HTFX 2025 Review: Everything You Need to Know

Executive Summary

This htfx review gives you a complete look at HTFX, an online forex and trading platform that has caught attention in the trading world. HTFX works as a retail forex broker that offers trading services across many types of investments including forex, precious metals, commodities, indices, stocks, and cryptocurrencies.

Our review shows some worrying issues that traders should think about carefully. HTFX has a low 2.78 TrustScore on Trustpilot based on 4 user reviews, which is a red flag about how happy users are with their service. Several sources like Broker Watch Dog and Global Fraud Protection have put out warnings about problems getting deposits back, so traders should be very careful if they're thinking about using this broker.

The platform does have some good features, like trading across many different types of investments and bonus offers up to 50% on deposits. HTFX gives you both desktop and mobile trading platforms to match what different traders like. But these good points are much less important than the lack of clear information about regulations and many user complaints about getting their money back.

This broker seems to go after traders who are okay with higher risks. We strongly suggest that even traders who like taking risks should research carefully and think about safer options before putting money into HTFX.

Important Notice

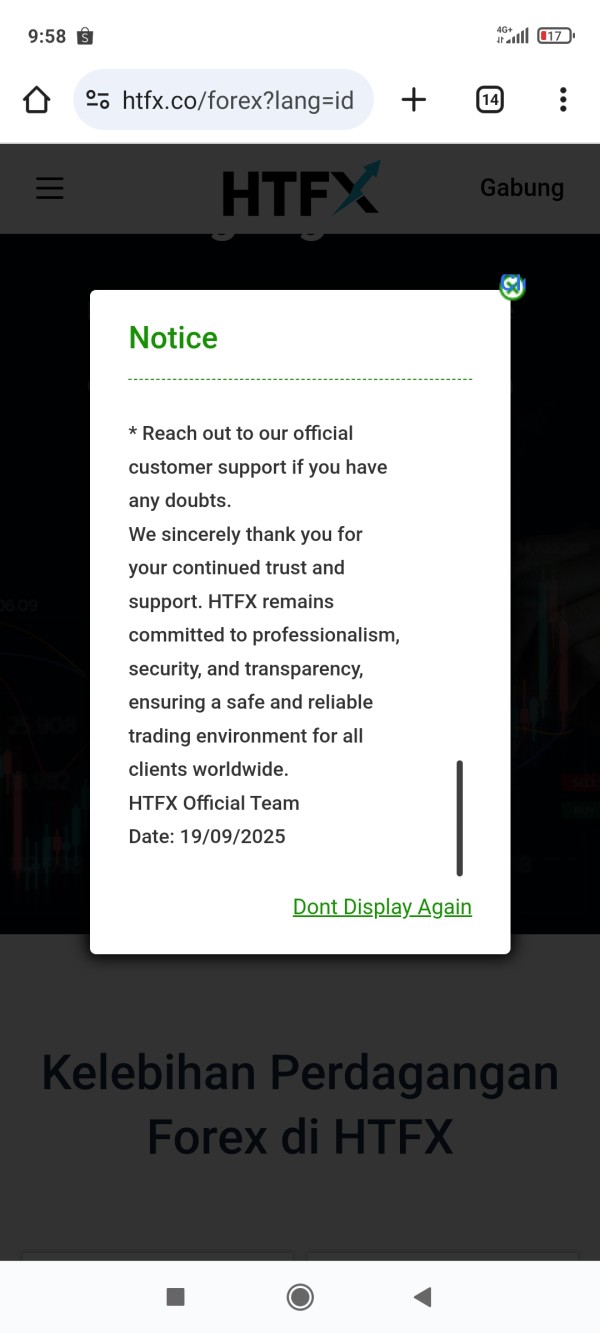

This review uses information from many independent sources as of January 2025. Rules and how the company works might be different in different countries, so traders should check current information directly with the broker before making any decisions about investing.

Our way of checking things includes user feedback from different review websites, checking regulatory databases, and looking at public information about the broker. Since there are worrying reports about problems getting funds back, we strongly suggest that potential clients do extra research and think about the risks.

The financial services industry changes quickly when it comes to rules and how companies operate. Information in this review should be looked at along with the most current regulatory warnings and user reports that are available when you make your decision.

Rating Framework

Based on our complete analysis, here are HTFX's ratings across six key areas:

Overall Rating: 3.5/10 - Poor

These ratings show big concerns about how reliable the broker is, how open they are, and how happy users are based on evidence and user feedback.

Broker Overview

HTFX says it's an online trading platform that gives access to multiple financial markets. The company doesn't clearly share details about when it was founded in the materials we could find, but it presents itself as a broker that handles many types of assets for regular traders in different countries. How the platform makes money focuses on giving trading access to forex markets along with other popular types of investments.

The broker has parts of its business in different regions, but the specific rules and licensing details are not clear from public information we could find. This lack of openness about regulatory oversight is a big concern for traders who want secure and compliant trading environments.

