GoDo 2025 Review: Everything You Need to Know

Executive Summary

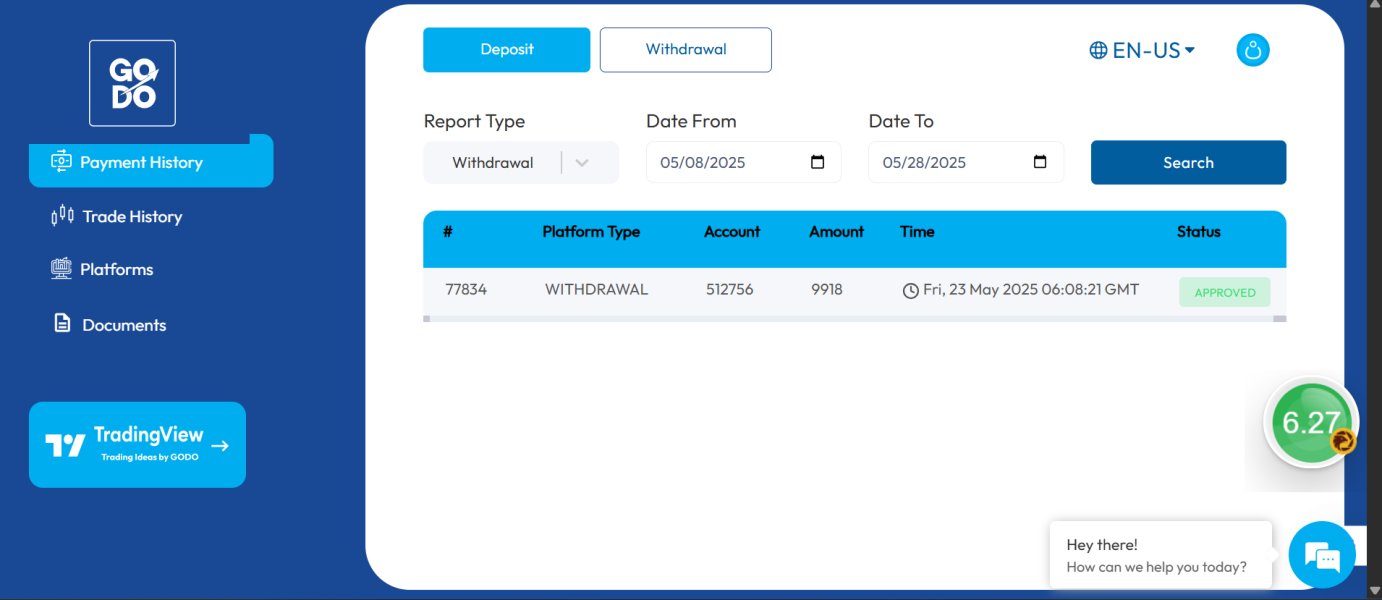

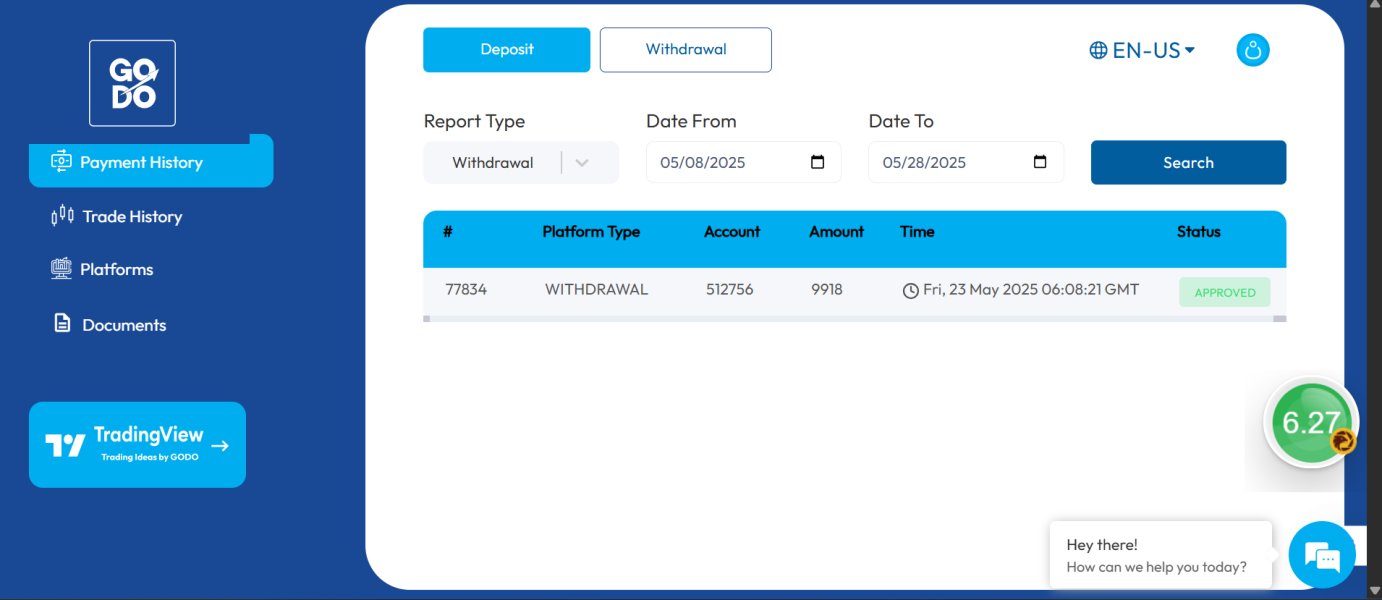

GoDo stands out as a reliable and customer-friendly trading platform that has gained recognition for its fast withdrawal services and comprehensive trading solutions. This godo review reveals a broker that caters to both retail and institutional clients seeking diverse trading opportunities across multiple asset classes. The platform's key strengths include offering leverage up to 1:1000 and supporting multiple trading platforms including MT4, MT5, and cTrader.

GoDo provides access to over 35 asset categories spanning forex, precious metals, oil, indices, and cryptocurrencies, making it an attractive choice for traders seeking portfolio diversification. According to available user feedback and platform analysis, GoDo targets traders who prioritize platform reliability, quick fund access, and comprehensive trading tools. The broker has established itself as a dependable option for those venturing into online forex and CFD trading, with spreads starting from 0 pips and robust customer support infrastructure. While the platform demonstrates strong performance in several key areas, this review identifies both advantages and areas for potential improvement, providing prospective traders with a comprehensive understanding of what GoDo offers in the competitive online trading landscape.

Important Disclaimers

Regional Entity Differences: GoDo operates under different regulatory frameworks across various jurisdictions. The broker is regulated by the Securities and Commodities Authority (SCA) in the United Arab Emirates, and traders should be aware that regulatory conditions and available services may vary depending on their location and applicable local laws. Review Methodology: This comprehensive godo review is based on a thorough analysis of user feedback, official platform information, and available regulatory documentation.

The assessment incorporates real user experiences, platform performance data, and official broker communications to provide an objective evaluation of GoDo's services and offerings.

Rating Framework

Broker Overview

GoDo operates as an online forex and CFD trading service provider that has positioned itself to serve both retail and institutional clientele. The broker focuses on delivering comprehensive trading solutions across multiple asset classes, emphasizing accessibility and platform reliability.

While specific founding details are not extensively documented in available materials, GoDo has established itself as a legitimate player in the competitive online trading sector. The company's business model centers on providing multi-platform trading access through established industry-standard platforms while maintaining competitive trading conditions. GoDo's approach emphasizes customer service quality and operational efficiency, particularly in areas such as withdrawal processing and account management.

