Is ALPEX TRADING safe?

Pros

Cons

Is Alpex Trading A Scam?

Introduction

Alpex Trading is a relatively new player in the forex market, claiming to offer a comprehensive online trading platform for various financial instruments, including forex, commodities, and cryptocurrencies. As the trading landscape becomes increasingly crowded, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. This assessment is especially important given the prevalence of scams and fraudulent schemes in the financial industry. This article aims to provide a thorough investigation of Alpex Trading, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The analysis is based on various online sources, user reviews, and regulatory databases to ensure a well-rounded evaluation.

Regulation and Legitimacy

The regulatory status of a trading platform is a key factor in determining its legitimacy. Alpex Trading operates without a recognized regulatory license, which raises significant red flags. The broker claims to be based in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This lack of oversight can expose traders to substantial risks, including the potential for fraud and mismanagement of funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulatory oversight means that Alpex Trading is not subject to the stringent requirements that regulated brokers must adhere to, such as maintaining client funds in segregated accounts and providing transparent reporting. This lack of regulation can lead to a higher risk of financial loss for traders, as there are no governing bodies to intervene in case of disputes or fraud.

Company Background Investigation

Alpex Trading was established in 2023, making it a relatively new entrant in the trading industry. The company's official website provides limited information about its history, ownership structure, and management team. This lack of transparency is concerning, as reputable brokers typically offer detailed insights into their background and operational practices.

The management team behind Alpex Trading is not well-documented, raising questions about their expertise and experience in the financial markets. Without credible information about the individuals running the company, it is difficult for potential clients to gauge the broker's reliability. Furthermore, the company's address in Saint Vincent and the Grenadines is often associated with numerous other unregulated brokers, further complicating the legitimacy of Alpex Trading.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Alpex Trading claims to offer competitive spreads, various account types, and a user-friendly trading platform. However, the absence of a comprehensive fee structure raises concerns about hidden costs that could significantly impact traders' profitability.

| Fee Type | Alpex Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | $8 per lot | $5 per lot |

| Overnight Interest Range | Variable | 0.5%-1.5% |

The commission structure of $8 per lot for forex trades is higher than the industry average, which may deter cost-conscious traders. Additionally, the variability of spreads could lead to unexpected trading costs, especially during volatile market conditions. Such pricing policies can be detrimental to traders, particularly those who engage in high-frequency trading strategies.

Client Fund Safety

The safety of client funds is a primary concern for any trader. Alpex Trading does not provide clear information regarding its fund security measures, such as segregation of client accounts or investor protection schemes. Without these safeguards, traders may find themselves at risk of losing their investments in the event of the broker's insolvency or mismanagement.

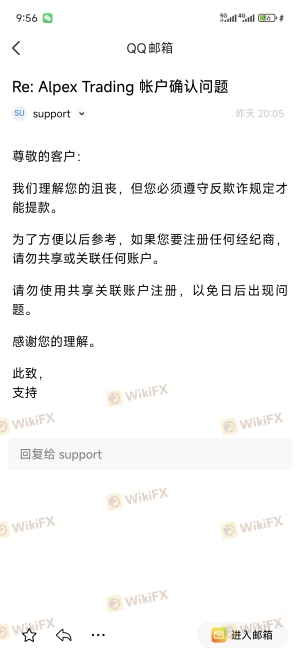

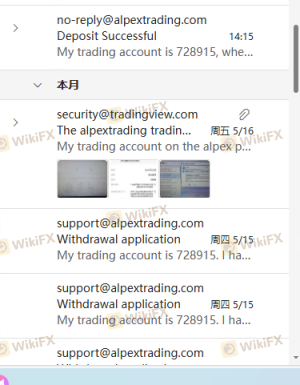

Historically, unregulated brokers have faced numerous allegations of fund misappropriation and withdrawal issues. Alpex Trading has not been immune to such concerns, as many users have reported difficulties in withdrawing their funds, raising alarms about the broker's operational integrity.

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing a broker's reliability. Reviews of Alpex Trading reveal a pattern of negative experiences, with common complaints including withdrawal delays, poor customer service, and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Customer Service | Medium | Inconsistent Support |

| Misleading Practices | High | No Adequate Response |

For instance, some users have reported being unable to withdraw their funds after repeated requests, with the broker providing vague excuses or failing to respond altogether. Such complaints highlight a troubling trend that could indicate deeper operational issues within the company.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Alpex Trading claims to offer a user-friendly interface and fast execution times. However, user reviews suggest that the platform may suffer from technical glitches, leading to slow execution and slippage during critical trading moments.

Concerns about execution quality can further exacerbate traders' frustrations, especially in fast-moving markets. Additionally, any signs of platform manipulation or unfair trading practices should be taken seriously, as they can significantly impact traders' outcomes.

Risk Assessment

Using Alpex Trading entails several risks that traders should be aware of. The lack of regulation, combined with negative customer reviews and withdrawal issues, paints a concerning picture of the broker's operational integrity.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight raises concerns. |

| Fund Safety Risk | High | Lack of transparency regarding fund security measures. |

| Customer Service Risk | Medium | Inconsistent support and slow response times. |

To mitigate these risks, traders should conduct thorough research before engaging with Alpex Trading. It may also be advisable to start with a small investment or explore more established, regulated brokers.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Alpex Trading may not be a trustworthy broker. Its lack of regulation, negative customer feedback, and withdrawal issues raise significant concerns about its legitimacy and operational practices. Traders should approach this broker with caution and consider alternative options that offer greater transparency and regulatory oversight.

For those seeking reliable trading platforms, it is recommended to explore well-regulated brokers with a proven track record, such as those licensed by the FCA, ASIC, or SEC. These alternatives can provide a safer trading environment and better protection for client funds.

Is ALPEX TRADING a scam, or is it legit?

The latest exposure and evaluation content of ALPEX TRADING brokers.

ALPEX TRADING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ALPEX TRADING latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.