HTFX offers trading services across six main types of investments: foreign exchange (forex), precious metals, commodities, stock indices, individual stocks, and cryptocurrencies. This wide range of options suggests they're trying to help traders with different market interests and strategies. The platform works on both desktop and mobile, but specific platform details and whether they use their own software or third-party software is not clearly explained in available documentation.

The broker seems to target regular traders who want access to multiple markets through one platform. But the worrying user feedback and warning alerts from industry watchdogs suggest that how they actually run this business model has big problems that potential clients should carefully think about.

Regulatory Status

Available information doesn't give clear details about HTFX's regulatory status or licensing jurisdictions. This lack of openness about regulatory oversight is a big red flag for potential traders who want secure and compliant trading environments.

Deposit and Withdrawal Methods

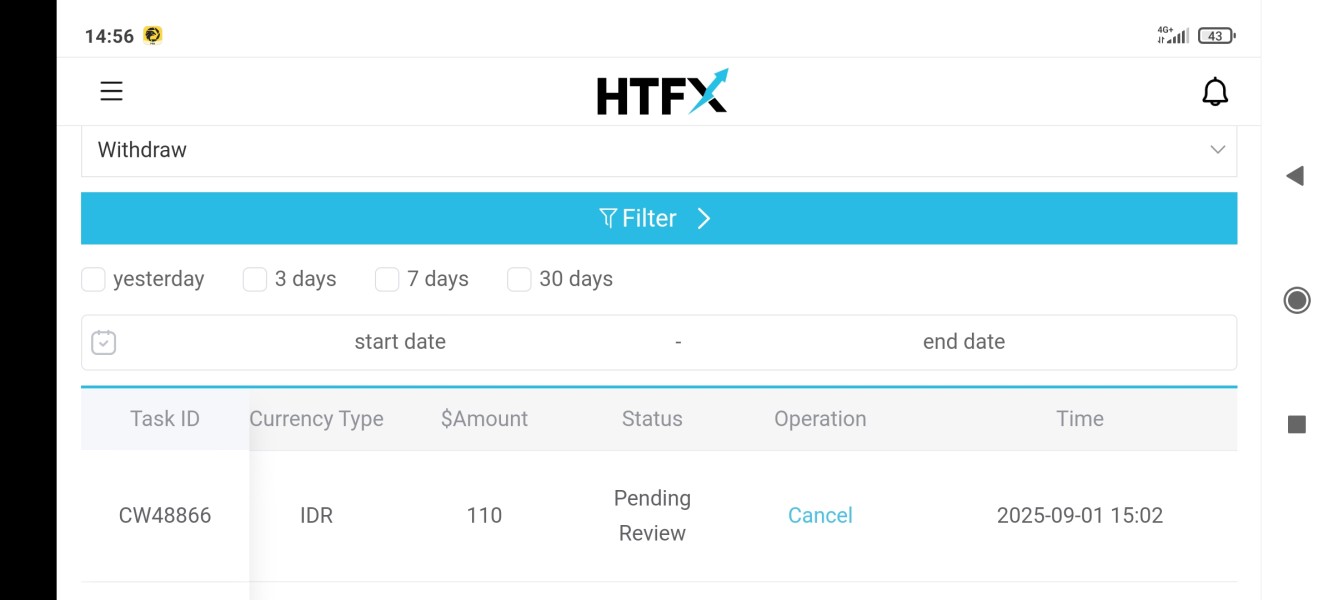

Specific information about deposit and withdrawal methods isn't detailed in available materials. This missing information about clear payment processing adds to concerns about how open they are about their operations.

Minimum Deposit Requirements

Minimum deposit requirements aren't specified in available documentation, making it hard for potential traders to plan their initial investment.

HTFX offers deposit bonuses of up to 50%, which might look attractive to new traders. Industry experts generally tell people to be careful with high bonus offers because they often come with restrictive terms and conditions.

Available Trading Assets

The platform provides access to multiple asset classes including:

- Foreign Exchange (Forex) pairs

- Precious metals (gold, silver, etc.)

- Commodities

- Stock indices

- Individual stocks

- Cryptocurrencies

Cost Structure

According to available information, HTFX's commission structure is rated as moderate with a fee score of 6/10. Specific details about spreads, overnight fees, and other trading costs aren't clearly outlined in available materials.

Leverage Options

Leverage ratios and margin requirements aren't specified in available documentation, which is concerning given how important it is to understand these risk parameters.

HTFX supports both desktop and mobile trading platforms, though specific platform names, features, and capabilities aren't detailed in available materials.

This htfx review shows big gaps in available information about key trading conditions, which itself is a concerning aspect of how open the broker is.

Detailed Rating Analysis

Account Conditions Analysis (Rating: 4/10)

HTFX's account conditions get a poor rating mainly because of the lack of openness about essential account features and requirements. The missing information about clearly stated minimum deposit requirements, account types, and specific features makes it hard for potential traders to make informed decisions about opening accounts.