Platform Infrastructure: GoDo supports three major trading platforms - MT4, MT5, and cTrader - providing traders with flexibility in choosing their preferred trading environment. The broker offers access to forex, precious metals, oil, indices, and cryptocurrencies, creating a comprehensive trading ecosystem. Regulatory oversight is provided by the Securities and Commodities Authority (SCA) in the United Arab Emirates, establishing a foundation for operational compliance and client fund protection.

Regulatory Jurisdiction: GoDo operates under the regulatory oversight of the Securities and Commodities Authority (SCA) in the United Arab Emirates, providing clients with regulatory protection and compliance standards. Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in current available documentation, requiring direct platform inquiry for comprehensive payment options.

Minimum Deposit Requirements: Current available materials do not specify minimum deposit requirements, suggesting potential flexibility or varied account-type requirements that warrant direct verification. Bonus and Promotional Offers: Available documentation does not detail specific bonus structures or promotional campaigns, indicating either absence of such programs or need for direct platform consultation. Tradeable Assets: The platform provides access to over 35 asset categories including forex currency pairs, gold, silver, oil, major indices, and cryptocurrency instruments, offering comprehensive market exposure for diverse trading strategies.

Cost Structure: Trading costs begin with spreads from 0 pips, though specific commission structures and additional fees require clarification through direct platform inquiry for complete cost transparency. Leverage Options: GoDo offers maximum leverage up to 1:1000, providing significant trading flexibility while requiring appropriate risk management considerations. Platform Selection: Three professional trading platforms are available - MT4, MT5, and cTrader - each offering distinct features and capabilities for different trading preferences and strategies.

This godo review identifies several areas where additional information would benefit prospective clients, particularly regarding specific account requirements and fee structures.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

GoDo's account conditions present a competitive foundation with spreads starting from 0 pips, indicating potential for cost-effective trading. However, the lack of detailed information regarding account types and minimum deposit requirements creates uncertainty for prospective traders seeking specific account tier comparisons. The absence of publicly available information about different account categories makes it challenging to assess how GoDo segments its client base or what specific benefits each account level might offer.

This information gap particularly affects traders who prefer to compare account features before committing to a platform. User feedback suggests that account opening processes are generally straightforward, though specific details about verification requirements and timeframes are not extensively documented. The platform appears to accommodate both retail and institutional clients, but the distinction between service levels remains unclear from available materials. Special account features such as Islamic/Swap-free accounts are not mentioned in current documentation, which could be a consideration for specific trader demographics.

This godo review notes that while basic trading conditions appear competitive, comprehensive account information would enhance transparency and client decision-making capabilities.

