Loyal Primus 2025 Review: Everything You Need to Know

Executive Summary

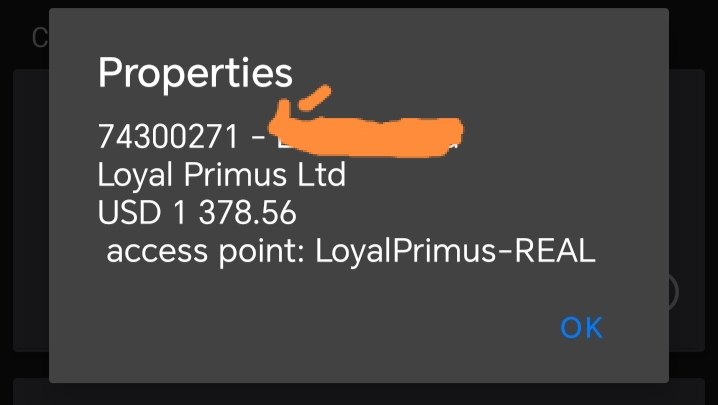

This loyal primus review shows a complete analysis of a broker that has gotten lots of bad attention in the forex trading world. The company started in 2020 and has its main office in South Africa. Loyal Primus says it is a multi-asset online trading platform that mainly targets big companies and institutional investors.

The broker claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, many user complaints show a troubling picture of how the company operates. The platform offers trading in forex, precious metals, and futures.

User feedback always points out serious problems about withdrawal difficulties, unresponsive customer service, and questionable business practices. Many sources, including recent reviews from 2023, have raised red flags about the broker's legitimacy. Some people even call it a potential scam operation.

The broker disappeared from active operations in less than a year after it started. This makes these concerns even worse and makes it a high-risk choice for potential investors.

Important Disclaimers

Regional Entity Differences: Loyal Primus operates from its South African headquarters while claiming ASIC regulation in Australia. This cross-jurisdictional setup may create big gaps in legal protection for traders, especially those outside Australia.

The regulatory protection available to clients may vary a lot depending on their geographic location and the specific entity they engage with. Review Methodology: This evaluation is based on publicly available information, user feedback from multiple review platforms, and regulatory data.

No actual trading tests were conducted with this broker. Given the many reports of suspicious activities and the broker's apparent operational cessation, we strongly advise extreme caution when considering this platform.

Rating Overview

Overall Rating: 2.8/10

Broker Overview

Loyal Primus emerged in the forex market in 2020. The company established its headquarters in South Africa with big claims of serving large enterprises and institutional investors.

The company positioned itself as a complete multi-asset trading platform, trying to capture market share in the competitive online trading space. However, according to multiple sources including ScamBrokersReviews, the broker "disappeared in less than a year." This raises immediate questions about its operational sustainability and genuine business intentions.

The broker's business model centered around providing access to multiple asset classes through what appeared to be a proprietary trading platform. Loyal Primus marketed itself to institutional clients, suggesting a focus on high-volume, professional trading relationships rather than retail customer acquisition.

This positioning strategy, while potentially profitable, also limited the broker's transparency and public accountability. Institutional-focused brokers often operate with less public scrutiny than retail-oriented platforms.

Despite claims of ASIC regulation, the trading platform offered access to forex pairs, precious metals including gold and silver, and various futures contracts. The broker's regulatory status with the Australian Securities and Investments Commission was intended to provide credibility and client protection.

However, later user experiences suggest big gaps between regulatory promises and actual service delivery. This loyal primus review reveals that the regulatory framework may not have provided adequate protection for traders who encountered difficulties with the platform.

Regulatory Status: Loyal Primus claims regulation under the Australian Securities and Investments Commission (ASIC), which typically provides strong investor protection. However, verification of active regulatory status remains unclear given the broker's operational issues.

