Axon Markets 2025 Review: Everything You Need to Know

1. Summary

The Axon Markets review shows a new forex broker that has gained attention since 2023. Axon Markets gets mostly positive ratings, especially for its good trading conditions. Key highlights include leverage up to 1:2000 and a very low minimum deposit of just 10 USD. This makes it appealing to new traders and those looking for high-leverage opportunities. The broker also launched a social trading platform that offers up to 2 USD cashback per lot traded. This is another standout feature. Despite these benefits, some users worry about customer service speed and regulatory transparency. Axon Markets operates under the Seychelles Financial Services Authority with license number SD115. Users should note that legal protection can vary by region. This comprehensive axon markets review uses various data points including official regulatory information, user reviews, and detailed market analysis. Such a balanced review makes it clear that while the broker's conditions are good for beginners, caution is advised. Some operational problems have been reported.

2. Important Considerations

Axon Markets is regulated by the Seychelles Financial Services Authority . This means its legal status and investor protection may differ across regions. The regulatory oversight from the SFSA might not be as strict as in other major areas. Potential clients should do their own research. This review combines user feedback, regulatory documents, and professional market analysis. This ensures an objective evaluation of the broker's offerings. Furthermore, certain aspects like deposit and withdrawal procedures have not been fully provided in the available data. Multilingual customer support details are also missing. As a result, while the review tries to provide a complete picture, prospective users should consider these limits before making decisions.

3. Scoring Framework

Below is the detailed scoring for Axon Markets across six critical dimensions:

4. Broker Overview

Axon Markets started in 2023 as a young but ambitious forex broker. The firm is based in the Seychelles and has been building its place by offering advanced trading solutions for modern needs. The company uses both STP and ECN systems. This dual approach helps maximize market liquidity while reducing trading costs. This is a big advantage for traders looking to speed up execution and reduce slippage. According to regulatory sources, Axon Markets has a license from the Seychelles Financial Services Authority with license number SD115. This provides basic but not complete investor protection.

Axon Markets gives clients the MetaTrader 5 platform. MT5 is one of the most respected platforms in the industry. Through MT5, clients can access many asset classes including forex, stocks, cryptocurrencies, spot metals, indices, and commodities. This wide asset selection is one of the strengths in this axon markets review. It serves traders with different interests and strategies. The broker's business model gets better with new ideas like its social trading platform. This platform lets users trade and also earn cashback up to 2 USD per lot. This feature appeals to today's competitive market and shows a creative approach to user engagement.

Despite these good features, some regulatory and service concerns have been raised by the trading community. This shows the need for future clients to be careful. Overall, while Axon Markets seems to offer competitive trading conditions and a user-friendly interface, its short track record suggests caution is needed. Some customer support issues have also been reported.

Source: SFSA documentation, User Reviews from various industry forums, and market analysis reports.

This axon markets review aims to provide a balanced view. It acknowledges both the strengths and potential problems of this new broker.

-

Regulatory Region:

Axon Markets is regulated by the Seychelles Financial Services Authority under license number SD115. This regulatory framework provides basic oversight. However, different regional legal standards can affect investor protection.

Deposit and Withdrawal Methods:

Specific details about deposit and withdrawal methods have not been provided in the available information.

Minimum Deposit Requirements:

Axon Markets requires a minimum deposit of just 10 USD. This is very attractive to new traders looking to enter the market with low investment risk.

Bonus Promotions:

The broker offers a social trading platform incentive where traders can get up to 2 USD cashback per lot. This unique promotion rewards active trading and improves user engagement.

Tradable Assets:

Axon Markets supports many tradable instruments including forex pairs, stocks, cryptocurrencies, spot metals, indices, and commodities. This wide range ensures that users can spread their trading across various asset classes.

Cost Structure:

Detailed information on spreads and commissions is not clearly provided. However, user feedback suggests that while spreads tend to be tight, the cost structure lacks transparency.

