Soolike 2025 Review: Everything You Need to Know

Executive Summary

This soolike review looks at a South African online forex broker that has gotten mixed attention from traders. Soolike Capital Markets (Pty) Ltd works under the rules of the Financial Services Conduct Authority (FSCA) of South Africa, and it offers many different trading tools including forex, precious metals, CFDs, stocks, commodities, and cryptocurrencies.

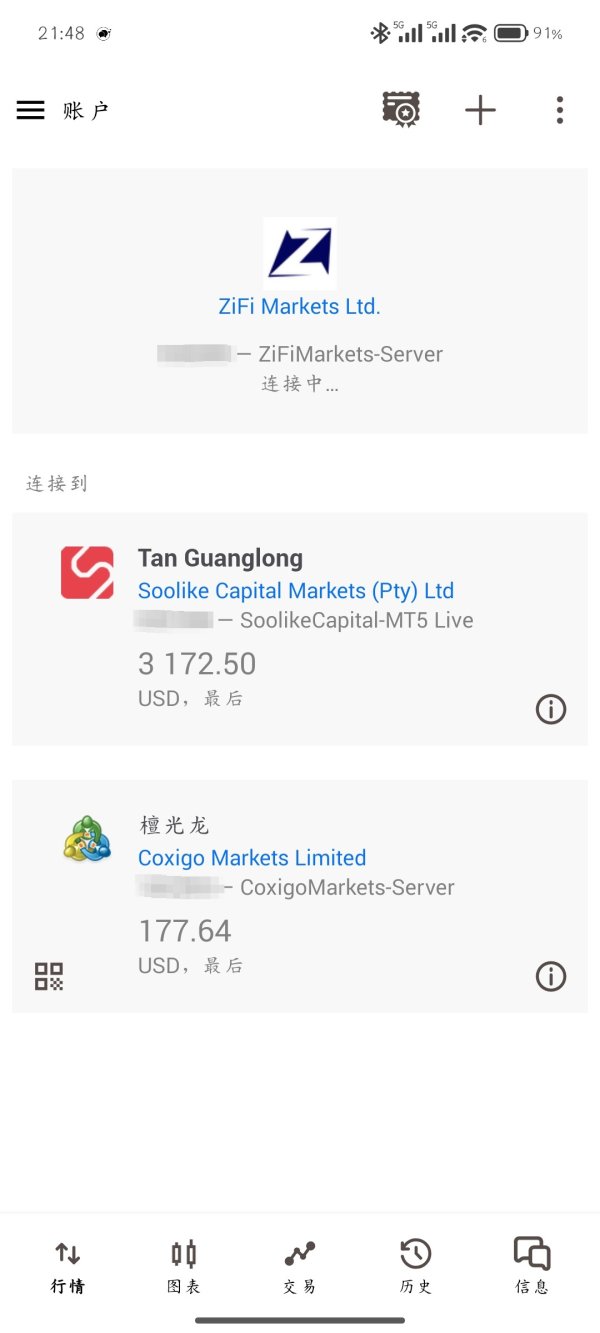

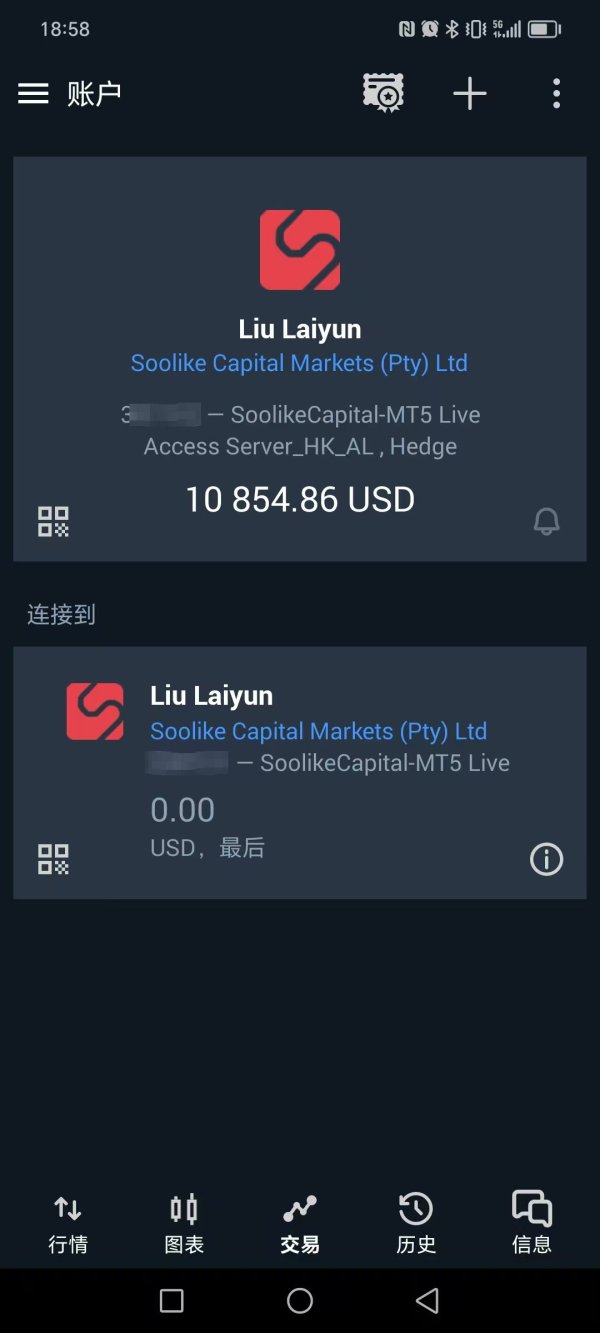

The broker mainly focuses on small to medium-sized investors who want different types of assets with good trading conditions. Soolike offers the MetaTrader 5 platform and says it has low spreads and fast withdrawals, according to what we found. But our overall view of the broker stays neutral because users have mixed feelings about how clear and real the company is.

Key features include access to many asset types, good spreads, and the popular MT5 trading platform. The broker seems right for traders who want variety in their trading, though people thinking about using it should carefully look at the rules and do their homework before putting money in.

Important Disclaimer

Soolike works as a South African broker under FSCA rules, which means users in other countries may face different legal situations. The protection that South African people get may not help international clients, and traders should check if the broker is legal in their own countries.

This review uses information that anyone can find and feedback from users we collected from different places. How accurate and current the information is may change, and trading conditions can change without warning. We strongly tell readers to check all information directly with the broker and think about their own money situation before making any trading choices.

Rating Framework

Broker Overview

