KGI Asia 2025 Review: Everything You Need to Know

KGI Asia has established itself as a prominent financial brand in the Asia region since its inception in 1997. The broker is well-regarded for its diverse range of services, including wealth management, brokerage, and investment banking. However, user experiences and expert opinions reveal a mix of strengths and weaknesses that potential clients should consider. Notably, KGI Asia does not offer CFD or forex trading, which may limit options for some investors.

Note: It is essential to recognize that KGI Asia operates under different entities in various regions, which can impact the services and regulations applicable to clients. This review aims for fairness and accuracy by considering the distinct aspects of KGI Asia's operations across jurisdictions.

Rating Overview

How We Rate Brokers: Our ratings are based on a combination of user feedback, expert analysis, and factual data regarding services, fees, and regulatory compliance.

Broker Overview

Founded in 1997, KGI Asia is headquartered in Hong Kong and is regulated by the Securities and Futures Commission (SFC). The broker offers a variety of trading platforms, including its proprietary web and mobile platforms, though it does not support popular platforms like MetaTrader 4 or 5. KGI Asia provides access to various asset classes, including mutual funds, global stocks, futures, options, and structured products, but notably lacks forex and CFD trading options.

- Regulated Areas/Regions: KGI Asia is primarily regulated in Hong Kong by the SFC, ensuring compliance with local financial regulations.

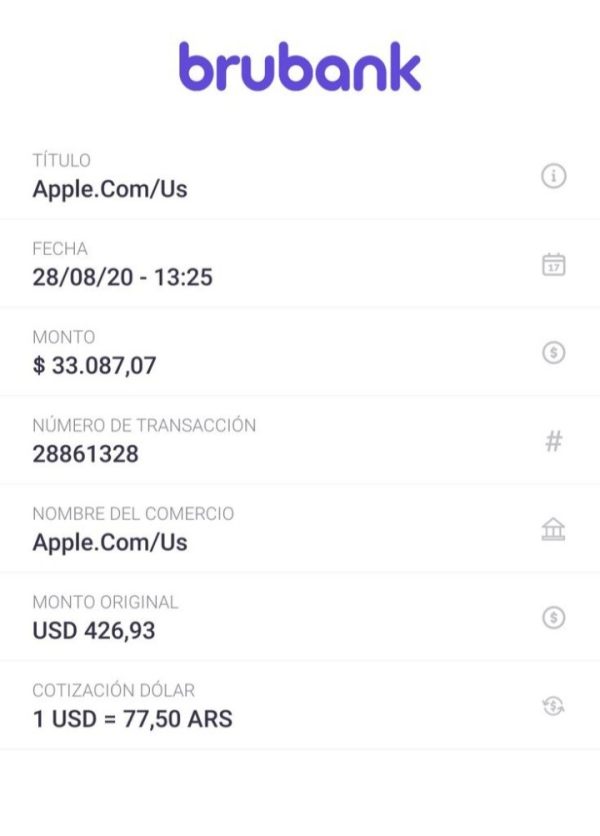

- Deposit/Withdrawal Currencies: Clients can deposit and withdraw in Hong Kong Dollars (HKD) and other currencies through various methods, including bank transfers and online banking.

- Minimum Deposit: Specific minimum deposit requirements are not clearly stated, which could pose a challenge for potential clients.

- Bonuses/Promotions: KGI Asia currently offers a welcome reward of HKD 950 and $0 platform fees for trading U.S. fractional shares, making it an attractive option for new clients.

- Tradeable Asset Classes: The broker supports trading in wealth products, global stocks, warrants, IPO subscriptions, grey market trading, futures, options, and ETFs.

- Costs: Commission rates for stock trading range from 0.25% to 0.5%, with additional fees such as stamp duty and transaction levies applicable.

- Leverage: KGI Asia does not specify maximum leverage, which may concern traders looking for leveraged trading options.

- Allowed Trading Platforms: KGI Asia provides its own trading platforms, including mobile and web-based solutions, but lacks support for popular platforms like MT4 or MT5.

- Restricted Regions: While specific restrictions are not detailed, the absence of forex and CFD trading may limit its appeal to international traders.

- Available Customer Service Languages: KGI Asia offers customer support primarily in English and Chinese, catering to its regional clientele.

Rating Breakdown

Account Conditions: 6.5/10

While KGI Asia provides a variety of account types, the lack of transparency regarding minimum deposits and account specifics may deter potential investors. The absence of forex and CFD trading is a significant limitation for those seeking a broader trading experience.

KGI Asia offers educational resources aimed at enhancing investor literacy and understanding of financial products. However, the lack of advanced trading tools compared to competitors may hinder experienced traders.

