FOREXimf 2025 Review: Everything You Need to Know

Executive Summary

This detailed foreximf review looks at a forex broker that gets attention for its high leverage and regulatory status. However, people question how reliable it really is. FOREXimf says it's a regulated broker that works under Indonesian rules, offering good trading conditions with a low $100 minimum deposit and leverage up to 1:500.

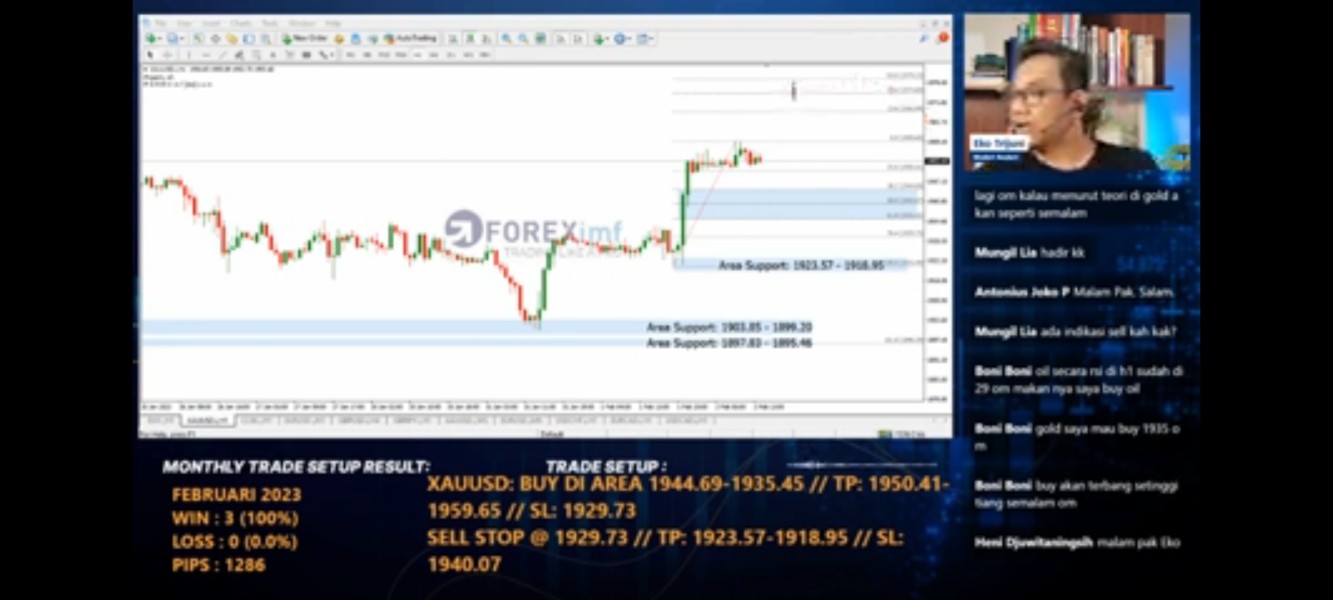

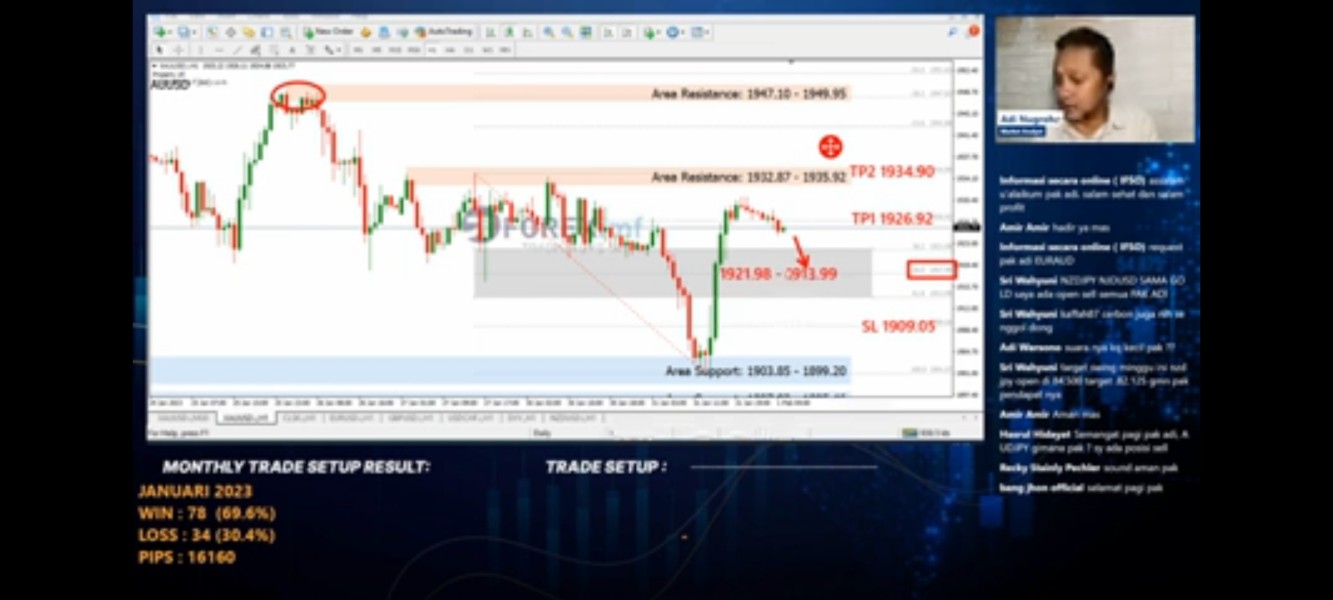

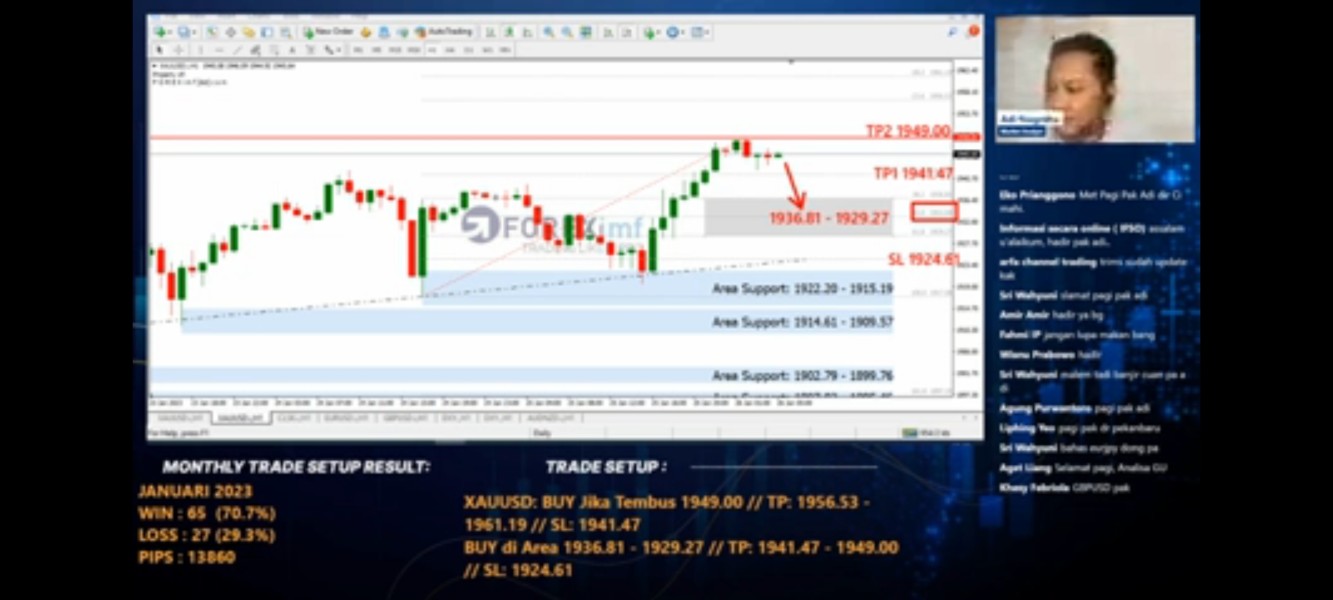

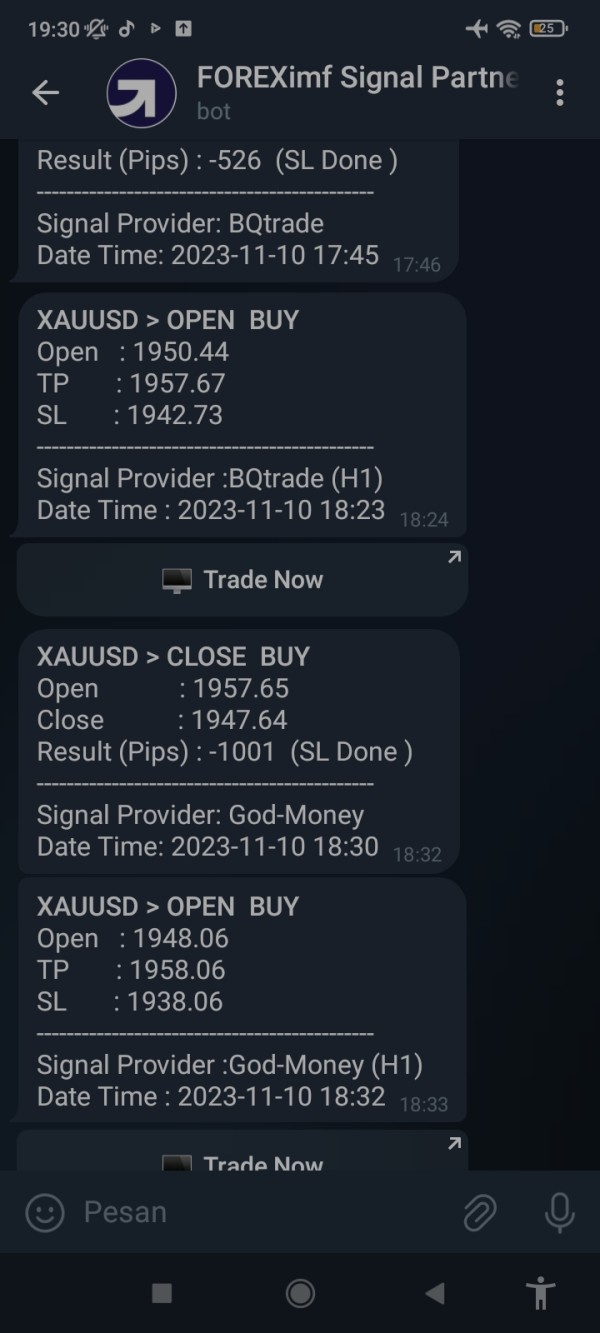

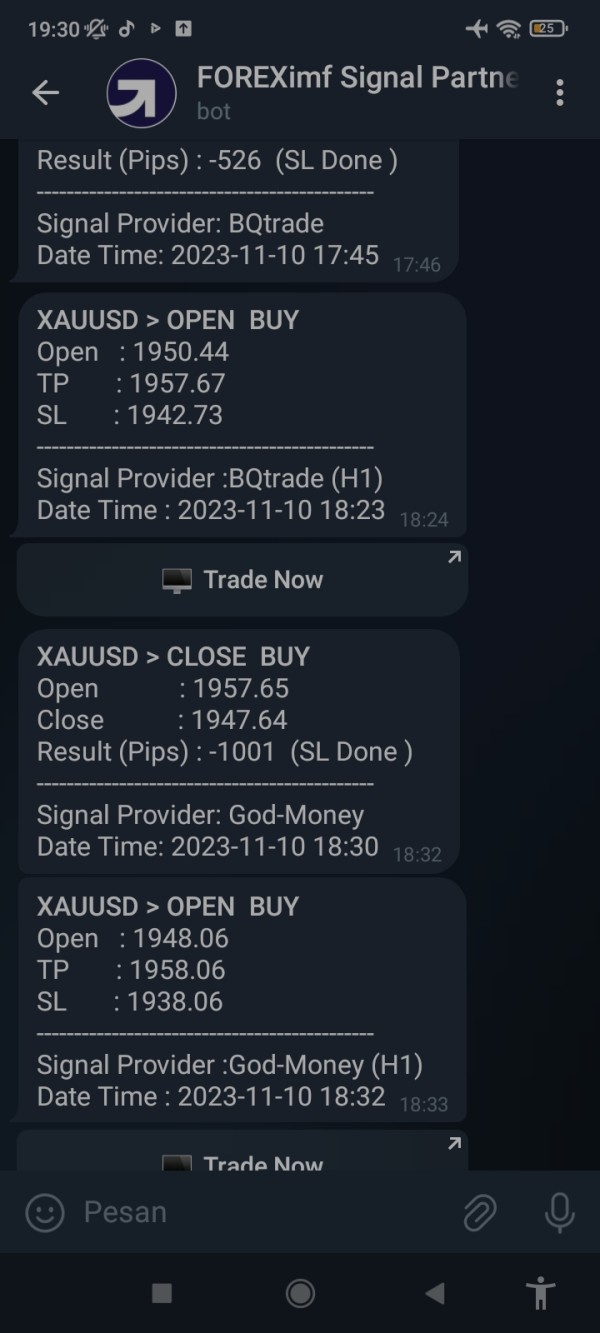

The broker mainly targets traders who want high-leverage chances across different skill levels. New traders like the low minimum deposit, while experienced traders want to make their positions bigger. FOREXimf gives access to many asset types including forex pairs, precious metals like gold and silver, and energy items such as oil through the popular MetaTrader 4 platform.