Leverage:

The broker offers high leverage with ratios up to 1:2000. This allows traders to take larger positions with smaller amounts of capital.

Platform Choice:

Axon Markets provides the MetaTrader 5 platform. MT5 is a strong and widely known trading platform with comprehensive analytical tools and customizable interface.

Regional Restrictions:

Specific regional restrictions were not mentioned in the available data.

Customer Service Languages:

Information on the languages supported by the customer service team has not been provided in the available sources.

This detailed section of the axon markets review brings together all important information. It offers future clients a clear view of what they can expect from the broker. While the minimum deposit and high leverage options are clear advantages, aspects like detailed cost structures remain less clear. Deposit methods and multilingual support also need more transparency. These gaps show the importance of doing more research before committing to the platform.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

Axon Markets provides different account types designed for various trading needs. The low minimum deposit of 10 USD is especially welcoming for new traders who may hesitate to invest large amounts initially. The broker's account conditions get better with high leverage up to 1:2000. This lets traders increase their market exposure while using relatively small amounts of capital. User feedback often highlights how easy it is to enter the market under these flexible conditions. This is one of the major strengths of Axon Markets noted in this axon markets review. While the account opening process has not been detailed in the available sources, reported user experiences show a straightforward registration process. There are minimal initial hurdles. However, some details like the availability of specialized accounts have not been mentioned. Compared to more established brokers, the low entry barrier stands out. But potential users should also weigh this advantage against concerns about regulatory oversight and user support. Overall, the account conditions provided by Axon Markets attract beginners while still offering appealing features for experienced traders. These traders seek high leverage and competitive spreads.

Axon Markets gives its traders a selection of strong trading tools, most notably the MetaTrader 5 platform. This platform is famous in the industry for its complete technical analysis capabilities and extensive customization options. This ensures that traders have access to functions essential for effective decision-making. Despite this, the axon markets review finds that while the variety of trading instruments is good, the provision of comprehensive educational materials and research resources is lacking. The absence of detailed educational content means that beginners might not find the guided learning support that some other brokers offer.

Additionally, the review does not mention specific support for automated or algorithmic trading beyond the basic MT5 functions. User feedback shows appreciation for the breadth of tools available. However, several traders expressed disappointment in the limited availability of training resources and market analysis reports. This gap suggests that although the technical toolset works well for executing trades, traders might need to look elsewhere for structured market education. It remains important for future users to consider whether they might supplement these resources through independent educational platforms. They should also consider if they would prefer a broker that offers a more integrated approach to trader development.

6.3 Customer Service and Support Analysis

Customer service and support are critical factors in any forex broker review. In the case of Axon Markets, while several support channels reportedly exist, user feedback shows a less-than-ideal picture regarding response times and problem-solving efficiency. Several users have noted that the customer service department tends to respond slowly. In some instances, the quality of the support provided falls short of expectations. This problem has been particularly evident during periods of high trading activity or technical issues on the platform. Although details such as the exact operating hours or the range of languages supported were not included in the available data, the general feeling remains one of caution.

Traders have reported that the response time to questions can be frustratingly long. This occasionally impacts the overall trading experience. The reviews show a need for improvement in both the professionalism and timeliness of support services. Given that effective client support is important for both new and experienced traders, Axon Markets would benefit from a more robust and clearly defined customer service framework. This analysis draws on user comments and comparisons with industry norms. It suggests that while the broker offers several innovative features, its support infrastructure may not yet be ready to meet the demands of a global clientele.