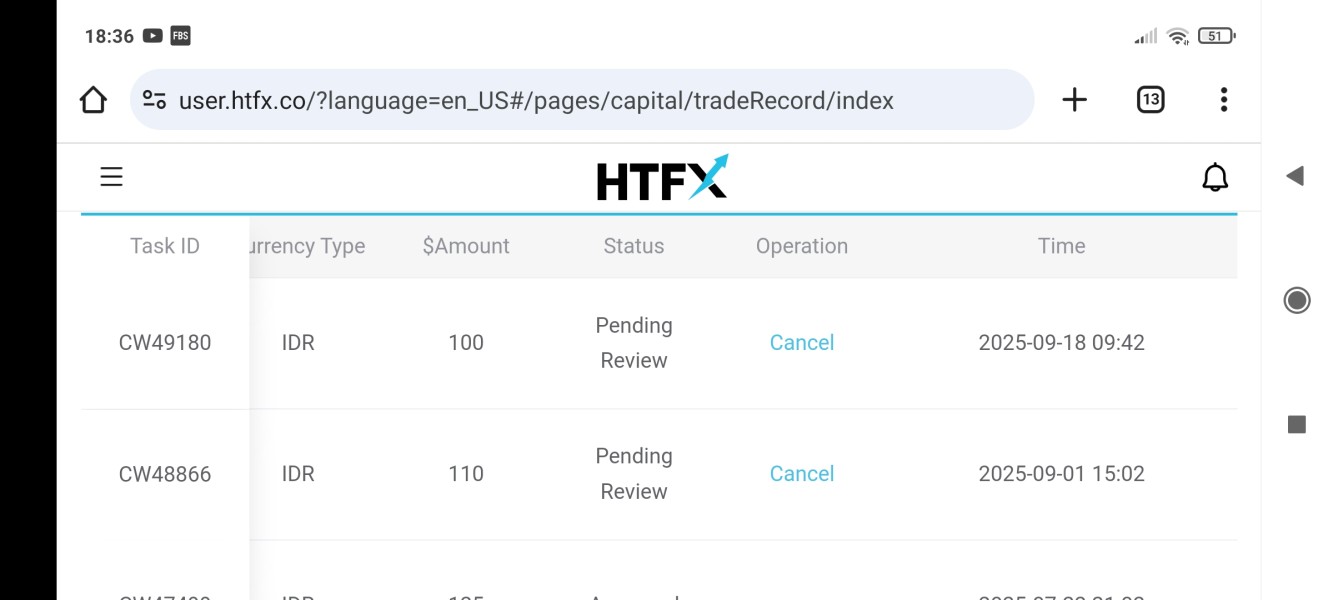

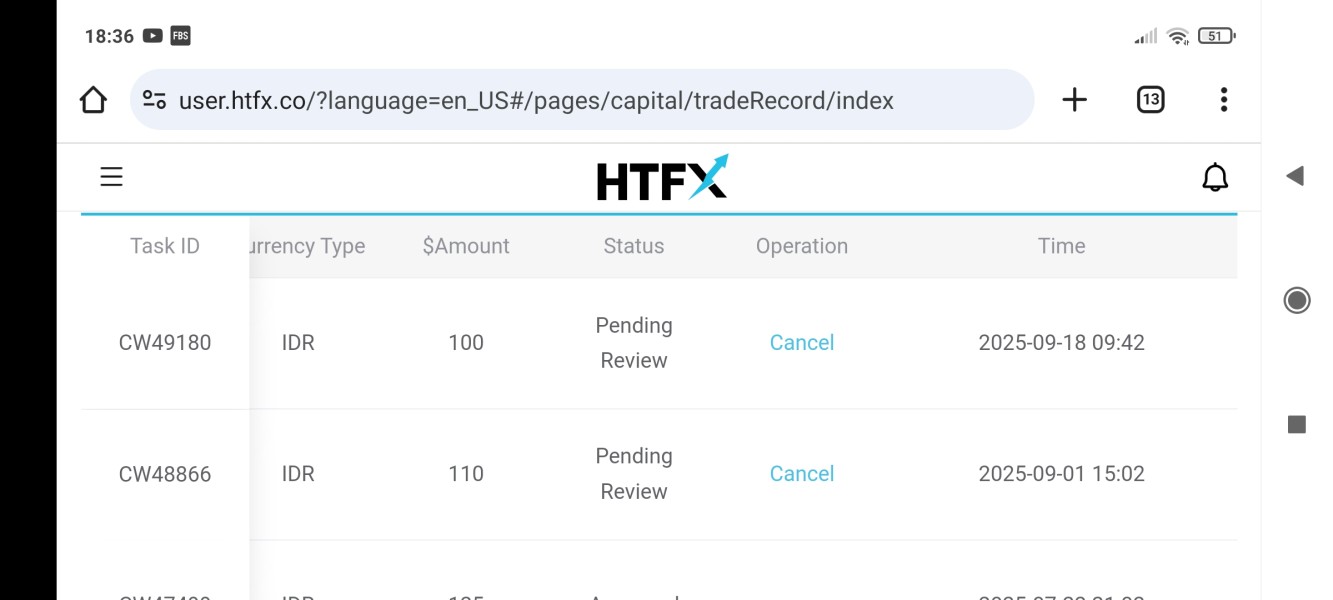

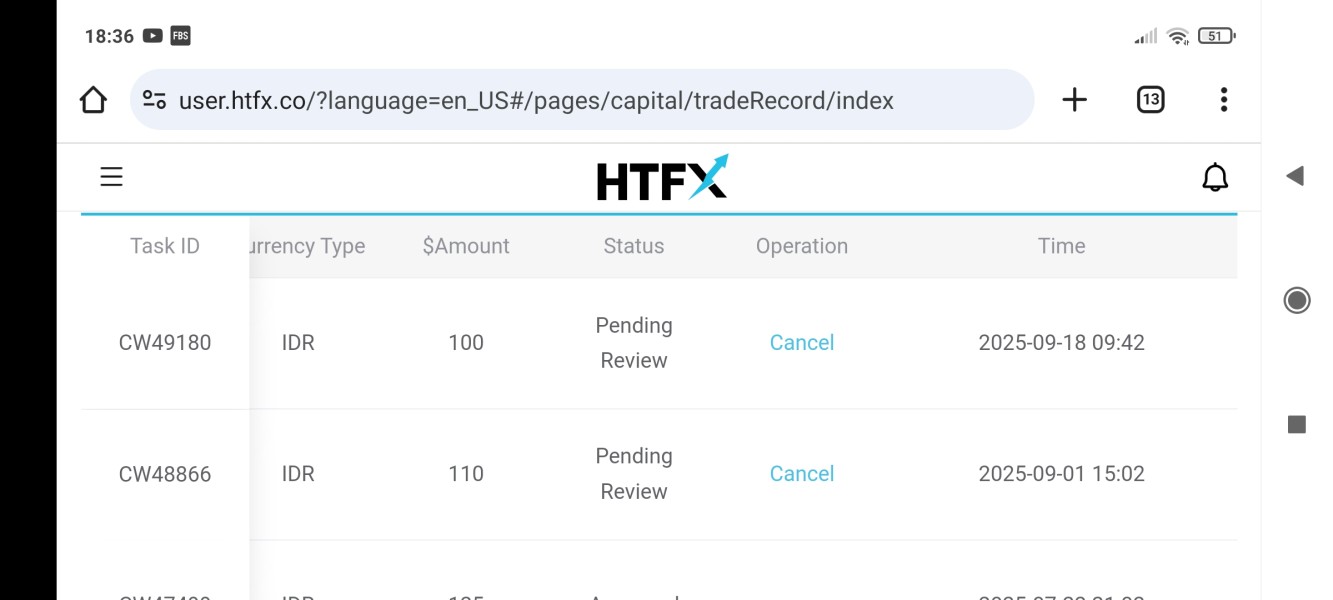

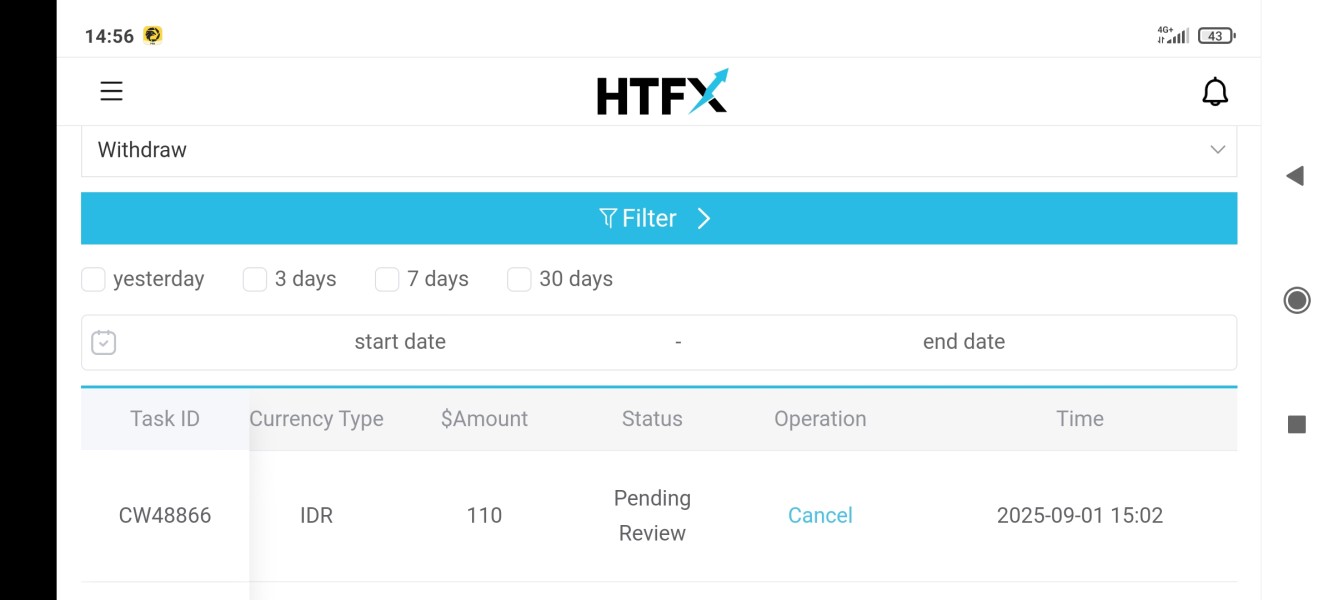

User feedback suggests problems with account management, especially about fund withdrawals and account closure procedures. Multiple sources report difficulties in getting deposits back, which shows serious issues with account liquidity and fund security. The warning alerts from industry watchdogs specifically mention concerns about deposit recovery, suggesting that account holders might face big challenges when trying to access their funds.

