Naqdi 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive naqdi review looks at one of Dubai's new forex and precious metals brokers that has caught attention for its client-focused approach. Naqdi started in 2010 and has its main office in Dubai, UAE, where it operates under the Securities and Commodities Authority (SCA) with license number 20200000150. The broker has built a strong reputation for great customer service, with users always praising their careful attention to detail and personal approach to client relationships.

Key highlights include their SCA regulatory compliance and their focused approach to forex and precious metals trading. Based on user feedback, Naqdi's best feature is their commitment to providing personal service that makes them stand out in Dubai's competitive financial brokerage market. The broker mainly targets investors interested in forex and precious metals trading, positioning itself as a boutique-style service provider rather than a mass-market platform.

While Naqdi shows strong regulatory credentials and customer service excellence, this review will look at all parts of their offering to give potential clients a complete picture of what to expect from this UAE-based broker.

Important Notice

Regional Entity Differences: Since Naqdi is registered and regulated in the United Arab Emirates under the Securities and Commodities Authority, the broker may face different regulatory requirements and operational limits when serving clients in different areas. Potential clients should check their eligibility and understand any regional limits that may apply to their specific location.

Review Methodology: This evaluation uses available public information, user feedback, and regulatory filings. Due to the limited scope of publicly available detailed information about Naqdi's complete service offering, this review may not cover all trading conditions, platform details, or promotional terms. Readers should contact the broker directly for complete details about current offerings and terms.

Rating Framework

Broker Overview

Company Background and Establishment

Naqdi appeared in the Dubai financial services landscape in 2010, positioning itself as a specialized online trading broker focused on serving global clients interested in forex and precious metals markets. Based in Dubai, UAE, the company has built its reputation on providing personal financial brokerage services in one of the Middle East's most active financial hubs. The broker operates as an online trading platform, though specific details about their own technology or third-party platform partnerships remain limited in publicly available information.

The company's business model centers on delivering boutique-style brokerage services, making itself different from larger, more impersonal trading platforms through what users describe as exceptional attention to individual client needs. This approach has reportedly helped Naqdi build a loyal client base despite operating in a highly competitive regional market.

Regulatory Framework and Asset Coverage

Operating under the regulatory oversight of the UAE Securities and Commodities Authority (SCA), Naqdi holds license number 20200000150, providing clients with regulatory protection under UAE financial services laws. This naqdi review confirms that the broker's primary focus remains on forex and precious metals trading, though the extent of their instrument offerings and whether they plan to expand into other asset classes requires direct inquiry with the broker.

The SCA regulatory framework provides a solid foundation for client protection, though traders from other areas should verify how this regulatory coverage applies to their specific circumstances and whether additional protections may be available through their local financial authorities.

Regulatory Jurisdiction: Naqdi operates under the supervision of the UAE Securities and Commodities Authority (SCA), holding license number 20200000150. This regulatory framework provides oversight for the broker's operations within UAE financial services regulations.