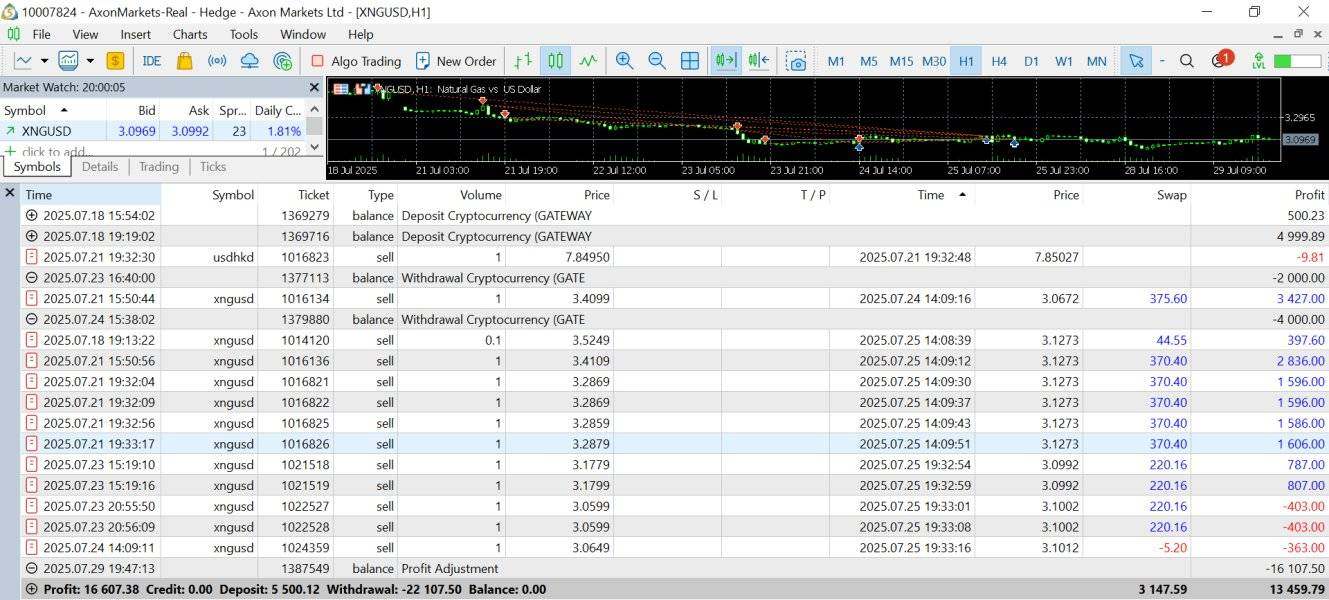

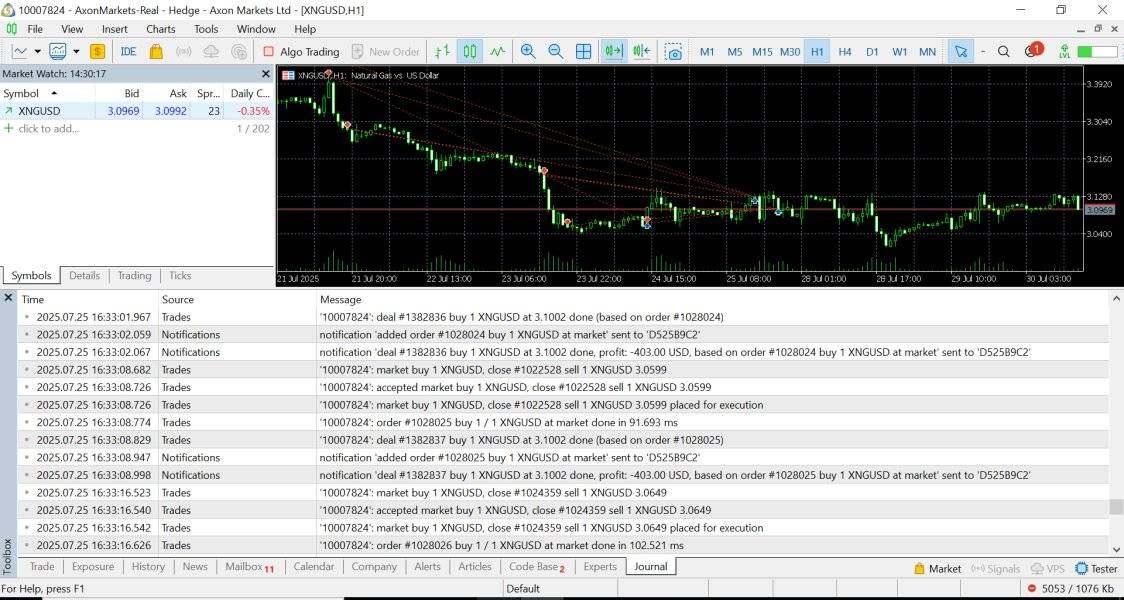

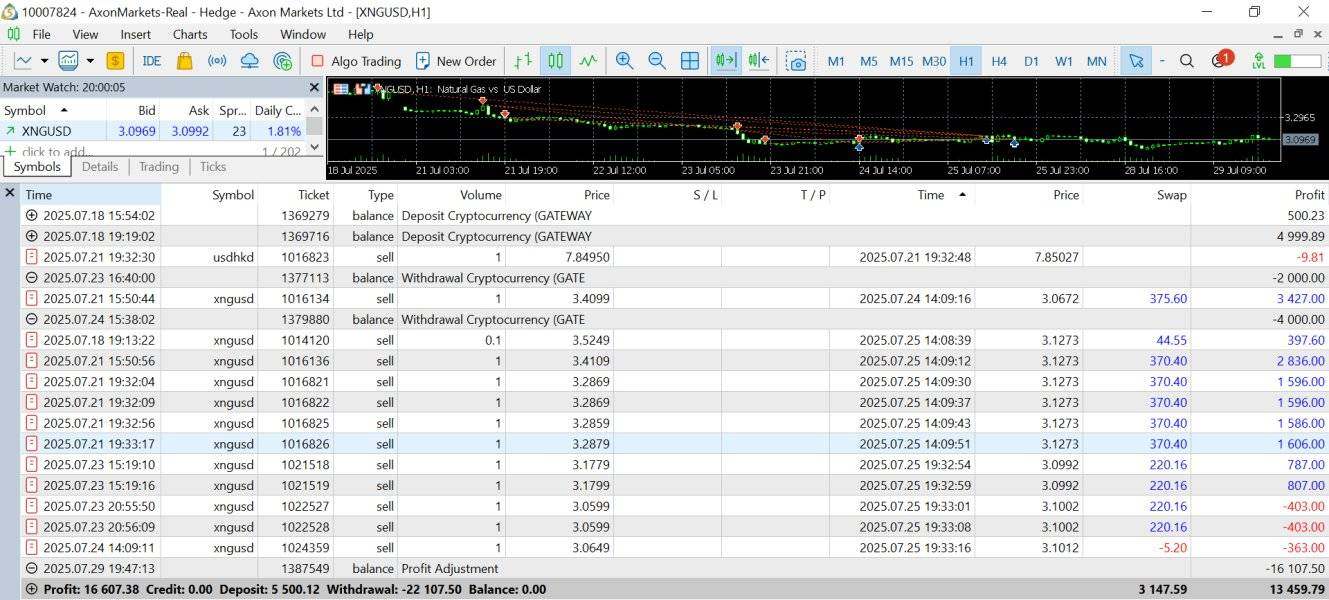

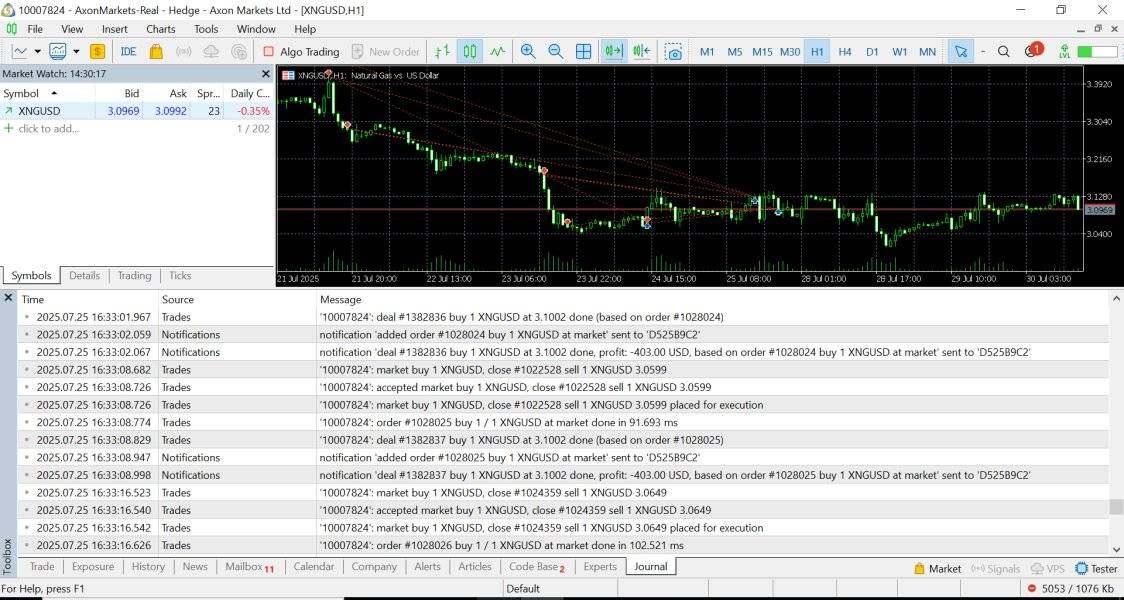

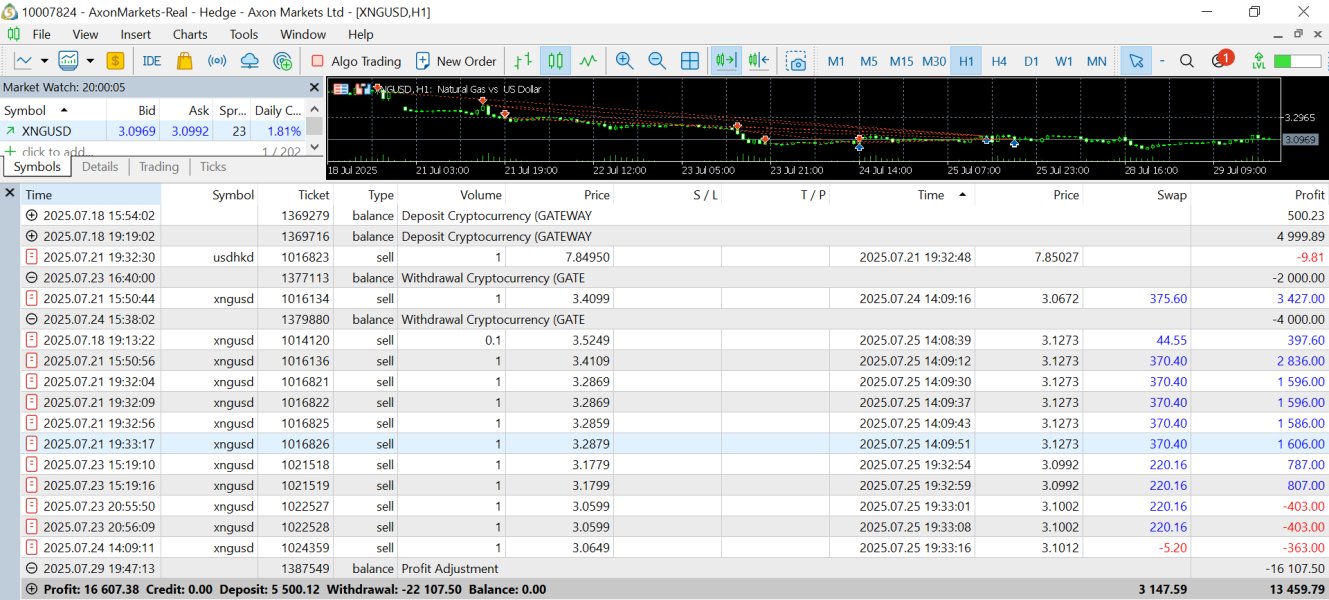

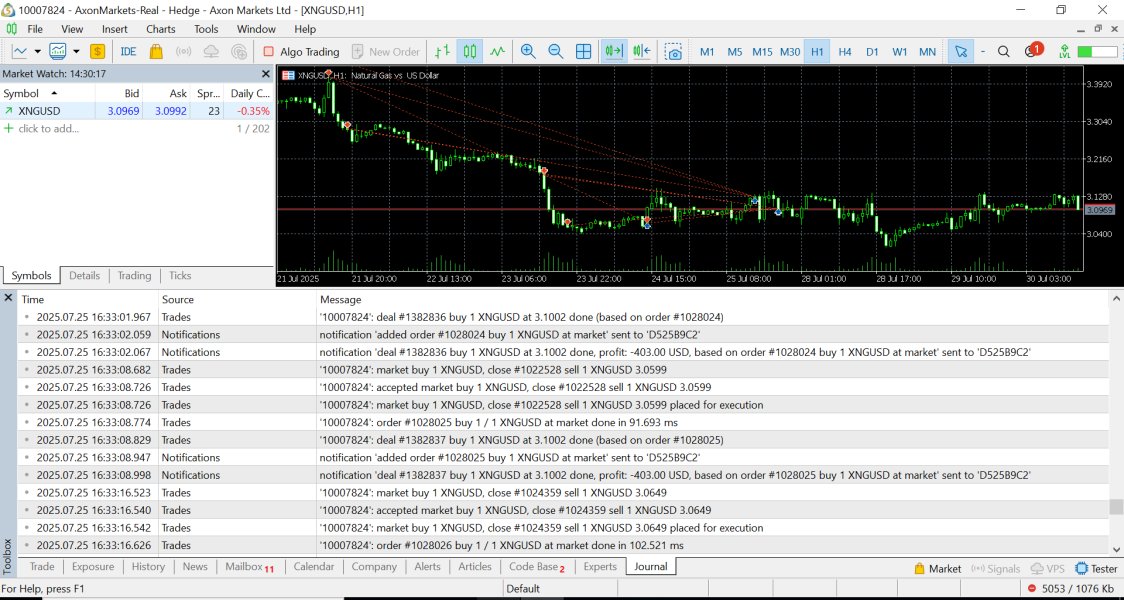

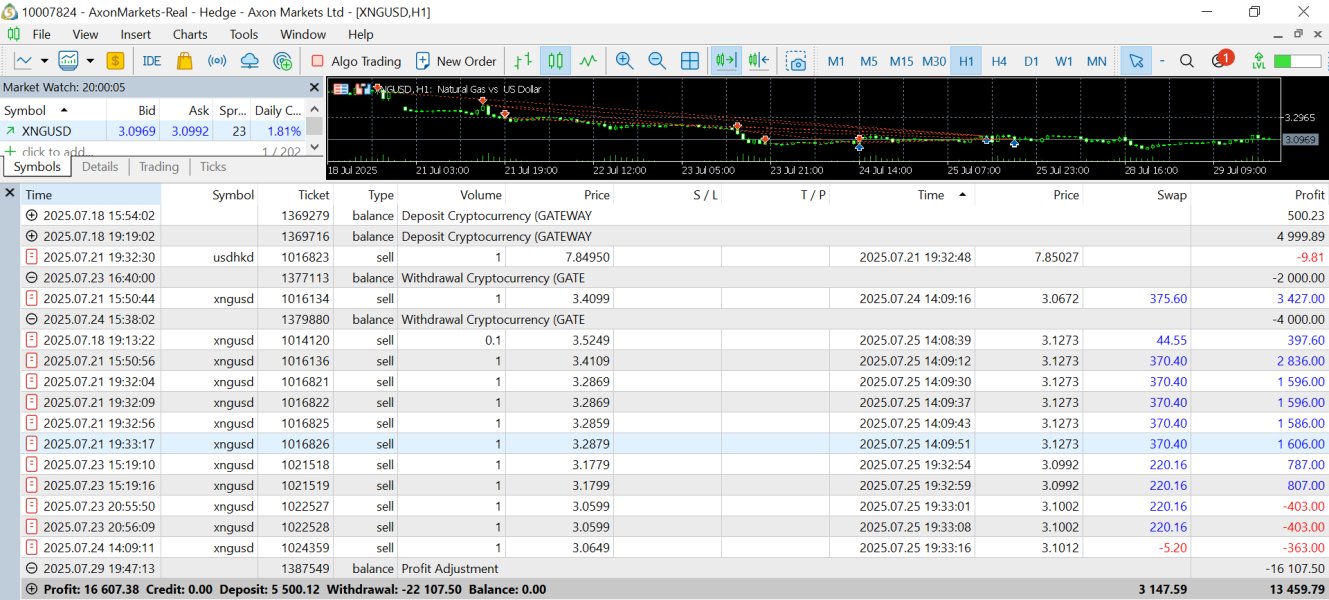

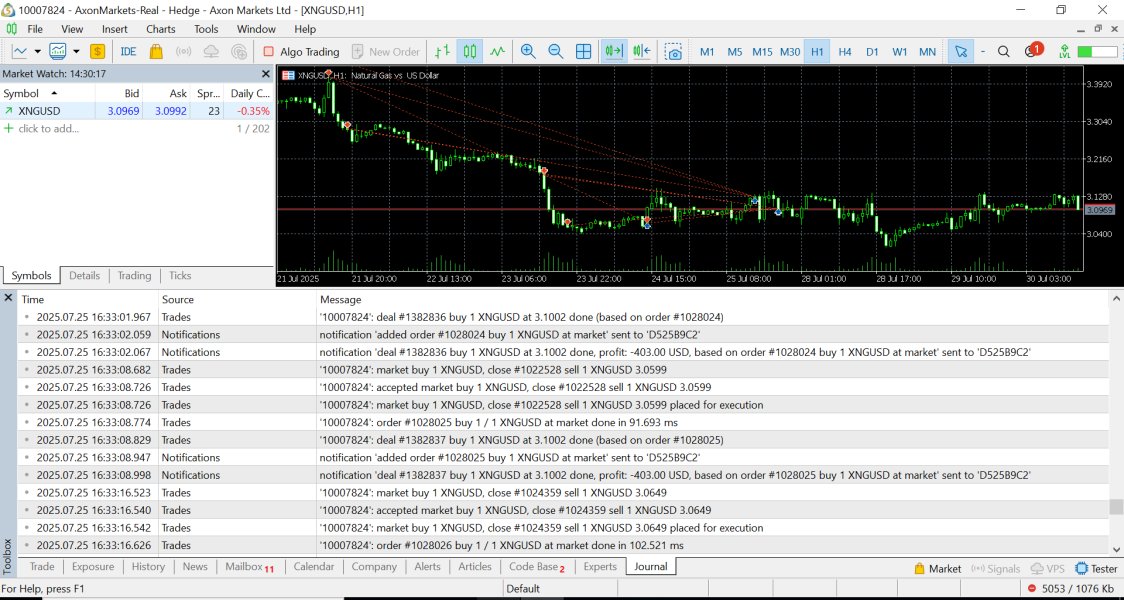

6.4 Trading Experience Analysis

The trading experience provided by Axon Markets is one of its most praised features in this axon markets review. Users have repeatedly highlighted the platform's stability and the rapid execution of orders. These are particularly important during periods of high market volatility. The MetaTrader 5 platform, known for its reliability and comprehensive feature set, ensures that traders experience minimal slippage and consistent liquidity. The technical performance of the platform combined with intuitive navigational tools allows for a smooth and efficient trading environment. This