Trade Quo 2025 Review: Everything You Need to Know

Executive Summary

Trade Quo Global Ltd is a competitive foreign exchange broker. The company operates under the regulatory oversight of the Seychelles Financial Services Authority (FSA), which provides basic consumer protection and ensures the broker follows standard industry practices. This comprehensive trade quo review reveals a broker that positions itself strategically in the retail forex market. The company has several noteworthy characteristics that distinguish it from competitors.

The broker's most compelling feature lies in its offering of leverage ratios up to 2000:1. This high leverage specifically caters to traders seeking enhanced market exposure with relatively smaller capital requirements, though it also increases risk significantly for less experienced participants. Additionally, Trade Quo supports both MT4 and MT5 trading platforms. These industry-standard platforms provide traders with comprehensive tools for technical analysis and trade execution.

Based on available user feedback and regulatory information, Trade Quo appears to target intermediate to advanced traders. These traders prioritize high-leverage trading opportunities combined with low-spread environments, allowing them to maximize their market exposure while minimizing transaction costs. The broker's social trading features and real-time ranking systems suggest a modern approach to forex trading. This approach incorporates community-driven insights and collaborative trading strategies that help traders learn from experienced participants.

User testimonials indicate positive experiences regarding order execution speed and market access. Many clients have provided particular praise for the broker's deposit and withdrawal flexibility, noting the convenience of multiple payment options and efficient processing times. However, as with any financial service provider, potential clients should carefully evaluate their individual trading requirements. They must compare these requirements against the broker's specific offerings and regulatory framework before making any commitments.

Important Disclaimers

Trade Quo operates across different jurisdictions with varying regulatory requirements. These different rules may affect service availability and trading conditions for users in different regions, so clients should verify their local compliance requirements before proceeding. Prospective clients should verify their local regulatory compliance requirements before engaging with the broker's services.

This evaluation is based on publicly available information, regulatory filings, and user feedback collected through various review platforms. The comprehensive assessment does not include personal trading experiences or subjective preferences, focusing instead on objective analysis of documented features and user-reported experiences. The assessment does not include personal trading experiences or subjective preferences. Instead, it focuses on objective analysis of the broker's documented features, regulatory status, and user-reported experiences. All information presented reflects the current available data. Potential clients should verify this information independently before making any trading decisions.

