Regarding the legitimacy of PRESTIGE forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is PRESTIGE safe?

Software Index

Risk Control

Is PRESTIGE markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

天譽金號有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.prestigegroup.com.hkExpiration Time:

--Address of Licensed Institution:

九龍宏光道1號億京中心B座35樓E室Phone Number of Licensed Institution:

37596888Licensed Institution Certified Documents:

Is Prestige A Scam?

Introduction

Prestige is a forex broker that has garnered attention in the trading community, positioning itself as a provider of various trading opportunities. However, the rapid growth of online trading platforms has also led to an increase in fraudulent schemes, making it crucial for traders to carefully assess the legitimacy and safety of their chosen brokers. With numerous reports of scams and unregulated brokers, the importance of thorough due diligence cannot be overstated. In this article, we will investigate Prestige's regulatory status, company background, trading conditions, customer experiences, and overall safety to determine whether it is a trustworthy broker or a potential scam.

Our investigation methodology involved a comprehensive review of online sources, including regulatory databases, user reviews, and expert analyses from reputable financial websites. We will use a structured evaluation framework to present our findings, allowing traders to make informed decisions about their investments.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A broker that operates under a recognized regulatory authority is generally considered safer than those that are unregulated. Unfortunately, Prestige lacks oversight from any top-tier regulatory body, which raises significant concerns about its legitimacy and the safety of clients' funds.

Here is a summary of the regulatory information for Prestige:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Prestige is not subject to the stringent standards and oversight that protect traders from fraud and malpractice. Top-tier regulators, such as the FCA in the UK or ASIC in Australia, enforce strict rules to ensure fair trading practices and transparency. Without such oversight, traders are left vulnerable to potential scams and unethical practices.

Moreover, there have been multiple warnings issued against Prestige by various financial authorities, highlighting its unregulated status and the risks associated with trading through this broker. The lack of a reliable regulatory framework significantly diminishes the trustworthiness of Prestige and raises red flags for potential investors.

Company Background Investigation

Understanding the company behind a trading platform is essential for evaluating its credibility. Prestige is operated by Euro Wealth OÜ, a company registered in Estonia. The lack of transparency regarding its ownership structure and management team is concerning. While the broker claims to offer a range of trading services, the absence of detailed information about its history, development, and operational practices raises questions about its legitimacy.

The management teams background is also crucial in assessing a broker's reliability. Unfortunately, detailed profiles of the individuals running Prestige are not readily available, which further complicates the evaluation process. A reputable broker typically provides information about its management team, including their professional experience and qualifications. In the case of Prestige, the lack of such disclosures is a significant drawback.

Additionally, the company‘s transparency regarding its operations and policies is minimal. Traders should be able to access comprehensive information about the broker’s practices, including its financial stability and operational history. The absence of such details often indicates a lack of accountability, making it difficult for clients to trust the broker with their funds.

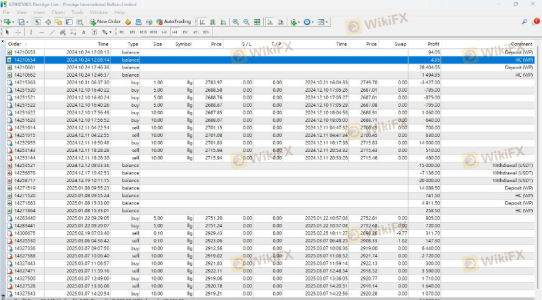

Trading Conditions Analysis

When evaluating a broker, it is essential to consider its trading conditions, including costs, fees, and overall trading environment. Prestige has been reported to have a high fee structure compared to industry standards, which can significantly impact traders' profitability.

Here is a comparison of core trading costs associated with Prestige:

| Fee Type | Prestige | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 4.0 pips | 1.0-1.5 pips |

| Commission Model | None reported | Varies |

| Overnight Interest Range | High | Varies |

The spreads offered by Prestige are notably higher than the industry average, which can erode potential profits for traders. High spreads often indicate that a broker is taking a larger cut from each trade, which can be detrimental to a trader's bottom line. Furthermore, the lack of clarity regarding commission structures raises concerns about hidden fees that could further impact trading costs.