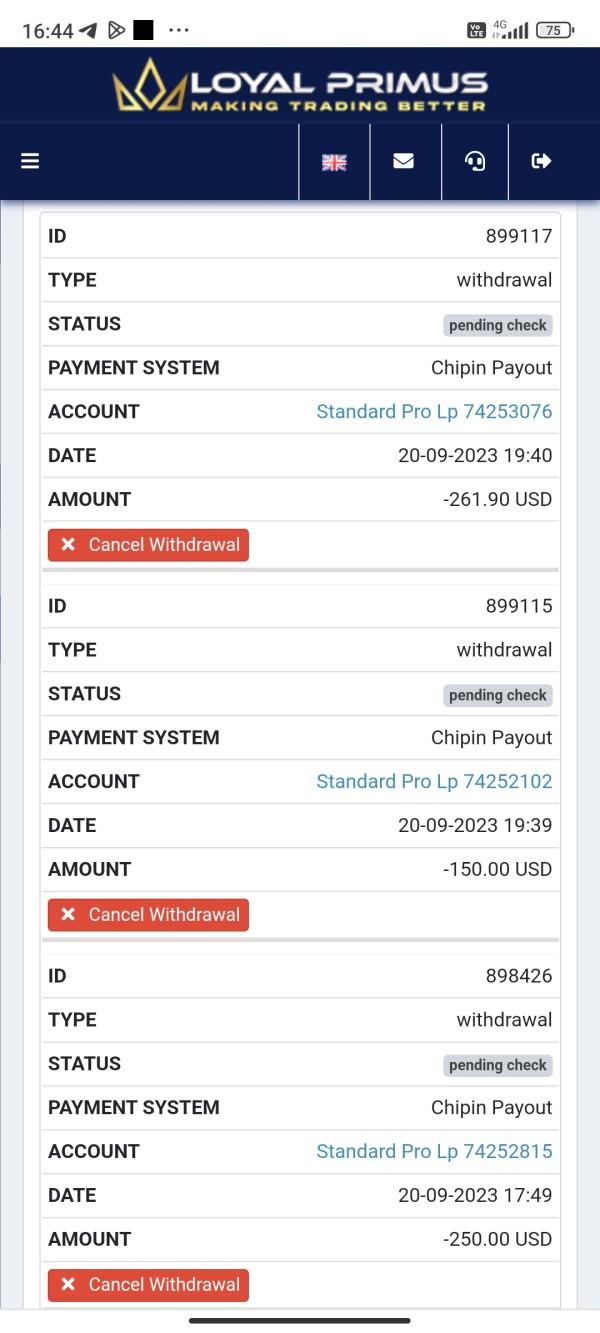

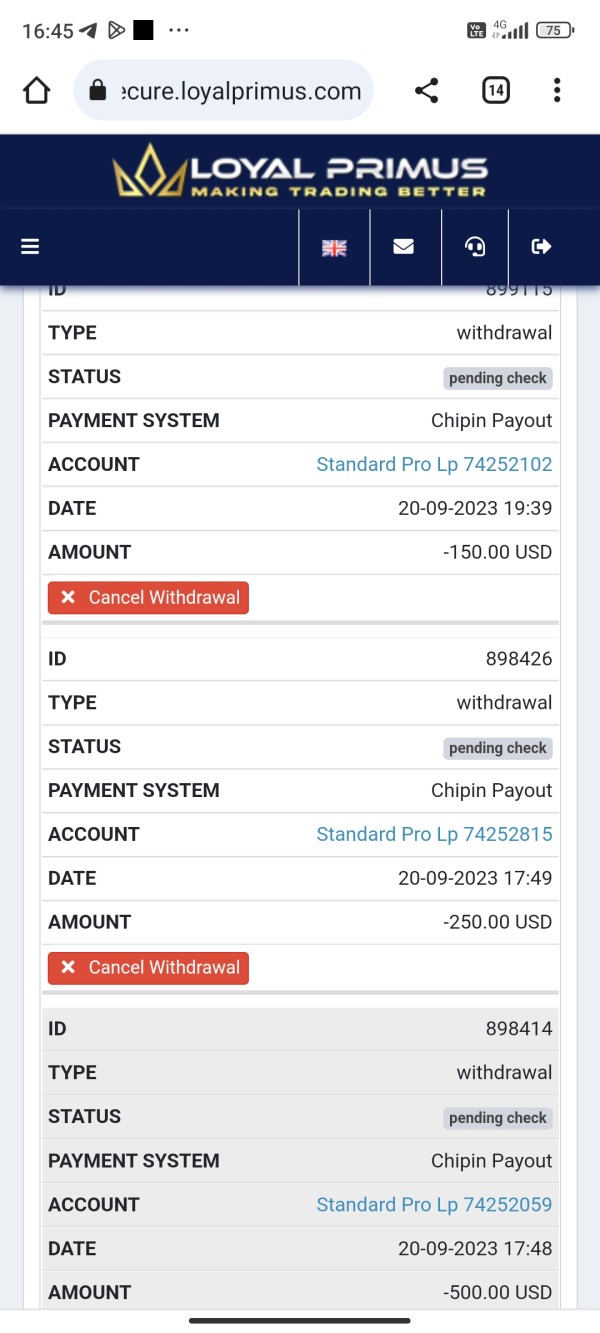

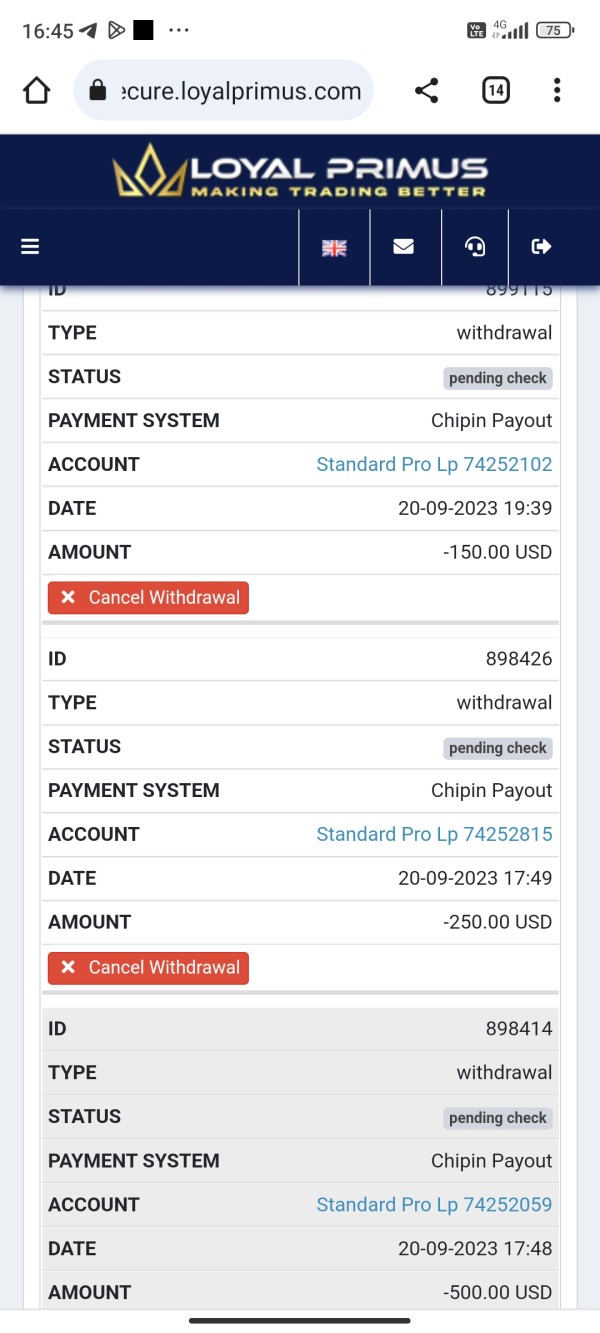

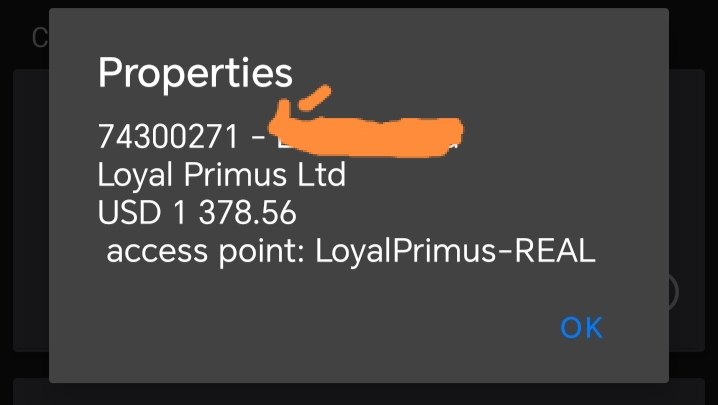

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods was not detailed in available materials. User complaints consistently mention big difficulties with fund withdrawals, suggesting limited or problematic payment processing systems.

Minimum Deposit Requirements: The exact minimum deposit amounts are not specified in available documentation. This itself raises transparency concerns for potential clients seeking clear account opening requirements.

Bonuses and Promotions: No specific bonus or promotional offerings are mentioned in available materials. This indicates either a lack of such programs or insufficient marketing transparency.

Tradeable Assets: The platform provides access to three main asset categories: foreign exchange currency pairs, precious metals (primarily gold and silver), and futures contracts across various markets. Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in the reviewed materials.

This represents a big transparency gap for potential clients trying to evaluate trading expenses. Leverage Ratios: Specific leverage offerings are not detailed in available documentation.

ASIC regulation typically limits leverage to 1:30 for major currency pairs for retail clients. Platform Options: The specific trading platforms offered by Loyal Primus are not clearly documented in available materials.

The broker appears to have operated its own proprietary system. Geographic Restrictions: Information about regional trading restrictions is not specified in available documentation.

Customer Support Languages: Available customer service languages are not detailed in the reviewed materials. This loyal primus review highlights big information gaps that potential clients should consider concerning when evaluating any broker's transparency and professionalism.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

The account conditions offered by Loyal Primus present several concerning gaps in transparency and accessibility. Available documentation does not provide clear information about different account types, their specific features, or the requirements for each tier.

This lack of clarity immediately raises red flags for potential clients who need to understand exactly what services and protections they would receive. The absence of clearly stated minimum deposit requirements represents a big transparency failure.