Soolike Capital Markets (Pty) Ltd started in 2010 as an online forex and CFD broker based in South Africa. The company says it provides complete trading solutions, giving access to many financial markets through one platform. Soolike works under the watch of South Africa's Financial Services Conduct Authority (FSCA), which creates rules to protect investors in South Africa, according to what we found.

The broker's business plan focuses on giving retail and business clients access to global financial markets through good spreads and many different assets. Soolike's method focuses on technology and customer service, though we don't know much about who started the company and how it's organized from public sources.

The broker mainly uses the MetaTrader 5 platform, supporting trading across forex pairs, precious metals, contracts for difference (CFDs), stocks, commodities, and cryptocurrency tools. This soolike review finds that the broker targets traders who want to spread their money across many asset types, especially those who are okay with South African rules and want good trading conditions in emerging markets.

Regulatory Jurisdiction: Soolike works under the rules of South Africa's Financial Services Conduct Authority (FSCA), which watches over financial services companies working in South Africa. This system aims to protect investors through rules and standards that companies must follow.

Deposit and Withdrawal Methods: We didn't find specific information about how to put money in or take money out from available sources. Traders who want to know about funding options should contact the broker directly for current payment methods and how long they take.

Minimum Deposit Requirements: The minimum money needed to open an account with Soolike wasn't listed in available papers. People thinking about opening accounts should check current minimum funding needs directly with the broker.

Bonus and Promotional Offers: We didn't find information about welcome bonuses, special offers, or reward programs in available sources. Traders should ask directly about any current special deals.