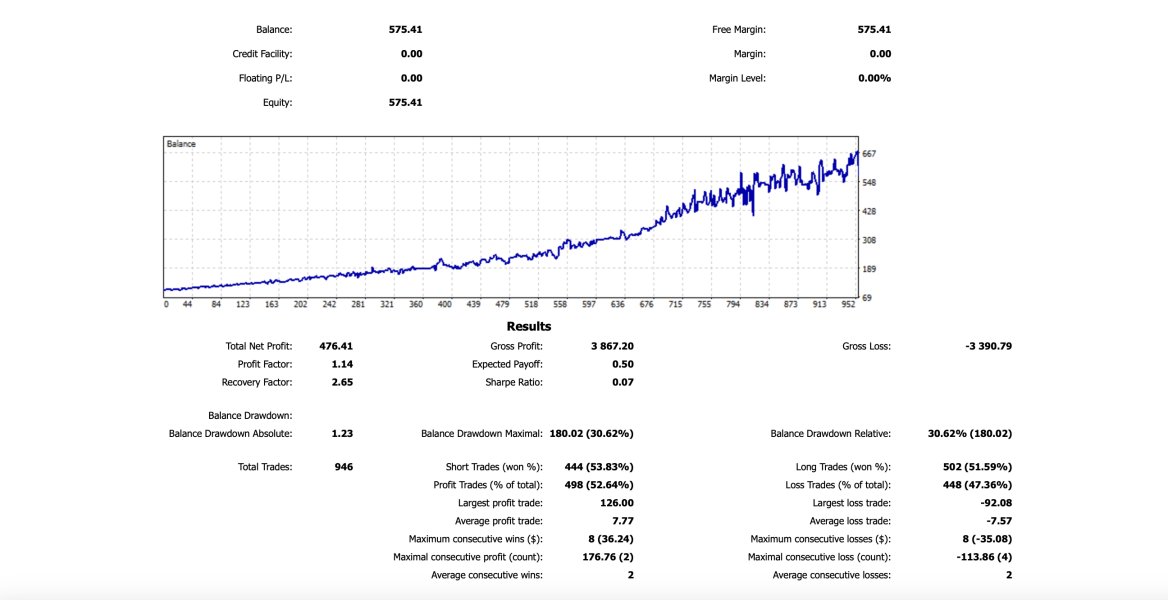

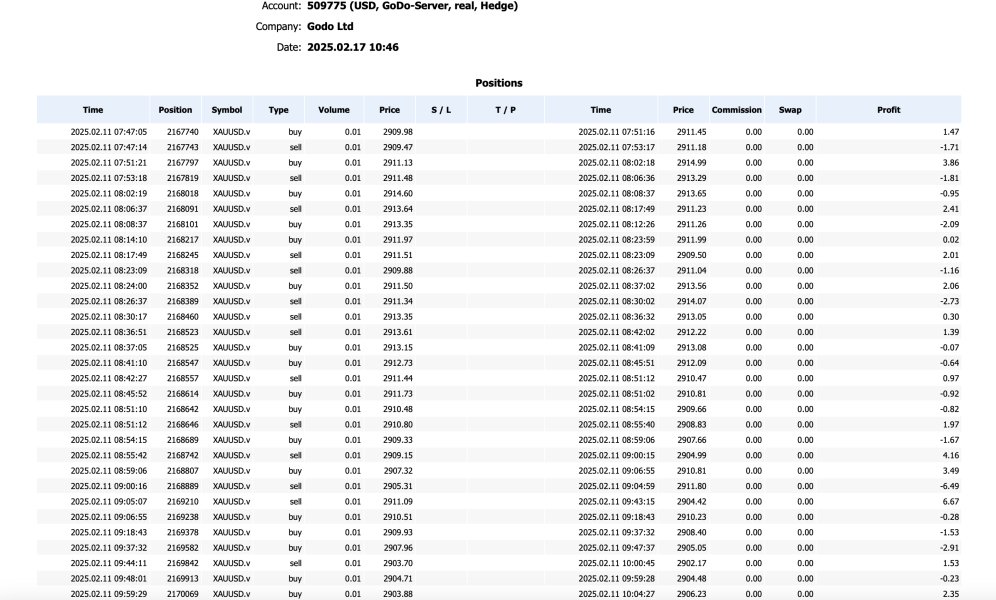

GoDo demonstrates strong performance in platform diversity by offering MT4, MT5, and cTrader access, providing traders with industry-standard tools and advanced functionality. This multi-platform approach accommodates different trading styles and technical analysis preferences effectively. The availability of 35+ asset categories creates substantial opportunities for portfolio diversification and strategy implementation across various market sectors.

This comprehensive asset selection particularly benefits traders seeking exposure to both traditional financial instruments and emerging markets like cryptocurrencies. Research and analysis resources are not extensively detailed in available documentation, though the platform's support for professional trading platforms suggests access to standard technical analysis tools and charting capabilities. The integration with established platforms like MT4 and MT5 inherently provides access to expert advisors and automated trading systems.

Educational resources and training materials are not specifically mentioned in current available information, representing a potential area for platform enhancement. User feedback indicates satisfaction with available tools, though specific details about proprietary research or market analysis offerings require direct platform investigation.

Customer Service and Support Analysis (8/10)

User feedback consistently highlights positive experiences with GoDo's customer support team, indicating responsive and helpful service delivery. Clients report satisfaction with support quality, though some users have identified areas where service could be enhanced further. The responsiveness of customer service appears to be a platform strength, with users noting timely assistance with account-related inquiries and technical issues.