But this broker works in a tough market where user reviews show mixed feelings. Some traders like the good trading conditions and learning materials, but others worry about whether the broker is real and reliable for the long term. The rules come mainly from Indonesian authorities BAPPEBTI and ICDX, which gives some oversight, though questions remain about how the broker works in markets outside Indonesia.

Important Disclaimers

FOREXimf's regulatory status changes a lot across different areas, with its main oversight coming from Indonesian regulatory bodies BAPPEBTI and ICDX. This regional focus might affect how people judge the broker's legitimacy and reliability, especially for traders working outside the Indonesian market. Potential clients should think carefully about how this regulatory limit might affect their trading experience and legal protections.

This review uses public information and user feedback collected from various sources as of 2025. The forex industry changes quickly, and broker conditions, regulatory status, and service quality can shift rapidly. Readers should check current information directly with the broker and relevant regulatory authorities before making any trading decisions.

Overall Rating Framework

Broker Overview

FOREXimf works as an Indonesian-based forex broker that has placed itself in the competitive online trading world by offering high-leverage trading chances across multiple financial tools. The broker focuses on giving accessible trading solutions with special attention to helping traders who want big leverage ratios for their trading strategies.

The company's business model centers on offering forex trading alongside other financial tools including precious metals and energy items. While specific founding details stay unclear in available documents, FOREXimf has made itself known as a broker that serves both new and experienced traders through its low entry requirements and educational resource offerings.

