Regarding the legitimacy of LOYAL PRIMUS forex brokers, it provides FSCA and WikiBit, .

Is LOYAL PRIMUS safe?

Pros

Cons

Is LOYAL PRIMUS markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

LOYAL PRIMUS (PTY) LTD

Effective Date:

2021-10-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

20 JN SEMBILANG, SEKSYEN 17, SHAH ALAM SELANGOR, MALAYSIA WESTERN CAPE SOUTH AFRICA 7700Phone Number of Licensed Institution:

71 4755068Licensed Institution Certified Documents:

Is Loyal Primus A Scam?

Introduction

Loyal Primus is a relatively new player in the forex trading market, having been established in 2020. It positions itself as a broker that offers a variety of financial instruments, including forex, commodities, and cryptocurrencies, through the widely used MetaTrader 4 platform. As the online trading landscape continues to grow, traders must exercise caution when selecting a broker. The potential for scams and unethical practices in the forex market is significant, making it crucial for traders to conduct thorough evaluations of their chosen brokerage firms. This article aims to provide an objective assessment of Loyal Primus by examining its regulatory status, company background, trading conditions, and customer experiences, among other factors.

Our investigation is based on a comprehensive analysis of various online sources, including reviews, regulatory information, and user feedback. We will utilize a structured framework to evaluate the broker's trustworthiness, focusing on key aspects such as regulation, company history, trading conditions, customer fund safety, and overall user experiences.

Regulation and Legitimacy

Loyal Primus claims to be regulated by the Financial Sector Conduct Authority (FSCA) of South Africa and also states that it is a member of the National Futures Association (NFA) in the USA. However, the legitimacy of these claims is questionable, as many sources indicate that the broker lacks proper regulatory oversight. The absence of a robust regulatory framework raises concerns about the safety of client funds and the broker's overall integrity.

Here is a summary of the regulatory information for Loyal Primus:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 51830 | South Africa | Unverified |

| NFA | Not applicable | USA | Unverified |

| SVG FSA | 26626 | Saint Vincent and the Grenadines | Verified |

The regulatory quality in Saint Vincent and the Grenadines is notably low, as the jurisdiction does not impose strict regulations on forex brokers. This lack of oversight can lead to significant risks for traders, as unregulated brokers are not held accountable for their actions, making it easier for scams to occur. Furthermore, the claims of NFA membership appear to be unfounded, further diminishing the broker's credibility.

Company Background Investigation

Loyal Primus is registered as an international business company in Saint Vincent and the Grenadines, with its operations based out of Suite 305, Griffith Corporate Centre, Beachmont, Kingstown. The company has been operational since 2020, but its short history raises questions about its stability and reliability. The ownership structure of Loyal Primus is unclear, and there is limited information available regarding its management team and their professional backgrounds.

Transparency is a critical factor in evaluating a broker's legitimacy. Unfortunately, Loyal Primus does not provide comprehensive information about its founders or key personnel, which can be a red flag for potential investors. A lack of transparency often correlates with a higher risk of fraudulent activity, as it becomes difficult for clients to hold the company accountable for its actions.

Trading Conditions Analysis

Loyal Primus offers a variety of trading conditions, including competitive spreads and high leverage options. However, the overall fee structure and potential hidden costs warrant careful scrutiny. The broker promotes commission-free trading, but the spreads may vary significantly based on market conditions.

A comparison of core trading costs is as follows:

| Cost Type | Loyal Primus | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While the advertised spread of 0.6 pips is competitive, some users have reported discrepancies in actual trading conditions. Additionally, the lack of clarity surrounding overnight interest rates and other potential fees can lead to unexpected costs for traders. It's essential for potential clients to fully understand the fee structure before committing to trading with Loyal Primus.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Loyal Primus claims to implement several measures to protect client deposits. However, the effectiveness of these measures is questionable due to the broker's regulatory status. The company does not participate in any investor compensation schemes, which means that clients could potentially lose their funds if the broker faces financial difficulties or insolvency.

Loyal Primus does state that client funds are held in segregated accounts, which is a positive aspect. However, the lack of negative balance protection is a significant concern, as traders could incur losses greater than their initial deposits. Historical reports of fund security issues or disputes have also been noted, further emphasizing the need for caution.