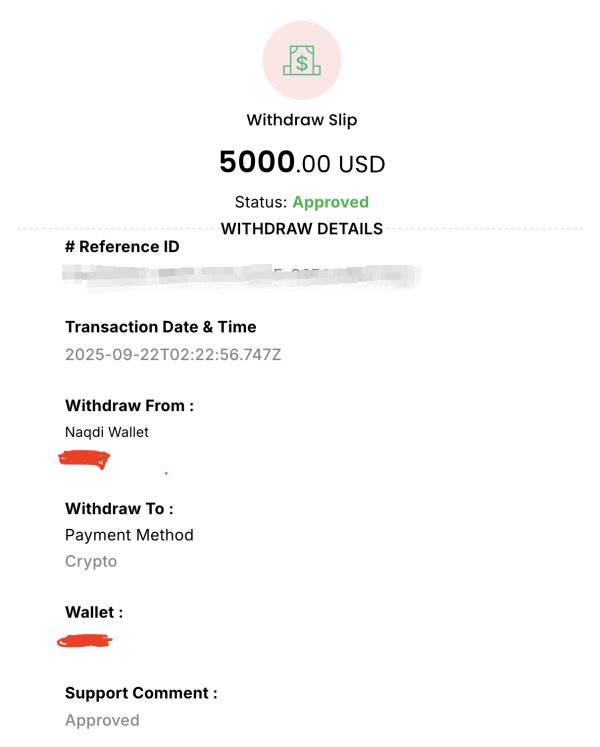

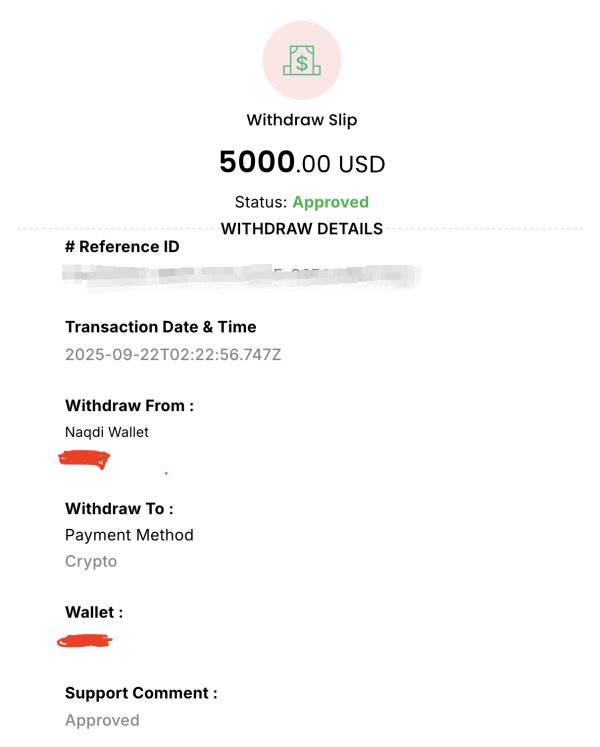

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available public sources and would require direct inquiry with the broker.

Minimum Deposit Requirements: The minimum deposit amount required to open trading accounts with Naqdi is not specified in available documentation.

Promotional Offers: Current bonus structures or promotional campaigns offered by Naqdi are not detailed in publicly available information.

Tradeable Assets: The broker's confirmed offerings include forex currency pairs and precious metals trading. The complete range of available instruments requires verification directly with Naqdi.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in available sources for this naqdi review.

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in publicly available broker information.

Platform Options: Details about trading platforms, whether their own or third-party solutions like MetaTrader, are not specified in available sources.

Geographic Restrictions: Specific countries or regions where Naqdi services may be restricted are not detailed in available information.

Customer Support Languages: The range of languages supported by Naqdi's customer service team is not specified in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: N/A/10)

The evaluation of Naqdi's account conditions faces big limitations due to not enough publicly available information about their account structures and terms. While the broker operates under SCA regulation, specific details about account types, whether they offer standard, premium, or VIP account tiers, remain unclear from available sources.

Minimum deposit requirements represent a crucial factor for potential clients, yet this information is not specified in accessible documentation. Similarly, the account opening process, required documentation, and verification procedures are not detailed in public sources. For traders considering Islamic accounts or other specialized account features, this information gap presents a significant limitation for informed decision-making.

The absence of clear information about account-related fees, maintenance charges, or inactivity fees makes it challenging for potential clients to fully understand the cost implications of maintaining an account with Naqdi. This naqdi review must note that prospective traders would need to contact the broker directly to obtain comprehensive account condition details.

Recommendation: Potential clients should request detailed account documentation directly from Naqdi to understand all terms, conditions, and requirements before making any commitment.

Assessment of Naqdi's trading tools and educational resources faces big limitations due to limited publicly available information about their platform capabilities and client support materials. The absence of detailed information about charting tools, technical indicators, or analytical resources makes it difficult to evaluate how well-equipped traders would be when using Naqdi's services.

Research and analysis support represents a critical component for informed trading decisions, yet specific details about market research, daily analysis, economic calendars, or expert commentary are not documented in available sources. Educational resources, including webinars, tutorials, or trading guides, are similarly not detailed in accessible information.