Rating Framework

Broker Overview

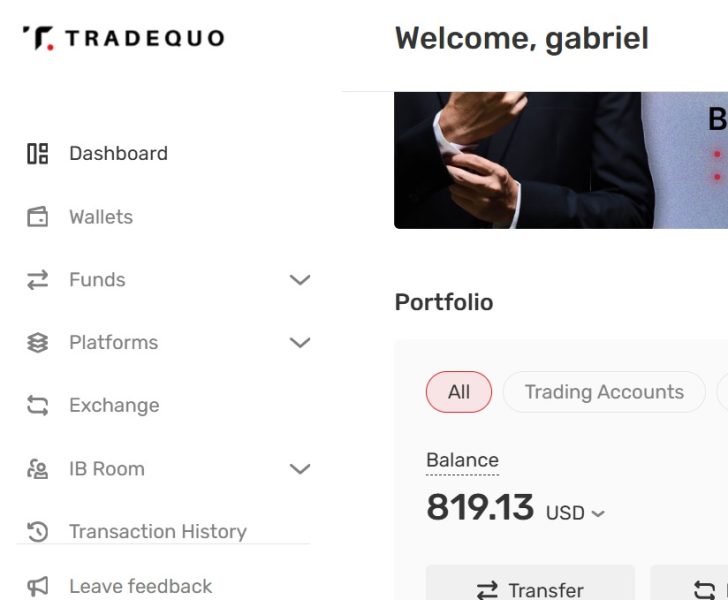

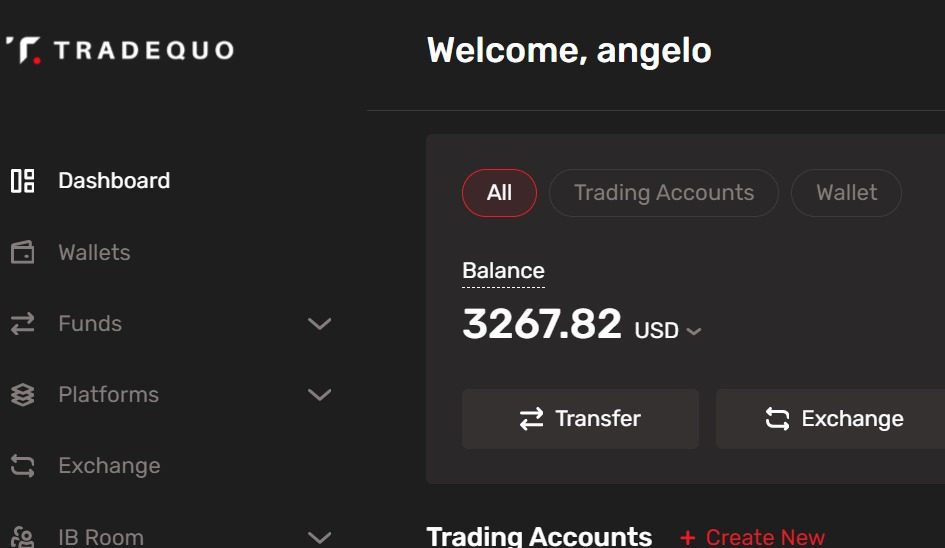

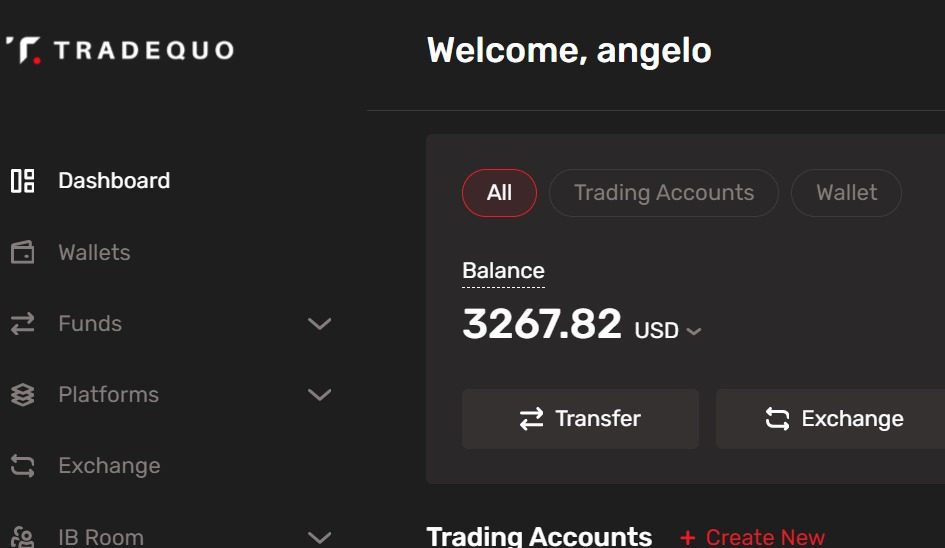

Trade Quo Global Ltd operates as an online foreign exchange and derivatives broker. The company is registered and regulated by the Seychelles Financial Services Authority under license number SD140, which provides basic regulatory oversight and consumer protection measures. The company positions itself as a modern trading platform that combines traditional forex brokerage services with contemporary social trading elements. This combination appeals to traders who value both individual analysis and community-driven insights for enhanced trading decisions.

The broker's business model centers on providing access to foreign exchange markets and various financial derivatives. The company achieves this through sophisticated trading platforms that support multiple trading strategies and experience levels. According to available information, Trade Quo emphasizes the integration of social trading features. These features allow users to connect with experienced traders, share strategies, and leverage collective market insights for enhanced trading decisions.

Trade Quo's platform infrastructure supports both MetaTrader 4 and MetaTrader 5. These are industry-standard platforms known for their comprehensive charting capabilities, technical analysis tools, and automated trading support that help traders execute various strategies effectively. This dual-platform approach caters to different trader preferences. MT4 serves traditional forex traders while MT5 accommodates those requiring multi-asset trading capabilities and advanced order management features.

The broker's regulatory framework under the Seychelles FSA provides a foundational level of oversight. However, this jurisdiction is generally considered less stringent than major financial centers like the UK or Australia. This trade quo review notes that while FSA regulation offers basic consumer protections, traders from highly regulated jurisdictions may find the oversight level different from their domestic expectations.

Regulatory Jurisdiction: Trade Quo Global Ltd operates under the authorization and regulation of the Seychelles Financial Services Authority (FSA). The company holds license number SD140, which authorizes its operations in foreign exchange and derivatives trading. This regulatory framework provides basic oversight for the broker's operations. However, the Seychelles jurisdiction is generally considered to have more flexible regulatory requirements compared to major financial centers like the UK's FCA or Australia's ASIC.

