Vonway 2025 Review: Everything You Need to Know

Executive Summary

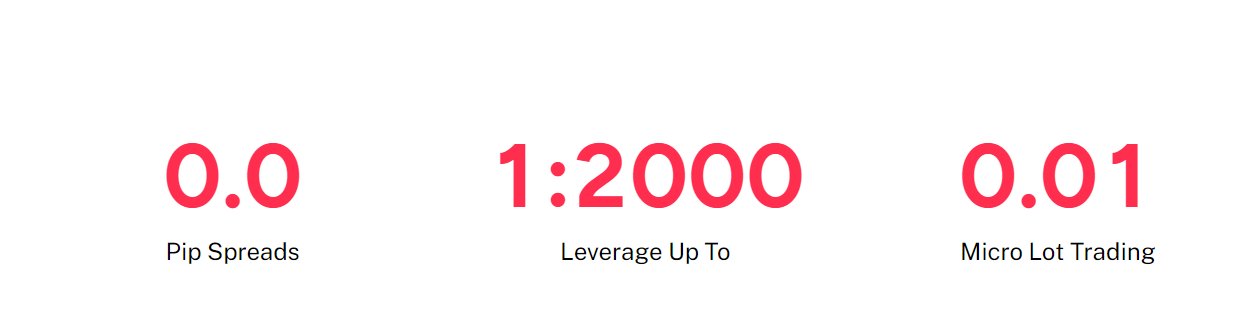

This comprehensive vonway review provides an in-depth analysis of Vonway, a Hong Kong-based forex broker that has been operating since 2017. Based on available user feedback and public information, Vonway receives a mixed assessment with a user rating of 68 out of 100. This rating shows moderate satisfaction among its client base. The broker attracts attention primarily through two key features: spreads starting from 0.0 pips and maximum leverage of up to 1:2000, positioning itself as an aggressive competitor in the retail forex market.

Vonway primarily targets small to medium-sized traders and investors with higher risk tolerance. The broker offers access to multiple asset classes including forex, indices, stocks, commodities, and cryptocurrencies through the popular MT4 trading platform. However, the broker's appeal is tempered by mixed user experiences, with some clients reporting satisfactory trading conditions while others express concerns about service quality and transparency issues. The minimum deposit requirement of $50 makes it accessible to beginner traders. However, potential clients should carefully consider the associated risks before opening an account.

Important Disclaimers

Traders should be aware that Vonway operates from Hong Kong without clearly disclosed regulatory oversight or license numbers in available public information. This may significantly impact user trust and confidence. This lack of transparent regulatory information represents a notable concern for potential clients seeking regulated trading environments.

This evaluation is based on publicly available information and user feedback collected from various sources. Given the limited regulatory transparency and mixed user experiences, prospective clients are strongly advised to conduct their own due diligence and carefully assess their risk tolerance before engaging with this broker.

Overall Rating Framework

Broker Overview

Vonway was established in 2017 and operates from its headquarters in Hong Kong. The company positions itself as a provider of forex and other financial trading services. The company has built its business model around attracting traders through competitive spreads and high leverage offerings, attempting to capture market share in the increasingly competitive retail forex space. According to available information, Vonway focuses on providing accessible trading conditions with a relatively low barrier to entry. The broker targets traders who may be seeking alternatives to more established brokers.

The broker operates primarily through the MT4 platform. It offers access to a diverse range of asset classes including foreign exchange pairs, stock indices, individual equities, commodities, and cryptocurrency instruments. However, specific regulatory oversight information remains unclear in available documentation, which represents a significant consideration for potential clients. The company's approach appears focused on volume attraction through competitive pricing rather than premium service differentiation. This is evidenced by their aggressive leverage and spread offerings combined with a low minimum deposit requirement.

Regulatory Status: Available information does not clearly specify regulatory oversight or license numbers. This raises important questions about compliance and client protection measures.

