Regarding the legitimacy of TenX Prime forex brokers, it provides FSCA and WikiBit, .

Is TenX Prime safe?

Pros

Cons

Is TenX Prime markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ALTRIX MARKETS (PTY) LTD

Effective Date:

2022-02-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

2ND FLOORNELSON MANDELA SQUAREWEST TOWER2146Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TenX Prime A Scam?

Introduction

TenX Prime is an online forex and cryptocurrency broker that has been gaining attention in the trading community since its inception in 2020. Operating from Saint Vincent and the Grenadines, TenX Prime claims to offer a user-friendly trading experience with access to a variety of financial instruments, including forex, commodities, and cryptocurrencies. However, the growing number of complaints and concerns surrounding its legitimacy raises alarms for potential investors.

As the forex market continues to expand, the need for traders to carefully evaluate brokers has never been more critical. With numerous unregulated and potentially fraudulent entities operating in the space, traders must conduct thorough due diligence before entrusting their funds. In this article, we will investigate TenX Prime's regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment. Our analysis will be based on a review of multiple sources, including user feedback, regulatory information, and expert opinions.

Regulation and Legitimacy

The regulatory status of a broker is a vital factor in determining its legitimacy and trustworthiness. A well-regulated broker is subject to strict oversight, which typically includes measures to protect client funds and ensure fair trading practices. In contrast, unregulated brokers often operate with little to no accountability, increasing the risk of fraud.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Sector Conduct Authority (FSCA) | 52035 | South Africa | Exceeded |

| Australian Securities and Investments Commission (ASIC) | 001300934 | Australia | Terminated |

TenX Prime claims to be regulated by the FSCA and ASIC. However, the FSCA's verification status indicates that TenX Prime has exceeded certain regulatory requirements, raising questions about its compliance. Furthermore, the termination of TenX Prime's ASIC license in August 2023 is a significant red flag, as it implies that the broker may no longer be operating under the stringent guidelines set forth by this regulatory body.

The lack of robust regulatory oversight places traders at risk, as they may not have access to the protections offered by regulated entities, such as segregated accounts, negative balance protection, and compensation schemes. Consequently, potential investors should exercise extreme caution when considering TenX Prime as a trading option.

Company Background Investigation

TenX Prime operates under the ownership of TenX Prime Ltd, which is registered in Saint Vincent and the Grenadines—an area known for its lenient regulatory environment. The broker was established in 2020, but its short history raises concerns about its reliability and stability.

The management team behind TenX Prime has not been extensively documented, which adds to the opacity surrounding the broker's operations. A lack of transparency regarding the company's leadership and their professional backgrounds can be a warning sign for potential investors. Trustworthy brokers typically provide detailed information about their management teams, including qualifications and industry experience.

Furthermore, the company's information disclosure is minimal, with limited details available on its website. This lack of transparency can be indicative of a broker that may not have the best interests of its clients at heart. Traders should be wary of companies that do not provide adequate information about their operations, as it can lead to potential financial losses.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for evaluating its overall value and competitiveness in the market. TenX Prime offers a range of trading instruments, including forex pairs, commodities, and cryptocurrencies, with a minimum deposit requirement of $25. However, the overall cost structure and potential hidden fees need to be thoroughly examined.

| Fee Type | TenX Prime | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.1 pips | 1.0 pips |

| Commission Model | No commissions | Varies by broker |

| Overnight Interest Range | No swap fees | Varies by broker |

TenX Prime advertises spreads starting from 0.1 pips, which is significantly lower than the industry average. However, the absence of a commission structure raises questions about the sustainability of such a low-cost model. It is essential to investigate whether TenX Prime applies any hidden fees or spreads that could impact overall trading costs.

Moreover, the lack of overnight interest (swap fees) may appeal to certain traders, particularly those who prefer not to incur overnight charges. However, potential clients should be aware of any non-trading fees that may apply, such as withdrawal fees or inactivity charges.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. A reliable broker should implement stringent measures to protect client deposits and ensure that funds are segregated from the broker's operational capital.

