Regarding the legitimacy of naqdi forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is naqdi safe?

Pros

Cons

Is naqdi markets regulated?

The regulatory license is the strongest proof.

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Naqdi Group (PTY) LTD

Effective Date: Change Record

2021-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

242 CORLETT DR BRAMLEY JOHANNESBURG 2018Phone Number of Licensed Institution:

97155 1759797Licensed Institution Certified Documents:

Is Naqdi Safe or a Scam?

Introduction

Naqdi is a relatively new player in the forex market, positioning itself as a multi-asset trading platform that offers a wide variety of financial instruments including forex, indices, shares, metals, and commodities. The broker claims to provide an ultra-fast trading experience with zero commissions, appealing particularly to both novice and experienced traders. However, with the rise of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and reliability of any broker before committing their funds. The forex market is often fraught with risks, including potential scams, and a thorough assessment can help mitigate these dangers.

This article aims to provide a comprehensive analysis of Naqdi by examining its regulatory status, company background, trading conditions, customer experience, and overall risk. We will utilize various data sources, including user reviews, regulatory information, and financial metrics to assess whether Naqdi is a safe trading platform or potentially a scam.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety of a forex broker. Naqdi claims to be regulated by two significant authorities: the Financial Sector Conduct Authority (FSCA) in South Africa and the Securities and Commodities Authority (SCA) in the UAE. Regulatory oversight is essential as it ensures that brokers adhere to specific standards that protect traders' interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 51598 | South Africa | Verified |

| SCA | 20200000150 | UAE | Verified |

The FSCA is known for its stringent regulatory framework, which includes regular audits and compliance checks. Naqdi's license under the FSCA indicates that it is subject to these regulations, which can enhance its credibility. Similarly, the SCA's license signifies that Naqdi is also monitored in the UAE, a region known for its growing financial market.

However, despite these regulatory approvals, it is essential to consider the historical compliance of the broker. Some user reviews have raised concerns about withdrawal issues and customer service responsiveness, which could indicate potential regulatory shortcomings. Thus, while Naqdi appears to be a legitimate broker on paper, its regulatory compliance must be assessed in conjunction with user experiences.

Company Background Investigation

Naqdi was established in 2010 and is registered under Naqdi Group (Pty) Ltd, headquartered in South Africa. The company has expanded its operations to the UAE, aiming to cater to a broader audience of traders. The management team comprises professionals with substantial experience in the financial markets, although specific details about their backgrounds are somewhat scarce.

Transparency is critical in the financial industry, and Naqdi's website provides basic information regarding its operations and regulatory status. However, further details about its ownership structure and the identities of its key executives are not readily available. This lack of transparency can raise red flags for potential investors, as knowing who is behind a trading platform can significantly impact trust levels.

The company's development history shows a steady growth trajectory, and its recent acquisition of licenses from respected regulatory bodies suggests a commitment to establishing itself as a reputable broker. However, the lack of detailed information about key personnel and ownership could be a concern for traders looking for a broker with a well-established reputation.

Trading Conditions Analysis

Naqdi offers a variety of trading accounts with appealing features such as zero commissions and leverage up to 1:500. However, it is essential to evaluate the overall cost structure and any potential hidden fees that could affect profitability.

| Fee Type | Naqdi | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.4 pips | From 1.5 pips |

| Commission Model | None | Varies (0-10 USD) |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Naqdi are competitive compared to industry averages, which is a positive aspect for traders. However, the absence of a clear commission structure could be misleading. While the broker advertises zero commissions, it is essential to verify whether spreads are inflated to compensate for this. Furthermore, the overnight interest rates can vary, and without clear disclosure, traders may face unexpected costs.

Overall, Naqdi's trading conditions seem favorable at first glance, but the lack of detailed information regarding hidden fees and commissions warrants caution. Traders should conduct thorough research and possibly reach out to customer service for clarification before opening an account.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Naqdi claims to implement stringent security measures to protect client funds, including segregated accounts and negative balance protection. Segregated accounts ensure that clients' funds are kept separate from the broker's operational funds, which is crucial in the event of financial difficulties.

Moreover, Naqdi states that it has a capital protection policy that safeguards up to $1,000,000 per account. This level of protection is significantly higher than what many brokers offer, which can provide peace of mind for traders. However, it is essential to consider whether these claims are backed by verifiable practices.