works even when large volumes of trades are executed at the same time. Furthermore, several users have shared positive experiences regarding the clarity of the platform's interfaces and the ease with which they can monitor and manage their trading positions.

It is important to note, however, that while individual experiences with order execution tend to be positive, there have been isolated reports of occasional minor delays during peak trading periods. These slight issues, while not taking away significantly from the overall experience, do highlight that there is still room for further improvement. Overall, the trading environment at Axon Markets stands out for its speed, reliability, and user-friendly interface. As such, for those seeking a combination of technical excellence and ease of use, the broker appears to deliver a strong trading experience.

6.5 Trustworthiness Analysis

Trustworthiness is a key concern for any forex broker, and Axon Markets' regulatory status plays a central role in this regard. As a broker regulated by the Seychelles Financial Services Authority under license number SD115, Axon Markets meets the basic regulatory requirements. However, this level of oversight is sometimes viewed as less strict compared to major regulatory bodies in regions like Europe or North America. As such, some industry observers and users have expressed concerns regarding the overall safety and security of funds with the broker. Reports and user reviews have occasionally hinted at potential risks, including warnings of possible fraudulent activities and shortcomings in transparency regarding fund protection measures.

The relatively recent establishment of the company in 2023 further adds to these concerns. A longer track record typically helps in building stronger trust metrics. Despite offering competitive trading conditions and innovative trading features, the