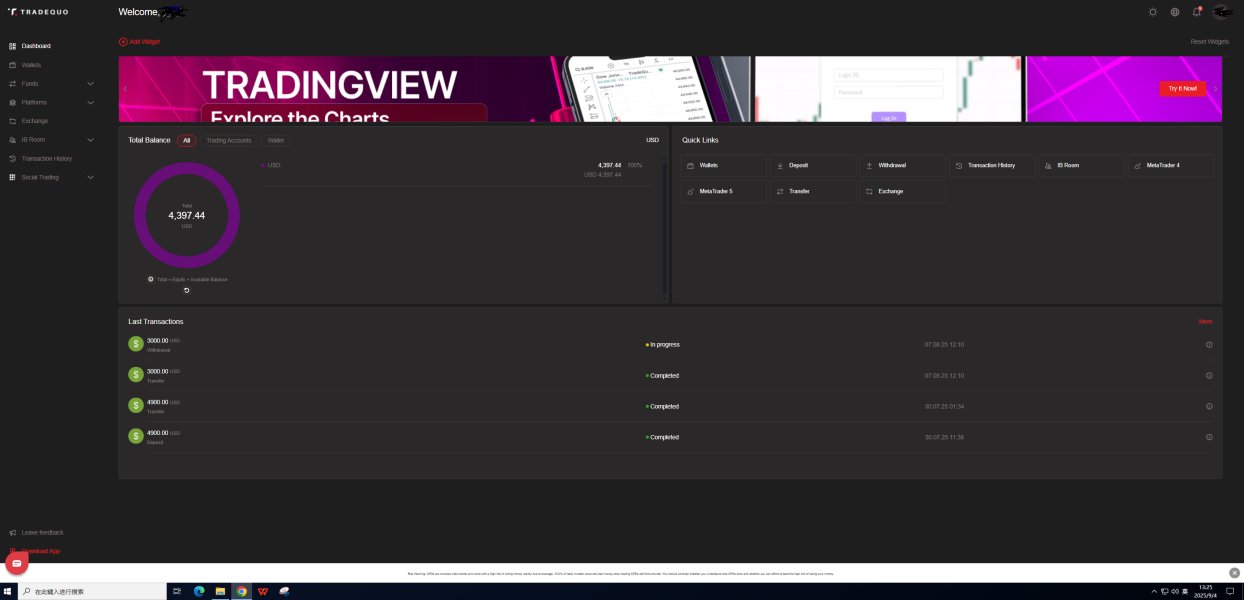

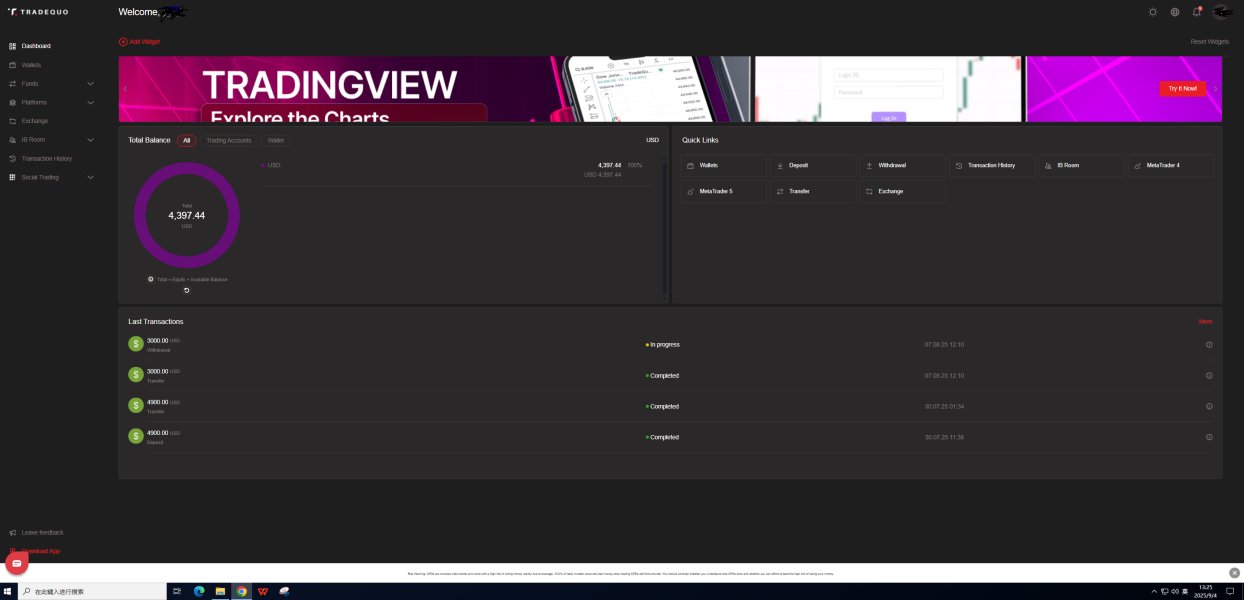

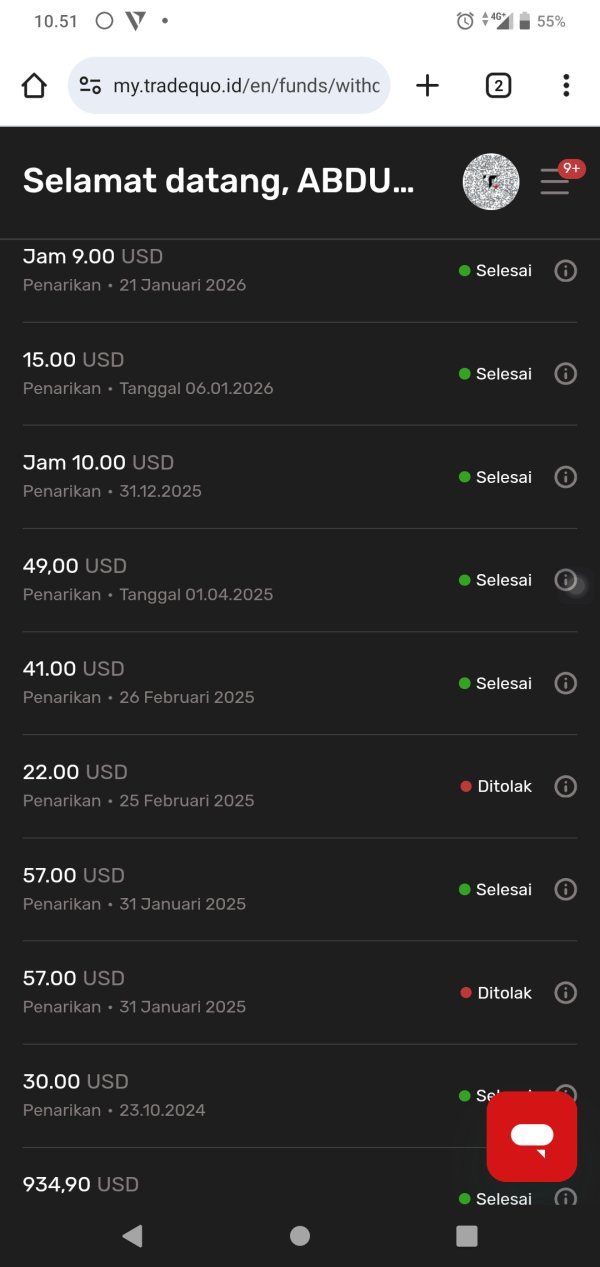

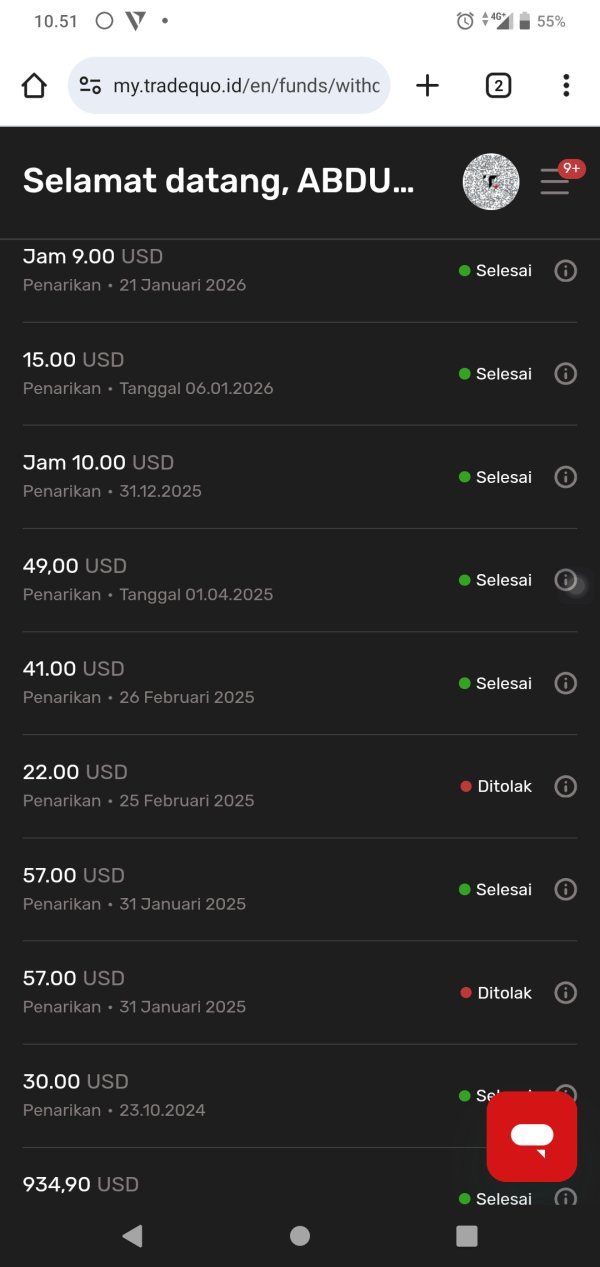

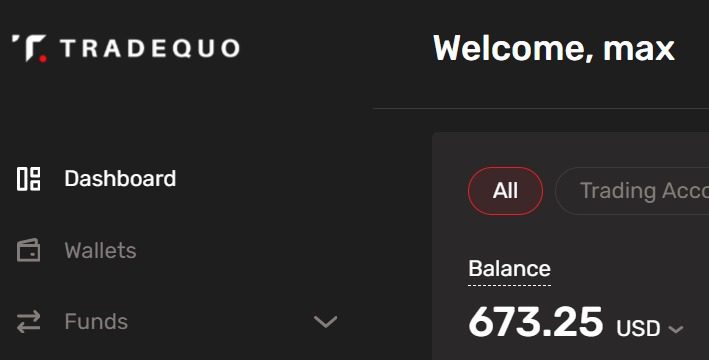

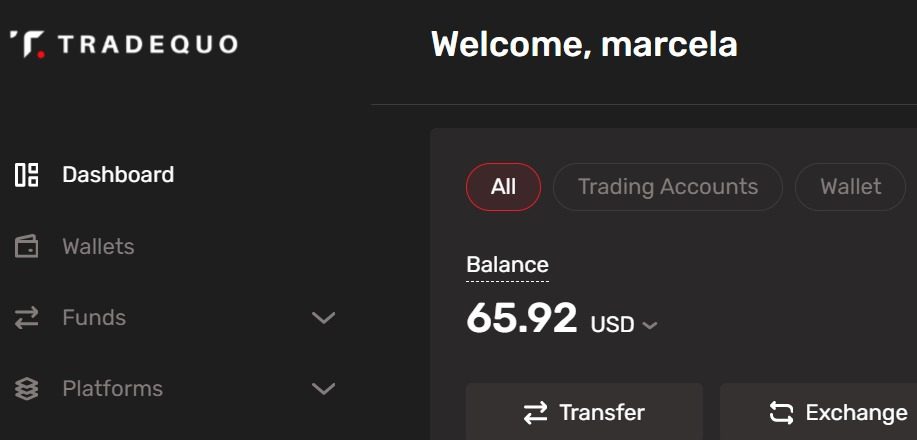

Deposit and Withdrawal Methods: According to user feedback, Trade Quo offers diverse deposit and withdrawal options. This flexibility provides convenience for international clients who may prefer different payment methods based on their geographic location or personal preferences. However, specific details regarding supported payment processors, processing times, and associated fees are not comprehensively detailed in available public information.

Minimum Deposit Requirements: The specific minimum deposit requirements for different account types are not clearly disclosed in available materials. This lack of transparency suggests potential flexibility in account opening requirements or tier-based structures that may vary based on account type selection.

Bonus and Promotional Offers: Current promotional activities or bonus structures are not detailed in available public information. This indicates either absence of such programs or limited public disclosure of promotional terms that might be available to new clients.