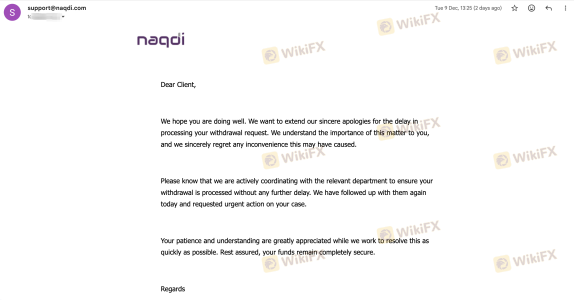

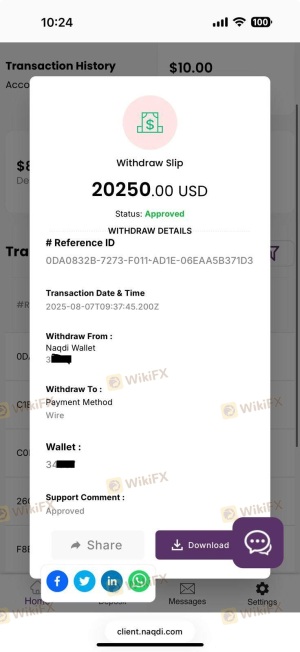

Despite these assurances, there have been reports from users regarding difficulties in withdrawing funds, which raises questions about the broker's actual practices concerning fund safety. Any historical issues related to funds can be a significant red flag for potential investors.

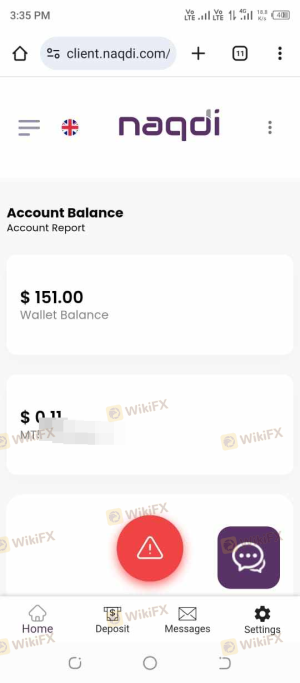

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Naqdi has received mixed reviews from users, with some praising its user-friendly platform and fast execution speeds, while others have reported significant issues with withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent |

Common complaints include delays in processing withdrawals and unresponsive customer service. For instance, one user reported waiting several days for a withdrawal, only to receive vague responses from the support team. Such experiences can significantly impact a trader's trust in the broker.

In contrast, some users have noted positive experiences with the trading platform's performance and execution speeds, suggesting that while the broker may have customer service issues, its trading conditions might still be satisfactory for some traders.

Platform and Trade Execution

Naqdi utilizes the MetaTrader 5 (MT5) platform, which is widely regarded for its advanced trading features and user-friendly interface. The platform supports algorithmic trading, multiple timeframes, and a range of analytical tools, making it appealing to various trading strategies.

However, the quality of order execution is a critical aspect that can directly affect trading outcomes. User reports indicate that while order execution is generally fast, there have been instances of slippage and order rejections, which can be detrimental, especially in volatile market conditions.

Traders should be cautious and conduct thorough testing on the platform before committing significant capital. Any signs of manipulation or persistent execution issues should be taken seriously, as they can indicate deeper problems within the trading environment.

Risk Assessment

Using Naqdi as a trading platform presents several risks that traders should be aware of. While the broker is regulated, historical complaints and issues with fund withdrawals indicate potential vulnerabilities.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Mixed user reviews on compliance |

| Customer Support | High | Slow response to complaints |

| Fund Security | Medium | Claims of high protection but mixed reviews |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and its features. Additionally, maintaining a diversified trading portfolio and only using funds that one can afford to lose can help manage overall risk exposure.

Conclusion and Recommendations

In conclusion, while Naqdi presents itself as a legitimate forex broker with favorable trading conditions and regulatory oversight, potential traders should exercise caution. Mixed reviews regarding customer service and withdrawal issues raise concerns about the broker's reliability.

Traders should carefully weigh the benefits against the risks and consider starting with a smaller investment to gauge the platform's performance. If you are risk-averse or have had negative experiences with Naqdi, consider exploring alternative brokers with stronger reputations and better customer feedback.

Overall, while Naqdi may offer attractive trading features, the presence of complaints and regulatory concerns suggests that traders should remain vigilant and conduct thorough due diligence before engaging with this broker.

Is naqdi a scam, or is it legit?

The latest exposure and evaluation content of naqdi brokers.

naqdi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

naqdi latest industry rating score is 6.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.