The lack of information about Islamic accounts, demo account availability, and special account features further reduces the broker's appeal to diverse trading communities. Professional traders typically need detailed account specifications to evaluate whether a broker meets their operational needs, and HTFX's lack of openness in this area is particularly problematic.

Account opening procedures and verification processes aren't clearly outlined in available materials, which raises questions about the broker's compliance with know-your-customer (KYC) and anti-money laundering (AML) standards that legitimate brokers typically emphasize.

This htfx review finds that the poor account conditions rating reflects both the lack of available information and the concerning user reports about fund access difficulties.

HTFX's tools and resources get a below-average rating because of limited information about available trading tools and educational resources. The broker offers both desktop and mobile platform access, but specific details about trading tools, technical analysis features, and research resources aren't clearly documented.

The missing information about charting capabilities, technical indicators, automated trading support, and market analysis tools suggests either limited offerings or poor communication of available features. Professional traders typically need comprehensive toolsets for effective market analysis and trade execution, and the lack of clarity about these features is concerning.

Educational resources, which are crucial for trader development and success, aren't mentioned in available materials. Legitimate brokers typically provide extensive educational content, webinars, tutorials, and market analysis to support their clients' trading education. The apparent absence of these resources suggests limited commitment to trader success and development.

Research capabilities, including market news, economic calendars, and fundamental analysis tools, aren't clearly outlined. These resources are essential for informed trading decisions, and their absence or lack of promotion indicates potential deficiencies in the broker's value proposition.

The moderate rating reflects the platform's basic functionality while acknowledging the significant gaps in available information about advanced tools and educational support.