Tradeable Assets: The broker provides access to foreign exchange markets and various financial derivatives. While specific asset categories and the total number of available instruments are not comprehensively detailed, the platform appears to focus primarily on forex trading with additional derivative products available.

Cost Structure: User feedback indicates competitive spreads throughout various currency pairs. However, specific spread ranges, commission structures, and overnight financing rates are not detailed in available public materials. The cost-effectiveness appears to be a positive aspect based on user testimonials mentioning "low spread" conditions.

Leverage Ratios: Trade Quo offers maximum leverage up to 2000:1. This high leverage positioning places the broker among those providing significant leverage trading opportunities for experienced traders. This level of leverage significantly exceeds regulations in many major jurisdictions. It primarily targets experienced traders comfortable with elevated risk exposure and sophisticated risk management techniques.

Platform Options: The broker supports both MetaTrader 4 and MetaTrader 5 platforms. This dual-platform approach allows traders to choose based on their specific requirements and familiarity with either platform's interface and functionality.

Geographic Restrictions: Specific information regarding geographic restrictions or service limitations for particular jurisdictions is not detailed in available materials. Potential clients should verify their local regulatory compliance before engaging with the broker's services.

Customer Service Languages: The range of languages supported by customer service teams is not specified in available public information. The broker appears to operate with English as a primary communication language, though additional language support may be available upon request.

This trade quo review identifies several areas where additional transparency regarding specific terms and conditions would benefit potential clients. Enhanced disclosure would help traders make more informed decisions about whether the broker's services align with their specific trading requirements.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Trade Quo's account structure demonstrates flexibility in accommodating different trader profiles. However, specific details regarding minimum deposit requirements and account tier distinctions remain somewhat opaque in public materials, which could create uncertainty for potential clients. The broker appears to offer multiple account types designed to serve varying trading volumes and experience levels. This represents a positive approach to client segmentation that recognizes the diverse needs of different trader categories.

User feedback suggests that the account opening process is relatively straightforward. Traders report minimal complications during registration and verification procedures, which helps new clients begin trading without unnecessary delays. However, the lack of clearly published minimum deposit requirements may create uncertainty. Potential clients attempting to evaluate their initial capital requirements before engaging with the broker may find this lack of transparency challenging.

The account conditions receive positive marks for flexibility, particularly regarding leverage options up to 2000:1. This high leverage significantly exceeds standard offerings in more regulated jurisdictions, providing experienced traders with enhanced market exposure opportunities. This high-leverage availability particularly appeals to experienced traders seeking enhanced market exposure. However, it simultaneously increases risk exposure for less experienced participants who may not fully understand the implications of leveraged trading.

Compared to industry standards, Trade Quo's account conditions appear competitive, especially considering the regulatory environment in which it operates. The combination of high leverage availability and multiple account options provides traders with customization opportunities that can be tailored to their specific trading strategies and risk tolerance levels. The combination of high leverage availability and multiple account options provides traders with customization opportunities. However, the trade quo review notes that greater transparency in published terms would enhance the overall client experience.

The absence of detailed information regarding special account features, such as Islamic accounts for Sharia-compliant trading, represents a potential limitation. This limitation may affect specific market segments, though this may be available upon direct inquiry with the broker.

