Regarding the legitimacy of KGI forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is KGI safe?

Pros

Cons

Is KGI markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

KGI Futures (Hong Kong) Limited

Effective Date:

2005-02-25Email Address of Licensed Institution:

compliance.hkg@kgi.comSharing Status:

No SharingWebsite of Licensed Institution:

www.kgi.com.hkExpiration Time:

--Address of Licensed Institution:

香港香港金鐘道88號太古廣場一座33樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is KGI Asia Safe or a Scam?

Introduction

KGI Asia, a prominent financial services provider based in Hong Kong, has been operating in the financial markets since 1997. It positions itself as a reputable broker offering a wide range of services, including wealth management, brokerage, investment banking, and asset management. As the forex market continues to attract traders from all backgrounds, it is crucial for potential investors to carefully assess the legitimacy and reliability of brokers like KGI Asia. With numerous reports of scams and fraudulent activities in the trading industry, traders must exercise caution and conduct thorough research before committing their funds. This article aims to evaluate the safety and reliability of KGI Asia by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory and Legitimacy

One of the most important factors to consider when evaluating a forex broker is its regulatory status. KGI Asia is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent oversight of financial institutions. The presence of regulation from a reputable authority adds a layer of trust and security for traders.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| SFC | ADW 991 | Hong Kong | Verified |

The SFC is an independent statutory body that ensures compliance with the Securities and Futures Ordinance, safeguarding investors' interests. KGI Asia has maintained its license since its establishment, indicating a history of compliance with regulatory requirements. This regulatory framework is essential, as it provides oversight and protection for clients, ensuring that the broker adheres to industry standards. However, traders should also be aware that while regulation is a positive indicator, it does not eliminate all risks associated with trading.

Company Background Investigation

KGI Asia has a rich history that dates back to its founding in 1997. It is part of the KGI Group, which is well-established in the Asia-Pacific region, with subsidiaries in Taiwan, Singapore, Indonesia, and Thailand. The company is backed by KGI Securities Company Limited and China Development Financial Holding Corporation, giving it a strong financial foundation.

The management team of KGI Asia consists of experienced professionals with extensive backgrounds in finance and investment. This expertise contributes to the company's credibility and operational efficiency. Transparency is a key aspect of KGI Asia's operations, as it provides detailed information about its services, fees, and trading conditions on its website. Such transparency is crucial for building trust with clients, as it allows potential investors to make informed decisions.

Trading Conditions Analysis

When assessing whether KGI Asia is safe, it is essential to analyze its trading conditions and fee structures. The broker offers a variety of trading instruments, including stocks, futures, and options, but notably does not provide forex or CFD trading. This limitation may be a concern for traders looking for a comprehensive trading experience.

KGI Asia's overall fee structure is competitive, with commissions for stock trading ranging from 0.25% to 0.5%, depending on the service. However, the lack of specific information on spreads and potential hidden fees can be a red flag for traders.

| Fee Type | KGI Asia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | Varies (0.5 - 1.5 pips) |

| Commission Model | 0.25% - 0.5% | 0.1% - 0.3% |

| Overnight Interest Range | Not Specified | Varies |

The absence of transparent information regarding spreads and overnight fees raises questions about the overall cost of trading with KGI Asia. Traders should carefully consider these factors when evaluating the broker's suitability for their trading strategies.

Customer Funds Security

The safety of client funds is paramount in determining whether KGI Asia is safe. The broker implements various security measures to protect client assets, including segregated accounts for client funds, which ensures that client money is kept separate from the company's operational funds. This practice is essential for safeguarding clients' investments in the event of financial difficulties faced by the broker.

Additionally, KGI Asia does not explicitly mention any negative balance protection policies, which could pose a risk for traders during volatile market conditions. While the broker has not faced significant historical controversies regarding fund security, potential clients should remain vigilant and inquire about the specifics of fund protection measures before opening an account.

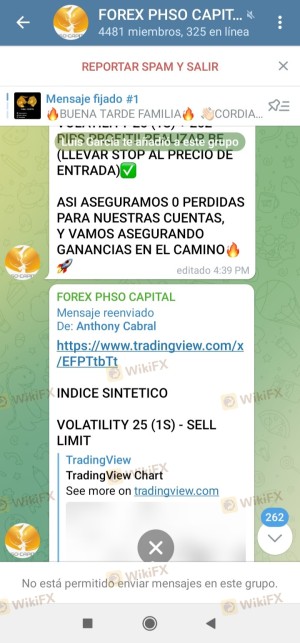

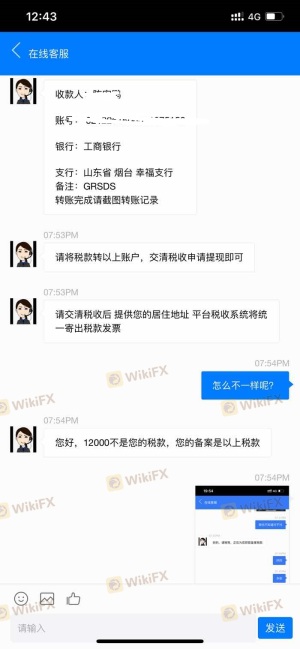

Customer Experience and Complaints

Customer feedback plays a significant role in assessing the overall reliability of a broker. Reviews of KGI Asia reveal a mixed bag of experiences. While some clients praise the broker for its efficient customer service and user-friendly trading platform, others have raised concerns about withdrawal issues and lack of responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Generally responsive |

| Fee Transparency | Medium | Lacks clarity |

One notable case involved a trader who reported difficulties withdrawing funds after experiencing significant profits. Such incidents can severely impact a broker's reputation and raise questions about its trustworthiness. While KGI Asia has a generally positive reputation, the presence of complaints should not be overlooked by potential clients.

Platform and Execution

KGI Asia offers multiple trading platforms, including mobile and desktop options, designed to cater to various trading preferences. The trading execution is generally regarded as stable, with users reporting minimal slippage and quick order processing. However, the absence of popular platforms like MetaTrader 4 or 5 may limit the trading experience for some users.

Traders should be aware of the potential for manipulation or unfair practices, although there is no substantial evidence to suggest that KGI Asia engages in such behavior. The broker's commitment to compliance and regulation serves as a deterrent against unethical practices.

Risk Assessment

Using KGI Asia comes with its own set of risks, which potential traders should carefully evaluate before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Low | Well-regulated by SFC |

| Fund Security | Medium | Segregated accounts, no negative balance protection |

| Withdrawal Issues | High | Reports of delays and issues |

To mitigate these risks, traders should conduct thorough research, maintain open communication with the broker, and ensure they understand the terms and conditions associated with their accounts.

Conclusion and Recommendations

In conclusion, KGI Asia presents itself as a reputable broker regulated by the SFC of Hong Kong, which is a positive indicator of its legitimacy. However, the lack of forex and CFD trading options, along with concerns regarding fee transparency and withdrawal issues, warrant caution. While there are no overt signs of fraudulent activity, potential clients should approach with due diligence.

For traders who prioritize regulatory oversight and a diverse range of financial services, KGI Asia may be a viable option. However, those looking for a comprehensive forex trading experience might consider exploring alternative brokers that offer more flexibility and transparency. Always remember to conduct thorough research and assess your individual trading needs before making any commitments.

Is KGI a scam, or is it legit?

The latest exposure and evaluation content of KGI brokers.

KGI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KGI latest industry rating score is 6.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.