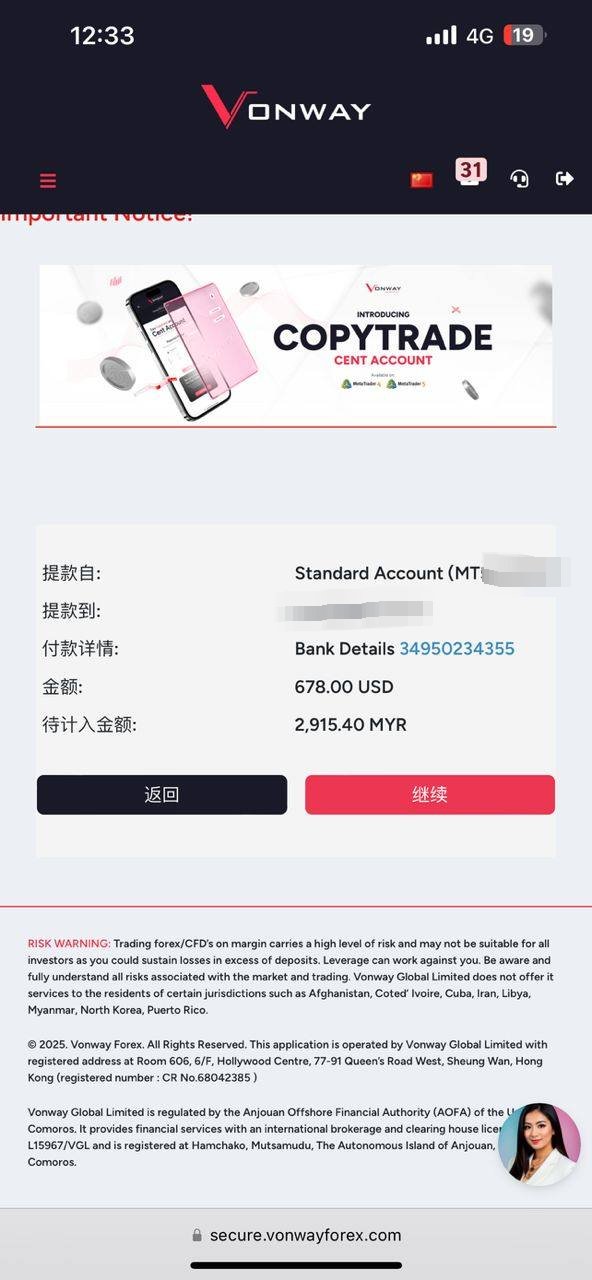

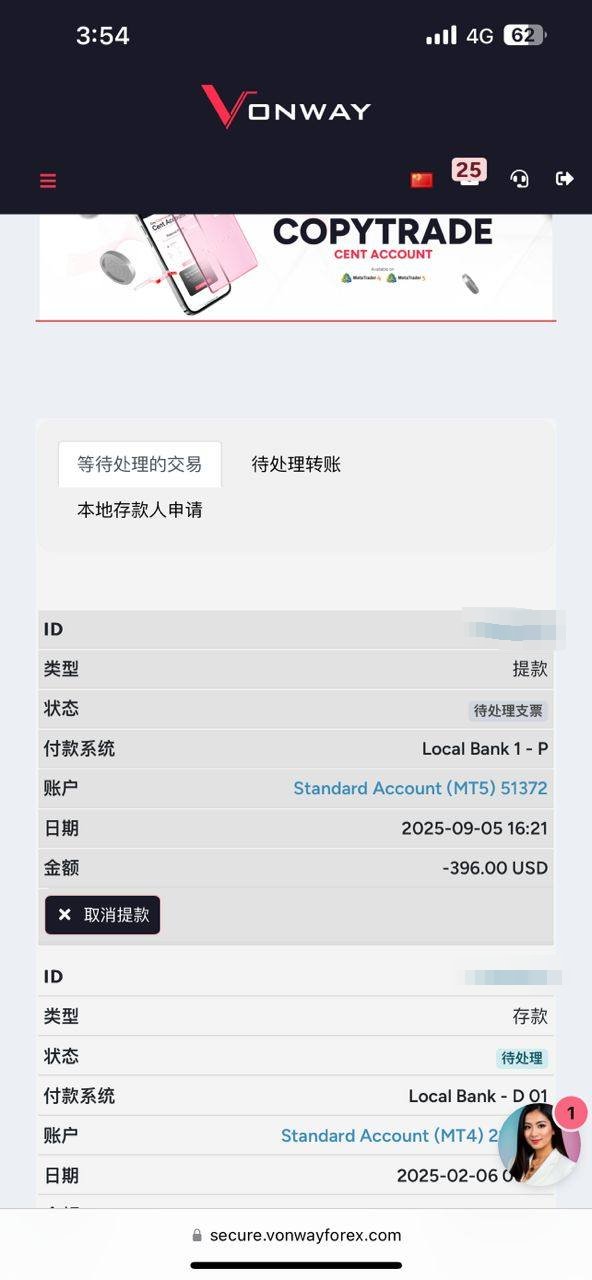

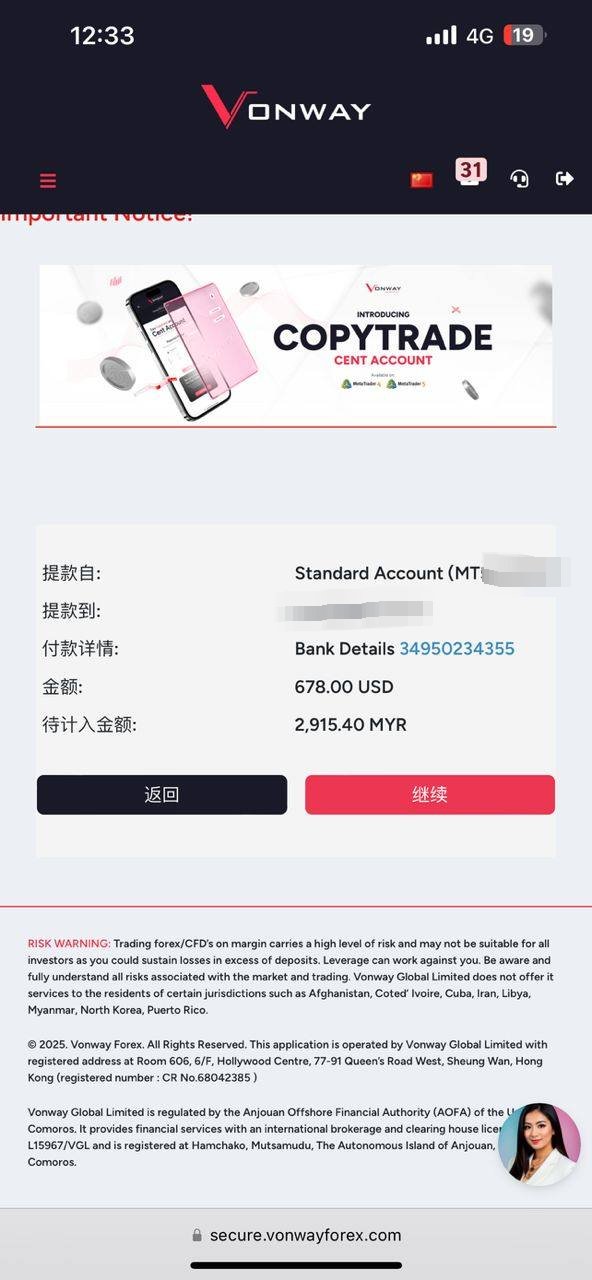

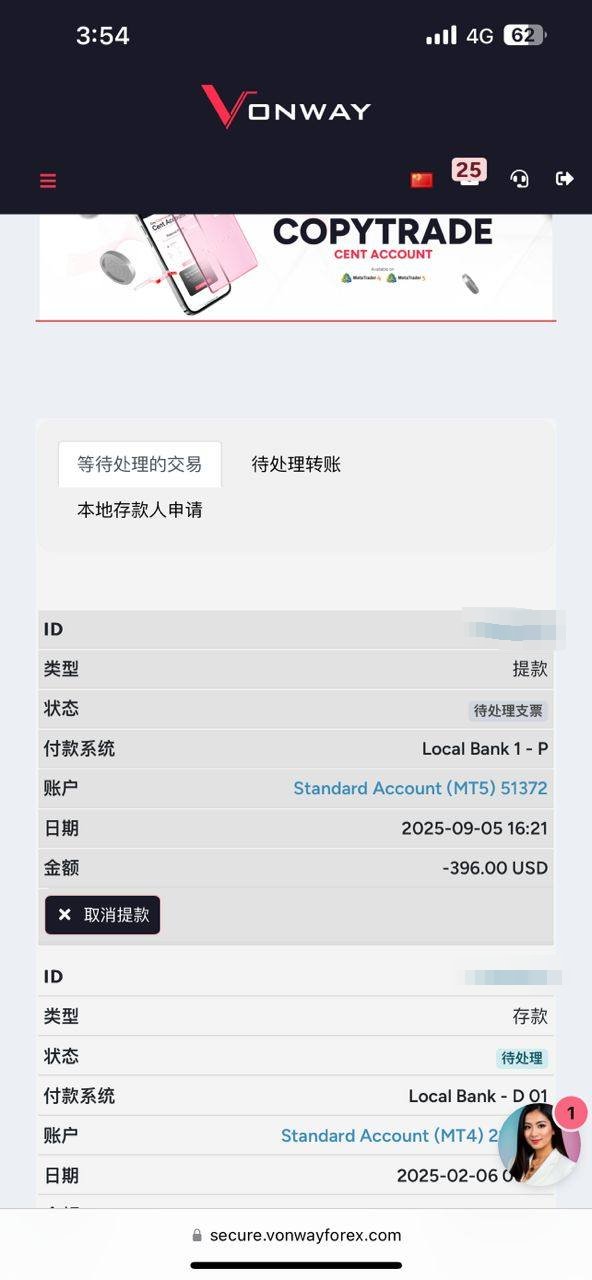

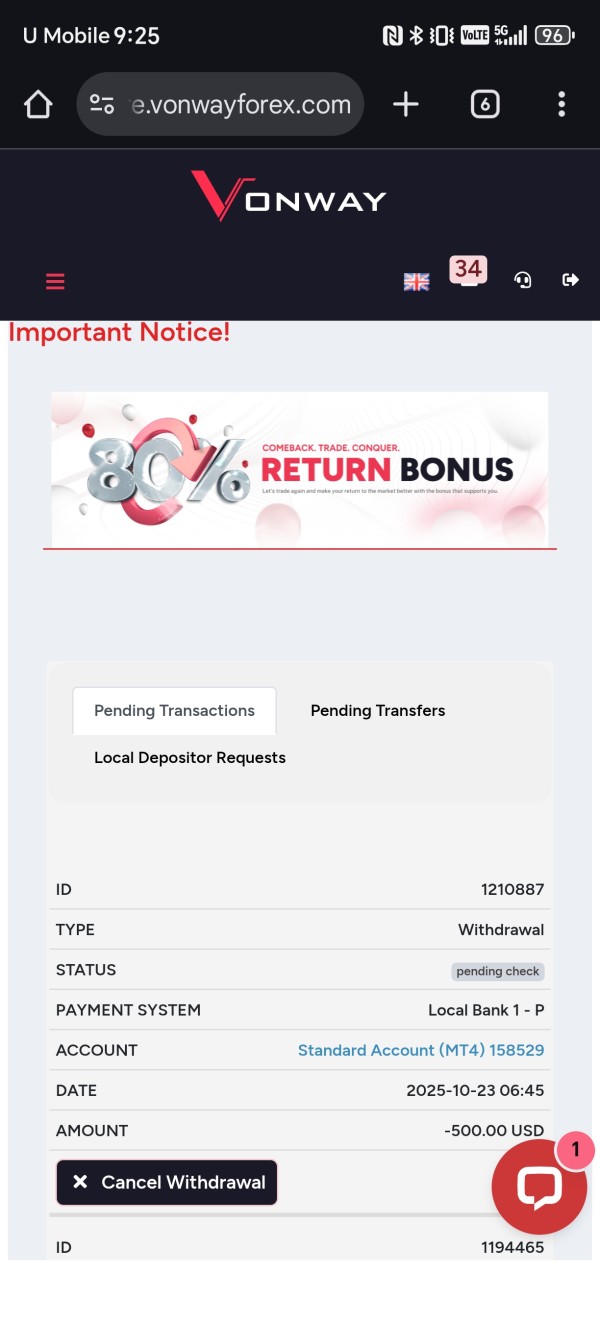

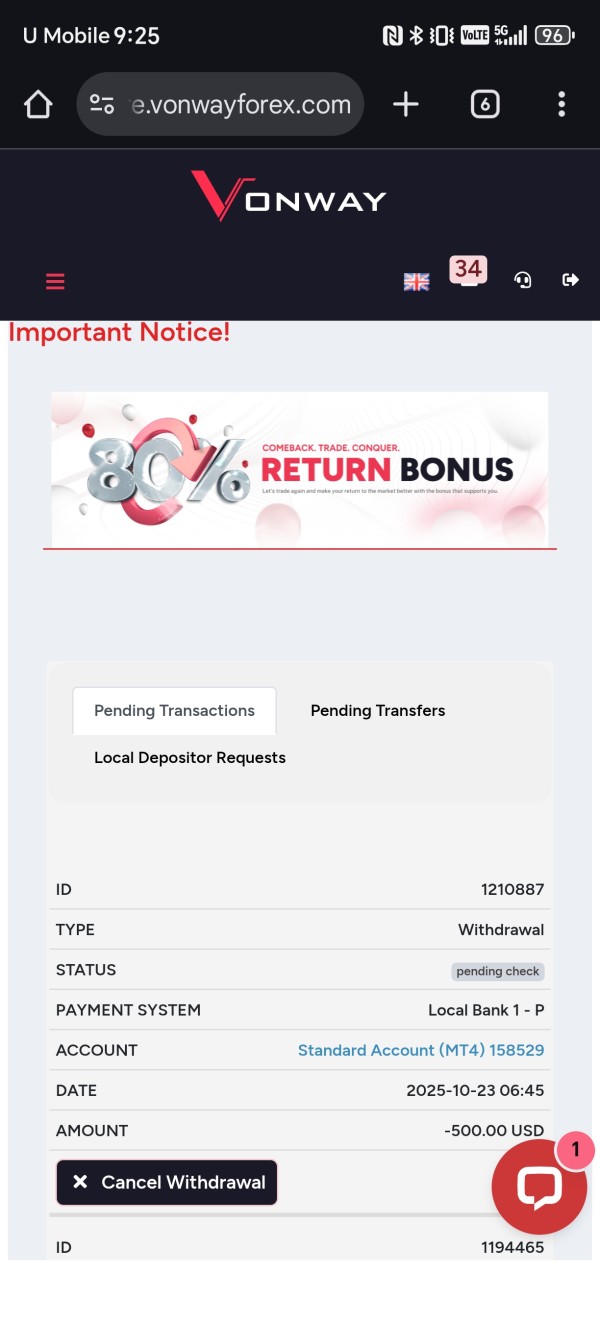

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in available public information. Traders must contact the broker directly for this information.

Minimum Deposit Requirements: Vonway sets a relatively accessible minimum deposit threshold of $50. This makes it approachable for new traders with limited capital.