This positive feedback suggests that GoDo prioritizes client support as a key service differentiator. Specific customer service channels and availability hours are not detailed in current documentation, though user experiences suggest adequate accessibility. The quality of support interactions appears to meet client expectations, with room for continued improvement based on user suggestions. Multi-language support capabilities and specialized support for different client categories (retail vs. institutional) are not specifically documented, representing areas where additional information would benefit prospective clients.

Despite these information gaps, the overall user satisfaction with customer service contributes positively to GoDo's platform evaluation.

Trading Experience Analysis (7/10)

User feedback indicates generally positive trading experiences with GoDo's platform, suggesting reliable order execution and stable trading conditions. However, some users have noted that the mobile application requires improvement to match desktop platform functionality. Platform stability and execution speed appear to meet user expectations based on available feedback, though specific technical performance metrics are not detailed in current documentation.

The support for multiple professional platforms (MT4, MT5, cTrader) provides traders with proven, reliable trading environments. Order execution quality and issues such as slippage or requotes are not extensively documented in available materials, though user feedback suggests satisfactory performance in normal market conditions. The variety of available trading platforms allows users to select environments that best match their execution preferences. Mobile trading experience has been identified by users as an area requiring enhancement, suggesting that while desktop platforms perform well, mobile functionality may lag behind industry standards.

This feedback indicates ongoing development needs to maintain competitive positioning.

Trustworthiness Analysis (7/10)

SCA regulation provides a solid foundation for client confidence, as the Securities and Commodities Authority maintains regulatory standards that protect client interests and ensure operational compliance. This regulatory oversight contributes significantly to platform credibility. Fund safety measures beyond regulatory requirements are not extensively detailed in available documentation, though users express general confidence in the security of their deposited funds.

The regulatory framework provides baseline protection, though additional security features would enhance client confidence. Company transparency regarding operational details, financial reporting, and corporate structure could be enhanced based on available public information. While regulatory compliance suggests operational legitimacy, additional transparency would strengthen client trust. Industry reputation appears positive based on user feedback, with clients expressing confidence in GoDo's reliability and operational integrity.

The absence of significant negative events or regulatory actions in available documentation supports the platform's trustworthiness assessment.

User Experience Analysis (7/10)

Overall user satisfaction with GoDo appears positive, with clients appreciating the platform's reliability and customer-focused approach. User feedback indicates that the platform successfully meets the basic requirements of most traders while maintaining competitive service standards. Interface design and usability receive positive feedback, particularly regarding the integration with established trading platforms that traders are already familiar with.

The multi-platform approach allows users to work within their preferred trading environments. Registration and verification processes are not extensively detailed in available documentation, though user feedback suggests that account setup procedures are manageable. The absence of significant complaints about onboarding suggests adequate process efficiency. Common user concerns include requests for mobile application improvements and enhanced service features, indicating that while the platform performs well in core areas, continued development could enhance competitive positioning.

This godo review notes that user feedback provides valuable insights for platform enhancement priorities.

Conclusion

GoDo establishes itself as a reliable and customer-friendly trading platform that successfully serves both retail and institutional clients seeking comprehensive trading solutions. The broker's commitment to fast withdrawal services, competitive spreads starting from 0 pips, and support for multiple professional trading platforms creates a solid foundation for online trading activities. Ideal user demographics include traders who prioritize platform reliability, diverse asset access, and responsive customer support.

The availability of high leverage (up to 1:1000) and access to 35+ asset categories makes GoDo particularly suitable for experienced traders seeking portfolio diversification and flexible trading conditions. Key advantages include SCA regulatory oversight, excellent customer support, multiple platform options, and competitive trading conditions. Areas for improvement involve enhanced mobile application functionality, greater transparency regarding account types and fee structures, and expanded educational resources.

Overall, GoDo presents a solid choice for traders seeking a dependable trading environment with professional-grade tools and responsive service.