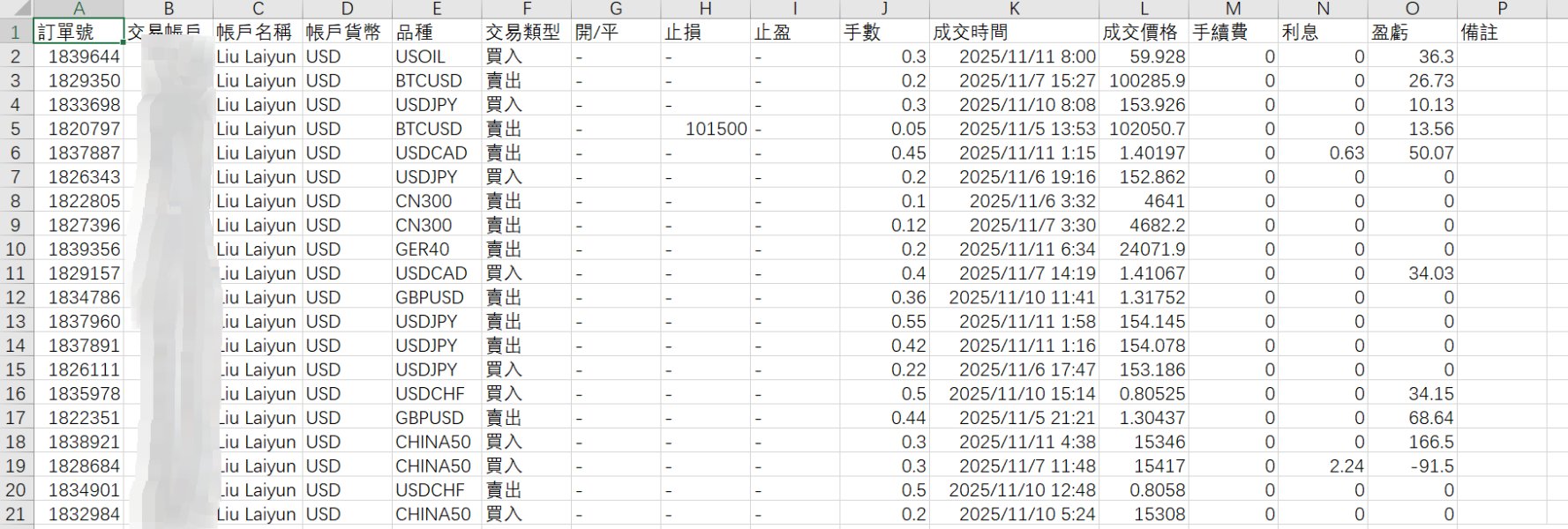

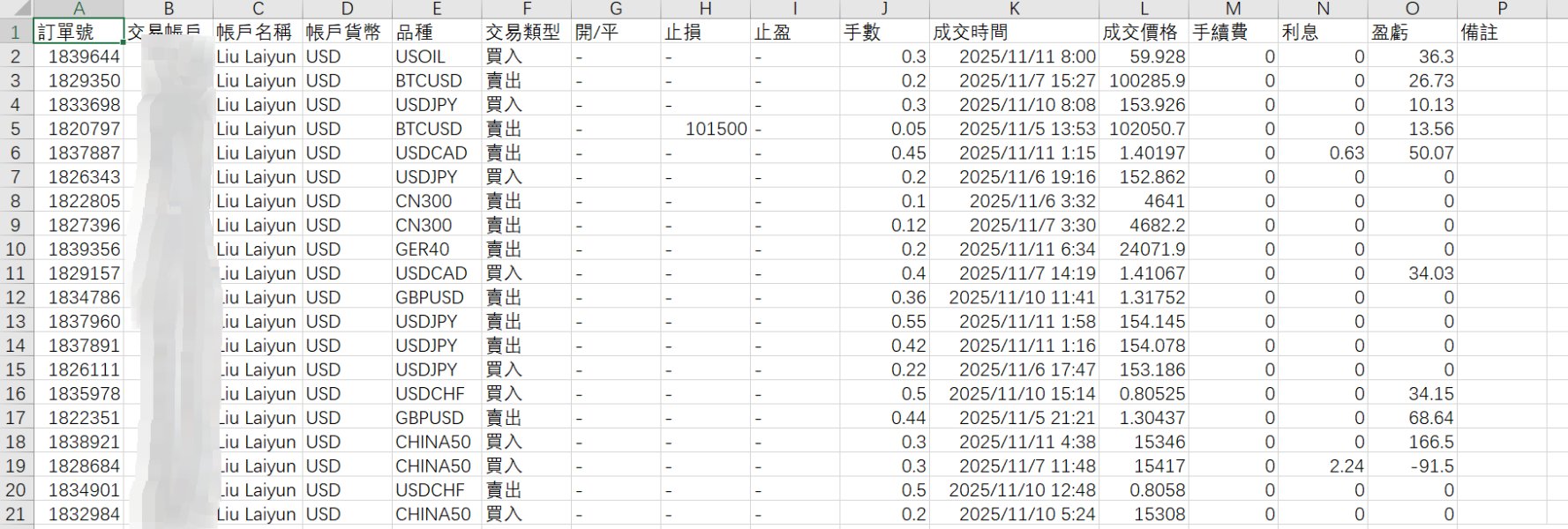

Tradeable Assets: Soolike gives access to many financial tools including major and minor forex currency pairs, precious metals such as gold and silver, contracts for difference (CFDs) across various underlying assets, stock CFDs, commodity futures, and cryptocurrency trading pairs. The broker offers a wide range of options for different trading styles.

Cost Structure: The broker advertises good spreads across its tools, though we didn't find specific commission structures and fee schedules in available sources. Users say trading costs are generally fair, though complete fee clarity seems limited.

Leverage Ratios: We didn't find specific maximum leverage ratios that Soolike offers in available papers. Leverage availability may change based on tool type and account type.