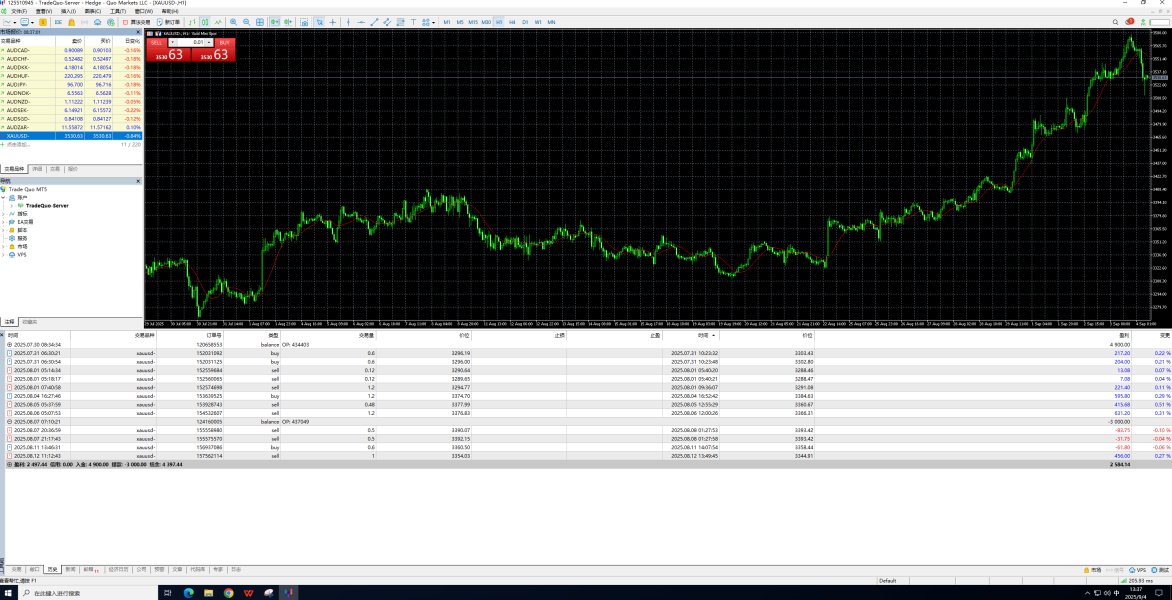

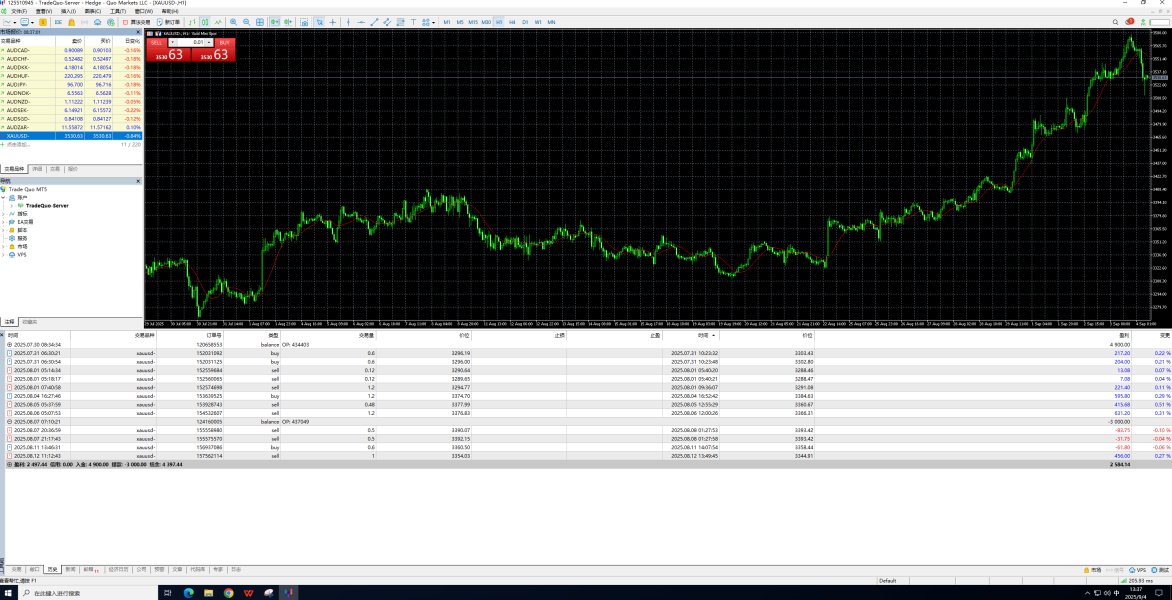

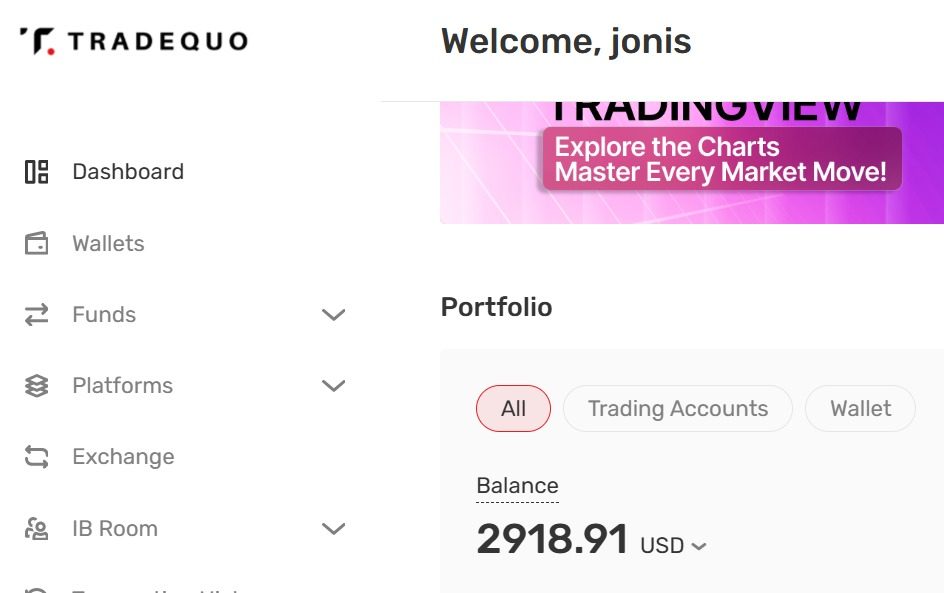

Trade Quo demonstrates strong performance in providing trading tools and resources. The broker's support of both MetaTrader 4 and MetaTrader 5 platforms represents a significant strength in their service offering. These industry-standard platforms offer comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies. They meet the requirements of both discretionary and systematic traders who employ different analytical approaches to market participation.

The broker's emphasis on social trading features represents a modern approach to forex trading. These features incorporate real-time rankings and expert insights that allow traders to benefit from community knowledge and shared strategies, creating opportunities for collaborative learning and strategy development. User feedback indicates positive reception of these collaborative trading elements. This suggests effective implementation of social trading functionality that adds genuine value to the trading experience.

According to available information, Trade Quo provides real-time rankings and expert advice. Users have praised these features for their practical value in trading decision-making, helping them identify successful strategies and learn from experienced traders. This combination of traditional technical analysis tools with contemporary social trading features creates a comprehensive trading environment. The environment caters to different analytical approaches and learning styles that traders may prefer.

The dual-platform offering allows traders to select their preferred trading environment based on familiarity and specific feature requirements. MT4's popularity among forex traders and MT5's enhanced multi-asset capabilities provide flexibility for traders with different market focuses and technical requirements that may evolve over time.

However, the evaluation notes limited specific information regarding educational resources, market analysis publications, or research materials. These additional resources might supplement the trading tools and provide valuable market insights for developing traders. Enhanced educational content could further strengthen the broker's resource offering. This would particularly benefit developing traders who are still building their market knowledge and analytical skills.