The availability of automated trading support, expert advisors, or algorithmic trading capabilities remains unclear. For traders who rely on sophisticated analytical tools or educational support to develop their trading strategies, this information gap represents a significant consideration.

Mobile trading capabilities and cross-platform synchronization details are not specified, limiting assessment of the broker's technology offering for modern traders who require flexible access to markets.

Customer Service and Support Analysis (Score: 8/10)

Naqdi's customer service receives notably positive recognition, with available user feedback consistently highlighting the broker's attention to detail and personalized approach to client relationships. According to user testimonials, the broker's "personal touch" distinguishes them within Dubai's competitive financial services market, suggesting a commitment to individualized client care that larger brokers may struggle to match.

Service quality appears to be a genuine strength for Naqdi, with users specifically praising the professional approach and responsiveness of their support team. The emphasis on personalized service suggests that clients receive individual attention rather than standardized, automated responses common with larger brokerage operations.

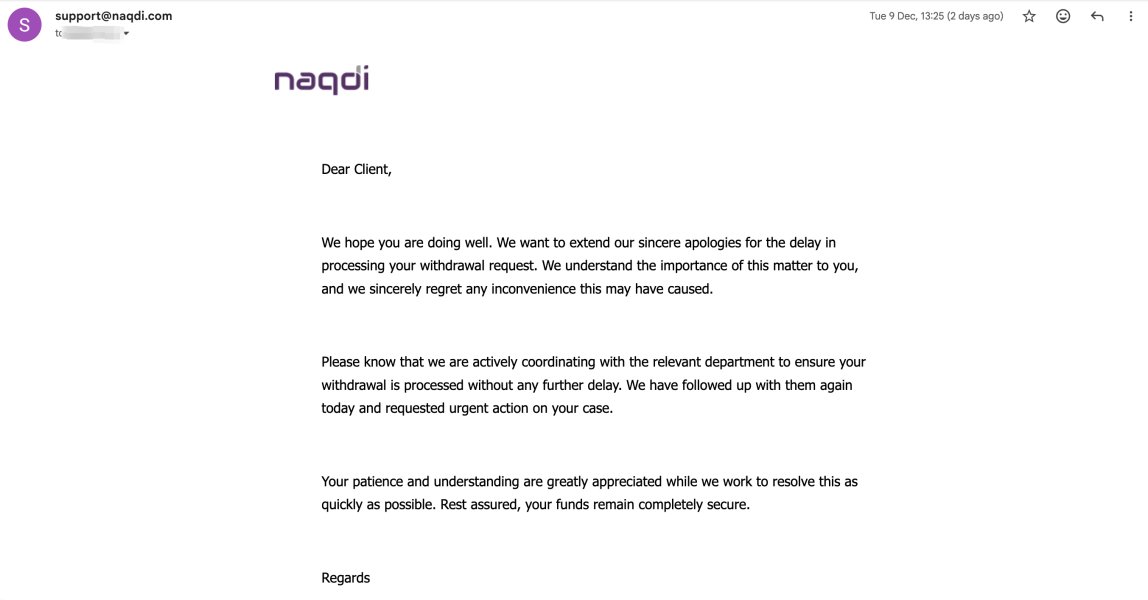

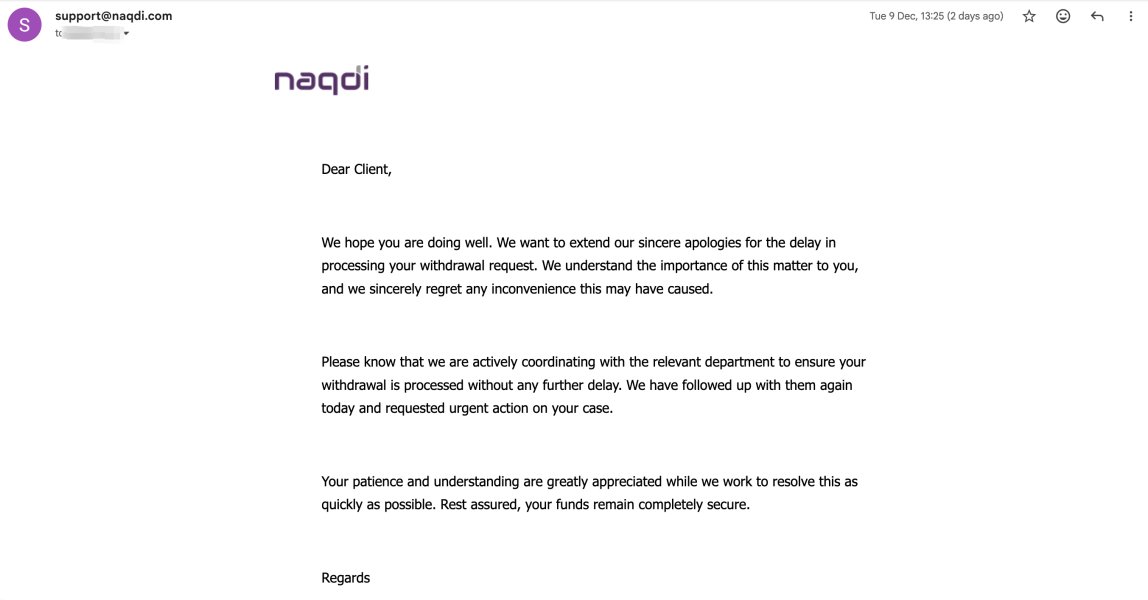

However, specific details about customer service channels, availability hours, response time commitments, and multilingual support capabilities are not detailed in available sources. The absence of information about 24/7 support, live chat availability, or dedicated account management services limits the complete assessment of their support infrastructure.

User satisfaction with customer service represents one of the few areas where Naqdi receives clear positive feedback, indicating that their approach to client relationships may be a genuine competitive advantage in their target market.

Trading Experience Analysis (Score: N/A/10)

Evaluation of the actual trading experience with Naqdi faces significant limitations due to insufficient information about platform performance, execution quality, and user interface design. Without specific details about order execution speeds, slippage rates, or platform stability, it becomes challenging to assess how the broker performs during active trading conditions.