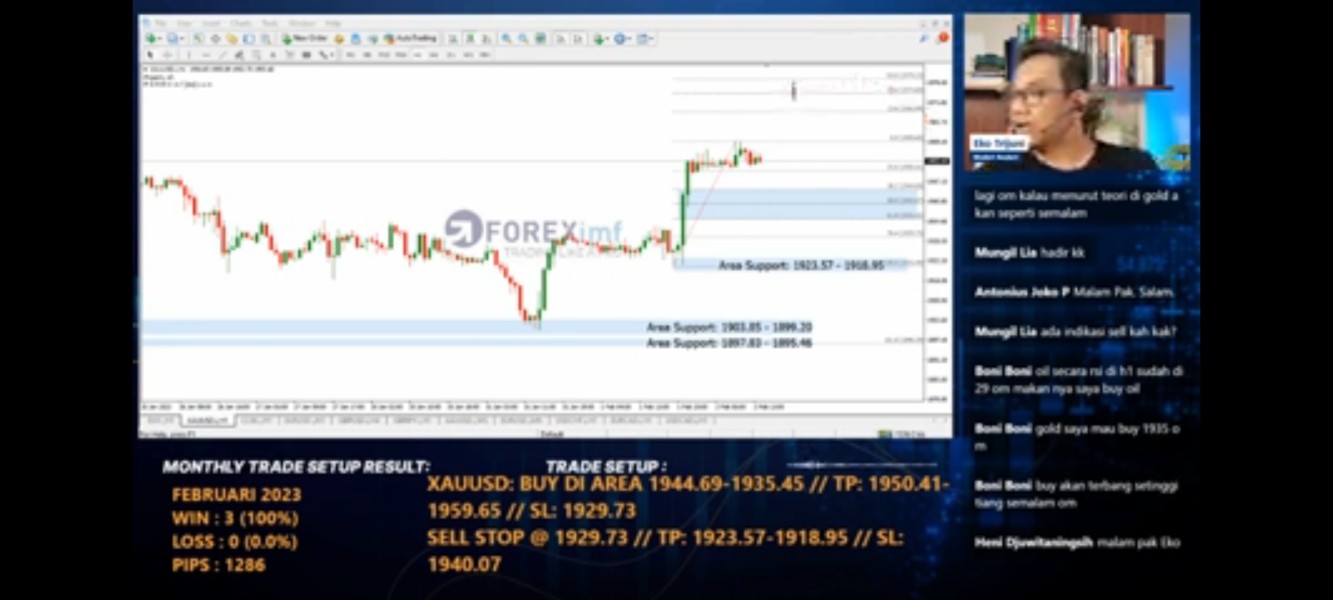

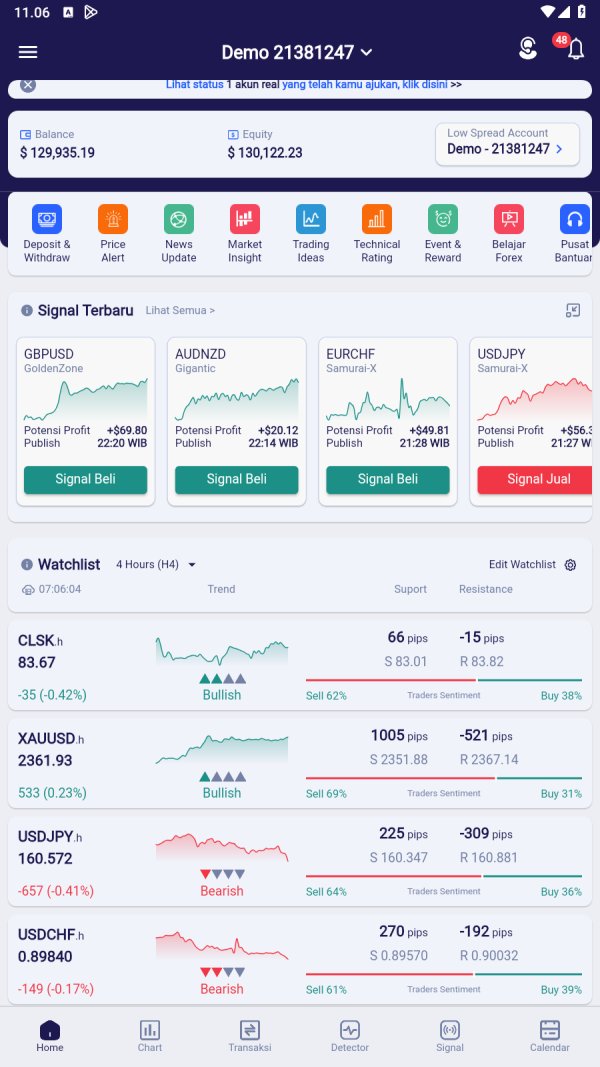

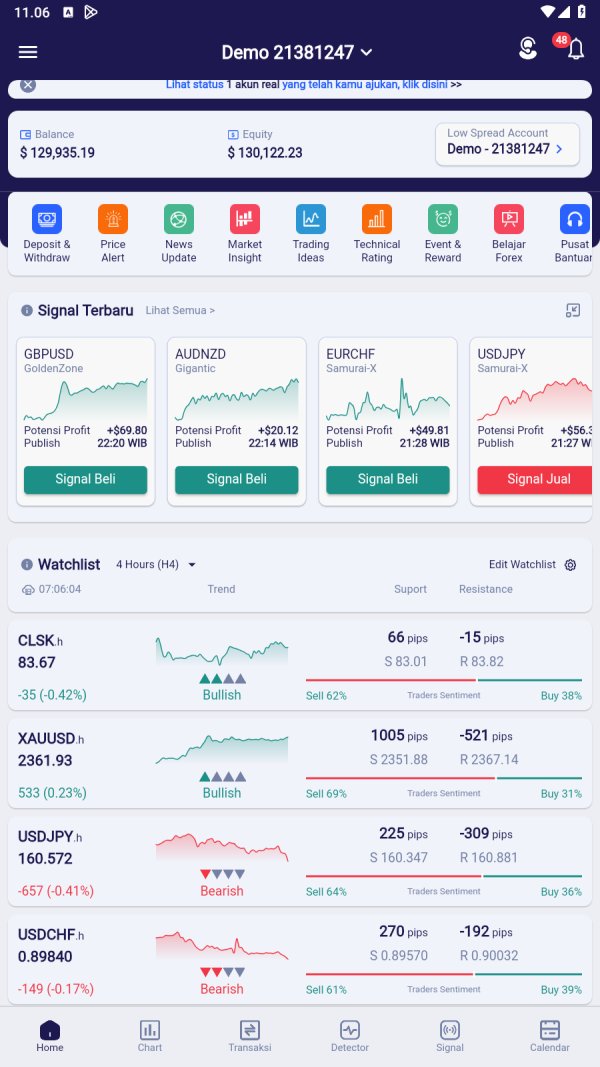

FOREXimf uses the MetaTrader 4 (MT4) platform as its main trading system, a choice that matches industry standards and trader preferences for familiar, reliable trading software. The broker's asset list includes major and minor currency pairs, gold, silver, and oil trading chances, giving traders variety options across different market areas.

The regulatory framework supporting FOREXimf includes oversight from BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi) and ICDX (Indonesia Commodity and Derivatives Exchange), both Indonesian regulatory institutions. This regulatory structure gives the foundation for the broker's operations within Indonesian jurisdiction, though questions remain about international regulatory recognition and cross-border client protection measures.

Regulatory Jurisdiction: FOREXimf operates under the supervision of BAPPEBTI and ICDX, Indonesian regulatory bodies that oversee commodity futures trading and derivatives exchange activities. This regulatory framework ensures compliance with Indonesian financial service standards.