Bonus and Promotional Offers: Current promotional activities and bonus structures are not specified in available documentation.

Tradeable Assets: The broker provides access to multiple asset classes including forex currency pairs, stock indices, individual stocks, commodities, and cryptocurrency instruments. This offers reasonable diversification opportunities.

Cost Structure: Spreads reportedly begin from 0.0 pips, though commission structures and additional fees are not clearly detailed in available information. Traders should verify complete pricing structures before committing funds.

Leverage Ratios: Maximum leverage reaches 1:2000. This represents extremely high risk potential that requires careful consideration and risk management.

Platform Options: Trading is conducted through the MT4 platform. This provides standard industry functionality.

Geographic Restrictions: Specific jurisdictional limitations are not detailed in available information.

Customer Support Languages: Language support details are not specified in current documentation.

This vonway review highlights the importance of obtaining complete information directly from the broker regarding missing details.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

Vonway's account conditions present a mixed picture that earns a solid 7 out of 10 rating. The broker's most attractive feature is its low $50 minimum deposit requirement. This makes it accessible to traders with limited starting capital. This approach demonstrates an understanding of market entry barriers and positions Vonway as a beginner-friendly option. The spreads starting from 0.0 pips represent competitive pricing that could appeal to cost-conscious traders, though the complete fee structure requires further clarification.

However, the lack of detailed information about different account types and their specific features represents a significant gap in transparency. Most established brokers offer tiered account structures with varying benefits. Available documentation doesn't clearly outline such differentiation. The account opening process details are also not readily available, which could create uncertainty for potential clients.

User feedback regarding account conditions shows moderate satisfaction. Some traders appreciate the low entry requirements while others express concerns about hidden fees or unexpected charges. When compared to other brokers in the market, the $50 minimum deposit is indeed competitive, though the overall value proposition depends heavily on the complete cost structure and service quality. This vonway review emphasizes the importance of understanding all account terms before proceeding.

The tools and resources offered by Vonway receive an average rating of 6 out of 10. This rating is primarily based on their MT4 platform provision and basic trading functionality. MT4 remains a popular choice among retail traders due to its familiar interface and widespread acceptance. It provides essential charting tools, technical indicators, and basic analysis capabilities. The platform supports automated trading through Expert Advisors, which appeals to traders interested in algorithmic strategies.

However, the broker appears to offer limited additional resources beyond the standard MT4 package. Research and analysis resources are not prominently featured in available information. This represents a significant shortcoming for traders who rely on fundamental analysis or market insights. Educational materials, webinars, or trading guides that could help develop trader skills are not clearly documented, limiting the broker's value proposition for learning-oriented clients.

Some users report that the basic tools meet their immediate trading needs. This is particularly true for those focused on technical analysis through MT4's built-in indicators. However, more sophisticated traders may find the resource offering insufficient compared to full-service brokers that provide comprehensive market research, economic calendars, and educational content. The absence of proprietary tools or enhanced analytical resources limits differentiation in a competitive market.

Customer Service and Support Analysis (Score: 5/10)

Customer service and support represent one of Vonway's weaker areas. The broker earns a below-average score of 5 out of 10 based on mixed user feedback and limited transparency about support infrastructure. Available information does not clearly specify customer service channels, operating hours, or response time commitments. This creates uncertainty about support accessibility when issues arise.

User feedback reveals inconsistent service experiences. Some clients report satisfactory problem resolution while others express frustration with response times and service quality. This variability suggests potential staffing or training issues that impact service consistency. The lack of clearly documented support procedures or escalation processes further compounds these concerns.

Multilingual support availability is not specified in available documentation. This could limit accessibility for international clients. Professional forex brokers typically provide comprehensive support documentation including FAQ sections, detailed contact information, and guaranteed response times, but such information appears limited for Vonway. The absence of 24/7 support confirmation is particularly concerning given the global nature of forex markets and the need for timely issue resolution during active trading sessions.

Trading Experience Analysis (Score: 6/10)

The trading experience with Vonway receives an average rating of 6 out of 10. This reflects mixed user feedback about platform performance and execution quality. Some users report satisfactory trading conditions, particularly regarding the MT4 platform's stability and familiar functionality. The competitive spreads starting from 0.0 pips can enhance trading economics for active traders, though execution quality and slippage characteristics require further verification.

Platform stability appears adequate based on available user feedback. The MT4 infrastructure generally provides reliable connectivity and order processing. However, specific performance metrics such as execution speeds, slippage statistics, or uptime guarantees are not documented in available information. Mobile trading experience details are also limited, which is increasingly important for traders who require flexible access.

The high leverage of up to 1:2000 provides significant amplification potential but also dramatically increases risk exposure. This requires sophisticated risk management from users. Some traders appreciate the flexibility this provides, while others may find such extreme leverage concerning. Order execution quality feedback varies among users, with some reporting smooth operations while others mention occasional technical issues. This vonway review emphasizes the importance of testing platform performance through demo accounts before committing significant capital.