Platform functionality details, including charting capabilities, order types, risk management tools, and mobile trading features, are not specified in available documentation. The absence of information about whether Naqdi offers popular platforms like MetaTrader 4 or 5, or operates their own trading software, represents a significant information gap for this naqdi review.

Market execution quality cannot be properly assessed without specific data about fill rates, requotes, or execution speeds during different market conditions. Similarly, the trading environment during high volatility periods or major news events remains unclear from available sources.

Mobile trading experience and cross-device functionality represent increasingly important factors for modern traders, yet specific capabilities and user experience details are not documented in accessible sources.

Trust and Reliability Analysis (Score: 9/10)

Naqdi demonstrates strong credentials in terms of regulatory compliance and institutional reliability through their Securities and Commodities Authority (SCA) license number 20200000150. The UAE regulatory framework provides a solid foundation for client protection and operational oversight, contributing significantly to the broker's trustworthiness profile.

Regulatory standing with the SCA indicates that Naqdi operates under established financial services regulations, though the specific client protection measures, compensation schemes, or dispute resolution procedures available through this regulatory framework require further investigation by potential clients. Company transparency regarding their regulatory status appears appropriate, with their SCA license number being readily available.

However, additional transparency measures such as detailed company ownership information, financial statements, or third-party audits are not detailed in available sources. Industry reputation appears positive based on available user feedback, though comprehensive third-party evaluations or industry awards are not documented in accessible sources.

The absence of significant negative publicity or regulatory actions suggests a clean operational record, though prospective clients should conduct their own due diligence regarding the broker's complete regulatory history.

User Experience Analysis (Score: N/A/10)

Assessment of overall user experience with Naqdi faces big limitations due to limited comprehensive feedback available in public sources. While customer service receives positive recognition, broader user experience elements including platform usability, account management processes, and overall satisfaction metrics are not well-documented.