Minimum Deposit Requirements: The broker keeps an accessible entry point with a minimum deposit requirement of $100 USD, positioning itself well for retail traders seeking low-barrier market access.

Available Trading Assets: FOREXimf provides access to forex currency pairs, precious metals including gold and silver, and energy items such as oil, offering traders variety across multiple asset classes.

Cost Structure: While specific spread and commission details are not widely documented in available sources, user feedback suggests that the broker offers competitive trading conditions that attract cost-conscious traders.

Leverage Offerings: The broker provides leverage ratios up to 1:500, enabling traders to control larger positions with smaller capital requirements, though this also increases potential risk exposure.

Platform Selection: MetaTrader 4 (MT4) serves as the primary trading platform, offering traders access to familiar charting tools, technical indicators, and automated trading capabilities standard to this widely-adopted platform.

Geographic Restrictions: Specific information regarding regional trading restrictions is not detailed in available documentation, though the Indonesian regulatory focus suggests primary market concentration in Southeast Asian regions.

Customer Support Languages: Available documentation does not specify the range of languages supported by customer service teams, though Indonesian language support would be expected given the regulatory jurisdiction.

This foreximf review continues with detailed analysis of each operational aspect to provide comprehensive broker evaluation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

FOREXimf shows competitive account conditions mainly through its accessible entry requirements and flexible leverage options. The $100 minimum deposit requirement positions the broker well within the retail trading market, especially appealing to newcomers who may not have substantial initial capital. This low threshold enables broader market participation while maintaining reasonable risk management expectations.

The 1:500 leverage ratio represents a significant offering that attracts traders seeking to maximize their market exposure with limited capital. However, this high leverage also brings substantial risk factors that require careful consideration. While specific account type variations are not detailed in available documentation, the broker appears to maintain straightforward account structures that avoid unnecessary complexity for new traders.

User feedback regarding account opening procedures suggests a relatively smooth process, though specific verification requirements and timeframes are not widely documented. The absence of detailed information about specialized account features, such as Islamic accounts for Shariah-compliant trading, represents a potential limitation for specific trader demographics.

When compared to industry standards, FOREXimf's account conditions align with competitive retail broker offerings, though the lack of detailed tier structures or premium account benefits may limit appeal for high-volume traders seeking enhanced features and preferential treatment.

The broker's reliance on MetaTrader 4 as its primary platform provides traders with access to a comprehensive suite of standard trading tools, including advanced charting capabilities, technical indicators, and automated trading functionality through Expert Advisors. MT4's proven track record and widespread adoption ensure that traders can access familiar tools regardless of their experience level with other brokers.

