Regarding the legitimacy of GODO forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is GODO safe?

Pros

Cons

Is GODO markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

GODO LTD

Effective Date:

2021-01-20Email Address of Licensed Institution:

redbird@godofx.com, s.mooraby@abcglobal.muSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

BANK STREET, 3RD FLOOR, STANDARD CHARTERED TOWER, CYBERCITY, EBENE, MAURITIUSPhone Number of Licensed Institution:

230 464 2668Licensed Institution Certified Documents:

Is GoDo A Scam?

Introduction

GoDo, also known as GoDo FX, positions itself as a global online broker offering trading services in the foreign exchange (forex) market. Established in the last few years, the company claims to provide a wide range of financial instruments, including forex pairs, commodities, and indices, through popular trading platforms like MetaTrader 4 and 5. However, the rapid growth of online trading has also seen a rise in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds.

In this article, we will investigate whether GoDo is a trustworthy broker or a potential scam. Our evaluation will be based on various factors, including regulatory status, company background, trading conditions, client experiences, and overall risk assessment. We will utilize data from multiple credible sources to provide a balanced view, ensuring that our readers can make informed decisions.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. GoDo claims to be regulated by the Financial Services Commission (FSC) in Mauritius. However, it is essential to note that Mauritius is often regarded as an offshore jurisdiction, which may not provide the same level of protection as more stringent regulatory bodies in regions like the UK or the EU.

Regulatory Information Table

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | GB20025812 | Mauritius | Active |

While GoDo holds a license from the FSC, the effectiveness of this regulation is often questioned due to the lack of strict enforcement and oversight in offshore jurisdictions. Furthermore, reports indicate that the company may also operate under a license from the Securities and Commodities Authority (SCA) in the UAE. However, this license seems to be questionable, as it appears to overstep its authorization concerning forex trading services.

The absence of robust regulatory frameworks raises concerns about investor protection. Traders should be cautious, as operating with an unregulated or loosely regulated broker can expose them to significant risks, including the potential loss of funds without any legal recourse.

Company Background Investigation

GoDo is operated by GoDo Limited, which is headquartered in Mauritius. The company is relatively new, having been established within the last five years. While the company claims to offer a wide range of trading services, details about its ownership structure and management team are not readily available.

The lack of transparency regarding the company's history and the qualifications of its management team can be a red flag for potential investors. A reputable broker typically provides detailed information about its founders, management, and operational history, allowing traders to assess the broker's credibility.

Moreover, the company's website does not provide clear insights into its financial standing or operational practices, which further adds to concerns about its transparency. Without adequate information, traders may find it challenging to trust the broker fully.

Trading Conditions Analysis

GoDo offers a variety of trading accounts with different minimum deposit requirements and leverage options. The broker claims to provide competitive trading conditions; however, a closer examination reveals some concerning aspects.

Trading Cost Comparison Table

| Cost Type | GoDo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spread for major currency pairs offered by GoDo is slightly higher than the industry average, which could impact traders' profitability. Additionally, while the broker claims to have no commissions, some reports suggest hidden fees or high overnight interest rates, which can be detrimental to traders, especially those engaged in long-term positions.

Such fee structures can be a tactic used by less reputable brokers to increase their profit margins at the expense of their clients. Therefore, it is crucial for traders to thoroughly read the fine print and understand all potential costs before opening an account.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. GoDo claims to implement various measures to protect client funds, including segregating client accounts from the company's operational funds. However, the effectiveness of these measures largely depends on the regulatory framework in which the broker operates.

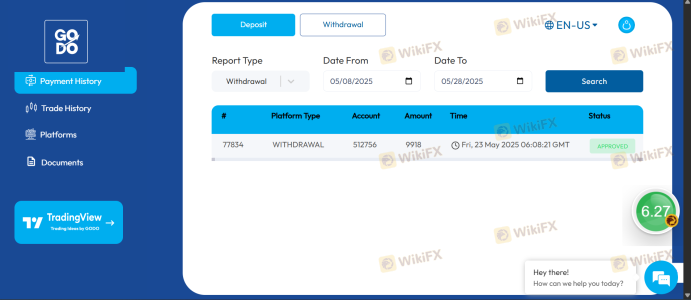

Reports suggest that GoDo does not provide any investor protection schemes, which could leave traders vulnerable in the event of financial difficulties or insolvency. Furthermore, there have been complaints from clients regarding withdrawal issues, which raises concerns about the broker's commitment to fund security.

Historical Safety Issues

While there are no significant historical incidents directly linked to GoDo, the lack of regulatory oversight in Mauritius means that clients may have limited recourse should issues arise. Traders should be wary of any broker that does not offer robust protections for their funds, as this can be indicative of deeper systemic problems.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's trustworthiness. GoDo has received mixed reviews from users, with several complaints highlighting issues related to withdrawal difficulties and customer service responsiveness.

Complaint Types and Severity Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow to respond |

| Customer Service | Medium | Inconsistent support |

| Account Management | Low | Limited information |

Common complaints from clients include the inability to withdraw funds and unresponsive customer support. These issues can significantly affect a trader's experience and raise red flags about the broker's operational integrity.

In one case, a trader reported that their withdrawal request was delayed for several weeks, leading to frustration and financial strain. Another trader mentioned that they received vague responses from customer support, which did not resolve their issues. Such experiences are concerning and suggest a lack of professionalism and reliability.

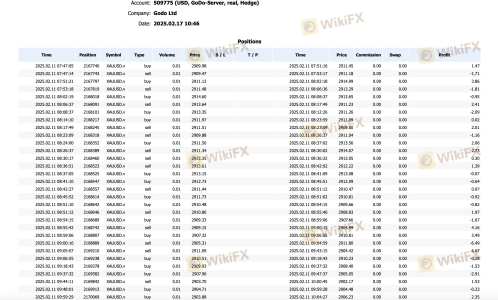

Platform and Trade Execution

GoDo offers trading through popular platforms like MetaTrader 4 and 5, which are well-regarded for their functionality and user experience. However, the quality of trade execution is equally important. Traders have reported instances of slippage and delays in order execution, which can significantly impact trading outcomes.

While the broker claims to provide fast execution speeds, the reality may differ for some users. Additionally, there are concerns about potential platform manipulation, particularly in volatile market conditions.

Risk Assessment

Engaging with GoDo comes with inherent risks that traders should carefully consider.

Risk Assessment Summary Table

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated offshore jurisdiction |

| Fund Safety Risk | High | Lack of investor protection |

| Execution Risk | Medium | Reports of slippage and delays |

Given the regulatory environment and the feedback from clients, the overall risk of trading with GoDo is elevated. Traders should approach this broker with caution and consider using risk management strategies to mitigate potential losses.

Conclusion and Recommendations

In conclusion, while GoDo presents itself as a forex broker with a variety of trading options, significant concerns about its regulatory status, transparency, and customer feedback suggest that it may not be a safe choice for traders. The combination of high regulatory risk and historical complaints regarding fund withdrawals raises serious questions about the broker's legitimacy.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated by reputable authorities, such as the FCA in the UK or ASIC in Australia. These brokers typically offer better investor protection and a more transparent trading environment.

Ultimately, potential clients should conduct thorough research and consider their risk tolerance before engaging with GoDo or any similar broker.

Is GODO a scam, or is it legit?

The latest exposure and evaluation content of GODO brokers.

GODO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GODO latest industry rating score is 6.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.