Professional brokers typically provide detailed account specifications, including minimum funding amounts, account currencies, and any special features or restrictions. The institutional focus claimed by Loyal Primus might explain higher minimum deposits, but the complete lack of published information suggests poor client communication standards.

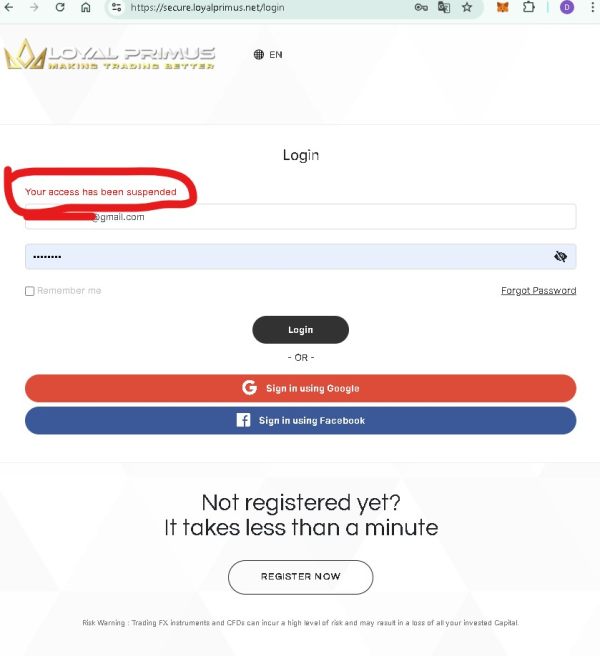

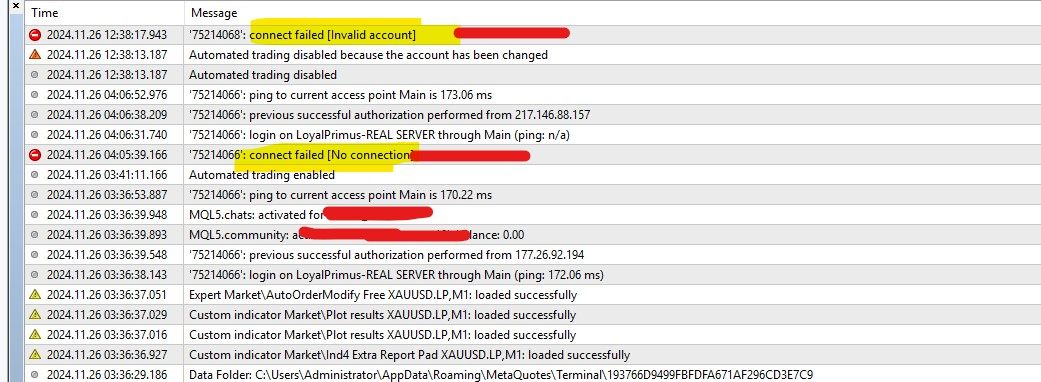

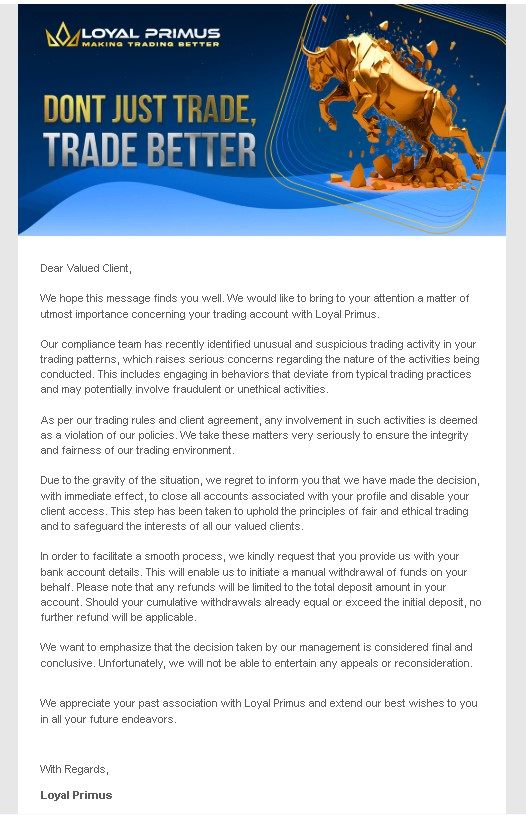

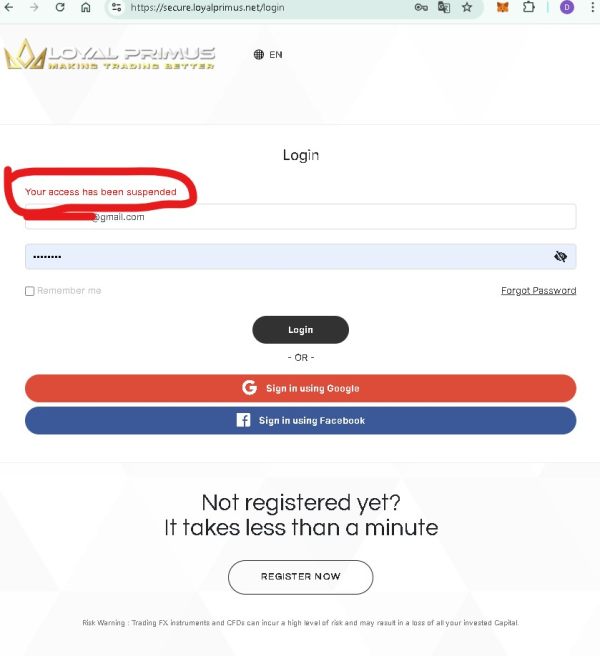