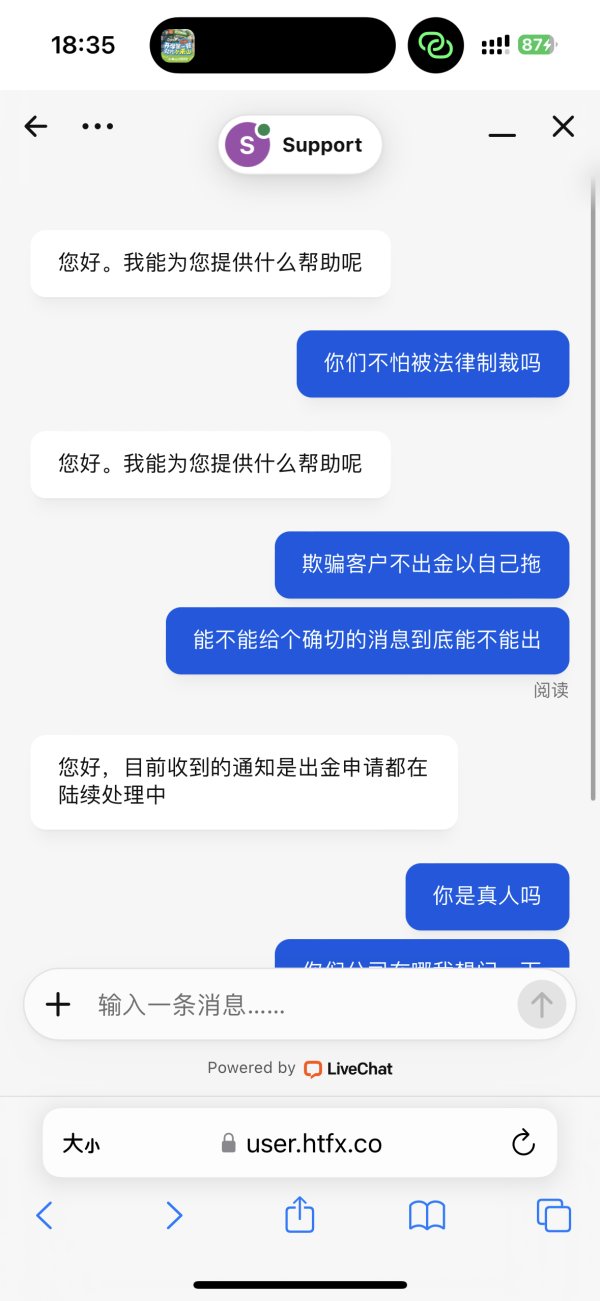

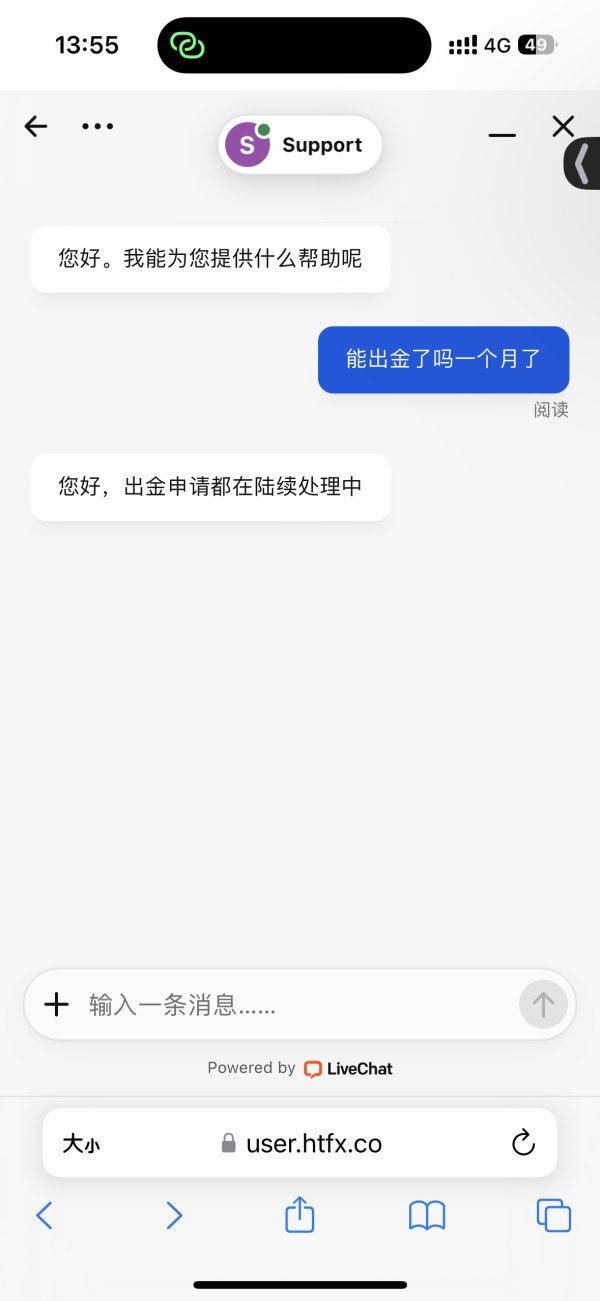

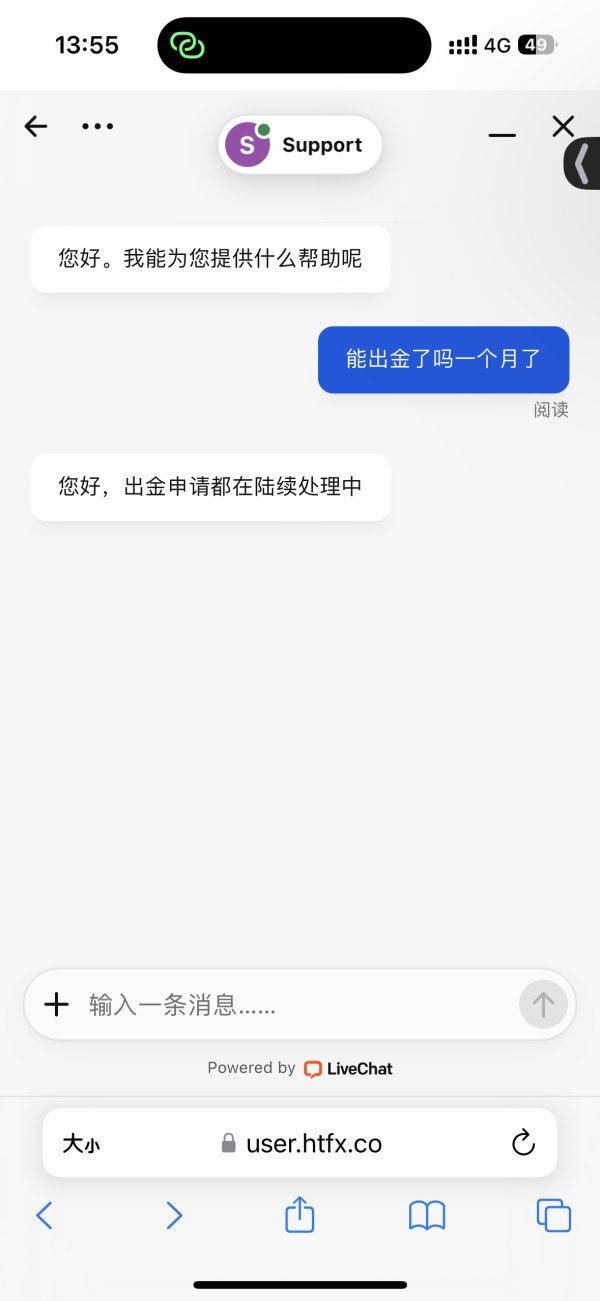

Customer Service and Support Analysis (Rating: 3/10)