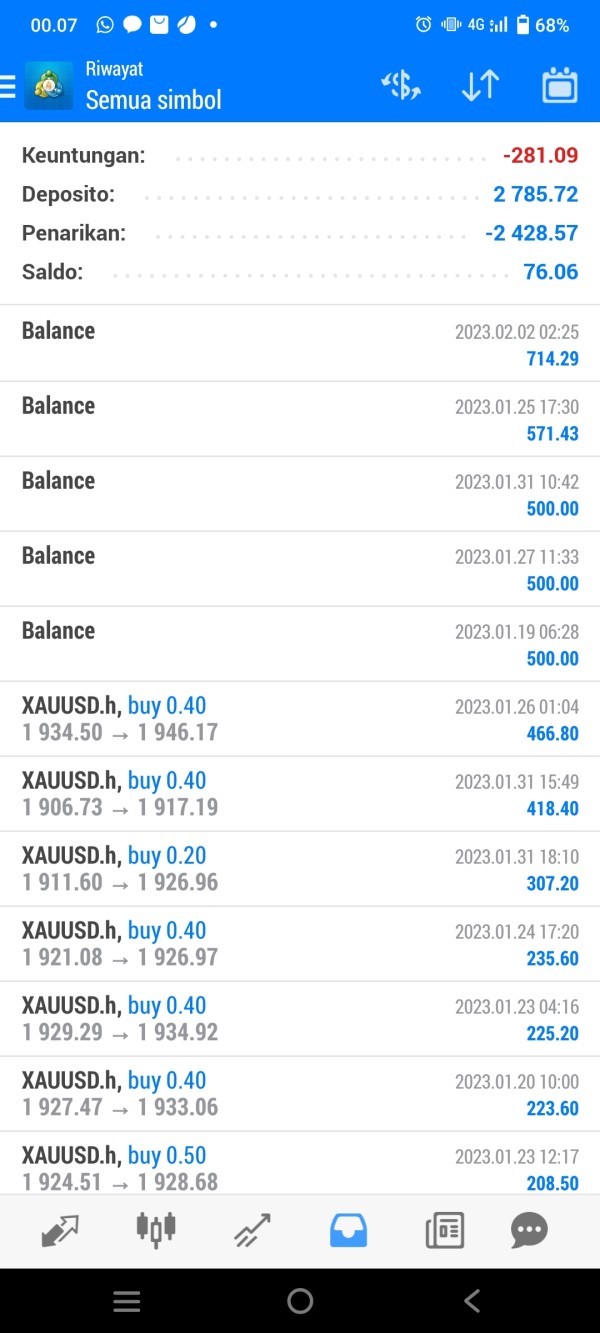

According to user feedback, FOREXimf provides educational resources that have received positive recognition from some clients. However, specific details about the scope, quality, and accessibility of these educational materials remain limited in available documentation. The absence of detailed information about market analysis, research reports, or trading signals suggests potential gaps in comprehensive trader support services.

The platform's asset diversity, spanning forex, precious metals, and energy items, provides reasonable trading opportunities, though the specific range of available instruments within each category is not widely detailed. This limitation makes it difficult to assess whether the broker meets the diverse needs of traders seeking exposure to specific market segments.

Automated trading support through MT4's standard functionality enables algorithmic trading strategies, though broker-specific enhancements or proprietary tools are not mentioned in available sources, suggesting reliance on platform defaults rather than innovative trading solutions.

Customer Service and Support Analysis (Score: 4/10)

Customer service evaluation for FOREXimf faces significant limitations due to sparse documentation regarding support channels, availability, and service quality metrics. Available information does not provide clear details about contact methods, whether through phone, email, live chat, or other communication channels that traders typically expect from professional brokers.

Response time expectations and service level commitments are not specified in available documentation, creating uncertainty about the broker's dedication to timely client support. This lack of transparency regarding customer service standards may concern traders who prioritize reliable support access, particularly during critical trading periods or technical difficulties.

Multi-language support capabilities remain unclear, though the Indonesian regulatory focus suggests primary support in Indonesian language. The absence of confirmed English or other international language support may limit the broker's appeal to international traders seeking comprehensive communication options.

User feedback specifically addressing customer service experiences is notably limited in available sources, preventing detailed assessment of real-world support quality. This information gap represents a significant concern for potential clients who rely on peer experiences to evaluate broker reliability and service commitment.

Trading Experience Analysis (Score: 6/10)

FOREXimf's trading experience centers around the MetaTrader 4 platform, which provides a stable and familiar environment for most traders. User feedback suggests generally positive experiences with the platform's performance, though specific metrics regarding execution speeds, server stability, or uptime statistics are not detailed in available documentation.

The broker's competitive trading conditions, as mentioned in user reviews, contribute to a reasonable trading environment, though specific details about spreads, slippage, or execution quality are not widely documented. This limitation makes it challenging to provide definitive assessments of the broker's trading environment compared to industry benchmarks.

Platform functionality through MT4 offers comprehensive charting, technical analysis tools, and order management capabilities that meet standard trader requirements. However, mobile trading experience details and platform customization options are not specifically addressed in available sources, potentially limiting assessment for traders who prioritize mobile accessibility.

Trading environment factors such as liquidity provision and market depth information are not detailed in available documentation. User feedback suggests acceptable performance levels, though the absence of specific performance metrics or third-party verification limits comprehensive evaluation of the actual trading experience quality.

This foreximf review indicates that while basic trading functionality appears adequate, the lack of detailed performance data and limited user feedback create uncertainty about consistent service delivery.

Trust and Reliability Analysis (Score: 5/10)

FOREXimf's regulatory status under BAPPEBTI and ICDX provides a foundation for operational legitimacy within Indonesian jurisdiction. These regulatory bodies offer oversight that ensures compliance with local financial service standards, though international regulatory recognition remains limited, potentially affecting trust levels for traders outside Indonesia.

User concerns regarding the broker's legitimacy and long-term reliability represent significant trust factors that potential clients must consider. While regulatory oversight provides some assurance, the mixed user sentiment suggests that operational transparency and communication may need improvement to build stronger client confidence.

Fund safety measures and client protection protocols are not widely detailed in available documentation, creating uncertainty about deposit insurance, segregated account policies, or other standard protection measures that established brokers typically provide. This information gap represents a critical concern for traders prioritizing capital security.

Company transparency regarding ownership, financial statements, or operational history is limited in available sources. The absence of detailed corporate information may concern traders who prefer comprehensive due diligence before committing funds to a trading relationship.

Third-party verification or independent audits of the broker's operations are not mentioned in available documentation, limiting external validation of the broker's claims and operational standards.

