KQ Markets 2025 Review: Everything You Need to Know

KQ Markets has garnered a mixed reputation in the forex trading community, with reviews highlighting both its potential and significant risks. The broker claims to offer a wide array of trading instruments, but its regulatory status raises concerns among potential investors. Notably, KQ Markets is regulated by the FCA, but its current status is marked as "exceeded," prompting warnings from various financial watchdogs.

Note: It is crucial to consider that KQ Markets operates under different entities in various regions, which could affect the level of service and regulatory oversight. This review is based on a comprehensive analysis of multiple sources to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on a combination of user reviews, expert opinions, and factual data from various authoritative sources.

Broker Overview

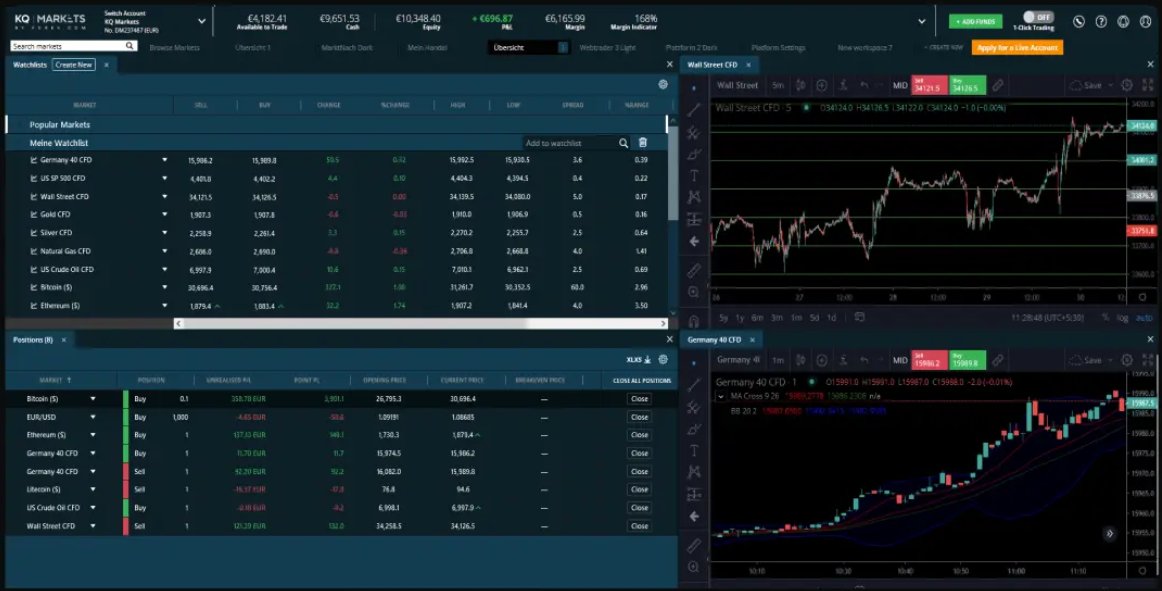

Founded in 2017, KQ Markets is a UK-based forex broker that offers access to a diverse range of trading instruments, including forex, commodities, ETFs, indices, and more. The broker operates on the widely used MetaTrader 5 (MT5) platform, which is suitable for both novice and experienced traders. KQ Markets is regulated by the Financial Conduct Authority (FCA) under license number 780026, although its regulatory status is currently flagged as "exceeded," indicating potential issues with compliance.

Detailed Breakdown

-

Regulated Areas/Regions: KQ Markets is primarily registered in the United Kingdom, but its regulatory status has raised concerns. The FCA has previously warned against KQ Markets, classifying it as a broker that exceeds its regulatory scope.

Deposit/Withdrawal Currencies: KQ Markets accepts various payment methods, including Visa, Mastercard, PayPal, and Skrill. However, specific details about processing times and fees remain unclear.

Minimum Deposit: The minimum deposit requirement is reportedly around £500 for a standard account, which may be considered high compared to other brokers in the market.

Bonuses/Promotions: There are no significant bonuses or promotions mentioned across the reviewed sources, which is a common practice among brokers aiming to maintain regulatory compliance.

Tradable Asset Classes: KQ Markets offers over 1,300 tradable instruments, including forex, commodities, ETFs, gold and silver, indices, and bonds.

Costs (Spreads, Fees, Commissions): Specific details on spreads and commissions are not clearly outlined, leading to concerns about transparency. Some users have reported widening spreads and slippage, which could significantly impact trading costs.

Leverage: The leverage options are not explicitly stated on the website, which can be a red flag for inexperienced traders who might not fully understand the risks involved.

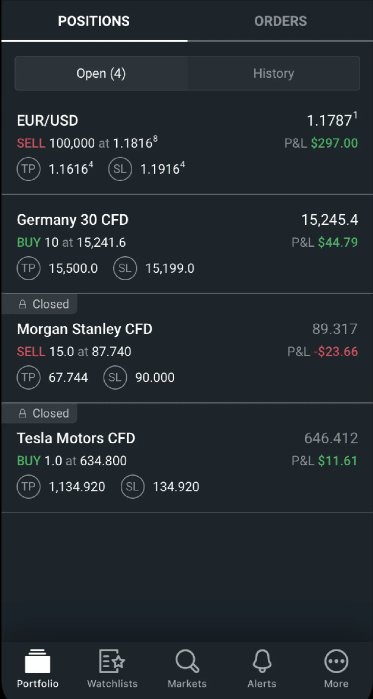

Allowed Trading Platforms: KQ Markets supports MT5, which is known for its advanced trading functionalities, and a proprietary web trader. The availability of mobile apps further enhances the trading experience.

Restricted Regions: While the broker is primarily focused on the UK market, there is no clear information about specific regions where trading is restricted.

Available Customer Support Languages: KQ Markets offers customer support in English, with contact options including phone, email, and various social media platforms.

Repeated Ratings Overview

Detailed Rating Breakdown

-

Account Conditions (4/10): The minimum deposit requirement of £500 is relatively high, which may deter new traders. Additionally, the lack of clarity regarding fees and commissions raises concerns.

Tools and Resources (5/10): While KQ Markets provides access to MT5 and a demo account, the overall educational resources and trading tools are limited compared to other brokers.

Customer Service and Support (6/10): Customer support has received mixed reviews, with some users praising the responsiveness, while others reported delays in responses.

Trading Setup (5/10): The trading experience on the MT5 platform is generally positive, although reports of slippage and widening spreads have been noted, impacting overall satisfaction.

Trustworthiness (3/10): The "exceeded" status from the FCA and various warnings from financial watchdogs significantly impact KQ Markets' trustworthiness. Users are advised to exercise caution.

User Experience (4/10): Overall user experience is mixed, with some traders appreciating the platform's functionality while others express concerns about withdrawal issues and customer support.

Additional Considerations (4/10): The lack of transparency regarding fees and regulatory issues poses significant risks for potential investors.

In conclusion, KQ Markets presents a mixed bag for potential traders. While it offers a variety of trading instruments and a reputable trading platform, significant concerns about its regulatory status and user experiences suggest that caution is warranted. Always conduct thorough research and consider safer, well-regulated alternatives before investing.