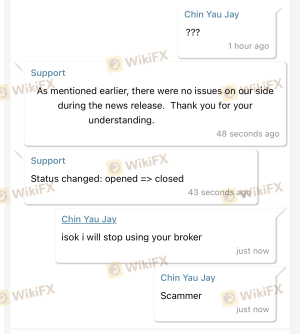

Customer Experience and Complaints

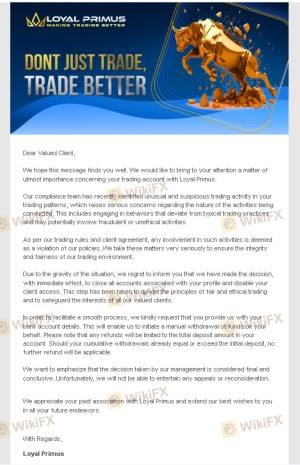

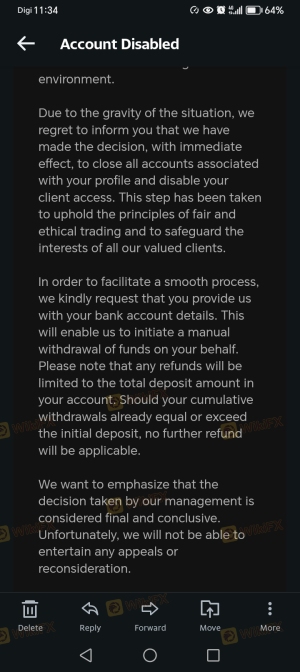

User feedback regarding Loyal Primus is mixed, with many clients expressing dissatisfaction with their experiences. Common complaints include difficulties in withdrawing funds, account suspensions, and poor customer support. These issues raise serious concerns about the broker's reliability and its commitment to customer service.

Here is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Suspension | High | No explanation |

| Customer Support Availability | Medium | Limited options |

Several users have reported that their accounts were disabled after they attempted to withdraw profits, indicating a troubling pattern that could suggest potential fraud. For example, one user claimed that their account was blocked without explanation after successfully trading and requesting a withdrawal. Such experiences raise red flags and suggest that potential investors should proceed with caution.

Platform and Trade Execution

Loyal Primus primarily utilizes the MetaTrader 4 platform, known for its user-friendly interface and advanced trading features. While the platform is widely regarded as reliable, concerns about order execution quality have been raised. Instances of slippage and order rejections have been reported, which can significantly impact trading outcomes.

The potential for platform manipulation is another critical area of concern. Traders have reported discrepancies in pricing and execution, suggesting that the broker may not always act in the best interests of its clients. This lack of transparency and potential for manipulation underscores the need for traders to be vigilant when using the platform.

Risk Assessment

Engaging with Loyal Primus carries inherent risks due to its regulatory status and customer feedback. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper oversight increases the likelihood of fraud. |

| Financial Risk | High | No investor compensation scheme; potential for fund loss. |

| Operational Risk | Medium | Complaints about withdrawal issues and account management. |

| Platform Risk | Medium | Reports of slippage and potential manipulation. |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and be prepared for potential challenges when withdrawing funds.

Conclusion and Recommendations

Based on the evidence presented, it is reasonable to conclude that Loyal Primus exhibits several characteristics of a potentially unreliable and risky broker. The lack of robust regulation, coupled with numerous customer complaints and reports of withdrawal issues, raises significant concerns about the broker's trustworthiness.

For traders considering engagement with Loyal Primus, it is advisable to proceed with extreme caution. Those new to forex trading or seeking reliable and secure trading environments should explore alternatives with established regulatory oversight and positive user feedback. Brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC would be far safer options, providing better protection for client funds and more transparent trading conditions.

In summary, while Loyal Primus may offer attractive trading conditions, the associated risks and potential for fraudulent behavior warrant serious consideration. It is crucial for traders to prioritize their safety and security when selecting a forex broker, making informed decisions based on thorough research and due diligence.

Is LOYAL PRIMUS a scam, or is it legit?

The latest exposure and evaluation content of LOYAL PRIMUS brokers.

LOYAL PRIMUS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LOYAL PRIMUS latest industry rating score is 5.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.