Customer Service and Support: 6.0/10

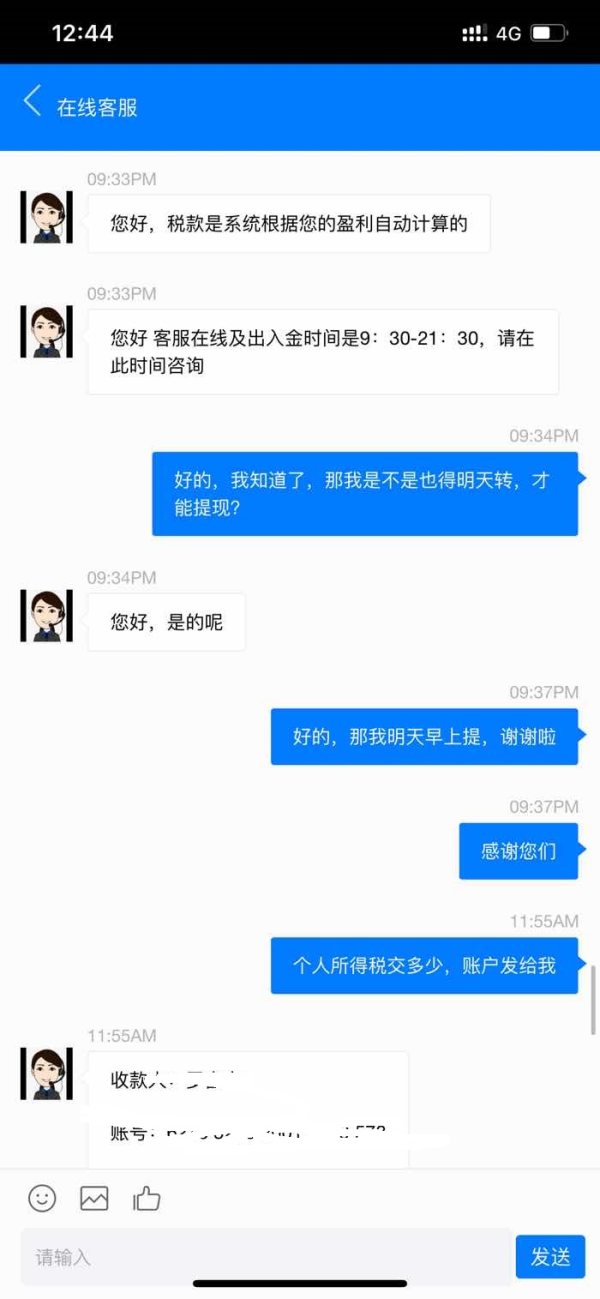

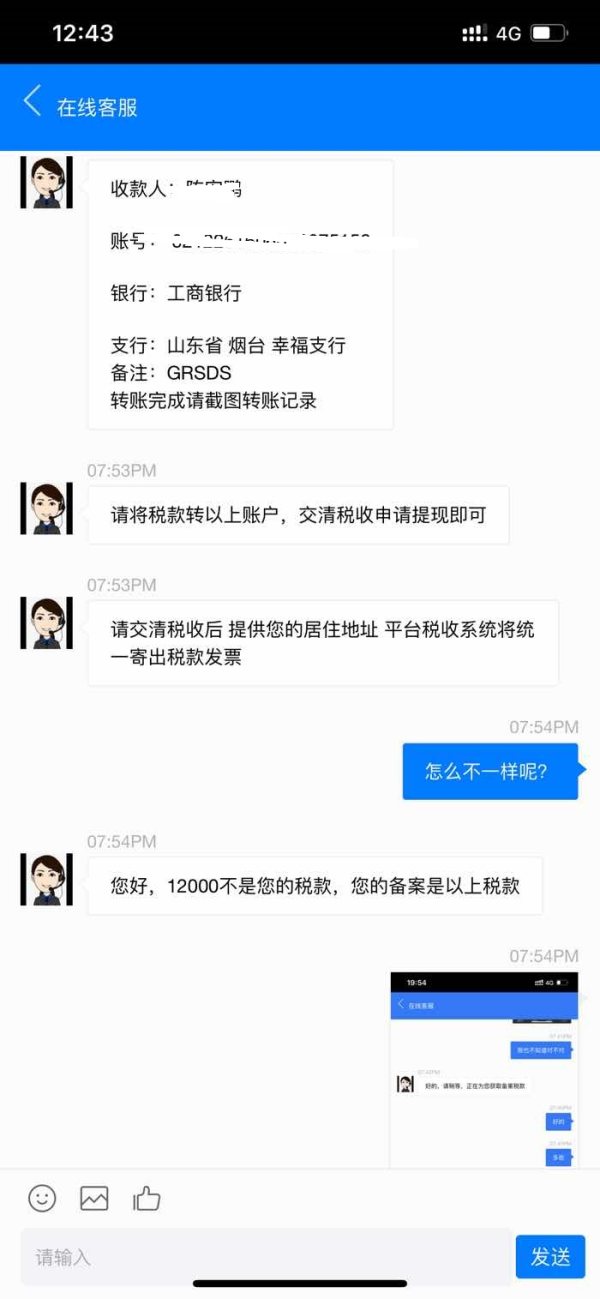

Customer service is accessible through multiple channels, including phone and email. However, feedback suggests that response times may vary, and the absence of a live chat feature could be a drawback for clients seeking immediate assistance.

Trading Setup (Experience): 7.5/10

The trading platforms provided by KGI Asia are designed for ease of use, allowing clients to trade various asset classes effectively. However, the absence of popular platforms like MT4 or MT5 may limit appeal for seasoned traders.

Trustworthiness: 8.0/10

KGI Asia is regulated by the SFC, which adds a layer of trust and credibility. The broker's long-standing presence in the market and compliance with local regulations further enhance its reputation.

User Experience: 6.5/10

Overall user experiences are mixed, with some clients praising the broker's services while others express concerns over withdrawal processes and customer support responsiveness. This highlights the importance of thorough research before engaging with KGI Asia.

Conclusion

In summary, KGI Asia presents a solid option for investors looking for a reputable broker in the Asian market. With its diverse range of financial products and regulatory compliance, it caters to various client needs. However, potential clients should carefully consider the limitations regarding forex and CFD trading, as well as the lack of transparency in account conditions. As always, conducting thorough due diligence is crucial before making any financial commitments.

For more details on KGI Asia, refer to the sources that contributed to this review, including user experiences and expert analyses.