trust factor remains a critical area for improvement. Axon Markets would benefit from implementing more robust security protocols and increasing transparency with its clients regarding fund protection. Perhaps seeking additional regulatory approvals from more established authorities would also help. Until then, the perceived risk level remains higher compared to some more established brokers in the market. This suggests that prospective users should exercise additional caution when considering this broker.

6.6 User Experience Analysis

Overall user experience with Axon Markets appears to be a mix of positive features and areas needing improvement. On the one hand, the intuitive design of the MetaTrader 5 platform and the ease of navigating its multiple functions have earned praise from numerous traders. This is particularly true for those who are new to the market. The low minimum deposit and high leverage options also contribute significantly to a favorable initial experience. This makes the broker accessible to a wide audience, especially beginners. However, the review also uncovers recurring issues that reduce the overall experience.

For instance, there have been multiple reports of payment delays and inconveniences during withdrawal processes. Additionally, while the platform itself is robust, the registration and verification process have not been described in detail in the available sources. This leaves potential gaps in user onboarding. Some users have raised concerns regarding the responsiveness of customer support when issues arise. This suggests that the user experience could be enhanced through improved service response times and more diversified payment options. In conclusion, while many elements of the trading interface, such as clarity, speed, and reliability, are good, Axon Markets must address these operational problems. This would help elevate the overall user experience further.

7. Conclusion

In summary, Axon Markets is a promising yet emerging broker that offers some highly attractive trading conditions. With a very low minimum deposit, high leverage , and an innovative social trading platform that rewards traders with cash back, it is particularly well-suited for beginners. It also appeals to those looking to maximize leverage. However, concerns surrounding customer service responsiveness, limited transparency in cost structures, and regulatory issues warrant caution. This axon markets review shows that while the advantages are significant, prospective clients should remain aware of the broker's potential risks. Ultimately, traders looking for a low-cost entry into the markets may find Axon Markets appealing. They should carry out thorough research before investing.

All key information is based on available regulatory reports, user reviews, and market analysis as of 2025.