Customer Service and Support Analysis (Score: 7/10)

Customer service quality receives generally positive feedback from users. Testimonials indicate satisfactory support experiences and effective problem resolution that meets most client expectations. However, specific details regarding customer service channels, availability hours, and response time commitments are not comprehensively detailed. This lack of detailed information makes it difficult for potential clients to set appropriate expectations for support availability.

The diversity of deposit and withdrawal options mentioned in user feedback suggests effective customer service support. The customer service team effectively supports various payment processing requirements, contributing to overall client satisfaction and reducing potential frustration with financial transactions. Users have specifically noted the convenience of multiple payment choices. This indicates that customer support successfully facilitates financial transactions and addresses payment-related inquiries effectively.

User testimonials suggest that customer service representatives demonstrate competence in addressing trading-related inquiries. They also effectively handle technical support issues that may arise during platform usage or account management activities. The positive feedback regarding problem resolution indicates that the support team possesses adequate knowledge. They also have sufficient authority to address common client concerns effectively without unnecessary escalation delays.

However, the absence of detailed information regarding multilingual support capabilities represents a potential limitation. The lack of information about specific communication channels (live chat, phone, email) and guaranteed response times represents areas where additional transparency would benefit potential clients. Professional traders often require rapid support access. This is particularly important during active trading sessions when technical issues could impact trading outcomes.

The overall customer service evaluation reflects positive user experiences balanced against limited public disclosure. The limited disclosure of specific service standards and availability commitments could be improved for better client confidence. Enhanced transparency regarding support procedures and service level agreements could strengthen client confidence. This would help potential clients better understand what level of support they can expect from the broker's customer service capabilities.

Trading Experience Analysis (Score: 8/10)

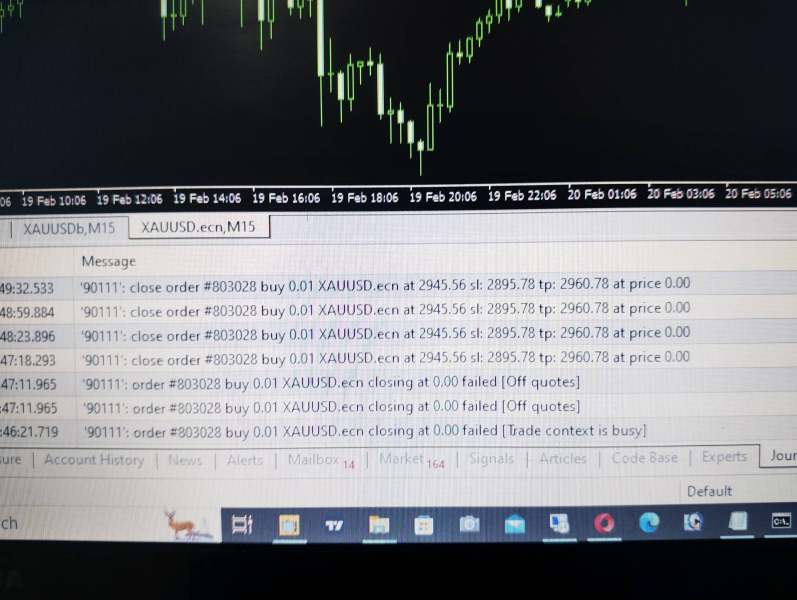

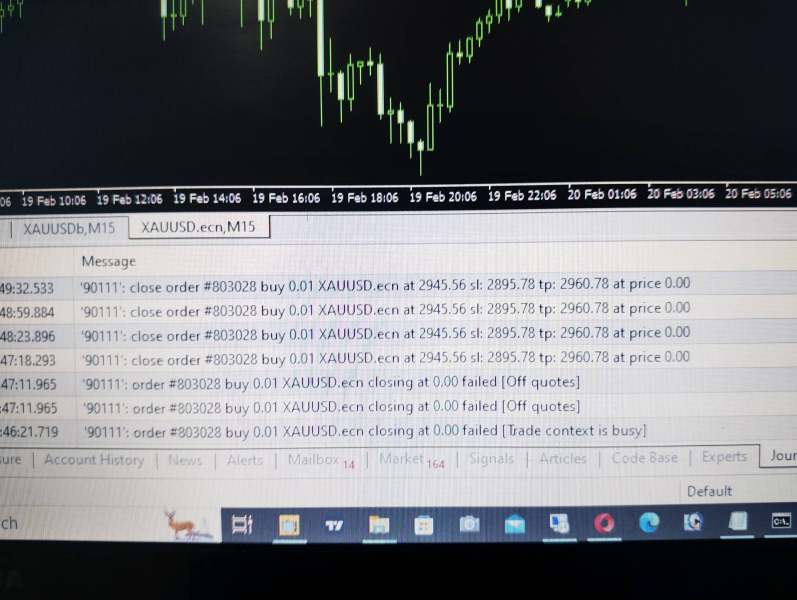

User feedback consistently highlights positive trading experiences. Traders particularly emphasize fast order execution and platform stability as key strengths of the broker's service offering. According to testimonials, traders experience "quick action in orders and market executions." This suggests that the broker's technical infrastructure effectively supports active trading requirements without significant latency issues that could impact trading outcomes.

The platform stability receives positive user assessment. Users report minimal technical disruptions or system downtime that could impact trading activities, which is crucial for maintaining consistent market access. This reliability factor is crucial for active traders who require consistent platform access during market hours. This is particularly important when managing leveraged positions that require prompt attention and quick decision-making capabilities.