Traders should be cautious when encountering brokers with unusually high fees, as this may be a tactic to exploit inexperienced traders. A transparent fee structure is essential for building trust, and the ambiguity surrounding Prestige's costs is a significant concern.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Prestige's lack of regulation raises serious questions about its fund safety measures. Regulated brokers are required to implement strict protocols for fund segregation, investor protection, and negative balance protection. However, Prestige does not provide any information regarding these critical safety measures.

Without regulatory oversight, there is no guarantee that client funds are kept in separate accounts, which means that traders could be at risk of losing their investments if the broker faces financial difficulties. Additionally, the absence of investor protection mechanisms means that traders have little recourse if they encounter issues with fund withdrawals or mismanagement.

There have been reports of clients experiencing difficulties when attempting to withdraw their funds from Prestige, which further highlights the potential risks associated with trading through this broker. Historical incidents involving fund safety issues should serve as a warning to potential investors.

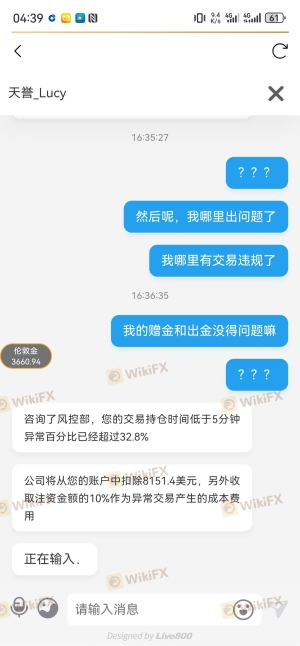

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, Prestige has received numerous complaints from users regarding withdrawal issues, unresponsive customer service, and overall dissatisfaction with the trading experience.

Here is a summary of the most common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Unclear Fees | High | Poor |

Many users have reported being unable to withdraw their funds, which is a significant red flag for any broker. Additionally, complaints about unresponsive customer service indicate a lack of support for clients facing issues. A broker that fails to address customer concerns effectively is unlikely to be trustworthy.

Typical case studies show that clients often struggle to obtain timely responses to their inquiries, leading to frustration and a sense of helplessness. Such experiences can deter traders from using the platform and raise concerns about the broker's overall reliability.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Prestige's platform has been criticized for its lack of advanced features, stability, and overall user experience. Traders expect a seamless trading environment with efficient order execution, but reports indicate that Prestige may not deliver on these expectations.

Concerns about order execution quality, slippage, and rejection rates have been raised by users. A platform that frequently experiences issues with order execution can lead to significant financial losses for traders. Furthermore, any signs of potential platform manipulation should be taken seriously, as they can indicate unethical practices.

Risk Assessment

Using Prestige as a trading platform involves several risks that traders should be aware of. Heres a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation exposes clients to potential fraud. |

| Financial Risk | High | High spreads and unclear fee structures can erode profits. |

| Fund Safety Risk | High | Unregulated status raises concerns about fund security. |

| Customer Support Risk | Medium | Poor customer service may lead to unresolved issues. |

To mitigate these risks, traders should consider using well-regulated brokers that provide robust investor protection, transparent fee structures, and reliable customer support. Conducting thorough research before investing is crucial to minimizing potential losses.

Conclusion and Recommendations

In conclusion, the investigation into Prestige reveals several concerning factors that suggest it may not be a safe or trustworthy broker. The lack of regulation, high fees, poor customer experiences, and potential issues with fund safety collectively paint a troubling picture.

Traders should exercise extreme caution when considering Prestige as a trading option. It is advisable to seek out well-regulated alternatives that prioritize client safety and offer transparent trading conditions. Brokers regulated by top-tier authorities such as the FCA or ASIC should be the preferred choice for traders looking to ensure the safety of their investments.

Overall, while Prestige may offer trading opportunities, the associated risks and lack of transparency make it a broker that traders should approach with skepticism.

Is PRESTIGE a scam, or is it legit?

The latest exposure and evaluation content of PRESTIGE brokers.

PRESTIGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PRESTIGE latest industry rating score is 6.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.