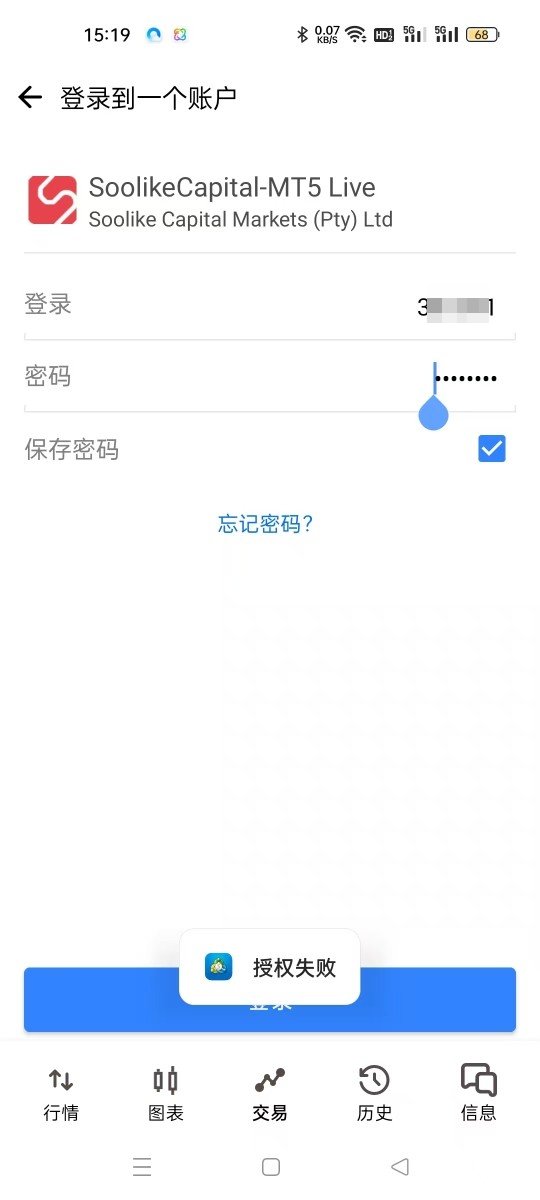

Platform Options: Soolike mainly offers the MetaTrader 5 (MT5) trading platform, which supports advanced charting tools, automated trading features, and complete market analysis tools. The platform works with both manual and computer trading strategies.

This soolike review notes that while the broker offers different trading opportunities, several key details need direct checking with the company for the most current and accurate information.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Soolike's account conditions get a medium rating because there isn't much clear information available to the public about account types, minimum deposits, and fee structures. Available sources don't say if the broker offers multiple account levels or special account types such as Islamic accounts for religious trading rules.