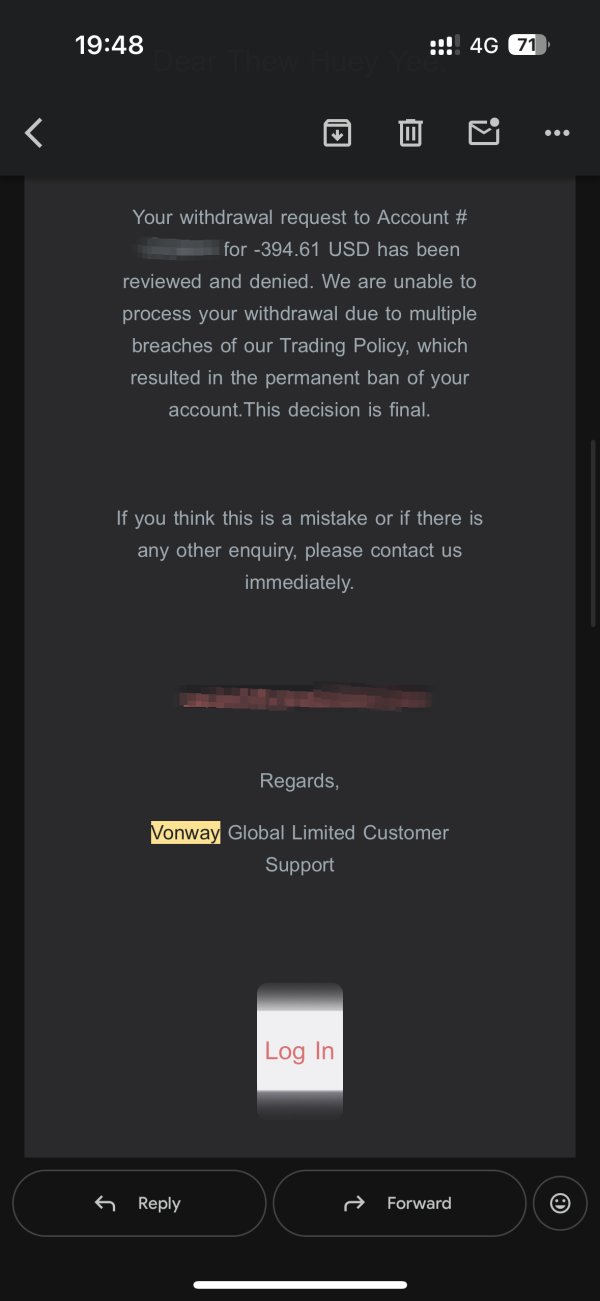

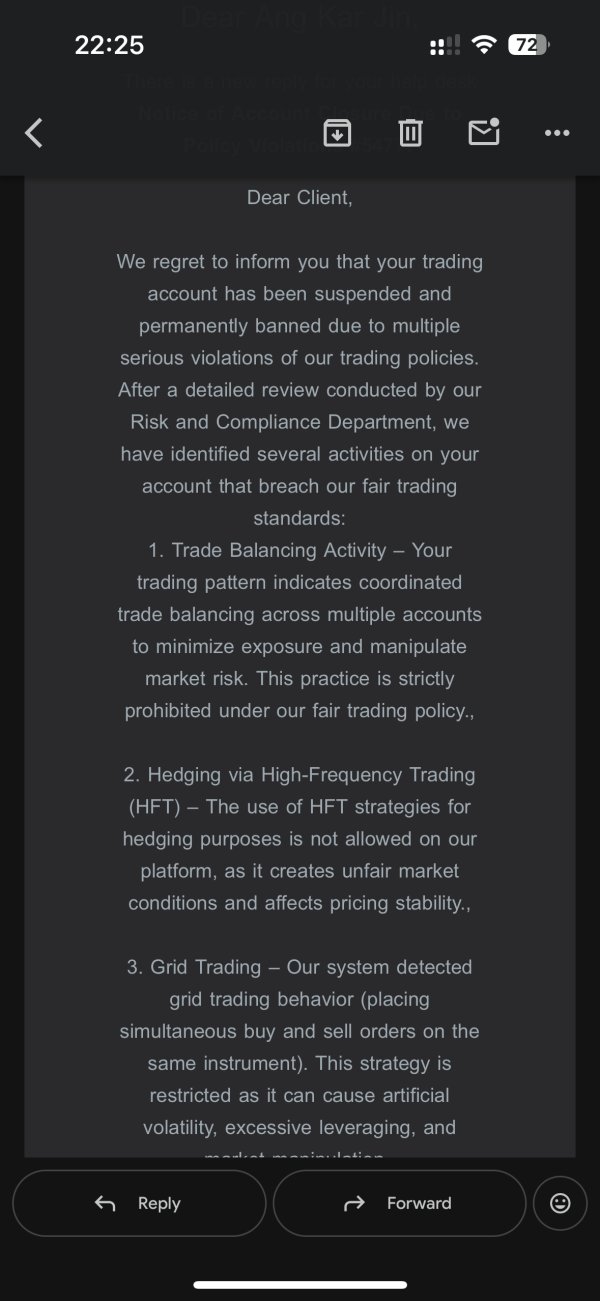

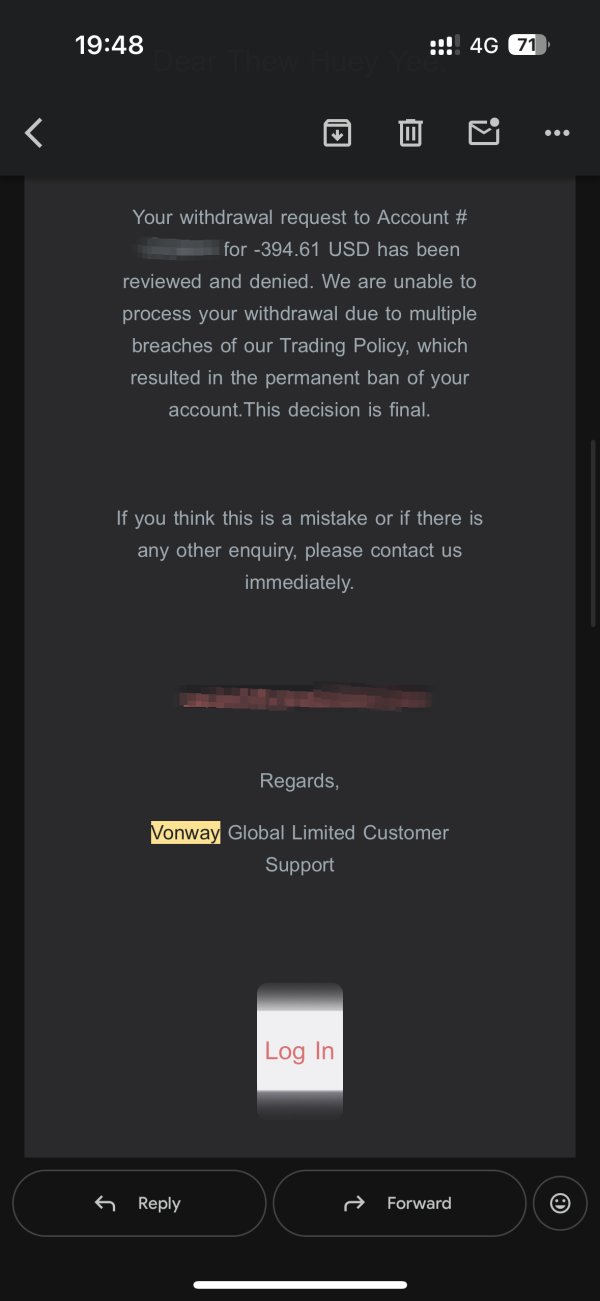

Trust and Reliability Analysis (Score: 4/10)

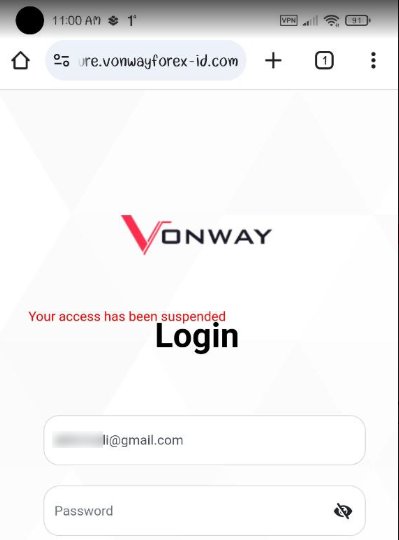

Trust and reliability represent Vonway's most concerning area. The broker receives a low score of 4 out of 10 due to significant transparency issues and regulatory uncertainty. The lack of clearly disclosed regulatory oversight or license numbers in available public information creates substantial concerns about client protection and compliance standards. Established brokers typically prominently display their regulatory credentials, but such information appears absent or unclear for Vonway.