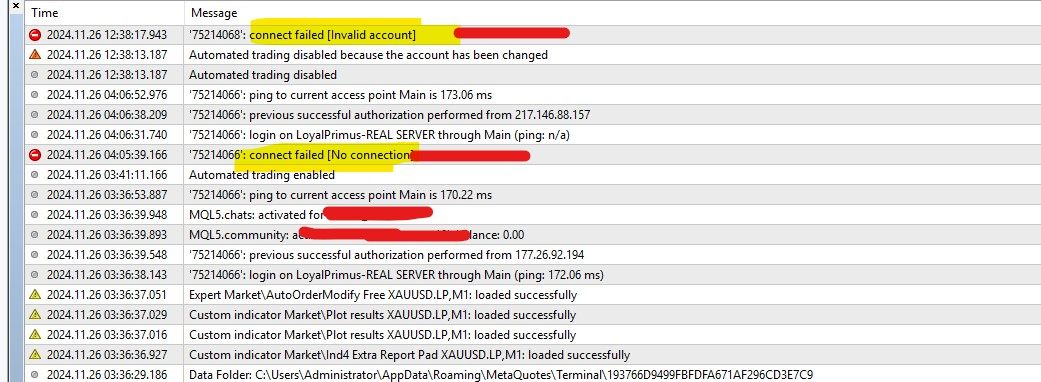

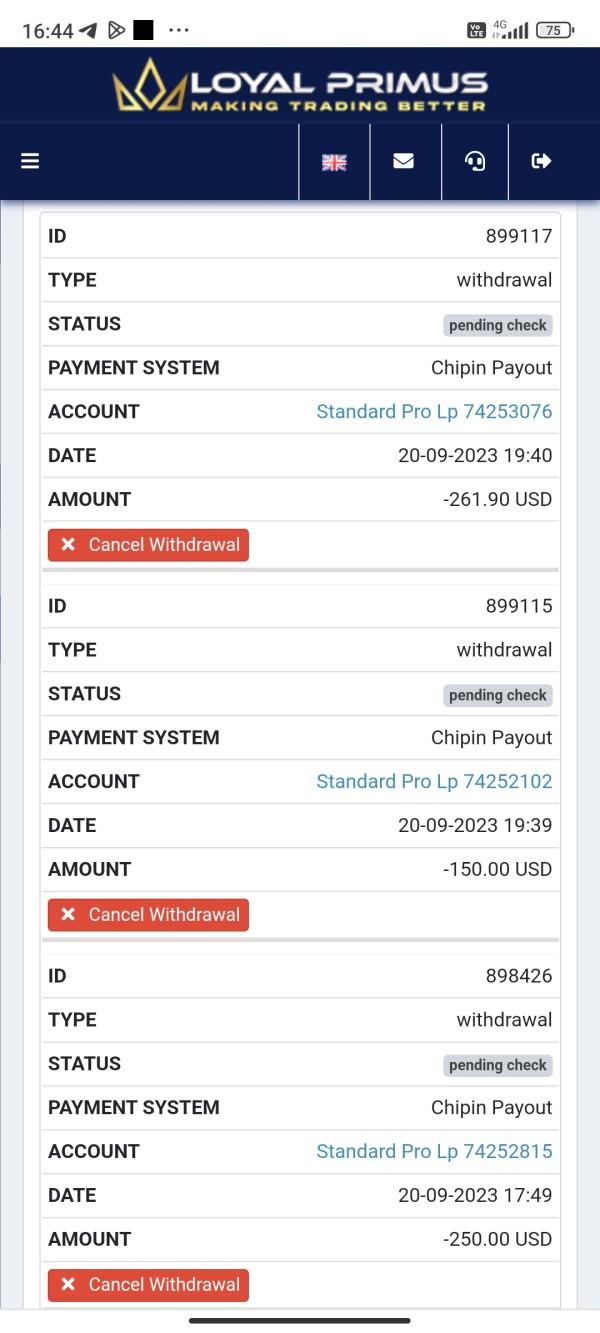

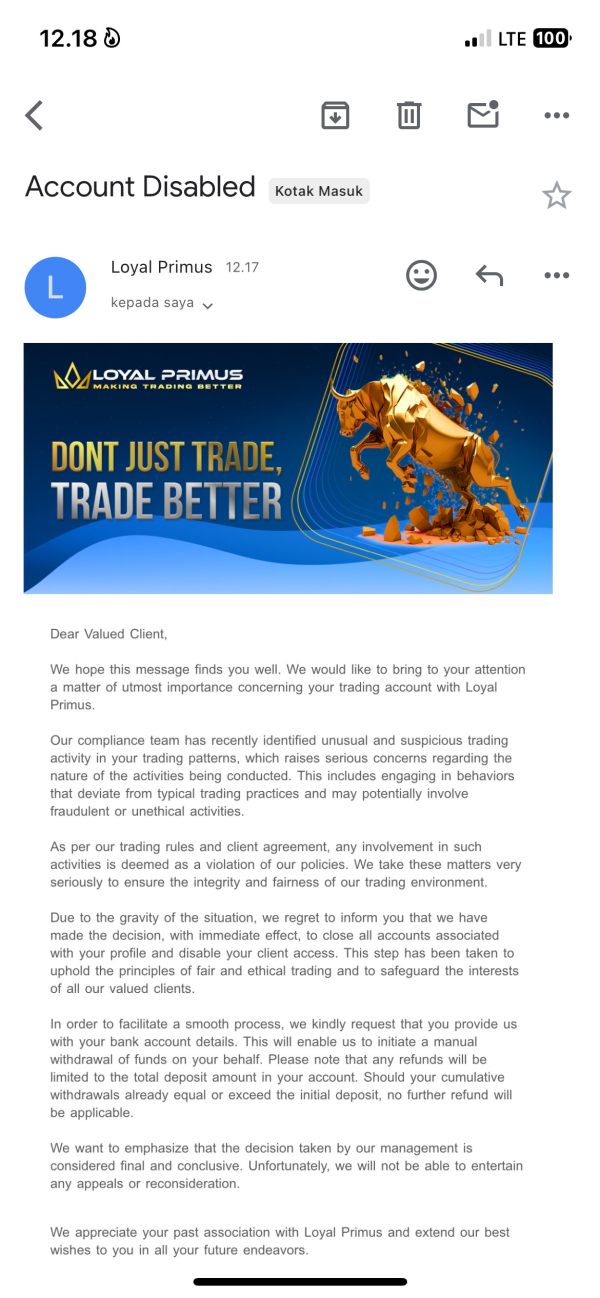

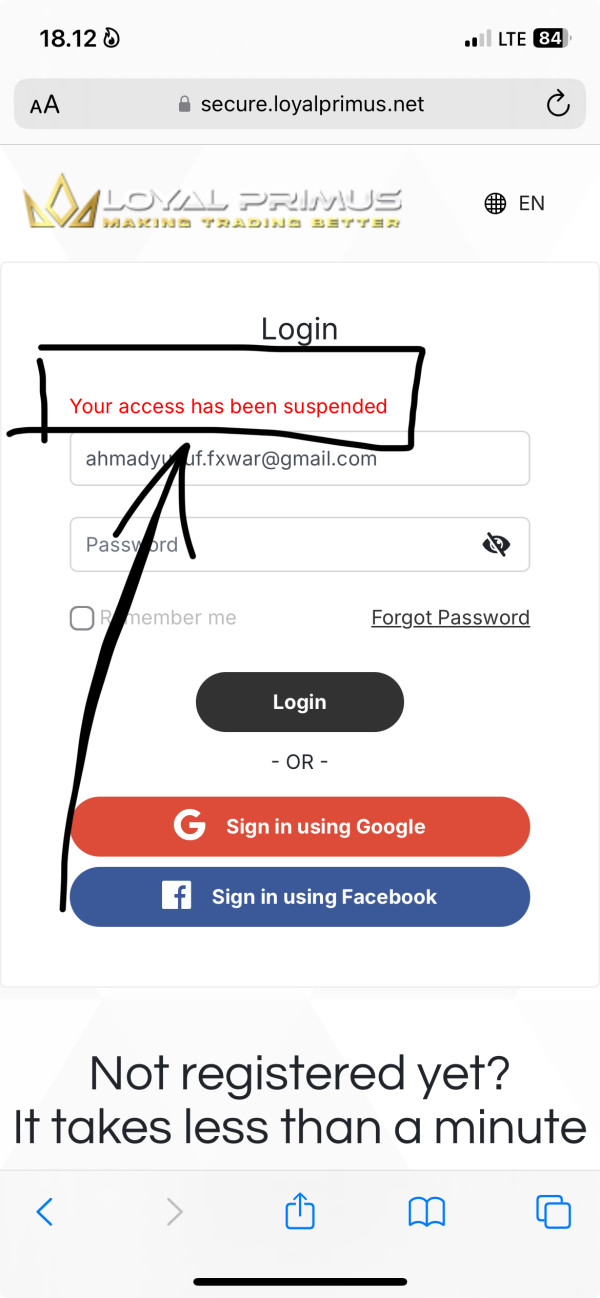

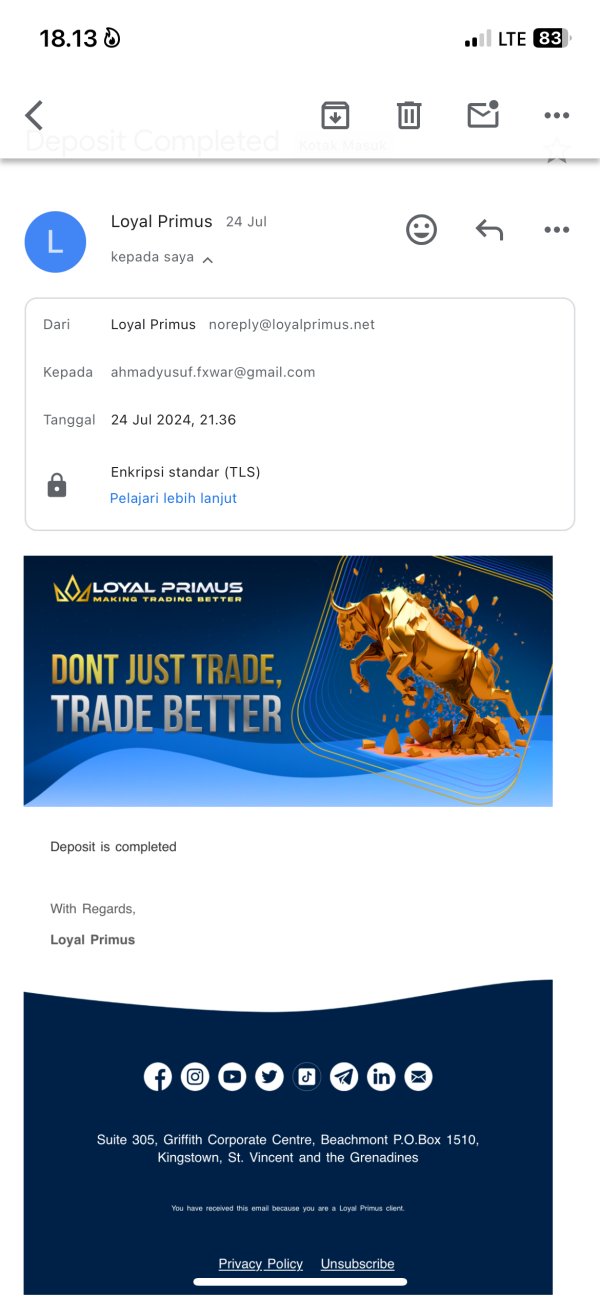

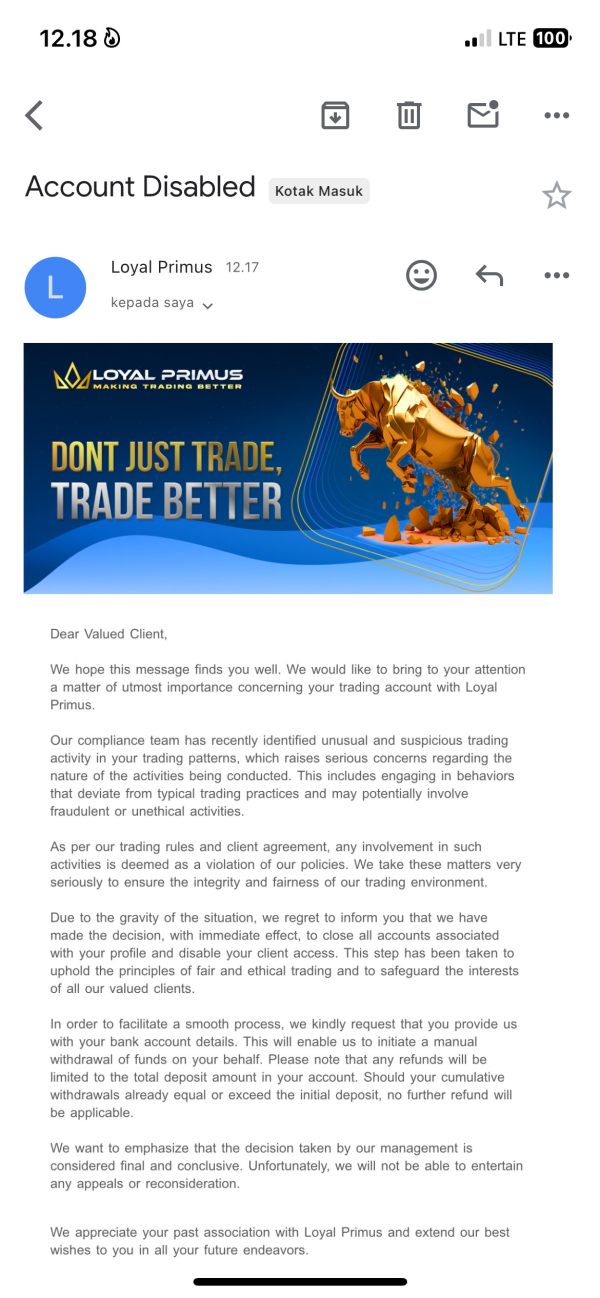

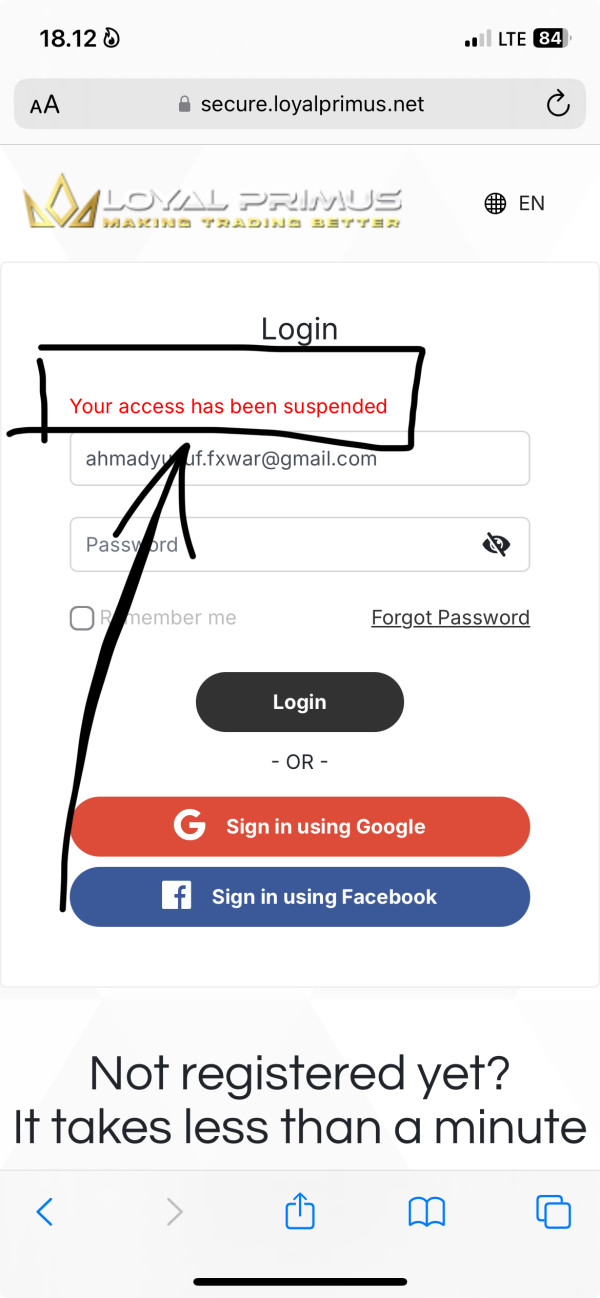

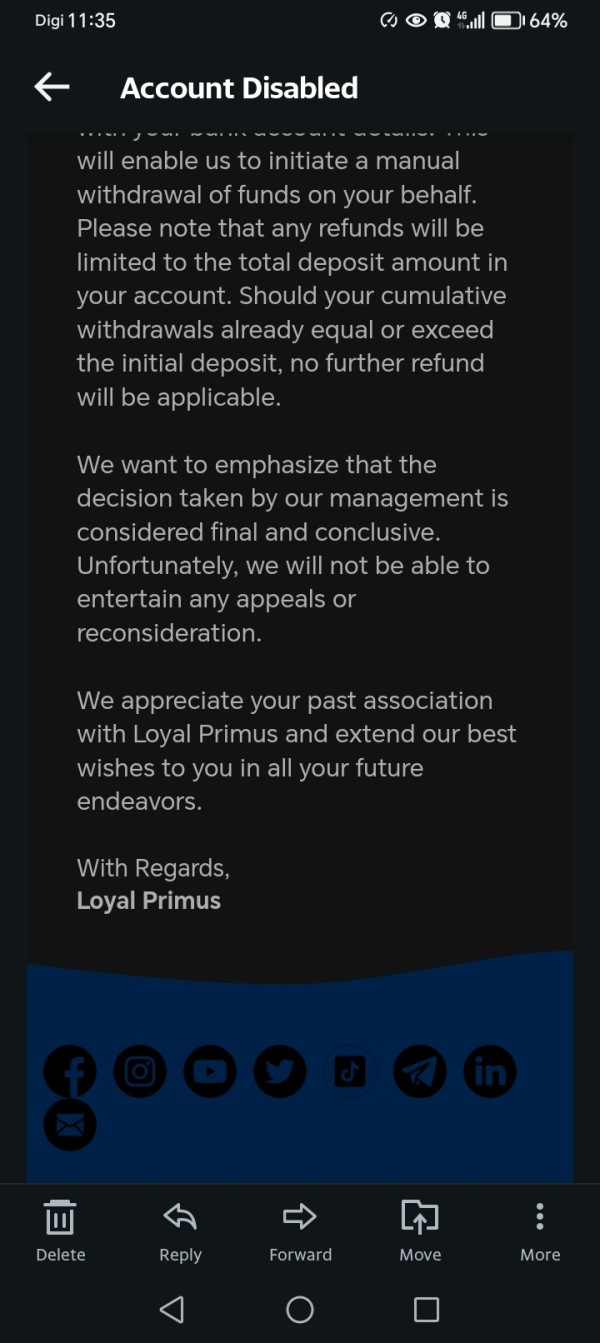

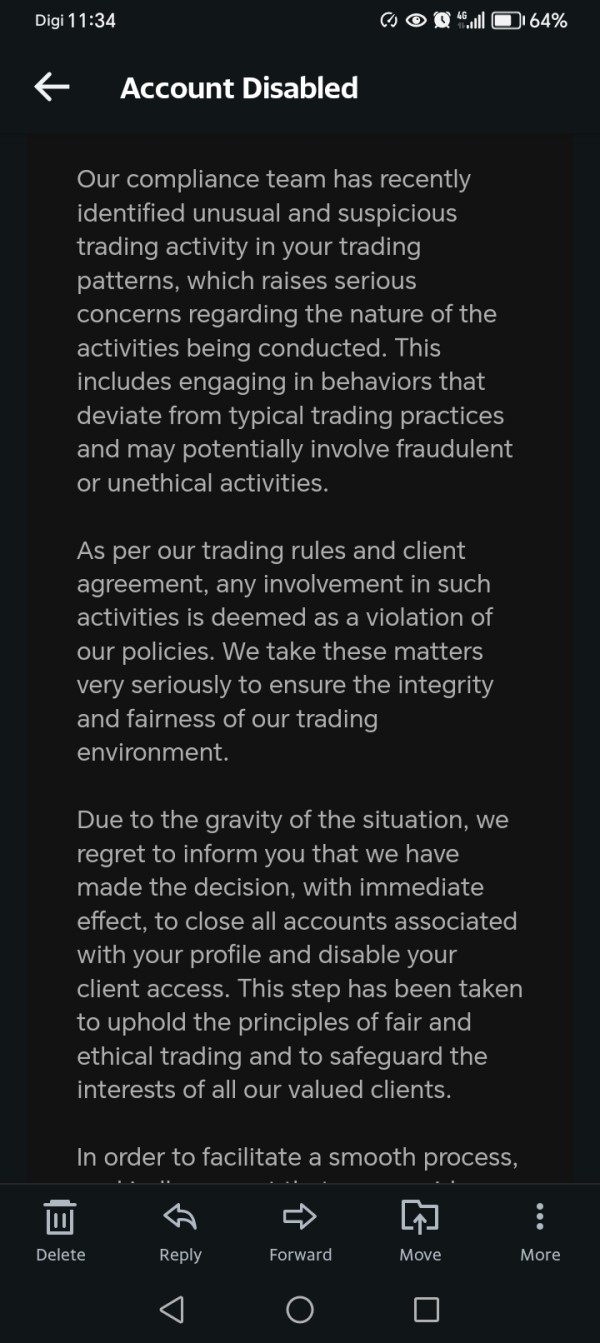

User feedback indicates big problems with account management and accessibility. Reports suggest that accounts were suspended without adequate explanation, preventing traders from accessing their funds or executing trades.

The account opening process appears to have lacked proper verification procedures. While this might be convenient for clients, it raises serious questions about compliance with anti-money laundering and know-your-customer regulations.

The absence of information about specialized account types, such as Islamic accounts for Muslim traders, demo accounts for practice trading, or institutional accounts with enhanced features, further shows the broker's limited service offerings. This loyal primus review finds that the overall account conditions fall well below industry standards for transparency and client protection.

The trading tools and resources provided by Loyal Primus appear severely limited based on available information. Unlike established brokers that offer complete market analysis, economic calendars, trading signals, and educational resources, Loyal Primus seems to have operated with minimal support infrastructure for its clients.