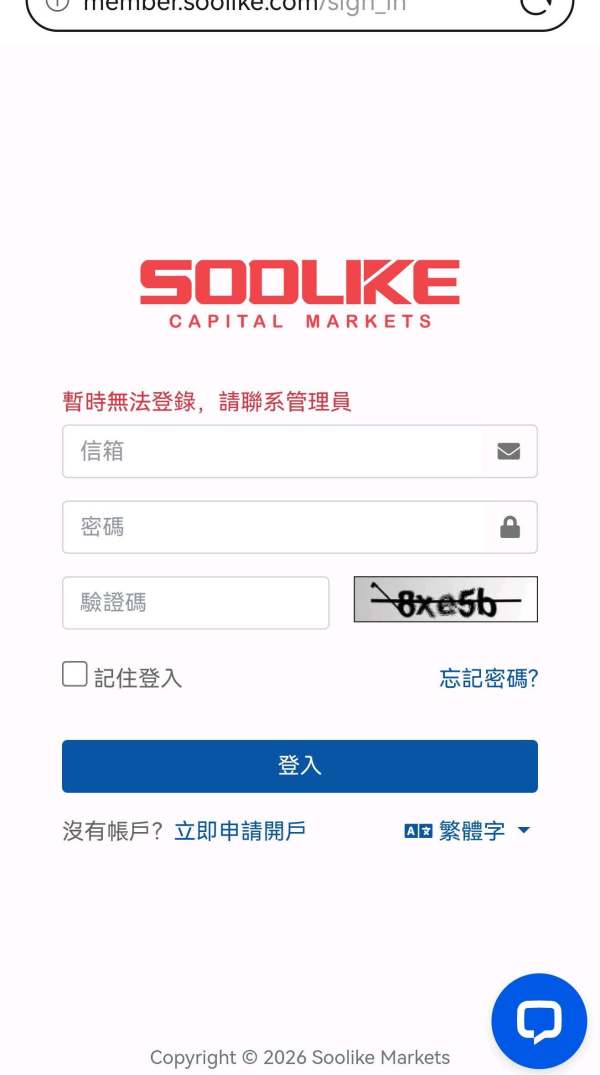

The account opening process details aren't fully explained in available papers, which may create confusion for people who want clear information about signup needs and verification steps. User feedback shows mixed experiences with account condition clarity, with some traders worried about the lack of detailed terms and conditions that are easy to review.

Compared to industry standards where top brokers usually provide complete account information including spreads, commissions, and minimum deposits upfront, Soolike seems to fall short in being clear. This lack of detailed public information may push away experienced traders who like to do thorough comparisons before picking a broker.

The absence of clearly defined account benefits, trading privileges, or level-based advantages makes it hard for potential clients to see if the broker's offerings match their trading needs and money strategies. This soolike review suggests that interested traders contact the broker directly to get complete account condition details before making any commitments.

Soolike shows strong performance in the tools and resources area, mainly through its use of the MetaTrader 5 platform, which many people think is one of the industry's best trading platforms. User feedback consistently shows happiness with the platform's features, stability, and complete tool set.

The MT5 platform gives traders advanced charting abilities, technical analysis tools, automated trading support through Expert Advisors (EAs), and access to the MetaTrader Market for additional trading tools and indicators. The platform's ability to trade multiple assets works well with Soolike's different tool offerings, letting traders manage positions across different asset types from one place.

While we didn't find specific information about the company's own research and analysis resources in available sources, the MetaTrader 5 platform includes built-in economic calendar features and basic market news feeds. However, the absence of detailed information about educational resources, webinars, or market analysis reports shows a possible gap in the broker's offering compared to full-service competitors.

User reviews suggest that the technical setup supporting the trading tools works reliably, with traders saying they're happy with execution speeds and platform stability. The support for automated trading strategies seems to be a particular strength, attracting traders interested in computer trading methods.

Customer Service and Support Analysis (7/10)