User Experience Analysis (Score: 6/10)

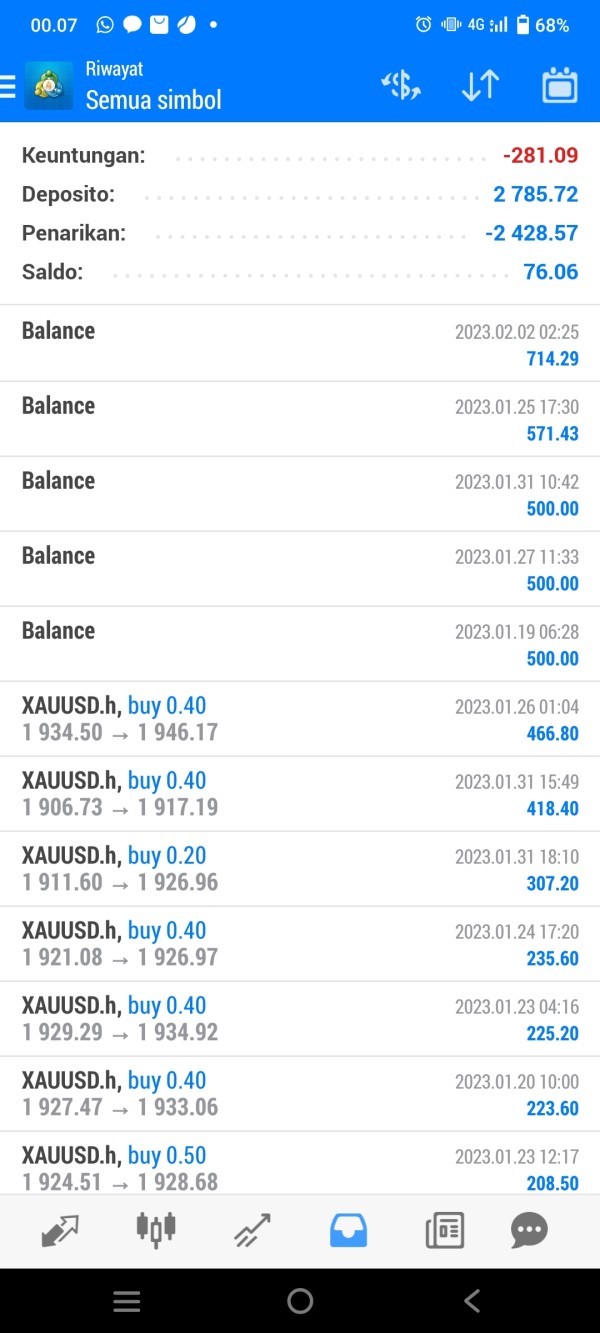

Overall user satisfaction with FOREXimf appears mixed based on available feedback, with traders expressing appreciation for competitive trading conditions while simultaneously raising concerns about reliability and legitimacy. This dichotomy suggests that while basic trading functionality may meet expectations, broader service aspects require improvement.

The MetaTrader 4 interface provides a familiar and user-friendly experience for most traders, with standard navigation and functionality that reduces learning curves for new clients. However, specific customization options or broker-enhanced features are not detailed in available sources.

Registration and account verification processes are not widely documented, though user feedback suggests reasonably straightforward procedures. The absence of detailed information about required documentation or verification timeframes creates uncertainty for potential clients planning their account opening timeline.

Common user concerns center around questions about the broker's legitimacy and reliability rather than platform functionality or trading conditions. This pattern suggests that while operational aspects may function adequately, broader trust and communication issues impact overall user satisfaction.

User demographic analysis suggests that FOREXimf appeals primarily to traders seeking high-leverage opportunities with low entry barriers, though the broker's ability to retain long-term clients remains unclear based on available feedback patterns.

Conclusion

This comprehensive foreximf review reveals a broker operating within a complex landscape of competitive trading conditions and reliability concerns. FOREXimf offers attractive entry-level features including a low $100 minimum deposit and high 1:500 leverage ratios that appeal to traders seeking accessible, high-leverage trading opportunities.

The broker best suits traders who prioritize low entry barriers and high leverage capabilities, particularly those comfortable with Indonesian regulatory oversight and willing to accept the associated limitations of regional regulation. Both novice traders attracted by low minimum deposits and experienced traders seeking leverage maximization may find value in FOREXimf's offerings.

Key advantages include competitive entry conditions and educational resource availability, while primary concerns center on customer service quality, transparency limitations, and mixed user sentiment regarding long-term reliability. Potential clients should carefully weigh these factors against their individual trading priorities and risk tolerance levels before making commitment decisions.