Research and analysis resources, which are essential for informed trading decisions, are not mentioned in any available documentation. Professional brokers typically provide daily market commentary, technical analysis tools, fundamental analysis reports, and access to third-party research providers.

The absence of such resources suggests that Loyal Primus clients would need to source market intelligence independently. This significantly hampers their trading effectiveness.

Educational resources, crucial for trader development and platform familiarization, appear to be completely absent from the broker's offerings. This lack of educational support is particularly problematic for newer traders who rely on broker-provided training materials, webinars, and tutorials to develop their skills and understanding of market dynamics.

Automated trading support, including expert advisors, copy trading, or algorithmic trading tools, is not documented in available materials. Modern trading platforms increasingly offer these advanced features to help clients optimize their trading strategies and manage risk more effectively.

The apparent absence of such tools places Loyal Primus well behind industry standards for technological innovation and client support.

Customer Service and Support Analysis (Score: 2/10)

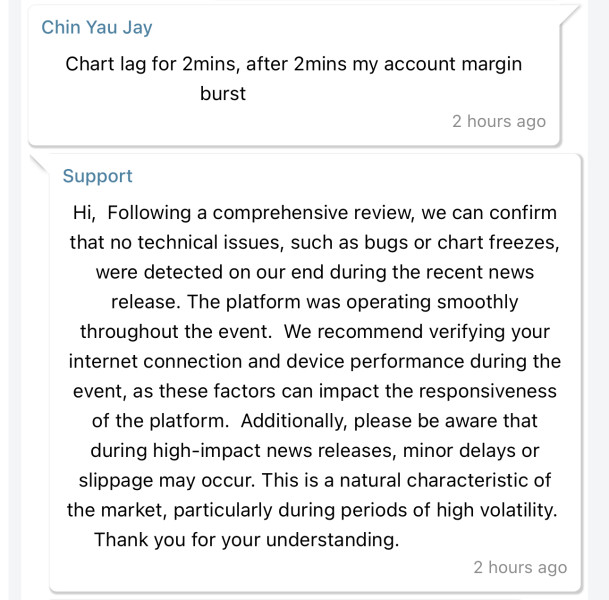

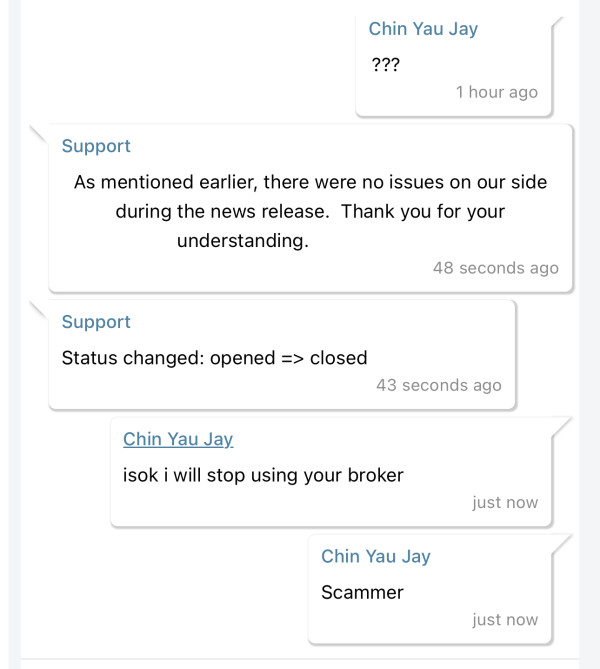

Customer service represents one of the most big failure points for Loyal Primus, with user feedback consistently highlighting severe deficiencies in support quality and responsiveness. According to multiple user reports and review sources, the broker's customer service team was largely unresponsive to client inquiries, particularly when issues involved withdrawal requests or account access problems.

Response times appear to have been exceptionally poor, with users reporting days or weeks without meaningful communication from support staff. This level of service failure is particularly problematic in the forex trading environment, where market conditions can change rapidly and traders need immediate assistance with technical or account-related issues.

The lack of timely support effectively prevented many users from managing their trading activities properly. The quality of customer service interactions, when they occurred, appears to have been substandard.

Users report that support staff lacked the knowledge or authority to resolve problems effectively, often providing generic responses that did not address specific client concerns. This pattern suggests inadequate training or insufficient staffing in the customer service department.

Multi-language support capabilities and service hours are not documented in available materials. Given the overall service quality issues, it's reasonable to assume these were limited.

Professional brokers typically offer 24/5 support during market hours with multiple language options to serve their international client base. The absence of clear service standards further shows Loyal Primus's operational deficiencies.

Trading Experience Analysis (Score: 3/10)

The trading experience provided by Loyal Primus appears to have been badly compromised by platform instability and operational issues. User reports indicate frequent problems with platform accessibility, including unexpected account suspensions that prevented traders from executing orders or managing existing positions during critical market periods.

Order execution quality seems to have been problematic, with users reporting difficulties in opening and closing positions at desired prices. While specific execution speed data is not available, the overall pattern of user complaints suggests that the broker's infrastructure was inadequate for reliable trade processing, particularly during periods of high market volatility when precise execution becomes crucial.

Platform functionality appears to have been limited compared to industry-standard trading platforms. The absence of advanced order types, sophisticated charting tools, or complete market data feeds would have badly handicapped traders trying to implement complex strategies or conduct thorough market analysis.

These limitations particularly impact professional traders who require advanced platform capabilities. Mobile trading experience is not documented in available materials, though given the overall platform limitations, it's likely that mobile functionality was either absent or severely restricted.

Modern traders increasingly rely on mobile platforms for market monitoring and trade management, making this a big competitive disadvantage. This loyal primus review finds that the overall trading experience falls well below acceptable standards for professional forex trading.

Trustworthiness Analysis (Score: 2/10)

Trustworthiness represents perhaps the most critical concern with Loyal Primus, as multiple independent sources have raised serious questions about the broker's legitimacy and business practices. While the broker claims ASIC regulation, the rapid operational cessation and widespread user complaints suggest big gaps between regulatory oversight and actual client protection.

Regulatory compliance appears questionable despite claimed ASIC authorization. Professional regulatory bodies typically require brokers to maintain adequate capital reserves, segregate client funds, and provide regular operational reports.

The broker's quick disappearance from active operations suggests potential failures in meeting these regulatory requirements. However, specific regulatory actions are not documented in available materials.