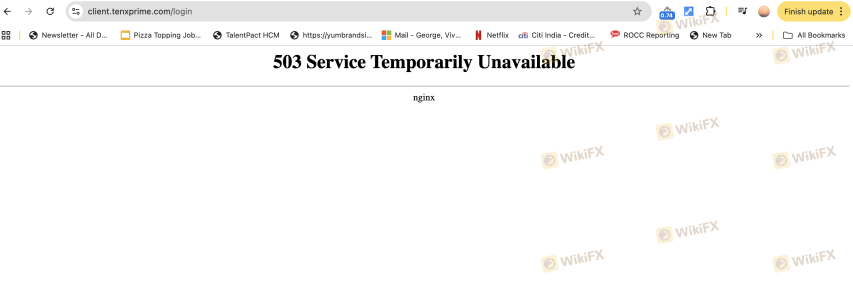

TenX Prime's website does not provide comprehensive information regarding its fund safety measures. There is no indication of whether client funds are held in segregated accounts, which is a standard practice among regulated brokers. Additionally, the absence of negative balance protection raises concerns about the potential for clients to incur losses exceeding their deposits.

Historically, there have been reports of clients facing difficulties when attempting to withdraw their funds from TenX Prime. Such issues can be indicative of a broker that may not prioritize client safety or adhere to best practices for fund management.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reputation and reliability. Many users have reported negative experiences with TenX Prime, particularly concerning withdrawal issues and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Account Suspension | High | Poor |

Common complaints include difficulties in processing withdrawals, with some clients reporting that their requests were ignored or delayed for extended periods. Furthermore, there are allegations that TenX Prime has suspended accounts without clear justification, leaving clients unable to access their funds.

In one case, a trader reported that after making a successful profit, their withdrawal request was rejected due to "suspicious activity," despite having provided all necessary documentation. Such incidents paint a concerning picture of the broker's operational integrity and responsiveness to client needs.

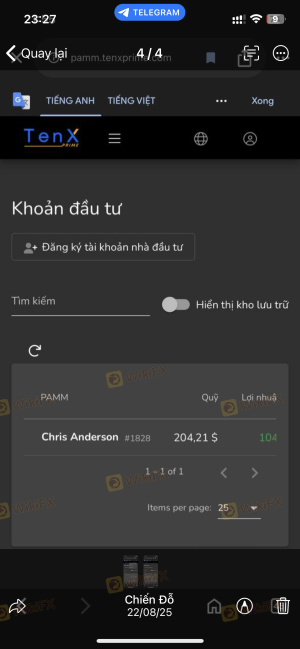

Platform and Trade Execution

The trading platform offered by TenX Prime is MetaTrader 4 (MT4), a widely recognized trading platform known for its user-friendly interface and advanced charting capabilities. However, the platform's performance and execution quality are vital factors to consider.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejected orders. In a highly competitive trading environment, these issues can significantly impact a trader's profitability and overall experience.

Moreover, there are concerns about potential platform manipulation, as some users have alleged that the broker may artificially inflate spreads during high volatility periods. Such practices can undermine the trustworthiness of a broker and lead to significant financial losses for traders.

Risk Assessment

Using TenX Prime presents several risks that potential investors should be aware of before committing their funds.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation increases the potential for fraud. |

| Withdrawal Risk | High | Numerous complaints regarding withdrawal delays and account suspensions. |

| Transparency Risk | Medium | Limited information about the company's management and operations. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with strong regulatory oversight and a proven track record. Additionally, it is crucial to remain vigilant and monitor account activity closely.

Conclusion and Recommendations

In conclusion, TenX Prime raises several red flags that warrant caution from potential investors. The broker's unregulated status, coupled with numerous customer complaints regarding withdrawal issues and lack of transparency, suggests that it may not be a trustworthy option for trading.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a positive reputation in the industry. Brokers such as IG, OANDA, and Forex.com offer robust regulatory frameworks, comprehensive customer support, and a commitment to client safety.

In summary, while TenX Prime may present attractive trading conditions, the risks associated with its lack of regulation and negative client experiences make it a broker that traders should approach with extreme caution.

Is TenX Prime a scam, or is it legit?

The latest exposure and evaluation content of TenX Prime brokers.

TenX Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TenX Prime latest industry rating score is 3.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.