Regarding the legitimacy of Axon Markets forex brokers, it provides FSA and WikiBit, .

Is Axon Markets safe?

Pros

Cons

Is Axon Markets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Axon Markets Ltd

Effective Date: Change Record

--Email Address of Licensed Institution:

info@axonmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.axonmarkets.comExpiration Time:

--Address of Licensed Institution:

1st Floor, Office 2, Unit 210, IMAD Complex, Ile du Port, Mahé, SeychellesPhone Number of Licensed Institution:

+248 4224183Licensed Institution Certified Documents:

Is Axon Markets A Scam?

Introduction

Axon Markets, operating under the brand name of Little Black Diamond Ltd, is a relatively new player in the forex trading arena, having been established in 2023. The broker positions itself as a provider of diverse trading options, including forex, commodities, and indices, through the popular MetaTrader 5 platform. Given the rapid growth of the forex market and the increasing number of brokers entering the space, it is crucial for traders to conduct thorough evaluations of any brokerage they consider.

In an industry where scams and frauds are not uncommon, the need for due diligence cannot be overstated. Traders must be aware of potential risks and red flags associated with unregulated or poorly regulated brokers. This article aims to provide an objective analysis of Axon Markets, examining its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment.

The investigation draws on various sources, including user reviews, regulatory information, and expert analyses, to present a comprehensive overview of Axon Markets. The evaluation framework includes assessing the broker's legitimacy, transparency, and the safety of client funds.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Axon Markets claims to be regulated by the Seychelles Financial Services Authority (FSA), which is known for its relatively lenient regulations compared to other jurisdictions like the UK or the US. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD115 | Seychelles | Verified |

While the presence of a license from the Seychelles FSA indicates some level of oversight, it is essential to recognize that this regulatory authority does not offer the same level of investor protection as more stringent regulators like the FCA or ASIC. The FSA's oversight is often criticized for being less rigorous, which raises concerns about the quality of protection for traders' funds.

Moreover, there have been warnings from various financial authorities, including the Japan Financial Services Agency, suggesting that Axon Markets may not be fully compliant with local laws regarding registration and licensing. This lack of robust regulation is a significant red flag for potential investors, as unregulated brokers can operate without accountability, potentially leading to fraudulent practices.

Company Background Investigation

Axon Markets is operated by Little Black Diamond Ltd, a company registered in Seychelles. The broker has a short operational history, having commenced its activities in 2023. The ownership structure and management team details are somewhat opaque, which is not uncommon for many offshore brokers.

The lack of transparency regarding the management team's qualifications and experience is concerning. A well-established brokerage typically provides information about its leadership, including their professional backgrounds and expertise in the financial markets. The absence of such information can lead to skepticism about the broker's credibility and operational integrity.

In terms of company transparency and information disclosure, Axon Markets appears to provide limited details on its website. While it offers basic information about its services and trading conditions, the lack of comprehensive disclosures about its financial health, ownership structure, and management team may raise concerns among potential clients.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital for assessing its competitiveness and fairness. Axon Markets offers various trading accounts with different conditions, but the overall fee structure needs careful examination.

The broker advertises a minimum deposit of $10 and maximum leverage of 1:2000, which are attractive features for new traders. However, traders should be cautious of the potential risks associated with high leverage, as it can lead to significant losses.

The following table summarizes key trading costs associated with Axon Markets:

| Cost Type | Axon Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.5 pips | 1.0 - 2.0 pips |

| Commission Model | $3 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Axon Markets are competitive, the commission structure may not be as favorable compared to industry standards. Additionally, traders have reported issues with withdrawal processes and hidden fees, which could indicate potential problems with the broker's fee transparency.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Axon Markets claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. Segregating client funds means that traders' money is kept separate from the broker's operating funds, which is a standard practice among reputable brokers.

However, the effectiveness of these safety measures largely depends on the regulatory environment. Since Axon Markets is regulated by the Seychelles FSA, which has less stringent oversight compared to other jurisdictions, the actual protection of client funds may not be as robust.

Furthermore, there have been no significant historical incidents reported regarding fund safety issues with Axon Markets, but the lack of a solid regulatory framework raises concerns about the broker's accountability in the event of financial mismanagement or insolvency.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of Axon Markets reveal a mixed bag of experiences among users. While some traders appreciate the competitive spreads and the user-friendly trading platform, others have raised significant concerns regarding customer service and withdrawal issues.

Common complaint types and their severity are summarized below:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| High Fees | Medium | Limited explanations |

Typical cases highlight traders experiencing prolonged delays in withdrawing their funds, with some users reporting that their requests went unanswered for weeks. This lack of responsiveness during critical times can lead to frustration and distrust among clients.

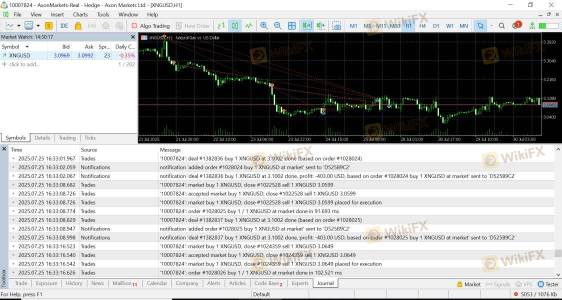

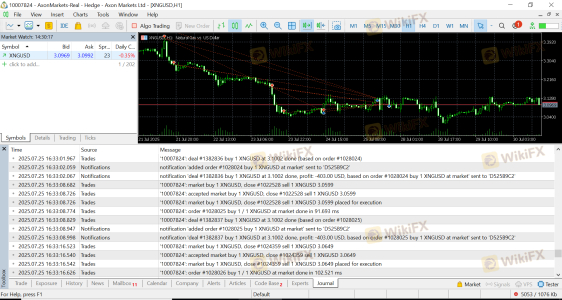

Platform and Execution

The trading platform's performance is critical for a smooth trading experience. Axon Markets utilizes MetaTrader 5 (MT5), which is widely regarded for its advanced features and user-friendly interface. Reviews suggest that the platform is generally stable, but some users have reported issues with slippage and order rejections during high volatility periods.

The quality of order execution is vital for traders, especially in fast-moving markets. While Axon Markets claims to offer a no-requote policy, anecdotal evidence suggests that some traders have experienced delays in trade execution, particularly during peak trading hours.

Risk Assessment

Using Axon Markets presents several risks that potential clients should consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Fund Safety Risk | Medium | Segregated accounts, but less robust protection. |

| Customer Service Risk | Medium | Reports of poor support and withdrawal issues. |

| Trading Execution Risk | Medium | Possible slippage and order rejection. |

To mitigate these risks, traders should approach Axon Markets with caution, considering lower investment amounts initially and ensuring they are familiar with the trading platform and its functionalities.

Conclusion and Recommendations

In conclusion, while Axon Markets offers some attractive features such as high leverage and a user-friendly trading platform, several red flags warrant caution. The broker's regulatory status under the Seychelles FSA raises concerns about investor protection, and the mixed reviews regarding customer service and withdrawal processes further complicate its credibility.

Traders should be wary of the potential risks associated with using Axon Markets, particularly the lack of stringent regulatory oversight and reported issues with fund withdrawals. For those considering trading with this broker, it is advisable to start with a small investment and thoroughly test the platform and customer support.

For traders seeking more reliable alternatives, consider brokers regulated by stricter authorities such as the FCA or ASIC, which provide enhanced investor protections and accountability.

Is Axon Markets a scam, or is it legit?

The latest exposure and evaluation content of Axon Markets brokers.

Axon Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Axon Markets latest industry rating score is 4.21, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.21 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.