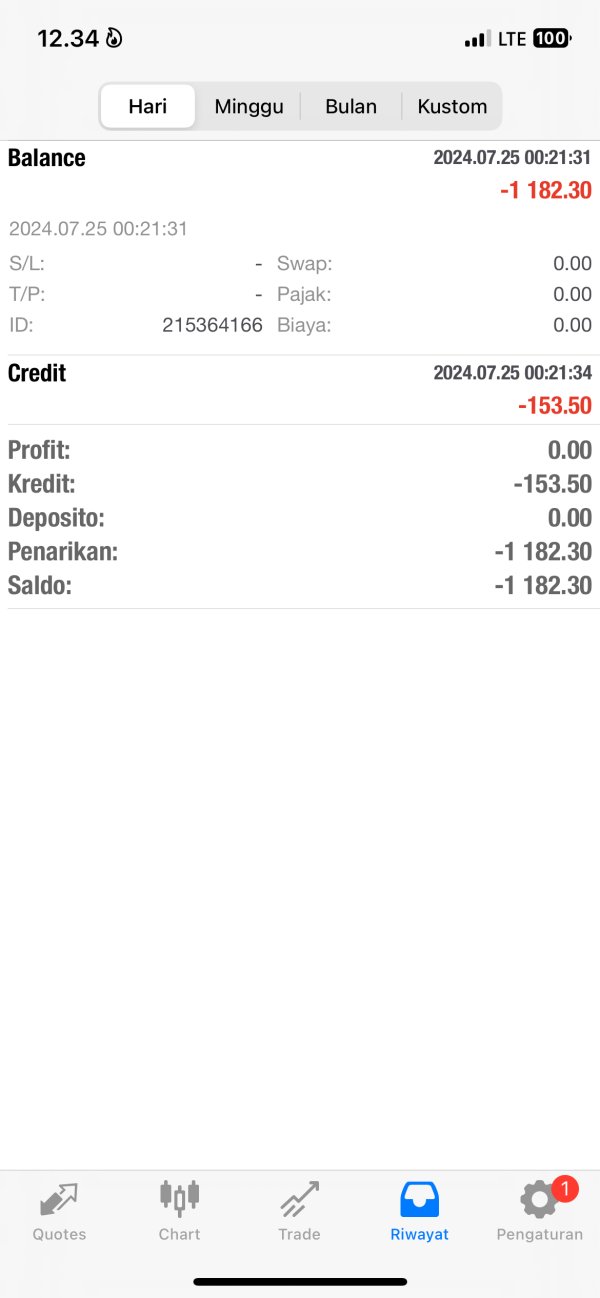

Fund security measures, crucial for client protection, appear to have been inadequate based on widespread withdrawal difficulties reported by users. Professional brokers typically segregate client funds in separate bank accounts and provide clear documentation about fund protection measures.

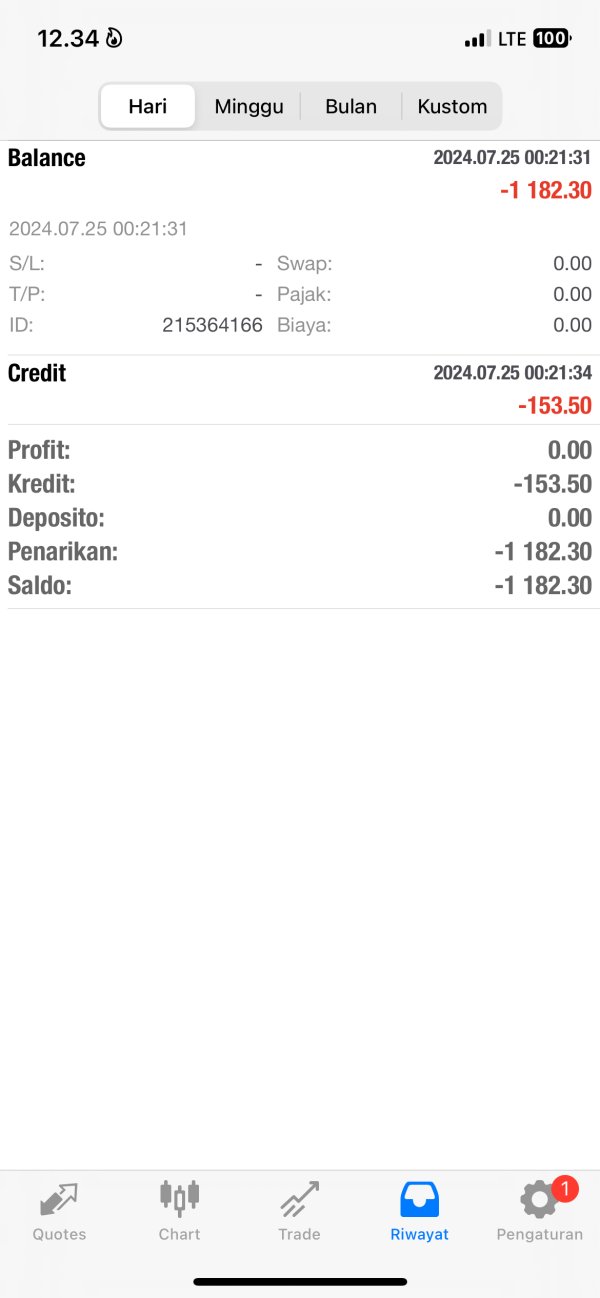

The consistent reports of withdrawal problems suggest that Loyal Primus may not have implemented proper fund segregation or protection protocols. Industry reputation has been severely damaged by multiple scam allegations and negative user experiences.

Sources including review platforms and industry watchdogs have specifically warned against Loyal Primus, with some labeling it a scam operation. This level of negative industry attention is extremely concerning and suggests systematic operational problems rather than isolated customer service issues.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with Loyal Primus appears to be extremely low based on available feedback from multiple review platforms and user testimonials. The consistent pattern of negative experiences across different user types and time periods suggests systematic problems with the broker's operations rather than isolated incidents or misunderstandings.

Interface design and usability information is not available in reviewed materials, though user complaints about platform functionality suggest that the trading interface may have been inadequate for professional trading needs. Modern traders expect intuitive, responsive platforms with complete functionality, and the absence of positive user feedback about platform usability is telling.

Registration and account verification processes appear to have been problematic, with users reporting difficulties in completing account setup or receiving proper documentation about their account status. Professional brokers typically provide clear, step-by-step onboarding processes with regular communication about verification progress and requirements.

Fund management represents the most big user experience failure, with widespread reports of withdrawal difficulties and fund access problems. Users consistently report being unable to withdraw their deposits or trading profits, which represents the most serious possible failure for any financial services provider.

These issues effectively trapped user funds and prevented normal account management activities. The primary user demographic appears to have been individual traders despite the broker's claimed institutional focus, and the negative feedback suggests that Loyal Primus failed to meet the needs of either retail or professional clients.

Recommendations for improvement would include complete operational restructuring, enhanced regulatory compliance, and fundamental changes to customer service and fund management procedures.

Conclusion

This complete loyal primus review reveals a broker with big operational deficiencies and serious trustworthiness concerns that make it unsuitable for any type of trading activity. The combination of poor customer service, withdrawal difficulties, questionable regulatory compliance, and eventual operational cessation creates a pattern that strongly suggests fraudulent or incompetent business practices.

The broker is not recommended for any user type, whether retail traders, professional investors, or institutional clients. The risks associated with fund security, platform reliability, and regulatory protection far outweigh any potential benefits from the limited asset offerings or claimed institutional focus.

Key advantages include claimed ASIC regulation and access to multiple asset classes, though these benefits are effectively negated by operational failures. Primary disadvantages include unresponsive customer service, severe withdrawal difficulties, poor platform reliability, questionable business practices, rapid operational cessation, and widespread negative user feedback.

Potential investors should seek alternative brokers with established track records, transparent operations, and verified regulatory compliance.