Order execution quality appears to meet user expectations. Traders report limited instances of significant slippage or execution delays that might negatively impact trading outcomes, contributing to overall satisfaction with the trading environment. The combination of competitive spreads and reliable execution creates a trading environment that supports various trading strategies. This environment accommodates different timeframes and approaches that traders may employ based on their individual preferences and market analysis.

The availability of both MT4 and MT5 platforms provides traders with comprehensive charting capabilities. These platforms also offer extensive technical indicators and automated trading support that enhance the overall trading experience. These platforms' established functionality and trader familiarity contribute to overall positive trading experiences. This is particularly beneficial for users transitioning from other brokers using similar platforms, as it reduces the learning curve associated with platform adaptation.

However, this trade quo review notes limited specific information regarding mobile trading platform capabilities. Mobile trading increasingly represents an important component of comprehensive trading experience for modern traders who require market access across different devices and locations throughout their daily activities.

Trust and Reliability Analysis (Score: 6/10)

Trade Quo's regulatory status under the Seychelles Financial Services Authority (FSA) provides a foundational level of oversight. The company operates with license number SD140, which authorizes its foreign exchange and derivatives trading operations. Though this jurisdiction generally offers less stringent regulatory requirements compared to major financial centers, it still provides legitimate regulatory framework. The FSA regulation does provide basic consumer protections and operational oversight. This contributes to overall legitimacy and ensures the broker follows standard industry practices.

The regulatory framework in Seychelles, while legitimate, may not offer the same level of investor protection. It also may not provide the compensation schemes available in more established regulatory jurisdictions such as the UK's FCA or Australia's ASIC. This regulatory difference should be considered by traders accustomed to higher levels of regulatory protection. Traders should understand the implications of this regulatory environment before committing funds to trading activities.

Available information does not provide detailed disclosure regarding fund segregation practices. The lack of information about insurance coverage or specific client money protection measures beyond basic regulatory requirements represents an area for improvement. Enhanced transparency regarding asset protection measures would strengthen overall trust assessment. This would provide potential clients with better understanding of how their funds are protected and managed by the broker.

The broker's operational transparency could be improved through publication of regular financial reports. Additional transparency through management team information or third-party auditing results would provide additional insight into corporate governance and financial stability that clients value when selecting a broker.

User feedback does not indicate significant trust-related concerns or widespread negative experiences. This suggests that the broker generally fulfills its operational commitments to clients and maintains reasonable business practices. However, the limited regulatory disclosure and transparency represent areas where improvements could enhance overall trustworthiness assessment. Enhanced disclosure would help potential clients make more informed decisions about the broker's reliability and long-term stability.

User Experience Analysis (Score: 7/10)

Overall user satisfaction appears positive based on available testimonials. Traders express general contentment with trading conditions and platform functionality, indicating that the broker successfully meets most client expectations. The combination of competitive trading conditions and reliable platform performance contributes to satisfactory user experiences. This positive experience spans across different trader profiles and experience levels.

The platform interface design receives positive assessment for user-friendliness and operational simplicity. The design allows traders to navigate effectively without excessive complexity that might hinder efficient trading activities. The straightforward approach to platform design appears to accommodate both experienced traders and those less familiar with advanced trading interfaces. This inclusive design philosophy helps ensure that traders can focus on market analysis rather than struggling with platform navigation.

Account registration and verification processes are described as convenient and efficient. These streamlined processes minimize barriers to account activation for new clients, reducing potential frustration during the initial setup phase. This streamlined approach to client onboarding contributes to positive initial experiences. It reduces potential frustration during the account setup phase that could negatively impact first impressions of the broker's services.

The diversity of deposit and withdrawal options contributes to positive user experience. This flexibility accommodates different payment preferences and geographic requirements that international clients may have based on their location and banking relationships. However, specific information regarding processing times and associated fees would provide additional clarity. This information would help users plan their financial transactions and set appropriate expectations for fund transfers.

The evaluation identifies limited specific information regarding common user complaints or areas of dissatisfaction. This could indicate either generally positive experiences or limited comprehensive feedback availability from the broader client base. Enhanced user feedback collection and publication could provide additional insight. This would help identify areas for potential improvement and demonstrate the broker's commitment to continuous service enhancement.

Conclusion

Trade Quo Global Ltd presents itself as a competent foreign exchange broker operating under Seychelles FSA regulation. The broker offers competitive trading conditions that particularly appeal to experienced traders seeking high-leverage opportunities and modern trading features. The broker's combination of industry-standard MT4/MT5 platforms, social trading features, and competitive spreads creates a trading environment that supports various trading strategies. This comprehensive approach accommodates different experience levels and trading preferences effectively.

The broker appears most suitable for intermediate to advanced traders. These traders prioritize high-leverage trading capabilities and appreciate the combination of traditional forex trading with modern social trading elements that enhance their market analysis and decision-making processes. The maximum leverage of 2000:1 and positive user feedback regarding execution quality make it particularly attractive. This combination especially appeals to experienced traders comfortable with elevated risk exposure and sophisticated risk management techniques.

Primary strengths include competitive spreads, reliable order execution, platform stability, and innovative social trading features. These strengths enhance the overall trading experience and provide traders with comprehensive tools for market participation. However, areas for improvement include enhanced transparency regarding specific terms and conditions. Additional improvements needed include detailed fund protection measures and comprehensive disclosure of customer service standards and availability commitments that would strengthen client confidence in the broker's services.