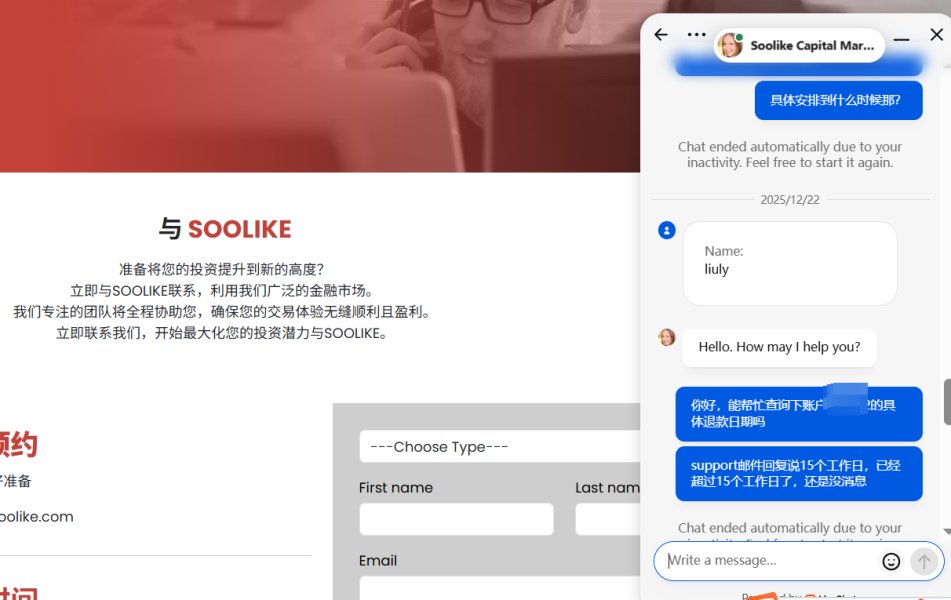

Customer service gets a solid rating based on generally positive user feedback, though complete details about support channels, operating hours, and language abilities aren't well documented in available sources. Users who have talked with Soolike's support team report generally okay experiences with problem solving and help quality.

The specific ways to contact customer support, such as live chat, email, or phone support, aren't clearly listed in public papers. This lack of clarity about support access may worry traders who want immediate help availability, especially during volatile market conditions.

Response time performance seems adequate based on user feedback, though specific service agreements or guaranteed response times aren't publicly documented. Some users have said they appreciate helpful support interactions, while others have suggested room for improvement in response speed and problem-solving efficiency.

Multi-language support abilities remain unclear from available sources, which could be a big consideration for international clients operating outside of English-speaking regions. The absence of detailed support documentation suggests that potential clients should verify support availability in their preferred language and timezone before opening accounts.

Trading Experience Analysis (7/10)

