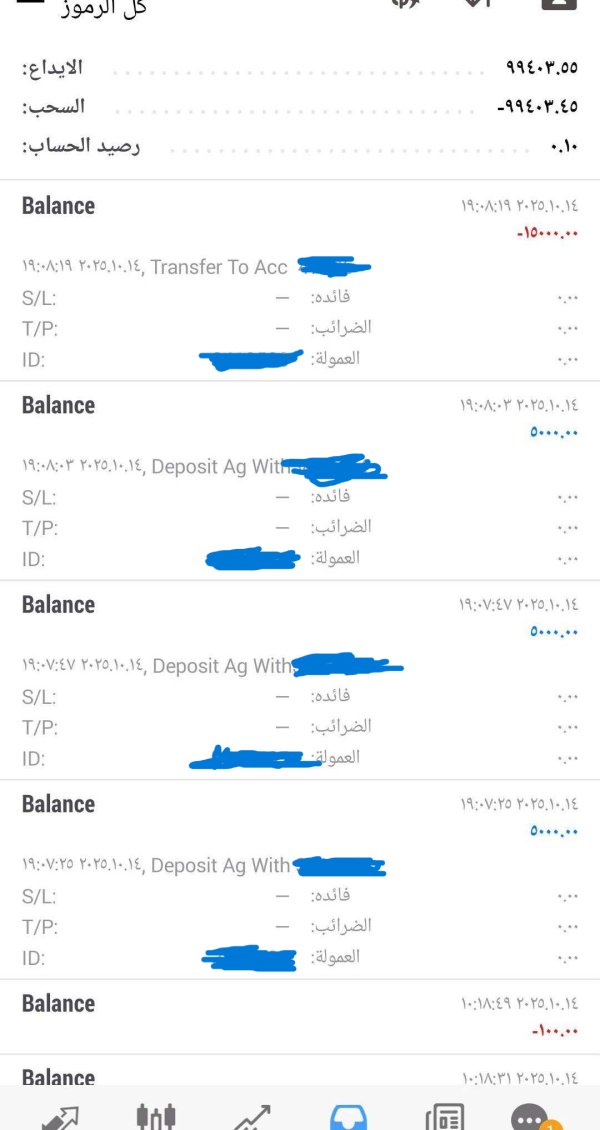

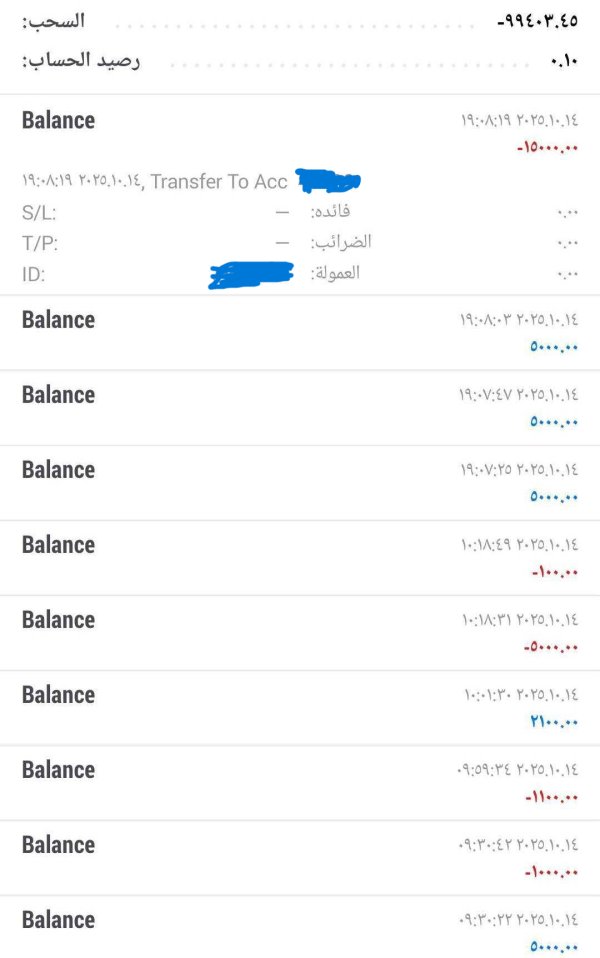

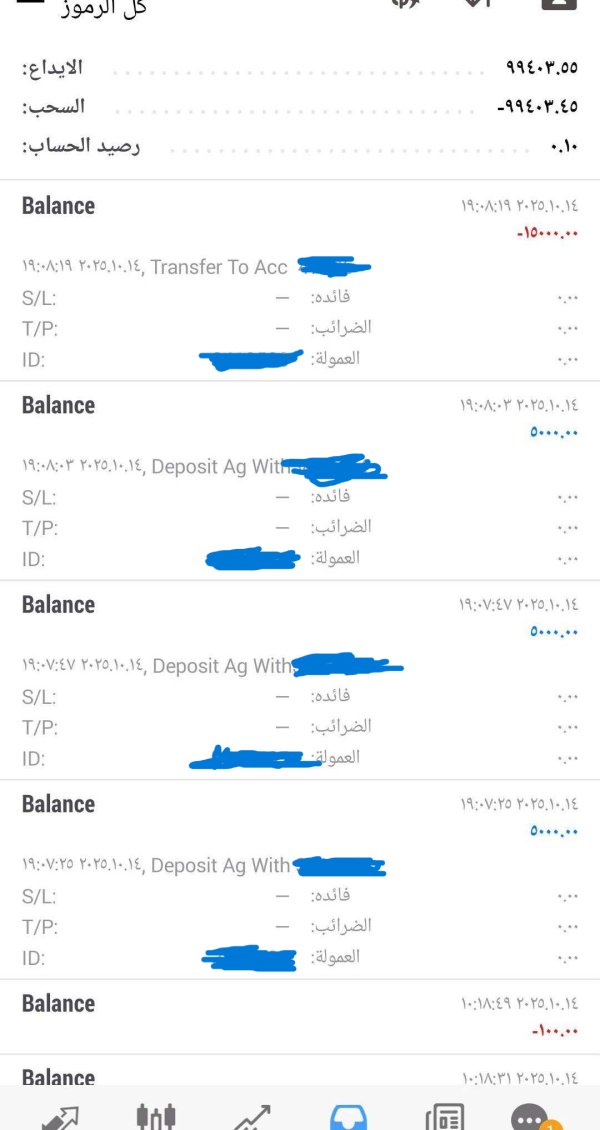

Deposit and Withdrawal Options

JMI Brokers accepts various currencies for deposits and withdrawals, including USD and EUR, and offers payment methods such as credit/debit cards, wire transfers, Neteller, and Skrill. The minimum deposit required to open an account is $100, making it accessible for new traders. However, user feedback indicates that withdrawal processes can be slow, with some traders reporting delays of over a week, which raises concerns about the efficiency of their operations.

Currently, JMI Brokers does not offer any notable bonuses or promotions, which may be a downside for traders looking for incentives to open an account. This lack of promotional offers contrasts with many competitors that frequently provide bonuses to attract new clients.

Tradable Asset Classes

Traders at JMI Brokers can access a wide range of asset classes, including over 25 forex pairs, precious metals, energy commodities, and stock indices. This variety allows for diversification in trading strategies. However, some users have reported that spreads on major currency pairs, such as EUR/USD, can start at 2 pips, which is higher than the industry average, potentially impacting profitability.

Cost Structure

The cost of trading with JMI Brokers consists mainly of spreads, with no commissions reported for forex trading. However, users have expressed dissatisfaction with the high spreads, particularly in volatile market conditions. Additionally, there is a $25 commission per lot for stock trading, which may deter some traders.

Leverage Options

JMI Brokers offers leverage up to 1:400 on its micro accounts, which may appeal to traders looking to maximize their trading potential. However, such high leverage also increases the risk of significant losses, emphasizing the need for careful risk management.

The broker provides access to the widely-used MetaTrader 4 platform, which is known for its user-friendly interface and extensive analytical tools. While MT4 is a robust platform, some users have reported issues with its performance, particularly when executing trades.

