Regarding the legitimacy of SOOLIKE forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is SOOLIKE safe?

Business

License

Is SOOLIKE markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SOOLIKE CAPITAL MARKETS (PTY) LTD

Effective Date:

2024-02-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

ATRIUM ON 5TH 9TH FLOOR 5TH STREET SANDTON 2196Phone Number of Licensed Institution:

0615144588Licensed Institution Certified Documents:

Is Soolike A Scam?

Introduction

Soolike is an online forex broker that has recently garnered attention in the trading community. Positioned as a platform that offers a wide range of trading instruments and advanced technology, Soolike aims to cater to both novice and experienced traders. However, the forex market is notorious for its high incidence of scams and fraudulent activities, making it imperative for traders to conduct thorough due diligence before committing their funds to any broker. This article aims to provide an objective analysis of Soolike's legitimacy by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk profile. Our investigation is based on a review of multiple sources, including regulatory databases, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. Soolike claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is known for its stringent oversight of financial institutions. Regulation by a reputable authority can provide traders with a layer of security, as it ensures that the broker adheres to established guidelines and standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 53244 | South Africa | Verified |

The FSCA is recognized for its robust regulatory framework, which includes requirements for capital adequacy, client fund segregation, and transparency in operations. However, while Soolike is indeed registered with the FSCA, it is essential to investigate whether it has faced any compliance issues or sanctions in its operational history. Reports indicate that some users have raised concerns about the broker's withdrawal processes and communication, which could suggest potential regulatory shortcomings. Therefore, while Soolike holds a valid license, the quality of its regulatory compliance and operational practices warrants further scrutiny.

Company Background Investigation

Soolike was established in 2010 and operates under the name Soolike Capital Markets (Pty) Ltd. The company is headquartered in Johannesburg, South Africa. Understanding the company's history and ownership structure is vital for assessing its credibility. Soolike's management team comprises individuals with varying degrees of experience in the financial services sector, yet specific details about their professional backgrounds remain limited.

The transparency of a broker is often reflected in its information disclosure practices. Soolike provides basic information on its website, including contact details and a brief overview of its services. However, the lack of detailed biographies or professional histories for key management personnel raises questions about the company's commitment to transparency. This opacity can be concerning for potential clients, as it may hinder the ability to assess the expertise and reliability of the individuals managing the broker.

Trading Conditions Analysis

A broker's trading conditions play a significant role in determining its attractiveness to traders. Soolike offers various account types, including standard, premium, micro, and ECN accounts, with a minimum deposit requirement starting at $100. The broker claims to provide competitive spreads, with some accounts offering spreads as low as 0.0 pips. However, traders should be cautious of any hidden fees or commissions that may not be immediately evident.

| Fee Type | Soolike | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Soolike's spreads appear competitive, traders should investigate whether the broker employs any unusual fee structures or conditions that could affect their trading experience. Additionally, it is essential to clarify the terms surrounding overnight interest rates, as these can significantly impact trading costs, particularly for longer-term positions.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Soolike claims to implement stringent security measures to protect client funds, including the segregation of client accounts from company funds. This practice is critical in ensuring that traders' funds remain safe in the event of the broker's insolvency. Furthermore, Soolike reportedly offers negative balance protection, which prevents clients from losing more than their deposited amounts.

However, it is crucial to investigate any historical issues related to fund safety or disputes involving client withdrawals. Some user reviews have indicated difficulties in accessing funds or delays in the withdrawal process, which could raise concerns about the broker's operational integrity. A broker's historical performance in managing client funds can be a significant indicator of its reliability.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reputation. Soolike has received mixed reviews from users, with some praising its trading conditions and customer support, while others have reported issues regarding withdrawals and communication. Common complaints include delays in processing withdrawal requests and a lack of responsiveness from customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Inconsistent |

Two notable cases highlight these issues. One user reported being unable to withdraw funds for several weeks, leading to frustration and distrust in the platform. Another trader expressed dissatisfaction with the quality of customer service, stating that their inquiries were often met with vague responses. Such complaints, particularly regarding withdrawal issues, can significantly detract from a broker's credibility.

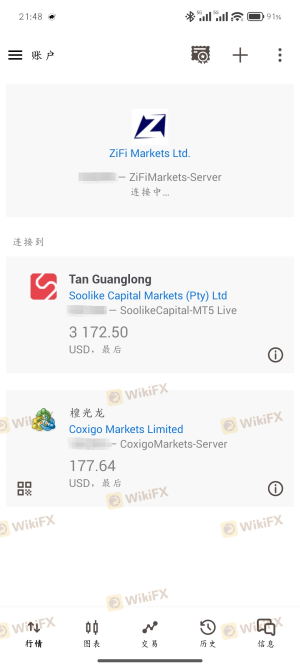

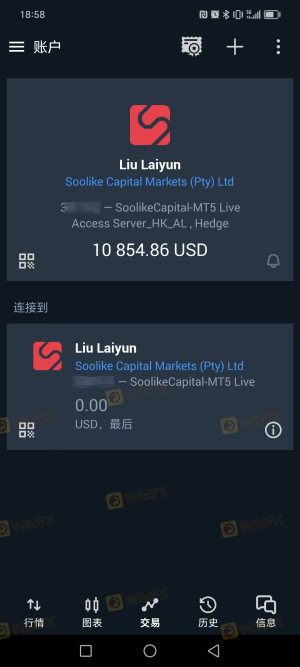

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Soolike offers the MetaTrader 5 (MT5) platform, which is well-regarded for its user-friendly interface and advanced trading features. However, traders should evaluate the platform's stability, order execution quality, and any occurrences of slippage or rejected orders.

Reports of platform manipulation or poor execution can be serious red flags. While Soolike claims to provide reliable order execution, user experiences regarding slippage and execution delays should be thoroughly examined. A broker's ability to deliver timely and accurate trade execution is fundamental to maintaining trust and ensuring a positive trading experience.

Risk Assessment

Using Soolike entails various risks that potential traders should consider. While the broker is regulated, the presence of user complaints and issues related to fund withdrawals raises concerns about its operational integrity.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Holds a license but faces complaints |

| Withdrawal Issues | High | Reports of delays and difficulties |

| Platform Stability | Medium | Mixed reviews on execution quality |

To mitigate these risks, it is advisable for traders to start with a small deposit and test the platform's functionality before committing larger amounts. Additionally, maintaining open lines of communication with customer support can help address any concerns promptly.

Conclusion and Recommendations

In summary, Soolike presents a mixed picture. While it is regulated by the FSCA and offers competitive trading conditions, user complaints regarding withdrawal issues and customer support raise significant concerns. Traders considering Soolike should exercise caution and conduct thorough research before depositing funds.

For those seeking alternative options, it may be beneficial to explore brokers with a stronger reputation for reliability and customer service. Brokers regulated by top-tier authorities and with positive user feedback should be prioritized to ensure a safer trading environment. Ultimately, the decision to trade with Soolike should be based on a careful evaluation of the risks involved and a clear understanding of the broker's operational practices.

Is SOOLIKE a scam, or is it legit?

The latest exposure and evaluation content of SOOLIKE brokers.

SOOLIKE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SOOLIKE latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.