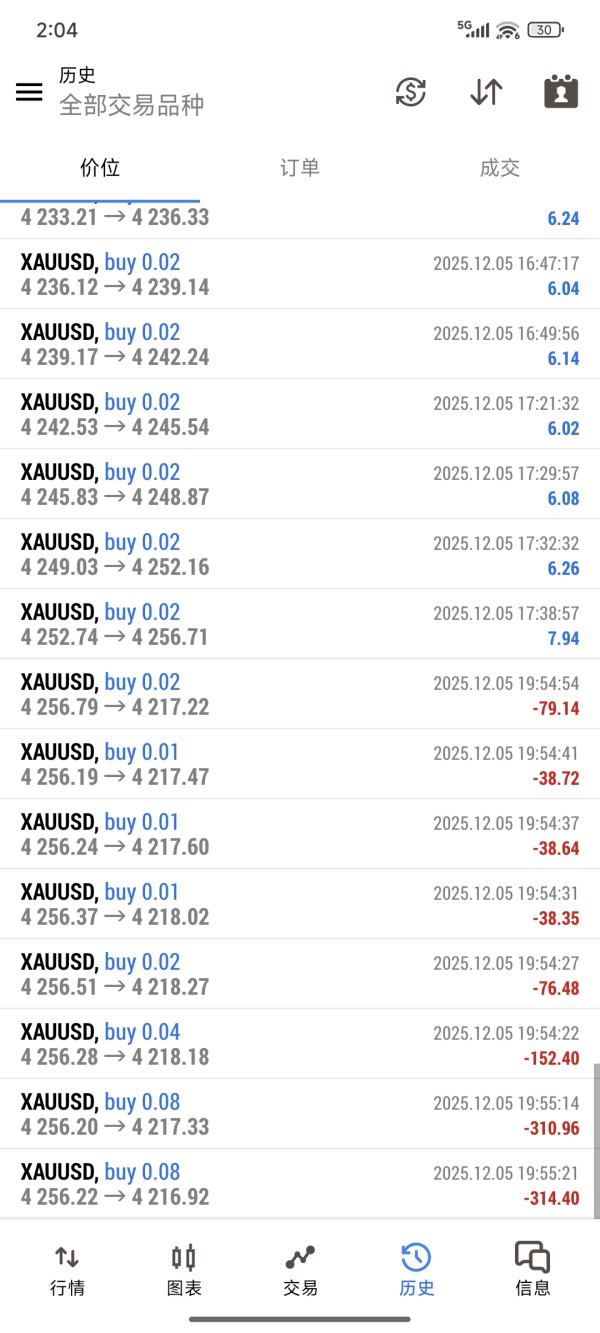

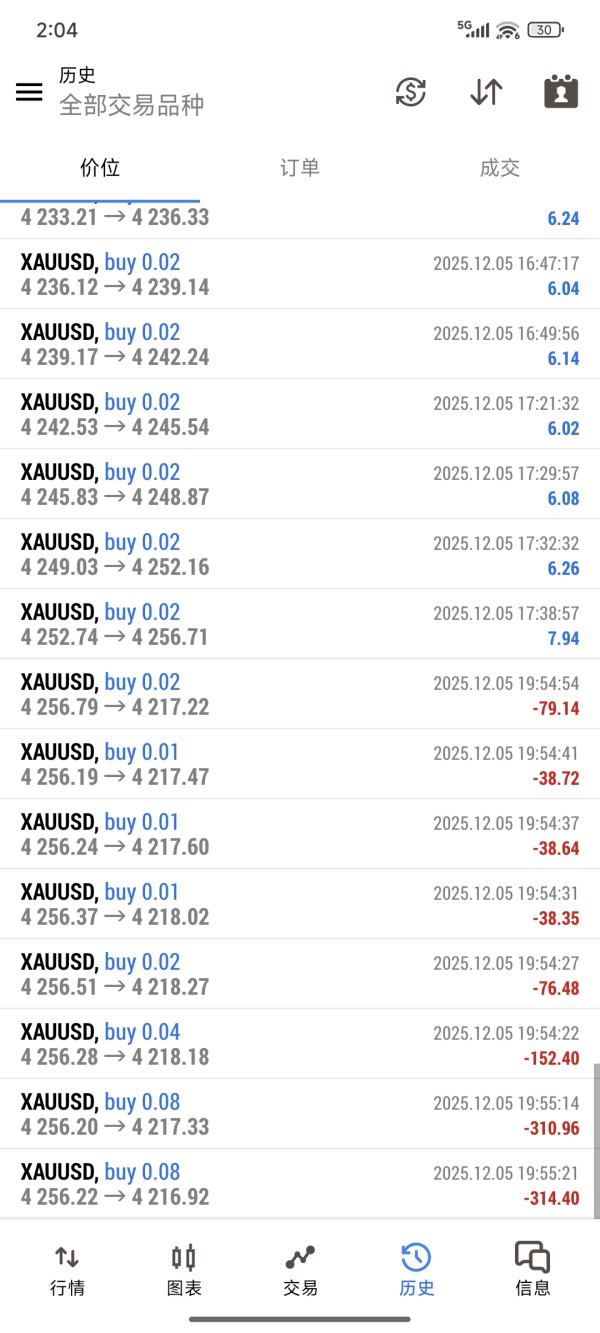

The trading experience with Soolike gets positive marks mainly for good spreads and reliable platform performance through MetaTrader 5. Users consistently report happiness with the execution environment, citing good speed and generally favorable pricing conditions across the broker's tool range.

Platform stability seems to be a strong point, with traders reporting minimal downtime and consistent access during normal market hours. The MT5 platform's strong structure supports both manual and automated trading strategies effectively, working for traders with different levels of technical knowledge.

However, specific information about execution quality numbers such as slippage statistics, requote frequency, or order fill rates isn't easily available in public sources. This lack of detailed execution data makes it hard to provide complete assessment of trading conditions compared to industry standards.

The variety of available tools enhances the trading experience for portfolio-focused traders, allowing for cross-asset strategies and diversification opportunities. Users appreciate the ability to trade forex, commodities, and other tools from a single platform, though specific contract details and trading hours for different tools require direct checking with the broker.

This soolike review notes that while user feedback on trading conditions is generally positive, the absence of detailed performance numbers and execution statistics limits the ability to provide definitive comparisons with other brokers in the market.

Trust and Reliability Analysis (6/10)

Trust and reliability present a mixed picture for Soolike, with FSCA regulation providing some regulatory assurance while user concerns about transparency and legitimacy create uncertainty. The South African Financial Services Conduct Authority oversight offers a framework for investor protection, though how much this protection helps international clients may vary.