Restricted Regions

JMI Brokers claims to accept clients from around the world; however, potential traders should verify their local regulations to ensure compliance, as some jurisdictions may impose restrictions on trading with offshore brokers.

Customer Support

Customer service at JMI Brokers has received mixed reviews. While some users praise the responsiveness and professionalism of the support team, others have reported difficulties in getting timely assistance. The lack of multilingual support may also be a barrier for non-English speaking clients.

Repeated Rating Summary

Detailed Breakdown

-

Account Conditions (6/10): JMI Brokers offers multiple account types, including micro, standard, and pro accounts, catering to different trading needs. However, the minimum deposit requirement and high spreads may deter some traders.

Tools and Resources (5/10): The MT4 platform provides essential trading tools, but the lack of educational resources can hinder novice traders from improving their skills.

Customer Service and Support (4/10): While some users report satisfactory experiences, the inconsistency in service quality raises concerns about the reliability of customer support.

Trading Setup (Experience) (6/10): The trading experience on MT4 is generally positive, but performance issues have been reported, particularly during high volatility.

Trustworthiness (3/10): Operating under offshore regulation significantly impacts JMI's trustworthiness, with many users expressing concerns about fund safety.

User Experience (5/10): User experiences vary widely, with some traders satisfied with their overall trading experience, while others report significant issues with withdrawals and platform performance.

In conclusion, while JMI Brokers offers a range of features and competitive trading conditions, potential traders should carefully consider the risks associated with its offshore regulatory status and mixed user feedback. Conducting thorough research and weighing the pros and cons is essential before deciding to engage with JMI Brokers.