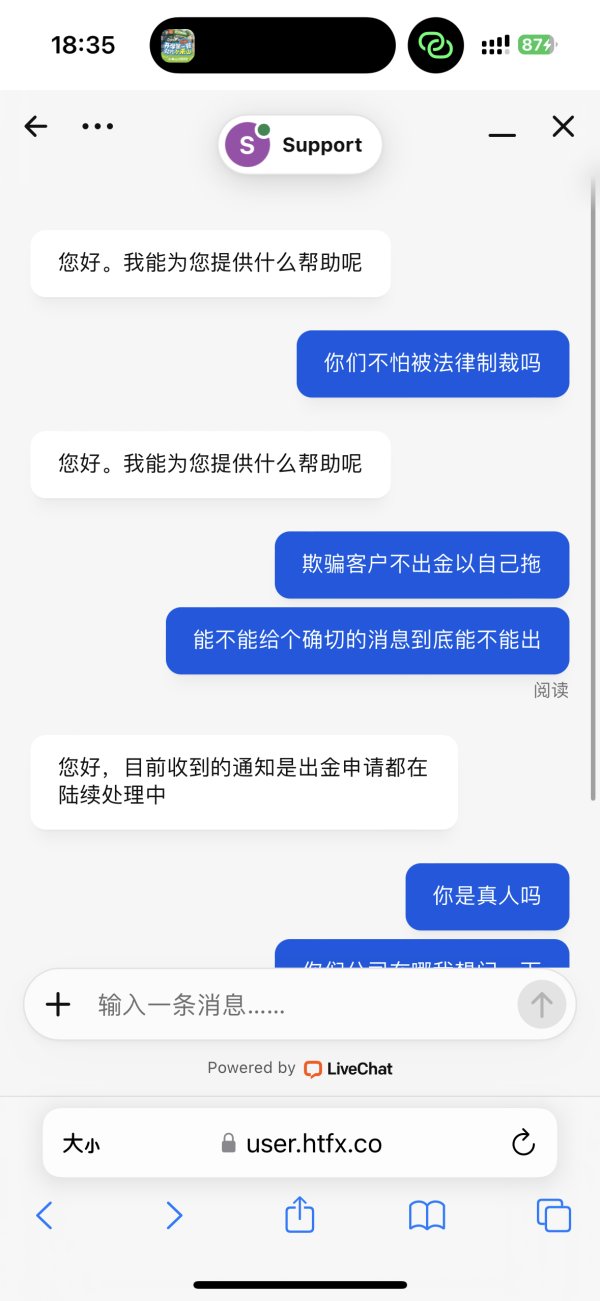

Customer service and support get a poor rating based on user feedback and the lack of clear information about support channels and availability. User reviews show big problems with customer service responsiveness, especially about fund withdrawal requests and account-related inquiries.

The warning alerts from multiple industry sources specifically mention concerns about customer support effectiveness in resolving deposit recovery issues. This suggests that when traders have problems, the support system might not provide adequate assistance or resolution.

Available materials don't specify customer service channels, operating hours, or multilingual support availability. Professional trading platforms typically provide multiple contact methods including live chat, phone support, and email assistance with clearly stated response times and availability schedules.

User feedback suggests that when traders try to contact customer service about fund withdrawals or account issues, they might experience delayed responses or inadequate resolution of their concerns. This pattern of poor customer service is particularly problematic in the financial services industry where timely support is crucial.

The absence of clear escalation procedures, complaint handling processes, and regulatory oversight of customer service standards further contributes to the poor rating in this category.

Trading Experience Analysis (Rating: 4/10)

The trading experience gets a poor rating mainly because of user reports of difficulties with fund management and concerns about platform reliability. HTFX offers trading across multiple asset classes, but user feedback suggests big problems with the overall trading environment.

Platform stability and execution quality are crucial factors in trading experience, and the concerning user reports about fund recovery suggest potential issues with trade settlement and account management systems. Reliable order execution and transparent trade processing are fundamental requirements for any trading platform.

The availability of both desktop and mobile platforms shows some attention to user accessibility, though specific performance metrics, execution speeds, and platform reliability data aren't available in the materials reviewed. Professional traders need detailed information about execution quality, slippage rates, and platform uptime to evaluate trading conditions effectively.

User complaints about fund withdrawal difficulties suggest that the post-trade experience, including profit realization and fund management, might be problematic. This represents a critical flaw in the overall trading experience, as traders need confidence that they can access their funds and profits when needed.

The poor rating reflects the combination of limited transparency about trading conditions and concerning user feedback about fund security and accessibility.