Fund security measures are not detailed in available documentation. This leaves questions about client money protection, segregation practices, and insurance coverage. These represent fundamental safety considerations that professional traders prioritize when selecting brokers. The absence of transparent information about company financials, auditing practices, or regulatory compliance further undermines confidence.

The broker's classification as high-risk in some assessments reflects these transparency concerns and regulatory uncertainties. User trust feedback shows mixed results, with some clients expressing satisfaction with their trading experience while others voice concerns about safety and reliability. Third-party ratings of 68 indicate moderate confidence levels, but this falls short of the trust scores typically achieved by well-regulated, transparent brokers. Without clear regulatory oversight and transparent operational practices, Vonway faces significant credibility challenges in the competitive broker marketplace.

User Experience Analysis (Score: 6/10)

Overall user experience with Vonway achieves an average rating of 6 out of 10. This reflects the mixed nature of client feedback and service delivery. The MT4 platform provides a familiar and relatively straightforward interface that most forex traders can navigate effectively. This contributes positively to the user experience. The low minimum deposit requirement also enhances accessibility for new traders entering the market.

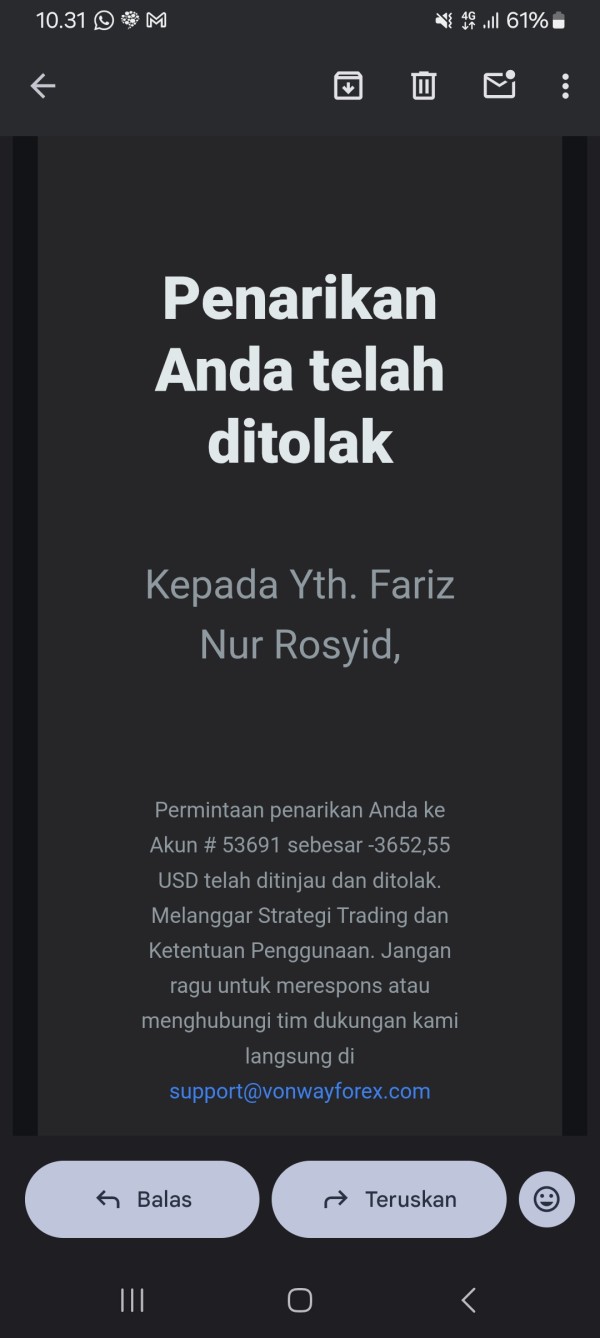

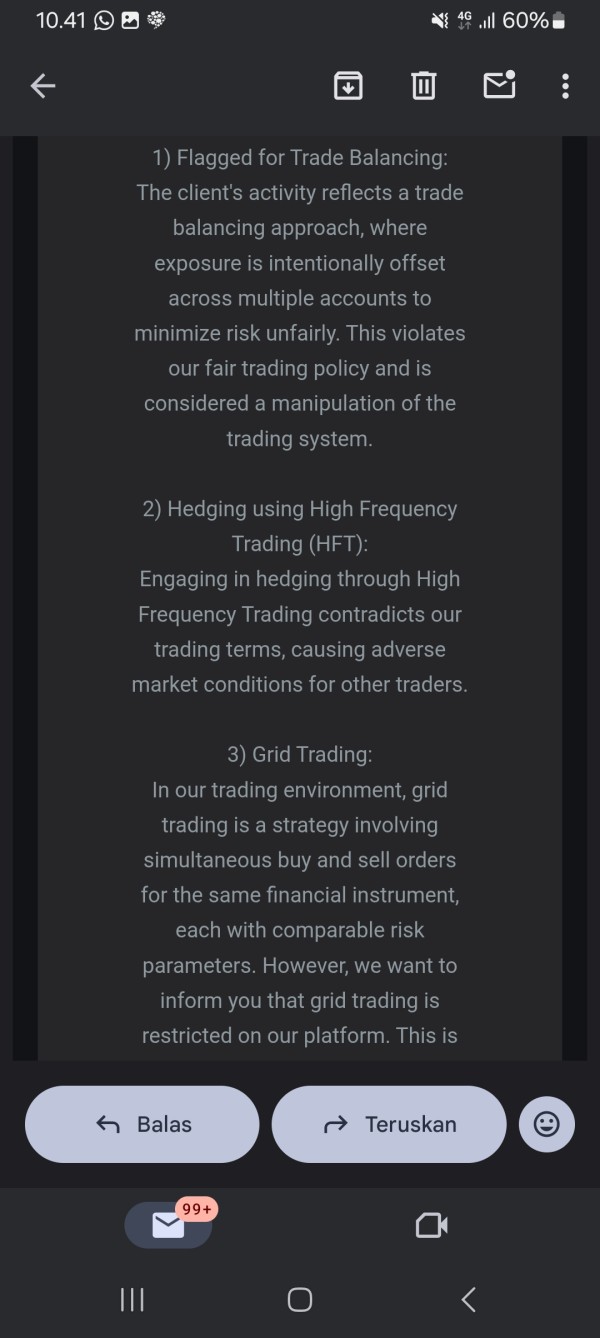

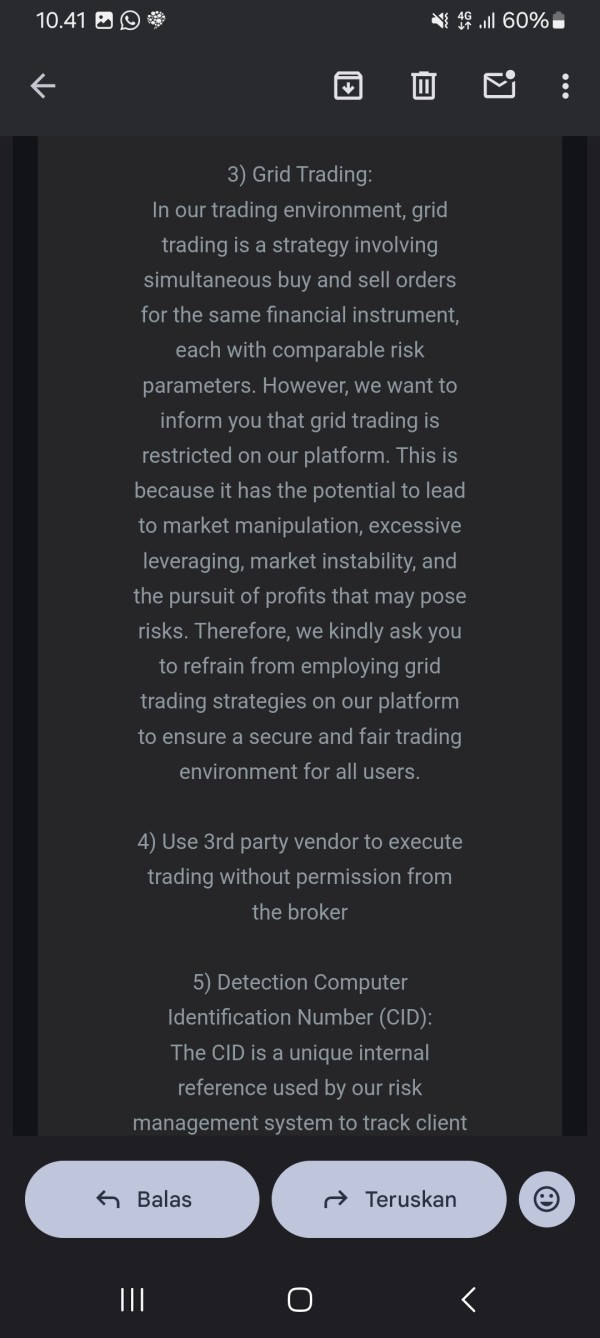

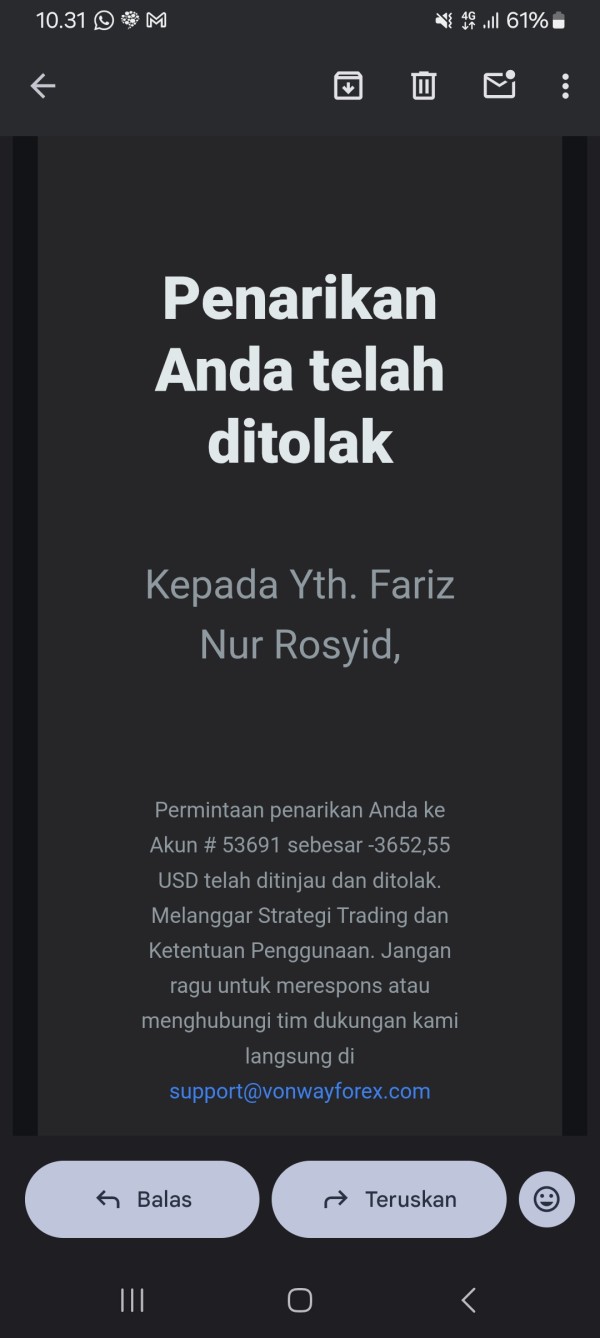

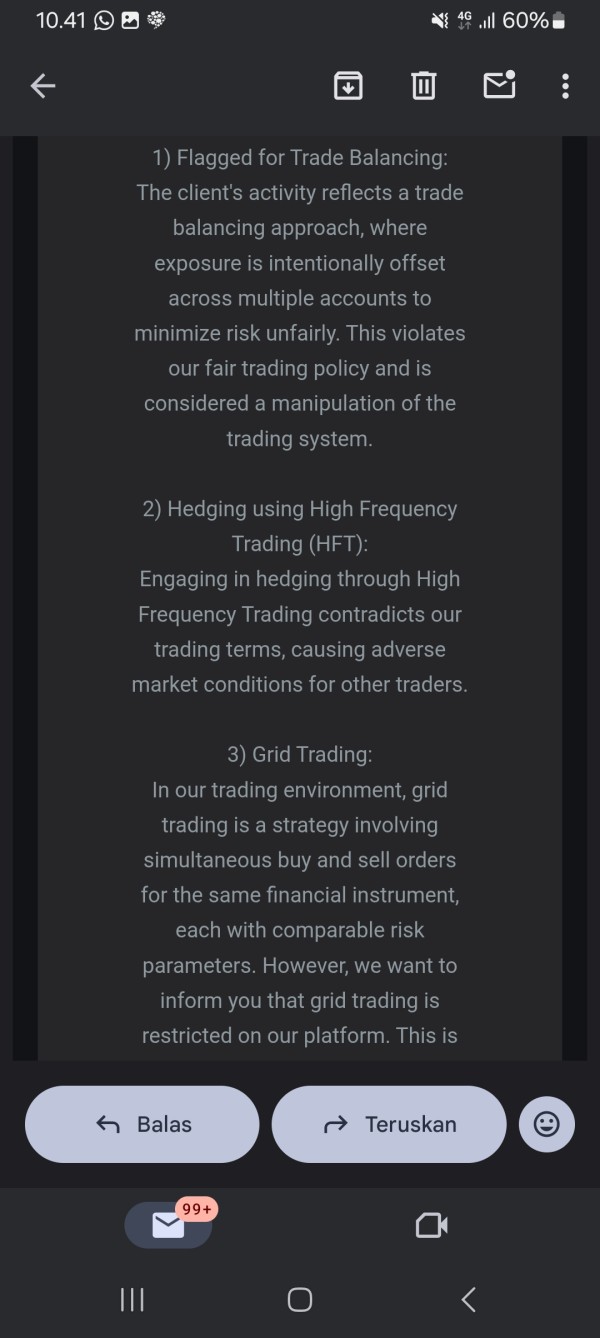

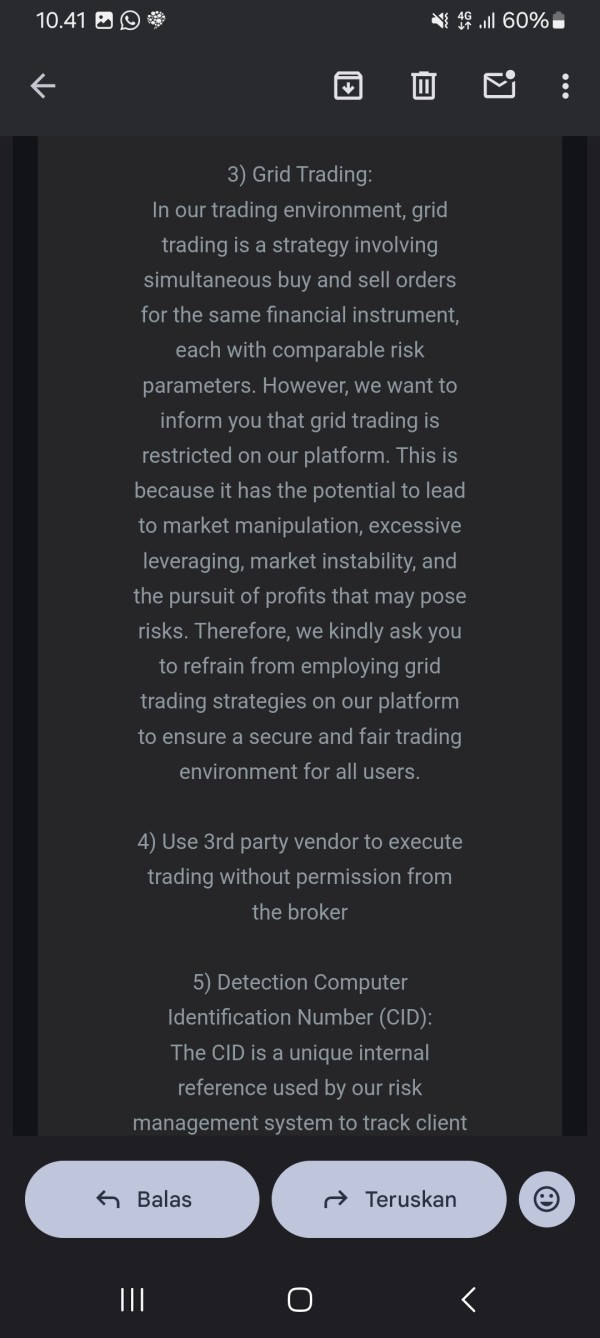

However, the user experience is significantly impacted by the transparency and service quality issues previously discussed. Registration and account verification processes are not clearly documented. This potentially creates friction for new clients. Fund management procedures, including deposit and withdrawal experiences, lack detailed documentation that could guide user expectations and processes.

User feedback reveals a divided experience. Some traders report satisfactory interactions and trading conditions while others express frustration with service quality and communication issues. This inconsistency suggests operational challenges that impact user satisfaction. The target user profile appears to be small to medium-sized traders willing to accept higher risk levels in exchange for competitive trading conditions, though the overall experience quality remains variable. Improvements in customer service quality, transparency, and communication could significantly enhance the user experience and broker reputation.

Conclusion

This comprehensive vonway review reveals a broker with both attractive features and significant concerns that potential clients must carefully consider. Vonway offers competitive trading conditions including low spreads starting from 0.0 pips, high leverage up to 1:2000, and an accessible $50 minimum deposit. These features appeal to small to medium-sized traders and those with higher risk tolerance.

However, the broker faces substantial challenges in transparency and regulatory clarity. This earns it classification as a high-risk option. The lack of clear regulatory oversight, mixed customer service feedback, and limited transparency about operational practices represent significant concerns for safety-conscious traders. While some users report satisfactory trading experiences, the inconsistent service quality and trust issues limit Vonway's appeal to risk-tolerant traders willing to prioritize competitive pricing over regulatory security and premium service quality.

Potential clients should conduct thorough due diligence, fully understand the risks involved, and consider whether Vonway's competitive trading conditions justify the associated uncertainties before opening an account.