Interface design and usability cannot be properly evaluated without access to detailed user feedback about platform navigation, feature accessibility, or learning curve requirements for new users. The registration and account verification process efficiency similarly lacks specific user experience documentation.

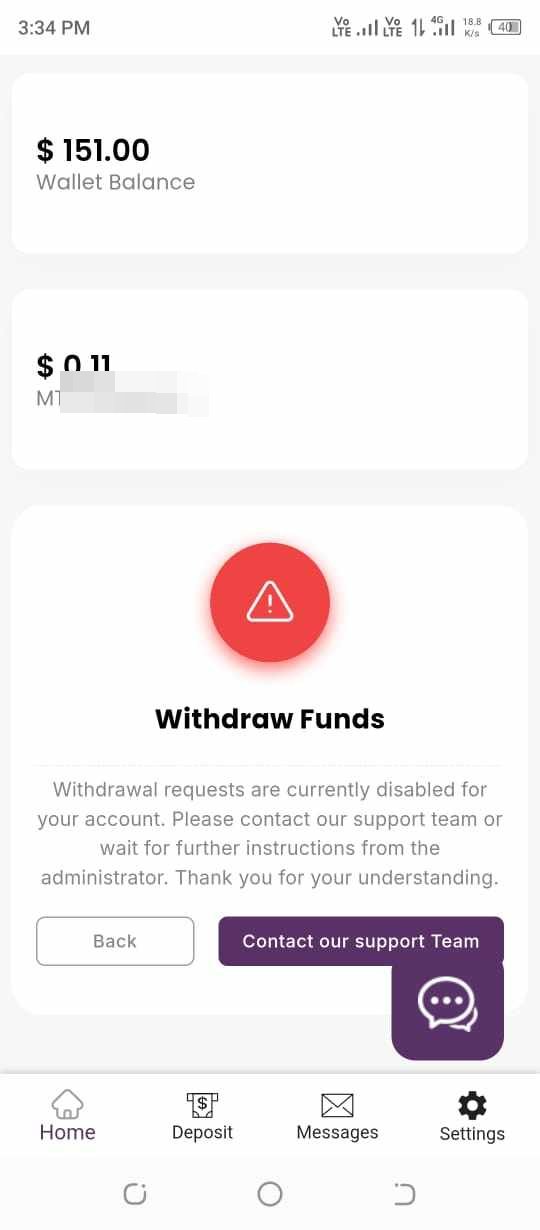

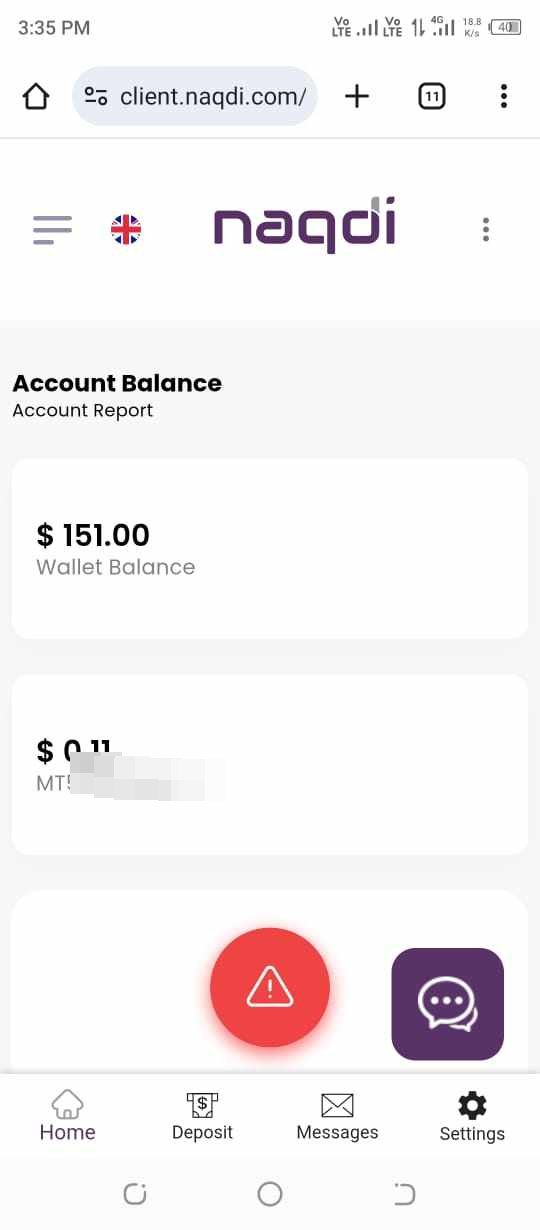

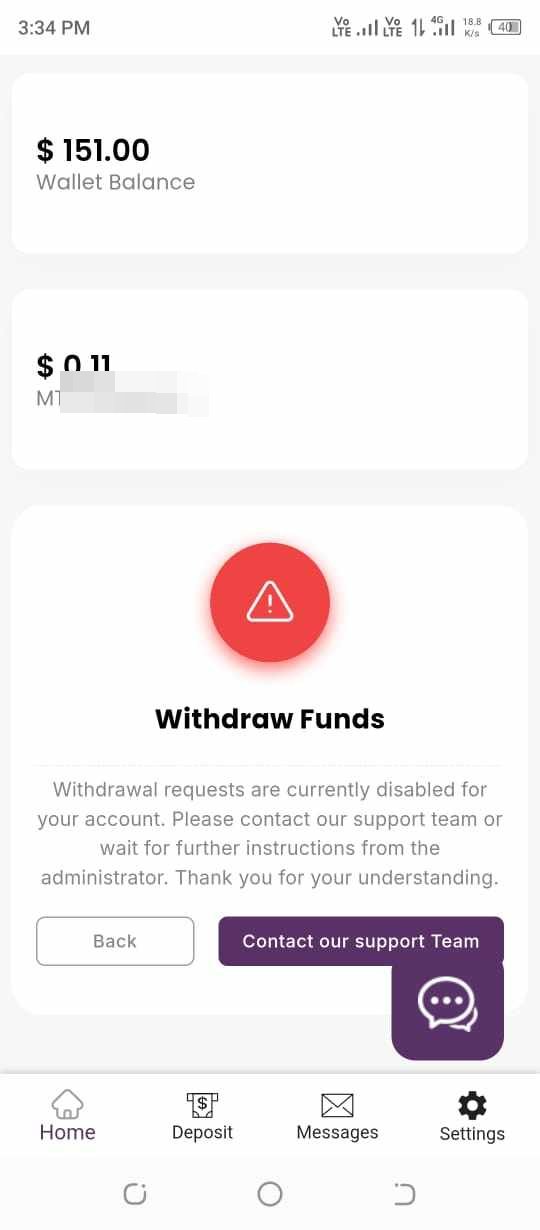

Funding and withdrawal experience represents a crucial component of user satisfaction, yet specific feedback about transaction processing times, fee transparency, or process complexity is not available in accessible sources. Common user complaints or frequently raised concerns are not documented in available information.

User demographics and the types of traders who find Naqdi most suitable remain unclear from available sources, limiting the ability to provide targeted recommendations about fit for different trading styles or experience levels. The positive customer service feedback suggests that users who do engage with Naqdi receive satisfactory support, though comprehensive user experience metrics would require direct research with current clients.

Conclusion

This naqdi review reveals a broker with solid regulatory foundations and a genuine commitment to personalized customer service, though significant information gaps limit a complete evaluation of their service offering. Naqdi's SCA regulatory compliance (License: 20200000150) and positive customer service feedback represent clear strengths, particularly for traders who value individualized attention and regulatory protection.

Ideal client profile appears to be investors interested in forex and precious metals trading who prioritize personalized service and regulatory compliance over extensive platform features or educational resources. The broker's boutique approach may particularly appeal to clients seeking more individualized attention than typically available from larger, mass-market brokers.

Primary limitations include the lack of publicly available information about trading conditions, platform specifications, costs, and comprehensive user experience data. Potential clients must conduct direct inquiry with Naqdi to obtain essential details about account conditions, trading costs, and platform capabilities before making informed decisions about their services.