Trust and Safety Analysis (Rating: 2/10)

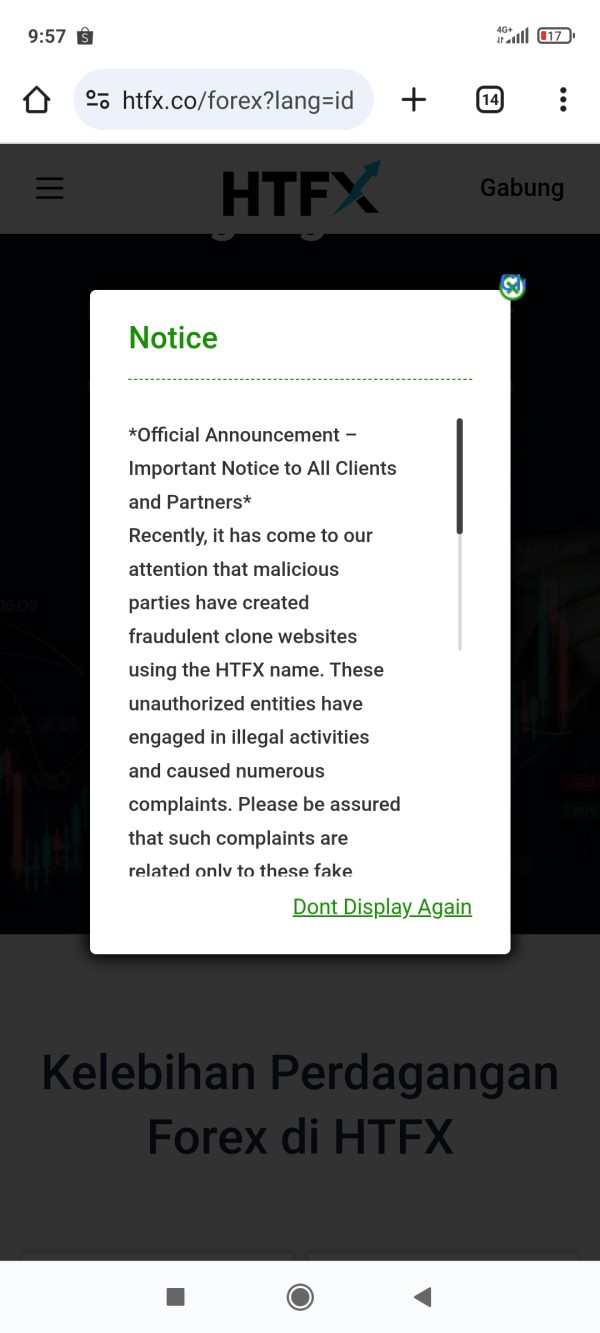

Trust and safety get the lowest rating because of multiple red flags about regulatory transparency, user warnings, and fund security concerns. The absence of clear regulatory information represents a fundamental trust issue, as legitimate brokers typically prominently display their licensing and regulatory compliance details.

Multiple industry watchdog sources have issued warning alerts specifically about HTFX, with particular emphasis on deposit recovery concerns. These warnings from independent monitoring organizations suggest serious issues with the broker's operational integrity and fund security practices.

The low TrustScore of 2.78 based on user reviews shows widespread dissatisfaction with the broker's trustworthiness and reliability. User feedback consistently mentions concerns about fund recovery, which is among the most serious issues a broker can face regarding client trust.

The lack of information about fund segregation, insurance coverage, and regulatory oversight mechanisms further undermines confidence in the broker's safety measures. Legitimate brokers typically provide detailed information about client fund protection measures and regulatory compliance to build trust with potential clients.

Industry reports suggesting that retail traders might be redirected to offshore entities raise additional concerns about regulatory arbitrage and potential jurisdiction shopping to avoid stricter oversight.

User Experience Analysis (Rating: 3/10)

User experience gets a poor rating based on the low overall satisfaction scores and concerning feedback about fundamental platform operations. The 2.78 TrustScore from user reviews shows widespread dissatisfaction with various aspects of the trading experience.

User feedback consistently mentions difficulties with fund recovery and withdrawal processes, which represents a critical failure in user experience design. The ability to easily deposit and withdraw funds is a fundamental requirement for any trading platform, and problems in this area severely impact overall user satisfaction.

The lack of clear information about account registration, verification procedures, and onboarding processes suggests potential issues with the initial user experience. Professional trading platforms typically provide streamlined, transparent procedures for account opening and verification to ensure positive first impressions.

Interface design and platform usability information isn't clearly available in reviewed materials, making it difficult to assess the quality of the user interaction design. The overall negative user feedback suggests that even if the interface is acceptable, fundamental operational issues overshadow any positive design elements.

The concerning pattern of user complaints about fund access and the warning alerts from industry monitors indicate systemic issues with user experience that extend beyond simple interface design problems to fundamental operational reliability concerns.

Conclusion

This comprehensive htfx review shows significant concerns about HTFX as a trading platform choice. The broker offers access to multiple asset classes and promotes attractive deposit bonuses, but these potential benefits are overshadowed by serious trust and operational issues.

The consistently poor ratings across all evaluation dimensions, particularly the very poor trust and safety score, indicate that HTFX might not meet the standards expected of a reliable trading platform. The warning alerts from multiple industry sources, combined with user reports of fund recovery difficulties, suggest that potential traders should exercise extreme caution.

HTFX might theoretically appeal to traders seeking multi-asset exposure with promotional incentives, but the risk factors identified in this review suggest that even risk-tolerant traders should carefully consider safer alternatives. The lack of regulatory transparency, poor user feedback, and industry warnings create a risk profile that might be unacceptable for most prudent traders.

We recommend that traders prioritize platforms with clear regulatory oversight, transparent operational practices, and positive user feedback when selecting a broker for their trading activities.