The FSCA registration provides regulatory accountability and compliance requirements that the broker must maintain, including capital adequacy standards and operational oversight. However, regulatory protection levels may differ significantly from those available in major financial centers such as the UK, EU, or Australia, potentially affecting the security available to client funds.

User feedback reveals mixed opinions about the broker's legitimacy and transparency, with some traders expressing concerns about the clarity of business operations and corporate structure. The limited availability of detailed company information in public sources may contribute to these trust concerns among potential clients.

Fund security measures, segregation policies, and compensation scheme participation details aren't completely outlined in available documentation. This information gap makes it difficult for traders to assess the safety of their deposits and the protection available if the broker has money problems or operational difficulties.

The broker's industry reputation appears to be developing, with limited third-party verification or industry recognition visible in public sources. Prospective clients should do thorough research and consider the regulatory environment carefully before putting in significant funds.

User Experience Analysis (7/10)

Overall user experience with Soolike reflects a balanced mix of positive and negative feedback, showing room for improvement while acknowledging certain strengths in the broker's service delivery. The MetaTrader 5 platform interface gets generally positive reviews for usability and navigation, with traders appreciating the familiar and professional trading environment.

User satisfaction surveys and feedback show that the platform's functionality meets most traders' basic requirements, though some advanced features and customization options may require additional development. The learning curve for new users appears manageable, particularly for those with previous MetaTrader experience.

Registration and account verification processes aren't detailed completely in available sources, though user feedback suggests generally straightforward onboarding procedures. However, some traders have noted delays or complications in the verification process, showing potential areas for operational improvement.

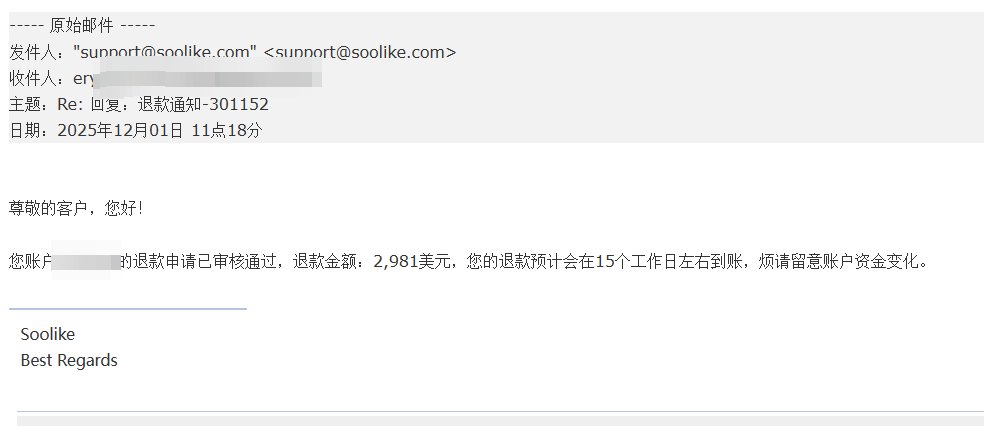

Fund management experiences vary among users, with some reporting satisfactory deposit and withdrawal processing while others express concerns about transparency in financial operations. The absence of detailed information about processing timeframes and requirements may contribute to user uncertainty about fund management procedures.

Common user complaints center around transparency concerns and the availability of detailed information about trading conditions and company operations. Traders seeking complete disclosure and detailed terms may find the current level of public information insufficient for informed decision-making. Improvements in communication clarity and information accessibility could significantly enhance the overall user experience.

Conclusion

Soolike presents itself as a developing forex and CFD broker with both strengths and areas requiring improvement. The broker's FSCA regulation provides some regulatory oversight, while the MetaTrader 5 platform and diverse asset offerings create potential value for traders seeking variety in their trading activities.

The broker appears most suitable for small to medium-sized investors comfortable with South African regulatory oversight and seeking access to multiple asset classes through competitive spreads. However, concerns about transparency and information availability may deter traders who prioritize comprehensive disclosure and detailed operational information.

Key advantages include the reputable MT5 platform, diverse instrument selection, and generally positive user feedback regarding trading conditions. Primary disadvantages center on limited transparency regarding account conditions, fees, and company operations, along with mixed user confidence in legitimacy and reliability aspects.

Prospective clients should conduct thorough due diligence, verify all trading conditions directly with the broker, and carefully consider their risk tolerance and regulatory preferences before opening accounts with Soolike.